Osmosis Liquidity Mining | The Impact of Osmosis Proposal on Incentive Pools and External Incentives

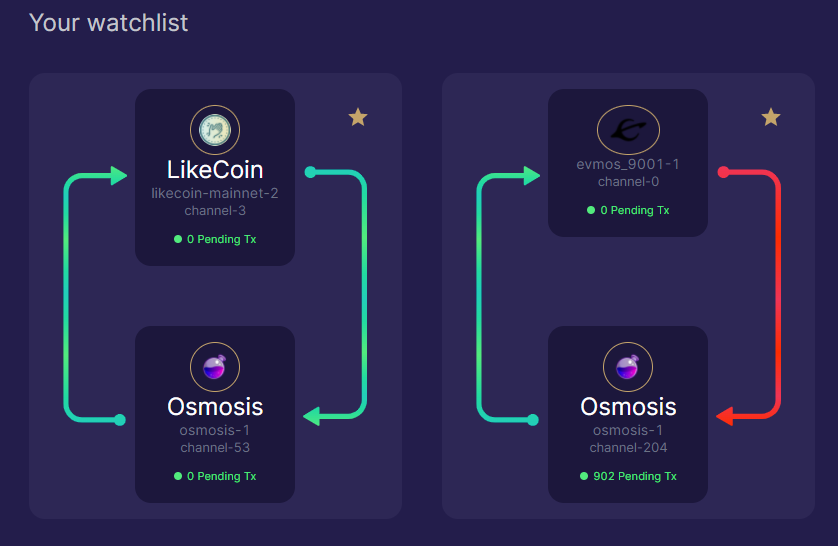

Osmosis IBC Status

Yesterday's article missed a point, that is, the IBC status of each chain can be seen on the IBC Status page of Osmosis. For example, LikeCoin in the picture below is very healthy, and there is no Pending Tx. And Evmos, which was running for a while but GG, was terrible. Add a star to them on the IBC Status page and you can monitor them at any time, which is very convenient. In the future, if Osmosis Assets IBC Deposit or Withdraw cannot receive it, you can see it here.

Brush up on liquidity pools, incentive pools, and external incentives

Regarding the incentive pool and external incentives, how is the Osmosis Liquidity Mining | APR adjusted? $DSM Pool Gorgeous Launch, Osmosis Liquidity Mining | Commonwealth, External Incentive Pool External Incentive Pool APR > 1000% DSM! It has been written superficially with previous articles, but it may also be consolidated and reviewed:

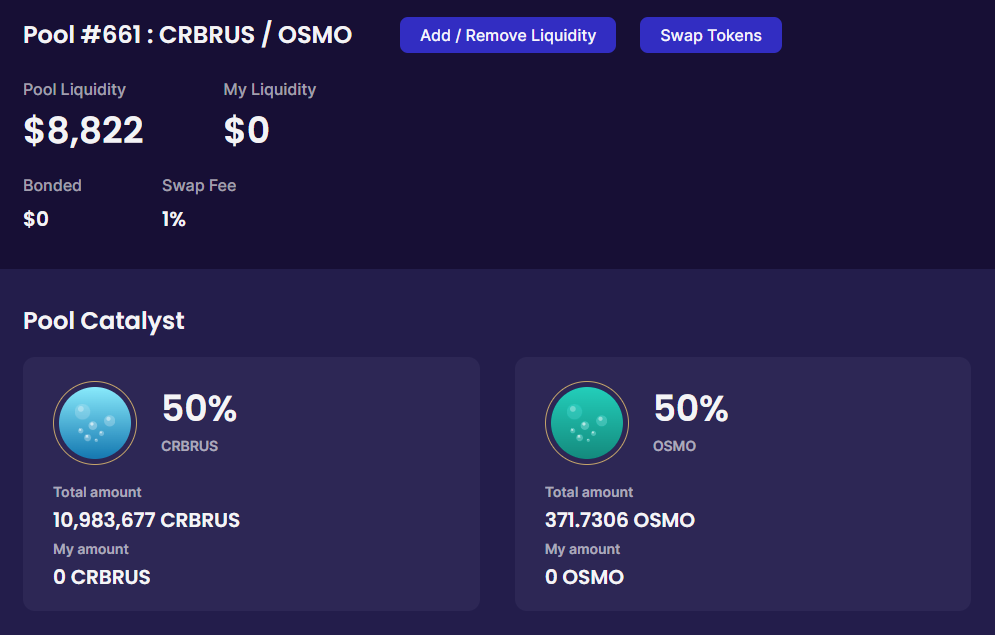

Liquidity Pool

1. Listed on Osmosis as a Liquidity Pool, as long as you can pay the opening fee of 100 $OSMO and prepare a 50/50 ratio of coins (like $ION? Not sure), anyone can get a liquidity Sexual pool (except for the Cosmos blockchain project leader, I don’t believe that “civilians” will have the leisure to create a pool by themselves), for example, LikeCoin has 553 and 555 pools with 50/50 LIKE/OSMO and LIKE/ATOM come out.

2. There is no additional reward for providing liquidity in the liquidity pool, only the Swap Fee swap transaction fee will be received, and some pools will provide the Exit Fee.

3. Because these pools do not have Liquidity/Yield Mining Incentives liquidity mining rewards, liquidity pools will not display APR%.

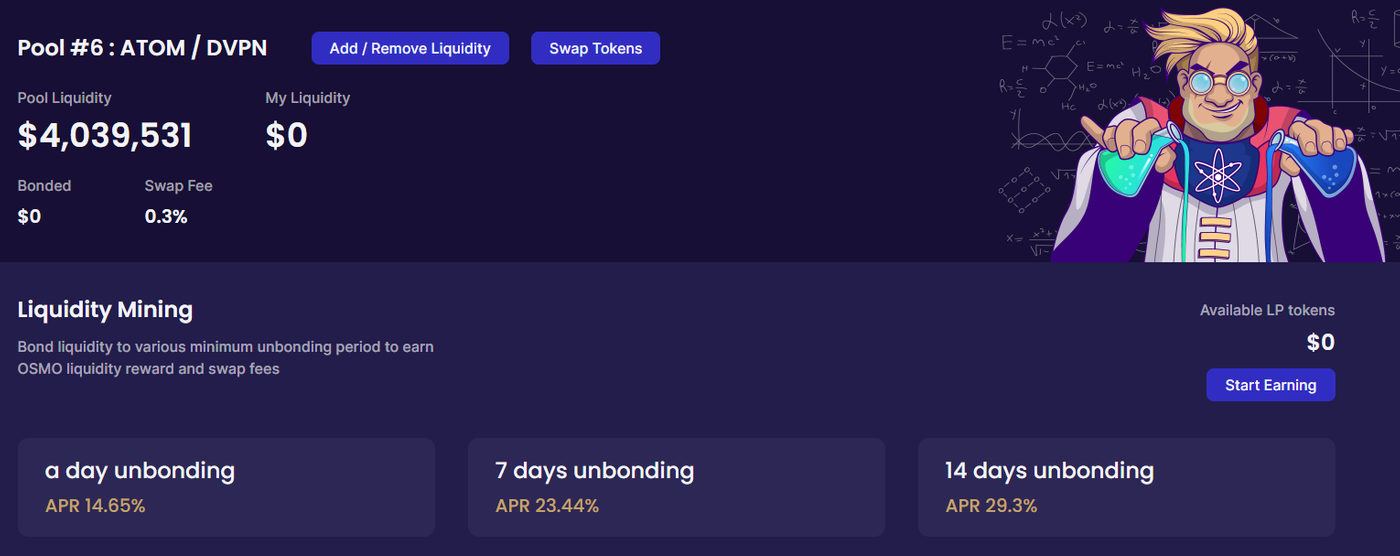

Incentivized Pool

4. The general liquidity pool needs to propose a proposal and the Osmosis community decides whether to make it an Incentivized Pool incentive pool and allow participants to obtain Liquidity/Yield Mining Incentives liquidity mining rewards. Proposals require a 500 $OSMO deposit to enter the voting stage. LikeCoin, through the Osmosis Proposal 51 in October last year, turned the 553 and 555 pools from ordinary liquidity pools into incentive pools, and began to show the APR% of the $OSMO reward for liquidity mining.

5. Osmosis does not have liquidity mining rewards for every pool because it needs to pass a proposal to become an incentive pool.

6. Every week Osmosis will have a proposal called Semi-Automatic Incentive Adjustments to adjust the APR % of all incentive pools according to the received Swap Fee and transaction volume. And as more and more people join a pool, the APR % will naturally decrease. According to the statement, it will not reduce the APR% by a single word, and the reduction rate is 10% per week.

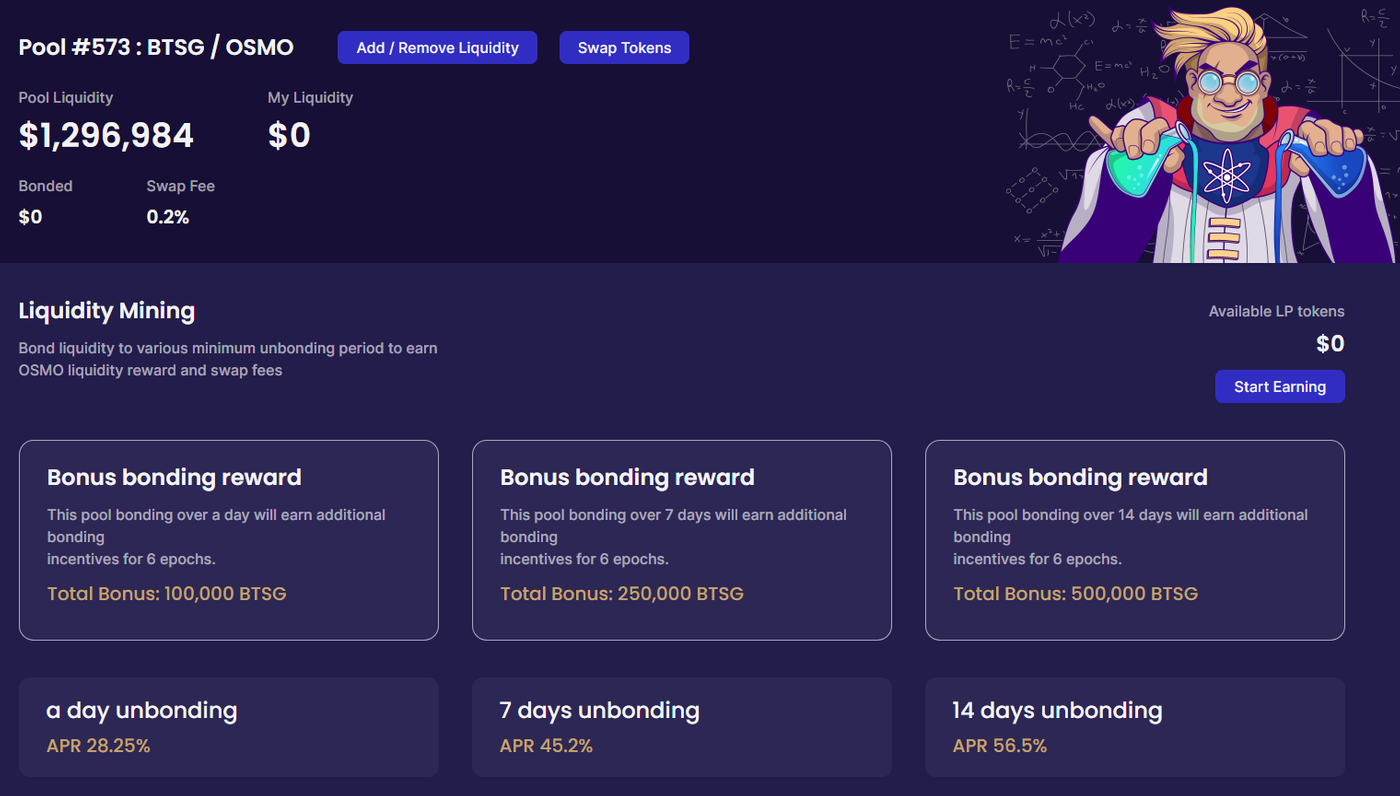

External Incentives

7. At this time, the project party, assuming it is $LIKE, can provide its own currency in its own incentive pool as an external incentive for External Incentives, and ask the Osmosis community to combine the original $OSMO internal reward with the blockchain project party to provide external incentives coin to match. Because the APR% provided by these external incentives is usually relatively high, the APR% of the incentive pool that was originally pulled down due to the participation of many people will be pumped up due to external incentive matching. For example, Osmosis Proposal 163 is to let the 553 and 555 pools provide external incentives $LIKE and $OSMO internal rewards to match. This matching proposal is passed, and then one more Semi-Automatic Incentive Adjustments proposal is passed for matching. Users who provide liquidity in these two pools will receive double rewards of $LIKE and $OSMO that have been adjusted to a higher level.

Note that the external incentive supply period is limited and will not exist forever. Before investing, pay attention to how many epochs are left, which is the number of days. After the end, it will return to the incentive pool and only provide $OSMO rewards.

8. Although the word used is matching, it will not actually be a complete match, and you can't always ask for coins that provide 1,000% APR external incentives to fully match the $OSMO reward. Because the overall $OSMO reward is an amount of $OSMO that is shared by all incentive pools, it is not because some projects provide a crazy external incentive APR%, and the entire Osmosis pool will run with you and not be enough to allocate.

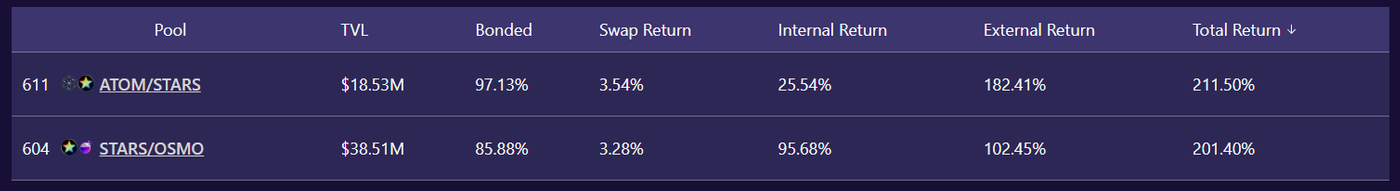

So why are some $OSMO rewards so far from external incentives? Because if the other half of the pool is $OSMO there will be preferential treatment. Taking 611 ATOM/STARS and 604 STAR/OSMO as an example, 604's $OSMO internal reward 95.68% APR and external incentive 102.45% APR almost match 1:1, because the other half of the pool is Osmosis's biological son $OSMO. On the contrary, since no part of 611 ATOM/STARS is biological, even if the external incentive has 182.41% APR, the $OSMO internal reward only gives 25.54% APR.

The impact of the Osmosis proposal on incentives and external incentives

Osmosis's motion has been less discussed, because the clan cannot prepare for the war, and it is too many and fast. But recently Motions 178 and 180 are worth looking into.

Proposal 180 makes 649 MARBLE/OSMO an incentive pool Voting: 18.6% Yes, 15.41% No, 0.15% No with Veto, 65.84% Abstain

Proposal 178 for 651 SWTH/OSMO liquidity pool matching external incentives passed: 55.95% voting rate, 21.76% Yes, 9.07% No, 0.1% No with Veto, 69.07% abstention

Some people say that the content of the MARBLE project can be completed after a long time, so it is opposed to it becoming an incentive pool. I have not studied this and do not understand comments, but it is worth noting that 178 and 180 have a large number of abstentions. Looking through the records is not that the pool has been rejected, including:

Proposal 144 ATOM/CHEQ was rejected as an incentive pool

Proposal 132 ROWN was rejected to become an incentive pool and match external incentives

Proposal 123 DIG was rejected as an incentive pool

But a large number of abstentions really do not know how to interpret. Now there are voices in the community suggesting that some incentive pools should be withdrawn (mainly because the project is obsolete or the performance of the pool is not good). I personally think that there are too many porridges and limited resources. If the incentive pool keeps increasing, the $OSMO reward will not be thinned. Method. However, will the two large abstentions so conspicuous be just an isolated case, or will the incentive pool and new external incentive proposals continue to do so in the future? Really want to see what happens next.

Osmosis Liquidity Mining Series (LikeCoin mining principles are also applicable to other coins)

- LikeCoin Liquidity Mining | Preparation・Deconstruction

- LikeCoin Liquidity Mining | Osmosis Background・Coin Economy

- LikeCoin Liquidity Mining | Osmosis Theory of Operation

- LikeCoin Liquidity Mining | Osmosis Deposit, Swap, Delegate and Vote

- LikeCoin Liquidity Mining | Osmosis Governance・State Affairs

- LikeCoin Liquidity Mining | Osmosis Flowchart and FAQ

- LikeCoin Liquidity Mining | Osmosis LIKE-ATOM, LIKE-OSMO mining rewards finally come

- LikeCoin Liquidity Mining | See LP and Delegated Rewards in Cosmostation

- Osmosis Liquidity Mining | How is APR adjusted? $DSM Pool Gorgeous Launch

- Osmosis Liquidity Mining | Commonwealth, External Incentive Pool External Incentive Pool APR > 1000% DSM!

- Osmosis Liquidity Mining | Dexmos.app to see all pools LP APR% at a glance

- Cosmos super novice to | Keplr / Osmosis transfer / transaction disappeared / unsuccessful what to do

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More