What changes will FATF's latest anti-money laundering guidelines in 2021 bring to cryptocurrency exchanges?

Q: What is travel rule?

Travel rule Travel rule means that information is transferred together with money.

When virtual currency (virtual currency, encrypted currency) is to be transmitted, from the withdrawer to the receiver, the information of the withdrawer and the receiver needs to be transmitted at the same time. For example, when A wants to transfer USDT in VASP (virtual currency exchange) to B's wallet in the exchange, the exchange needs to exchange data between A and B in addition to transferring less than USDT.

This rule originally limited notification obligations in wire transfers to banks and financial institutions in Recommendation 16 of the FATF Benchmark. Also applied to the transmission of virtual currencies (virtual currencies, cryptocurrencies) in the attention of the 2015 announcement. FATF requires banks to follow the same rules as VASPs (virtual currency exchanges).

Q: But how does VASP comply with such rules?

How does the virtual currency (virtual currency, cryptocurrency) based on blockchain technology apply the Travel rule? Details are included in this revision.

Specifically, it includes ① the specific method of the transaction object VASP, the VASP integrates each transaction information and sends it, but does not accept the transaction information before the transaction is confirmed, ③ the corresponding method for the sunrise clause, and ④ the clarification of the terms, such as the bank The account number clearly states that in the context of virtual currency, it refers to the wallet address and so on.

Q: When do you need to formally comply? What needs to be done before sunrise?

Since the time of introduction of the Travel Rule is not the same in each country, and the countries that implement it and those that do not implement it are mixed, the following suggestions are made to avoid transaction difficulties for VASP operators.

First of all, regarding whether to comply with the Travel rule, the guidelines recommend adopting a risk-based methodology. For the purpose of appropriate risk management, the overall risk reduction policy must be considered to determine whether and how to comply with the Travel rule.

Furthermore, even if some countries do not force the introduction of the Travel rule, VASP operators in countries that have not introduced the Travel rule also need to abide by these requirements through contractual agreements, business practices, etc.

Alternatively, the measures that can be taken for VASPs in countries that have not introduced the Travel rule include limiting the transfer of virtual currency (virtual currency, cryptocurrencies) to the same customer, and when transferring multiple VASPs, only the withdrawal is limited to the person with the currency. The premise is that the receiver is the same, and the strengthening of transaction monitoring is also strengthened. Therefore, even in countries that have not introduced the Travel rule, there will not be an absolute prohibition of transactions or prohibition of information transmission, but corresponding to it through a risk-based methodology.

Q: Besides that, what has changed the most in this anti-money laundering guideline?

The blockchain is decentralized and cannot be tampered with, so as long as the transaction is sent and recorded through distributed ledger technology, no one or any authority can revoke the transaction and allow the transferred money to be transferred back. . This is different from traditional bank transactions. In traditional bank transactions, authorities or persons with authority can transfer the transferred money back by canceling the transaction. The lost money can be directly transferred to the bank as long as it has not been withdrawn from the bank. make a withholding or repayment.

Therefore, in the traditional financial field, the bank or the country can transfer the transferred criminal proceeds to the original bank through inter-bank cooperation, international judicial cooperation, state orders, etc., for black money or criminal proceeds. However, in the world of blockchain, banks or countries cannot directly issue such instructions, so this guide also reminds the irrevocable risks of the above transactions. In order to reduce the irrevocable risks of transactions, the exchange will adopt the following transaction procedures .

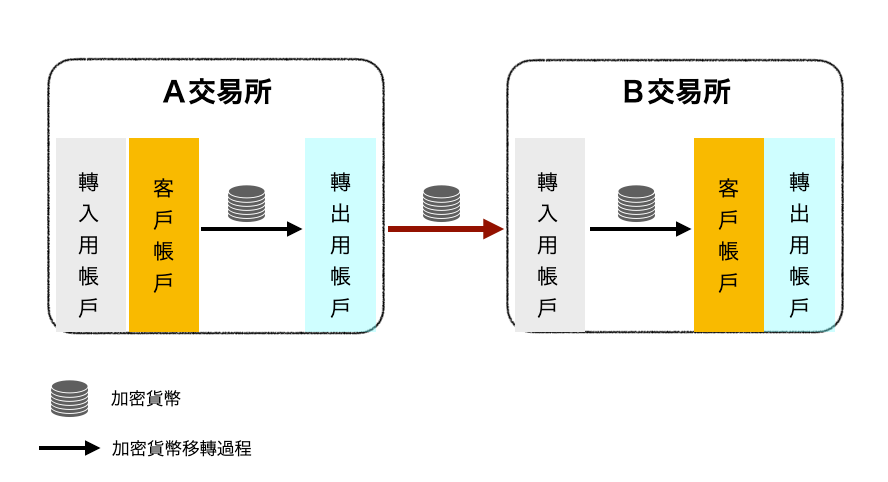

As shown in the figure above, the exchange will cut the simple transaction process into several transaction processes, so that when a high-risk transaction occurs at any stage, the exchange can take measures to avoid suspicious or dangerous transactions. Therefore, all outgoing or incoming cryptocurrencies will first go to the exchange's wallet, and the withdrawal and transfer will not be completed until the exchange has completed the relevant confirmation.

Therefore, on the graph, each line represents a review, including the review of the exchange by the exchange (whether it is a compliant exchange, whether it is an exchange in a high-risk area of money laundering, whether there is an exchange that has completed KYC) ), the review of the transaction initiator (whether it is a suspicious transaction, whether it is a high-risk person for money laundering), and the review of the transaction object (whether it is a suspicious transaction, whether it is a high-risk person for money laundering).

in conclusion

Blockchain and cryptocurrencies have gradually entered the stage of accelerated development and accelerated regulation from the wild land of the past. Just imagine when online shopping was just starting, people didn't know how to return or exchange goods, or how to use third-party payment. When people were still accustomed to the traditional shopping mode, they could vaguely hear the turbulent sound of a new generation of revolution. . I believe that blockchain and cryptocurrencies will continue to move forward, from the dark continent to the rule of law country.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…