Introduction to "The Most Important Thing in Investing"

Author: Howard. Howard Marks

Translator: Su Pengyuan Publisher: Business Weekly

What is the most important thing about investing? I hope to find the answer from " The Most Important Thing in Investment ". In addition, I am also a participant in the cryptocurrency market, and I am also curious about what I can learn from this book - written by Howard Marks, the founder of Oaktree Capital Management , for traditional financial investors. Can the knowledge gained be used in the currency circle? Let’s take a look.

Note that these labels ①②③⋯⋯ are chapters in this book. I tried to use my own context to gather them into four major categories and connect them in series. At the same time, I used blocks to superimpose and review them regularly.

■ The most important thing about investing

In July 2003, the author wrote a memorandum titled "The Most Important Thing" to sort out what he thought were the elements for successful investment, and then developed this book around this concept. It talks about the creed (not a reference book) that he abides by in his investment career, which guides him like a road sign... After reading, I divided the aspects touched on in the book into four major categories: human thinking and behavior, market, and risk. , strategies , discussed in order as follows:

1. People: Psychological factors play a major role in the market

At the outset, the book clearly states that investment is "not" a science, because psychological factors play a major role in the market and are highly variable, making the deduction of cause-and-effect relationships unreliable, which goes against the concept of science (changes can be controlled). Because, the results produced in the past can be replicated, and the causal relationship is reliable and unchanged).

Therefore, the author hopes that everyone will cultivate the insight of [① second level thinking], which is the artistic component of investment . Echoing the psychological factors just mentioned, gathering the psychological factors of most people to form a market consensus, and thinking deeper than the market consensus is the essence of "second-level thinking":

Example ◍ The first level of thinking would say: "This is a good company, just buy this stock!" ◍ The second level of thinking will say: "This is a good company, but everyone thinks this company is good, so it is not a good company. The stock price of this stock is overvalued and the market price is too high, so sell! "

But the author also emphasizes that "being different" should not be regarded as a goal, but should be regarded as a way of thinking . I think this should be the so-called reverse thinking skill!

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Second level thinking works

Continuing to explore further, I also saw probabilistic thinking (betting thinking), scattered in two chapters: [⑭ Recognize the limitations of prediction] and [⑯ Recognize the role of luck].

When it comes to investment, we have to be wary of those who claim to be "divine forecasters" (or who come up with such ideas themselves). They are classified by the author as the "I know" school of thought. They judge the quality of decision-making based on one or two results. ; In fact, this is not the case. We should embrace the "alternative history" or "uncertain world" viewpoint proposed by Taleb , who is world-famous for his book "The Black Swan Effect" . We should regard the future world as a random distribution and make predictions based on this condition. invest . The belief that you have limited knowledge and understand that even if you make the best decision, you may still lose the game because luck is involved in any outcome , this is the "I don't know" school of thought that the author promotes.

Therefore, Oaktree Capital Management insists on making defensive investments and [⑱ avoid investment traps]. A high proportion of this is [⑩ the negative impact of confrontational emotions], including greed, fear, Questioning, herd tendency, jealousy, arrogance, surrender mentality and other factors from the psychological side (emotional side). Another thing is that market cycles and fanaticism are not recognized ...

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Second level thinking works

And join the "I don't know" school of thought, which embraces probabilistic thinking

2. Market: The cycle will always gain the upper hand in the end

An important concept in investment science is called the efficient market hypothesis . This "efficiency" refers to the consensus that asset prices will "quickly" reflect the importance of those messages in the market. However, the author does not believe that this market consensus is necessarily correct. , this context still follows "psychological factors play a major role in the market"; after [② understanding the limitations of efficient markets], we know that inefficient markets provide the raw material of "mispricing", so we can use "Second thinking" allows some people to be market winners and some people to be losers.

The first priority is to [③ accurately estimate the actual value], which is referred to as valuation. There are various schools of analysis, which can be simplified into two categories: technical and fundamental, and this book belongs to the latter... In short, through skilled financial analysis skills, you can find out your firm views on "value" , which can help you face challenges. A situation where there is a disconnect with “price”.

Speaking of price, it’s time to [④ find out the relationship between price and value]. Returning to the starting point of "psychological factors play a major role in the market", it causes inefficient markets and mispricing (the decoupling of price and value is the norm), so the "second level of thinking" must include "the consideration of other investors". Insight” and then respond. Sometimes, even if the "price" suggests you are wrong, have the courage to buy because you have your own unwavering view of "value."

Overlay blocks:

∵ Psychological factors play a major role in the market

➨ Inefficient market and mispricing (price)

➨ The second level of thinking works, gaining insight into the psychology of the masses (price)

And join the "I don't know" school of thought, which embraces probabilistic thinking

This is slightly different from the thinking of "Stock God" Buffett . Buffett's investment style is to "buy good things" and prefers to buy high-quality equity. If we use the currency circle as an analogy, he would favor Bitcoin and Ethereum (although he himself hates cryptocurrencies). Extremely); and Howard Marks believes that investment success is not due to "buying good things" but "buying good things", so you will see a lot of "alternative investments" in the asset composition managed by Oaktree Capital. Finding bargains in assets that the market hates:

I found that the main premise of "psychological factors play a major role in the market" is always shown, because the author then throws out the theory of "cycle". As long as humans are involved, there will be changes and cycles in the results . The main reason is that ordinary people have emotions, are capricious, and are neither firm nor objective. Therefore, nothing can always move in the same direction. The cycle will always change in the end . Taking advantage of this , the phenomenon of [⑧Business Cycle] was created.

Therefore, it is very important to [⑮ detect the boom position], that is, to measure the heat of the market. The author said that the investment market will swing back and forth between OO and XX (OO and XX can be used in at least 7 sets of vocabulary). We must [⑨ be aware of the pendulum effect]. Among them, I think the most vivid description is about risks, and risks are dynamic .

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Inefficient markets and mispricing (prices)

➨ The second level of thinking works, gaining insight into the psychology of the masses (price)

➨ The investment market is like a pendulum, and the cycle will always gain the upper hand in the end ➨ Have the courage to buy compared to your unwavering (value) views

➨ Prefer “buying good stuff” to “buying good stuff”

And join the "I don't know" school of thought and embrace probabilistic thinking

3. Risk: Oscillating between tolerance and avoidance

This part is probably the most subversive part of the book.

Academics believe that investors’ attitude towards risk is fixed, but the author disagrees. He believes that it actually swings between risk tolerance and risk aversion ; academics also like to use "volatility" to measure risk (this I was deeply impressed by this paragraph. I have read a bunch of papers that use standard deviation and variation as risk proxy variables). The author refutes it again. He does not think that most investors care about the risk of "volatility". The most important risk is The possibility of losing money is straightforward.

The above is [⑤ Understand risks], and only when they are clearly defined can [⑥ Confirm risks].

When investors enter the market at a high price and do not know how to avoid it, this is the main source of risk and an inevitable feature of bubbles. Believing that the risk is very low, or even believing that "this time is different" the risk will disappear completely is a major factor in the generation of risk. , after all, "the cycle will always prevail in the end"; when investors are not afraid of risks, they will accept risks without asking for compensation; when those who provide funds are not risk-averse enough, they relax borrowing conditions and interest rates, Rather than requiring adequate protection or expected returns... In the final analysis, increased confidence in the market will create more risks that should be worried about. The author calls this phenomenon "risk willfulness" , and vice versa.

Risks cannot be eliminated, but can only be transferred and dispersed. This is [⑦ Risk Control], which affects the investment strategy of Oaktree Capital Management .

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Inefficient markets and mispricing (prices)

➨ The second level of thinking works, gaining insight into the psychology of the masses (price)

➨The investment market is like a pendulum, swinging between risk tolerance and risk aversion ➨ The cycle will always gain the upper hand in the end ➨ Compare your unwavering (value) view and have the courage to buy ➨ Compared to "buying good things" Prefer "good things to buy"

And join the "I don't know" school of thought and embrace probabilistic thinking

4・Strategy: Margin of safety, remain skeptical

The uncontrollable part of investment is called Beta, which is related to the market environment; the opposite is Alpha, which is the individual skill of the investor.

As mentioned earlier , Oaktree Capital Management is a member of the "I don't know" school of thought. It understands that there are too many things (Beta) that cannot be controlled in investment, and investors only control part of the investment results (Alpha) , so [⑰ Adopt a defensive investment strategy] , this style emphasizes "not doing things right, but not doing things wrong." I feel awe and fear about investing, and I act cautiously to make fewer mistakes, but I can't write great poetry. Aim for average on-base percentage, not for hitting home runs with a big bat (and a high strikeout rate).

Under the defensive strategy, as long as there is an average return during the long market, it is good, but it must beat the market during the short market . Excellent Alpha creates this "asymmetry in performance", which is the asymmetry we want ( The performance earned by rising prices is greater than the loss caused by falling prices), which is the source of [⑲ added value] to the investment portfolio.

Therefore, the author highly advocates the concept of "margin of safety", [⑫ find cheap targets] and [⑬ wait patiently for the opportunity]. His style of buying targets is like (in an American TV series) when he sees a household moving, so he has a bunch of "For Sale Lists" are displayed on the roadside, and you can choose from them. Rather than carrying a "shopping list" and only wanting to hold certain items. Great buying opportunities arise when asset holders are forced to sell , and that's when you need to be in the buyer's shoes.

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Inefficient markets and mispricing (prices)

➨ The second level of thinking works, gaining insight into the psychology of the masses (price)

➨ The investment market is like a pendulum, swinging between risk tolerance and risk aversion ➨ Increased confidence (risk tolerance) in the market will instead create more risks that should be worried about ➨ Increased fear (risk aversion) in the market will actually decrease Risk ➨ The cycle will always gain the upper hand in the end ➨ Be brave enough to buy compared to your unwavering (value) view ➨ Prefer "buying good things" to "buying good things"

And join the "I don't know" school of thought and embrace probabilistic thinking ➨ Defensive investment strategy

➨ Respect the "margin of safety"

In addition to the basic defensive investment strategy, the author also pursues the [⑪ Contrarian Investment] strategy, which is a derivative of "second-level thinking". What should be done is not only to do the opposite of the crowd, but also to understand why the crowd is wrong. of ?

This is also an attitude of always being skeptical, questioning both "too good to be true" and "too bad to be true"; having [⑳ reasonable expectations] for rewards, you can develop the habit of asking yourself " Why did I get this good luck and not others? Why should I earn compensation that exceeds the market price? It should be possible to avoid many investment minefields, especially the common fund fraud techniques in the currency circle, as well as in the real society.

Overlay blocks:

∵ Psychological factors play a major role in the market ➨ Inefficient markets and mispricing (prices)

➨ The second level of thinking works, gaining insight into the psychology of the masses (price)

➨ The investment market is like a pendulum, swinging between risk tolerance and risk aversion ➨ Increased confidence (risk tolerance) in the market will instead create more risks that should be worried about ➨ Increased fear (risk aversion) in the market will actually decrease Risk ➨ Cycles always gain the upper hand in the end

➨ Know why the crowd is wrong?

➨ Have the courage to buy based on your unwavering view of value ➨ Prefer "buying good things" to "buying good things"

And join the "I don't know" school of thought, embrace probabilistic thinking ➨ Defensive investment strategy ➨ Respect the "margin of safety"

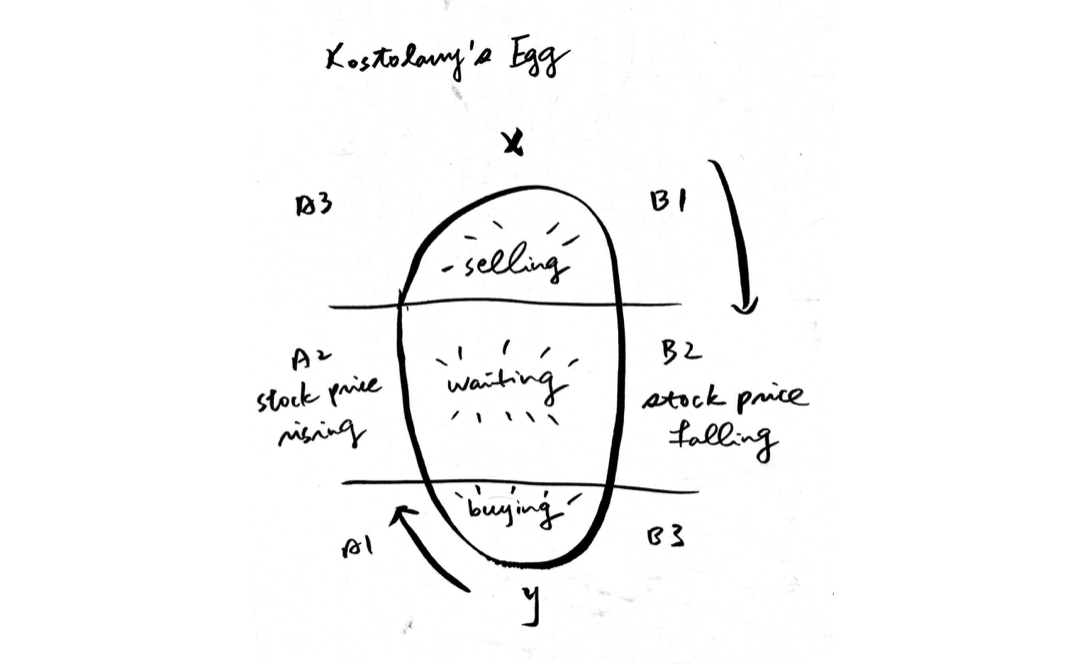

■ Epilogue: echoing the egg theory

In the process of studying, I often think of the "egg theory" of German stock god Kostolany . It is also a cycle, and the driving factors behind it are psychology + currency. Needless to say, the former is also the starting point of this book's argument; while the latter reflects the chips . The chips can speak. Who is in the hands of the stock (coin)?

In my opinion, in addition to using financial analysis skills to find "valuation", it is relatively unsuitable for the currency circle (after all, there is no such thing as financial reporting), others such as people's hearts, market cycles, risk swings, and defensive investments (margin of safety) ) and reverse investment strategies, etc., are both used in the fields of traditional finance and crypto-finance; then the original focus on fundamentals is replaced by research on the chip side - on-chain data analysis, the blockchain ecosystem is so transparent ——It’s perfect.

🌱 Join [ Zhongshu Nervous System ] Wailuo👇

The special topics #Reflections on Writing and #热内真情are being serialized.

🌱I appear on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocabulary 】

🌱My teaching articles and invitation links👇

≣Register noise.cash | Become a "noise coffee" and experience social finance together .

≣Register Presearch | Search to earn three birds with one stone .

≣Register for MEXC | Go to the Matcha Exchange to redeem OSMO and play wool .

≣Register Potato | Learn three things from Potato Media .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More