https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈科普網站【鏈習生】專欄作家 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

Four life philosophies taught by "The Mentality of Getting Rich"

Author: Morgan. Morgan Housel

Translator: Zhou Yuwen Publisher: World Culture

" Get Rich Mentality " is a big hit in the first half of 2021.

At first, I felt a sense of world-weariness about the Chinese translation of the title, and the words used in it were so ubiquitous that it evoked many memories of "stepping on a landmine".

But after referring to the English book title "The Psychology of Money", I decided to read it, and I almost missed a good book.

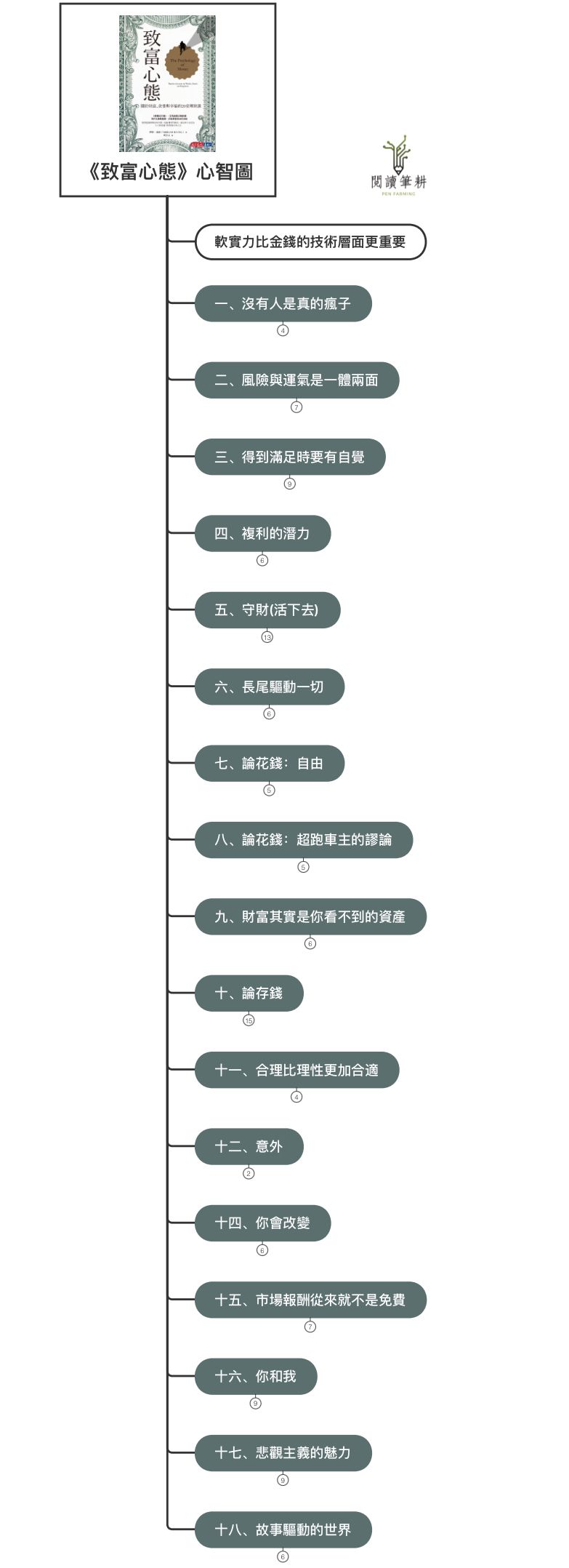

■ 18 "counter-intuitive" lessons

After deducting the summary of the last two chapters and the author's confession, this book brings to 18 financial issues related to human nature, words and deeds , and many of them are "counter-intuitive".

Writing this, I can't help but compare "The Psychology of Money " with "The Mentality of Getting Rich ".

The former mainly focuses on people’s money decisions when they “ consume ”, citing many academic studies, and reading a little more like textbooks; the latter focuses on the “ investment ” aspect, with stories and examples accounting for the majority, like an in-depth topic discussion. In fact, one of the author's identities is a financial columnist who has won numerous awards.

⋯

For the first time, the vertical layout is adopted. In line with the situation that modern people often use mobile phones to browse, the mind map of the node can be expanded/collapsed 👉Click here .

Next, use a few sets of keywords to make a summary for the " get rich mentality ":

⚠️ Respect, humility, moderation, and outlook on life.

■ Respect for individual differences

Your financial experience may only account for 0.00000001% of the world's financial experience, but 80% of you are seeing the world with these experiences.

As the opening remarks of this book, the OO experience is replaced by various propositions, and there is no sense of disobedience.

People experience different situations, learn different lessons from them, and see how OO works in vastly different ways, but everyone has a set of views embedded in their lives; so what seems crazy to you, is not to me. It may make sense in the eyes - no one should expect them to agree on important events, the value of things, the next big thing that might happen, and the best journey forward.

The above ideas are scattered in the chapters [① No one is really crazy], [⑪ Reason is better than reason], [⑯ You and I], [⑰ The charm of pessimism], [⑱ When you believe in anything] chapters.

We have been living different lives, shaped by different but equally compelling experiences .

Let us understand a little more, judge a little less, and stop looking at other people's OO abilities from a critical point of view.

Maybe next time you can think like this: "You're doing something stupid that seems crazy, but I kind of seem to understand why you're doing it."

■ Lower your profile and remain humble to the market

Please give the market some Respect!

This "Mr. Market" has an unpredictable temper, but there are always some timeless truths to follow.

Like [⑮ There is no free lunch in the world], he looks down on people who eat for free - who want to avoid volatility to get paid - some people get away with it, but many more get caught and pay double the price .

Not only the "menu" he provides, but also the time course of his "opening business" is full of 【⑥ Long Tail Effect】 and 【⑫ Accidents! ] Surprise - Few events produce most of the results .

When we are well versed in these rules, the only way to deal with "Mr. Market" is to keep a low profile and remain humble, and don't always think about fighting against him; instead, we understand the wisdom of [⑬ Reserve room for mistakes] - Plan your plans , acknowledging that the unknown like uncertainty, randomness, and chance are an ever-present part of life.

Achieving measurable results has to do with what you can do and repeat for the longest period of time, exploiting the potential of [④ confusing compound interest ] —also Atomic Habits— ; the key to the process is to differentiate [⑤ Getting rich and keeping wealth are two different things. The mentality of survival is more important than anything else . Persevere for a long time, and don’t leave easily or be forced to give up.

■ Moderate: avoid extremes

"The customer is always right" and "the customer doesn't know what they want" are accepted business wisdom.

There is only a thin line between boldness and recklessness, and [② Luck and Risk] are two sides of the same body.

So it can be dangerous to focus on a specific person and case study, such as a billionaire, a corporate CEO, or a case study with sky-high prices that dominates the news pages. Such outcomes are often driven by extreme luck or risk, making it difficult to apply these lessons. In your own life; instead, you should look for broadly applicable patterns of success and failure that will get you closer to highly actionable actions.

As discussed earlier, long-term planning is critical, and compounding yields growth. Of course [⑭ you will change], the world around you will change, and so will your goals and desires; when taking this into account, balancing at important points in life becomes a set of strategies to avoid future regrets and encourage yourself to persevere. down strategy.

Avoid regretting one day when one of these things falls on the extreme end of the spectrum . Not only for financial management, but also for career and interpersonal development.

■ On the concept of money, it is also the attitude of life

Desire is blinding.

Whether it's [③ insatiable greed], expectations keep rising with results, desperately pursuing more, taking more and more risks in decision-making; or [⑧ supercar owner's fallacy], like a peacock opening its screen, showing luxury to others Sending a message to get their respect and admiration often backfires.

The core of the problem behind these two phenomena stems from " social comparison " - fueled by jealousy. The solution given by " Mentality of Getting Rich " is " satisfaction ". The ceiling is too high. As long as you accept that you have been satisfied, it is good; I also remember that " Habits to Get Rich " let us replace jealousy with " thankful heart ", which is quite similar.

⋯

I like the metaphor that " exercise is like becoming rich, and wealth is like skipping a big meal but continuing to burn calories ".

Rich refers to current income, which is obvious. It is not difficult to recognize rich people at first sight. They often try their best to be known to everyone; but [⑨Wealth is actually an asset you cannot see], low-key, It's invisible and requires self-control.

To keep wealth is to keep [⑦ freedom] and flexibility. This is the highest dividend money pays you, although you may be tired of hearing it - I recommend " Money Super Thinking " which has also analyzed this proposition. It is more in-depth. the most complete reflection.

On the contrary, 【⑩ saving money】 does not need any specific reason. This point of view makes people's eyes brighter. You can save money just to save money . Echoing the previous mention, our world is unpredictable, so reserve the concept of "margin of safety".

■ Postscript: Squeeze out new ideas

In the process of reading, there is a wonderful feeling. You will find that the conclusions brought by each chapter seem to have been understood a long time ago, but it is deeply buried in your subconscious, waiting to be awakened by this book.

Should it be compared to "old wine in a new bottle"? No, it's not old for a non-drinker; that's because I'm "drinking like my life" to think so - we're all shaped by different but equally compelling experiences .

Your reading experiences may only account for 0.00000001% of the world's reading experiences, but 80% of the time you are seeing the world with those experiences.

Otherwise, think of it as a squeeze of lemon!

In the past, when I read such books on "money and human nature", I squeezed it with my hands, but today is the first time I have used a squeezer to squeeze out more juice and new ideas.

To me, "The Mentality of Getting Rich " is not just about getting rich with money, it is about ruminating about human nature. It taught me respect, tolerance, kindness, humility, a book of life.

Thank you for seeing this, and I would like to attach my [ Facebook Page ], [ Appreciate Citizens 2.0 ] and [ Room ] subscription links. Welcome to support and encourage ❤️.

🌱 Facebook 👉 https://www.facebook.com/penfarming .

🌱 Continuously ploughing and irrigating regularly 👉 https://liker.land/leo7283/civic .

🌱 Central Nervous System 👉 https://matters.news/~penfarming .

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…