https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈科普網站【鏈習生】專欄作家 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

"King of Cryptocurrency" Coinbase Chronicle

Author: Jeff. John. Jeff John Roberts

Translator: Hong Huifang Publishing House: Xinglu

This book tells the story of the startup of the cryptocurrency exchange Coinbase, supported by the Bitcoin wave.

■ Read first, read well

I feel that it is no longer suitable to use " King of Cryptocurrency " (hereinafter referred to as "Plus") as a guide to explore the ebb and flow of Bitcoin. And pull out the currency price chart reference online, and we will talk about it later.

This work is not difficult to reminiscent of " Aether Raid " (hereinafter referred to as "B"), the author's background is also a reporter, and the writing style adopts the same novel style. If I were to comment, I would say that "Jia" should be read first, and it is easier to read , for three reasons:

- After all, Bitcoin was the beginning of it all.

- In "B", the characters and locations that appear one after another are scattered all over the world, which makes "name blindness" commonplace; and no matter how the characters in "Jia" appear, they seem to be tied with a rope, and they converge and return to the scene soon after. Armstrong (the founder of Coinbase), it's a lot easier to read.

- Whenever I encounter technical vocabulary, for example, the two books talk about the passage of "How the Miners Dig the Mine", I think the explanation of "Jia" is easier to understand, while "B" is still unclear in some places. This is a subjective feeling.

■ Coinbase Events (Part 1)

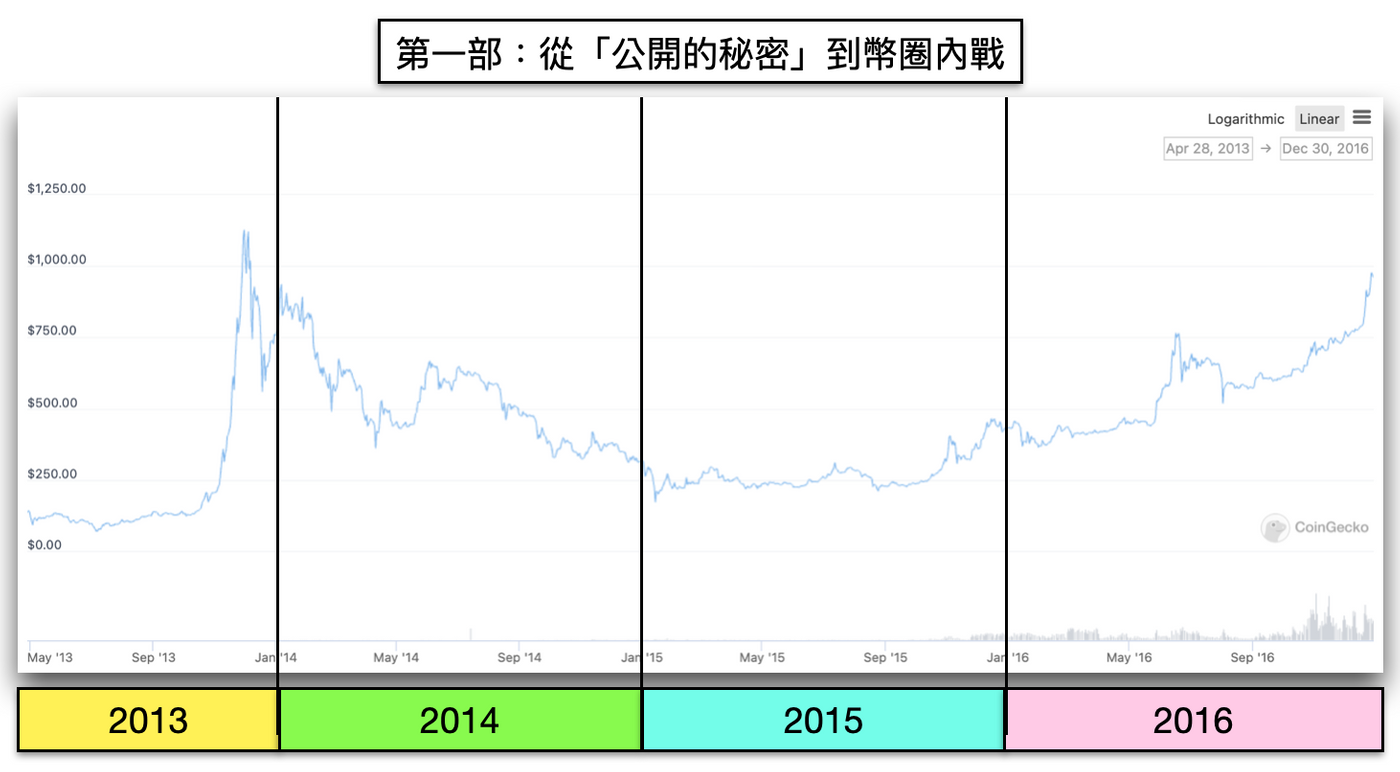

Next, I will try to sort out the content and compile it into a yearbook of "Coinbase Events", and look at it together with the historical trend of Bitcoin, which is particularly interesting.

By the way, the chart is cut to the end of 2016 (just covering the first part of the book), because if it is pulled directly to 2022, the previous price will be flattened to a line, and the upper limit of the Y-axis will be supported to a high relationship.

- 2008: Bitcoin comes out <br class="smart">Satoshi Nakamoto publishes a white paper.

- May 22, 2010: Bitcoin Pizza Day

Traceable first Bitcoin transaction. - November 2012: Coinbase goes live <br class="smart">Armstrong seizes on the open secret that "people want easy access to bitcoin" and offers a service that lets you own your private keys without having to control them For Bitcoin, Coinbase will help you take care of the private key, which is a kind of " centralized " custody.

But the fundamentalist of Bitcoin denounced this as heresy at all, betraying Satoshi Nakamoto's idea of " decentralization ", please allow me to mark it with "old hatred" first.

- May 2013: Closed Series A ($5 million)

Raised after suffering. - Mid-2013: Coinbase was hacked and <br class="smart"> lost $250,000, but luckily the news didn't leak and its credibility was preserved.

- Late 2013: Closed Series B round ($25 million)

The price of bitcoin has soared, driving a surge in the number of customers. Now, instead, Silicon Valley's top venture capitalists are rushing to invest in Coinbase. - February 2014: Mt. Gox goes bankrupt

Fortunately, Coinbase had already sensed the warning signal and pulled away in time. But the collapse of Mt. Gox sent Bitcoin tumbling for a long time. - Early 2015: Closed Series C round ($75 million)

Extensive expansion of overseas business, but the price of Bitcoin is still at the bottom.

Market downturn magnifies Coinbase's management issues.

Internally, "too cruel" phenomena such as work frenzy and ignoring low employee morale; the board of directors is worried, forcing Armstrong to do business transformation; externally, several consecutive public gaffes, screwing up with Silicon Valley Bank (SVB) I was siphoned out of money because of my relationship... In order to maintain operations, I was almost ready to lay off staff.

Miracles have come down from the sky. Bitcoin will return to blood at the end of the year, and performance (fee income) will cure all diseases and alleviate these problems.

- Early 2016: The battle for large and small blocks <br class="smart">As the number of users increased and the Bitcoin transaction network was congested, some people discussed whether to modify the code to expand the block used for accounting from 1 MB to 1 MB. 2 MB?

Armstrong supports the " big block " faction, but Bitcoin Fundamentalists oppose it, arguing that it threatens Satoshi Nakamoto's vision that " individual users are more important than corporate users " because large blocks are expensive and financially expensive to mine A strong legal person can achieve more (computing power) advantages.

So the " small block " faction has a new reason to attack Armstrong, which is a "new feud".

As the value of the currency continues to rise, this "civil war in the currency circle" has also begun to ease. When everyone's attention turns to the "gold rush" to hold for a long time and get rich, there is no need to quarrel over the trading time.

■ Success is also Bitcoin, failure is also Bitcoin

At this point, I want to take a break first, and I can't help but feel the emotion of " success is also bitcoin, failure is also bitcoin ".

From “successful things” such as entrepreneurial ideas, financing, and revenue (fee income), to “failures” such as hacking and being criticized by fundamentalists, Bitcoin has always been on the line, which also highlights that Coinbase’s business is too conservative The crux of the problem , at least until 2018, was still only able to trade four cryptocurrencies at that time. The price of faltering was being overtaken by the up-and-coming Binance exchange, which provided customers with a wide variety of commodities, adding another “defeat” thing".

*

As for the battle of beliefs, I feel that there is a bit of " brothers climbing mountains and working hard " in that there is always tension between collective consensus and individual actions . Some people learn to drive a car (managed by Coinbase), and some people learn to drive a car (manage it by themselves), as long as they are interested in driving (Bitcoin), it is a beautiful thing.

to be continued.

🌱 Reflections on thematic writing are being serialized 👉 01 | 02 |

🌱 Irrigation regularly to support pen farming 👇

https://liker.land/leo7283/civic for extra bonus perimeter subscription

🌱 Tracking [ Zhongshu Nervous System ] broadcast information is not missed👇

Good Books Quotes / Book Market News / Mind Map / Drift Books / Storytelling Club

🌱 I am on other platforms👇

【 Facbook | Mastodon | Medium | vocus | Potato 】

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…