After losing more than half of his assets in the Terra incident, he severely tortured himself

In the recent UST depeg and Terra zero events, from the perspective of the dollar, I lost more than half of my assets in a short period of time.

I tried to be honest with myself, and in addition to deep reflection, I also characterized the incident, hoping to remind myself and others in the future, and avoid repeating the same mistakes.

The Cosmos are the natives of active volcanoes

Many comments assumed that the people who lost their hands in UST were because of Anchor's 19% annual interest rate, but they never thought that UST was the only native "stable currency" for a group of projects and users in the Cosmos ecosystem. It's as if a volcano in a certain place erupted, and the comments pointed out that many people ignored the risk to see the volcanic scenery, but an accident happened, but they ignored that some people were originally local aboriginal people. They were at fault for not leaving their home.

The annual interest rate of Anchor is not my consideration for using UST, it is not to deny greed, but I am more greedy, 19% is not enough to attract me, I would rather hodl BTC. What I am really greedy for is not interest, but a native stablecoin in the ecosystem, which allows me to deal with various expenses without using a centralized exchange at all.

Not many people have paid attention to it. The USDC publisher, Centre, announced in June last year[1] that it would issue USDC on Kava, one of the Cosmos chains, but it has only heard the sound of the stairs. As a result, for a year, the Cosmos ecosystem has only UST , and it did allow me and a group of Cosmos residents to manage assets in DEXs such as Osmosis for a while.

The Cosmos ecosystem does not plan to completely rely on UST for a long time. For example, Osmosis has already started to integrate the Ethereum bridge. After many community discussions, it voted to use Axelar as the default bridge last month [2], and introduced USDC, ETH, etc. Assets, I didn't expect that the bridge was built, and before it was too late to diversify the stable currency, an earthquake occurred immediately.

Nonetheless, I accept that none of the above is sufficient excuse for a lack of crisis awareness and poor risk management. I clearly know the systemic risks of UST, but I try to avoid the centralized exchange and use it. This is the first mistake I made in the incident. Since I am based on Bitcoin, and my personal material life is simple, I mainly spend it through the Crypto.com card, and exchange a little BTC when I need it.

Having said that, the projects I support have a lot of expenses, and the projects are all spent in US dollars. After the Terra incident, the value of my assets plummeted by half from the dollar standard. Although it will not affect my simple life, it makes me I lost my budget and was forced to sell BTC immediately to ensure that I could continue to support the project. This was the second mistake I made: not being disciplined enough to maintain enough dollars for at least the next year, including living and other expenses. What's even more outrageous is that instead of buying the dollar to cover a year's expenses when the dollar was cheap, I was forced to buy it because the dollar rose sharply, and this is not the first time I have made this mistake.

Unconsciously entering the derivatives market without knowing it

As for LUNA, I first bought 19% of the position on 2020.08.15, when the currency price was 0.5 magnesium; then I bought 28% of the position at an average price of 0.32 magnesium from September to October of the same year.

2021.05.24, LUNA rose to 4.37 magnesium, I will buy another 47%. In September of the same year, I quit my favorite project Aragon, and sold ANT in exchange for the remaining 6% of LUNA holdings, with an average price of 35.7 magnesium. LUNA became the second coin I bought in three orders of magnitude outside of ETH. That was the last time I bought LUNA at "real money" highs. Yes, 0.5 magnesium is also a high price, 3719 times higher than the current price (happy in pain:)

I have a principle to only hold the coins that I use for their related products, and as long as I hold them, I will pay attention to the development of the project, because it takes time and the cost of ownership is very high. Put down the ANT that I like very much, because it is no longer in use; holding more LUNA is not only optimistic about the currency price, but also because I use it more and more every day. Unexpectedly, this principle laid the ground for losing a lot of money in LUNA in the future. However, I don't see this principle as a mistake, but I think it should be grasped more tightly, with more careful selection of assets, and a better understanding of positions.

The real mistake, and my third mistake in the event, is to put all LUNA in the LP (liquidity pool) of LUNA/OSMO. My unsettling wishful thinking is this: I like Osmosis very much, the product is very smooth, the community is extremely active, and what is even more rare is that the governance is extremely serious. I still hold the airdropped UNI, and I occasionally use Uniswap. Both have their own advantages, but Uniswap's activeness in community governance is completely incomparable to Osmosis. Based on this premise, compared to LUNA, which has risen 200 times but is a bit impenetrable, I prefer to accumulate OSMO, so I use LUNA/OSMO LP to earn OSMO income.

The results were disastrous. The OSMO I put in the pool, because of extreme impermanent loss, lost 99.9%, what I earned was a deeper understanding of the power of impermanent loss, and 5mil LUNA, which is equivalent to $500 million at high levels (continue to trample myself for fun:)

I have always strictly adhered to the principle of no loans and no leverage (for Hong Kong people, mortgages are not leveraged : ), so I would not go bankrupt in the earthquake. However, I wonder if I've fallen behind another principle of not touching derivatives. In the traditional financial field, derivative products are relatively easy to understand, or the other way around, but anything that cannot be understood is probably derivative products, although it is not scientific, it is not far away. But after this battle, I suddenly woke up, will LUNA/OSMO LP also be a derivative product? Otherwise, why would I not only pay for LUNA, but also bury OSMO of the same value? In the world of DeFi, how should derivatives be defined? I'm still confused about this.

The greater the power of communication, the greater the responsibility

However, compared to personal losses, I am more concerned about whether I have given any inappropriate advice and caused others to lose money. I am not, and I never want to be a KOL, but after all, as an author and a part-time teacher, I have the responsibility to have a positive impact on people and must not mislead others. So I thought about it over and over again to see if there was anything wrong with it.

Writing, I believe, no. Although I post weekly, and I'm a Cosmos resident and a big fan, I've never written about Terra. I can clearly remember that I haven’t written it without looking it up. The reason is very simple. I never follow trends and topics, write about things that are not familiar enough, and even less likely to recommend coins that I don’t know well.

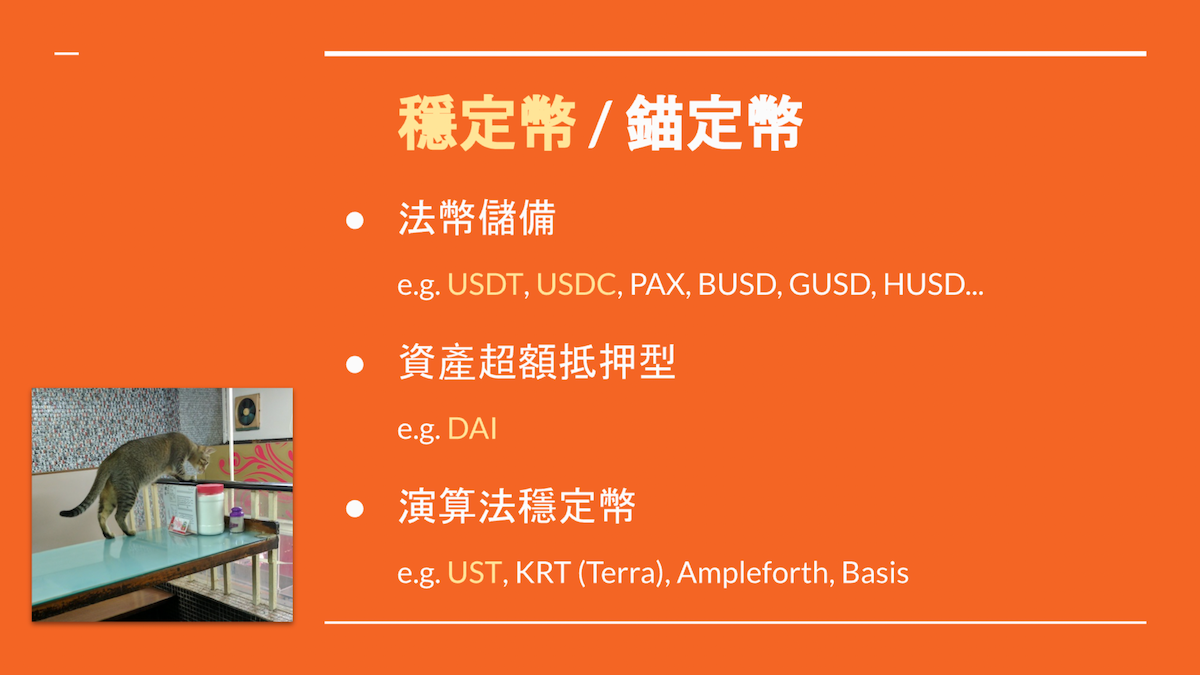

As for teaching, the first topic of DeFi in Unit 2 of Financial Freedom Course is stablecoins. I mentioned three types of stablecoins, one is more difficult to understand than the other, and I also mentioned that I like DAI (MKR) very much, but there is no such thing as Reminds and emphasizes that algorithmic "stablecoins" are risky; I need to improve on this. In addition, the 16 workshops of the whole course did not use UST, nor did they involve LUNA.

Those who have participated will know that the focus of the financial freedom course is not actually investment in the traditional sense. In the only investment-themed module 5, after I repeatedly emphasized "very subjective and extremely high risk", I shared my main positions, except The most mainstream BTC and ETH, in addition to the small SOL at that time, were less mainstream. The above-mentioned ATOM (Cosmos Hub), ANT and MKR did not have LUNA. I thought about it again and again and asked myself that I didn’t lead my classmates astray, but I still felt that I could do better and use more strength to remind new students of various potential risks.

After the Terra incident, some people blamed the KOL cultist Anchor for receiving interest and the like. I haven't seen any relevant articles or videos, so I can't comment, but I tend to feel that after all, everyone is responsible for their own decisions. Having said that, it is still recommended that a group of KOLs do more homework and fewer videos. There is already a lot of content in this world, and we don't need to follow topics and comment on everything. In addition, I also hope that KOLs will not just say "non-investment advice" in a formal way; I have heard some programs, and they are obviously recommending products from beginning to end, but at the end they read the reminder quickly, except for self-protection and exemption, it is meaningless .

Terra: fake it until you make it

I haven't written about Terra, and the only comment I made was in response to a message from a reader over a month ago asking my opinion on Terra and UST. At that time, I emphasized that I didn’t understand Terra very well, so I could only reluctantly respond, and pointed out that I didn’t think Terra was a scam, but a “very large-scale and bold currency experiment.”

After the Terra incident, many experts said that they knew that it was doomed for a long time, but I think it would be an oversimplification to regard it as a must-fail mechanism or a Ponzi scheme, but after it failed and I lost a lot of money, the results were reversed to prove the inference . Terra’s failure is an established fact, but it does not mean that it has never been successful. If the project implementation is not too aggressive, for example, the issuance of UST has an upper limit on the market value of reference reserve assets, the foundation has introduced more BTC as reserves earlier, or UST has For more application scenarios such as CHAI in South Korea, Terra may fake it until you make it, allowing UST and LUNA to embark on the road to success.

Although I lost a lot, and the whole deployment has a lot of room for improvement, I don't regret buying LUNA, and I don't regret not selling it after 200 times of appreciation (voice of fans: it would be nice if...). I would like to support an experiment that has a positive effect on human society with real money, although it may have a low probability of success.

After all, if there is a lack of innovation and adventurous spirit, and the mechanism that cannot be understood for a while will be denied, the world will not have today's Bitcoin and the entire blockchain industry.

Share with all the survivors who lost a lot of money in the Terra incident, and who survived with a shrewd eye.

ps children who return to the cover image: can be used to support more creators, journalists and meaningful projects

I am the author of "Blockchain Sociology: Reimagining Money, Media and Democracy" Gao Reconstruction, slash writing/teaching/entrepreneurship, publishes articles every Friday discussing freedom of the press, financial freedom and democratic freedom. spreading knowledge.

[ Subscription ]

If my article is valuable, don't punish opening, encourage closing, please consider the tuition fee, and the money will be fully invested in the LikeCoin Scholarship.

Further reading

- CENTRE Consortium: Announcing USDC on Ten New Blockchain Platforms

- Osmosis proposal #206: Adopt Axelar as the Canonical Ethereum Bridge Service Provider

- Blockchain Sociology. Financial Freedom

- The so-called "I don't invest" means all in fiat currency

- When it comes to money, everyone is the establishment

- Money Dictionary: Currency, Gold, Fiat, Currency, Bitcoin

- Is the instability of the currency price the biggest problem of Bitcoin? On Value Relativity

Original link: chungkin Express

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More