你好,我是東東,不只是作為一名社會工作師,同時也喜歡閱讀與寫作,希望在既有的工作之外,開展屬於自己的斜槓人生。喜歡我的文章的話,請幫我拍手5下,也歡迎到我的部落格『皓翅的飛翔日誌』來看看呦!

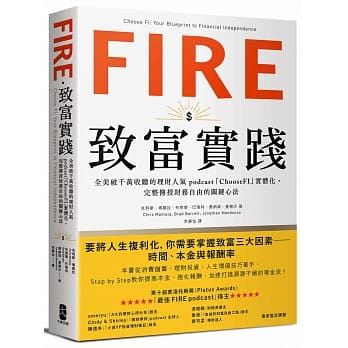

[Good book sharing] "FIRE. Getting Rich in Practice: A Small Step Towards Financial Freedom

Welcome to Hao Chi's Flight Log

Here I will share the dismantling of existing prejudices,

build good habits,

convey the correct concept,

A blog for continuous self-improvement,

By sharing simple self-growth concepts,

The work method of continuous improvement can be practiced concretely,

Combined with investment and financial management, positive psychology,

Habit formation, organization and separation,

and read widely to absorb new knowledge,

I hope we can all leave school,

Continue to learn and grow.

The latest articles are first published on my blog

Welcome to follow and follow

[Reading Notes] "FIRE. Getting Rich in Practice: A Small Step Towards Financial Freedom

Welcome to Hao Chi's Flight Log

Invite you to fly with Hao Chi

Today I want to share Chris. FIRE. FIRE by Chris Mamula et al. The practice of getting rich: The popular financial management podcast "ChooseFI", which has exceeded 10 million listeners in the United States, materializes and fully teaches the key to financial freedom (Choose FI: Your Blueprint to Financial Independence). The book mainly focuses on spending less, earning more, From the perspective of better investment, we will sort out various concepts and implementation methods of FIRE in the podcast program.

The FIRE life of pursuing "financial freedom and early retirement" is not about refusing to accept work and just wanting to eat and be lazy all day long, but to clarify the things that are really important to you, the things you really care about in a limited time, and truly hope to spend it from the bottom of your heart. The life of a person is not necessarily based on working hard every day according to social expectations, buying a big house, changing a big car, constantly being chased by bills, and can only work harder, but there is no chance to enjoy it at all.

At this time, it is very important to clarify the ideal life you really want, and money is only one of the elements to achieve this goal. What really matters is not money, but living in the right way. Money only allows you to achieve this goal. tool only.

[Reading Notes] The Secret to Profitable Index Investment: "Investing for 5 Minutes a Year"

[Reading Notes] "88 Compulsory Courses in Taiwan Stocks for Trend Investors"

[Reading Notes] A Small Step Towards Financial Freedom: "Why He Has Money and Leisure"

Although reducing expenses is the fastest way to achieve financial freedom, under the calculation of the 4% rule, as long as the accumulation of assets reaches 25 times the annual expenditure, the ideal of "financial freedom and early retirement" can be achieved. But spending less does not mean that you have to tighten your belts to live, but invest your limited resources on things you really like, not necessarily physical items, travel, experience life, expand your horizons, and invest your time and money. in matters that you consider meaningful.

When resources are limited at the beginning, don't rush to invest in financial products, but start investing in human capital. Investing in yourself is an investment that will definitely pay off and will not lose money, but it just takes time. The three key factors to make a profit in the financial market are cost, rate of return, and investment time. As long as the time is long enough, under the operation of compound interest, the goal of financial freedom can be achieved.

In the better part of investing, before pursuing profits and rewards, you must first have the concept of risk management. As a passive investor, I personally support the three-fund investment portfolio of Berger's head believers, which is to diversify assets. In the global market capitalization ETF, the US market capitalization ETF, and the world's overall debt, rebalancing is performed regularly. For more articles on passive investing, please refer to the following articles:

【Investment and wealth management】Investment is not the goal of life, but a means

【Investment and Financial Management】Portfolio and Rebalancing Tips

【Financial Strategy】Find the investment method that suits you

After reading this book, in addition to having a deep understanding of the concept of FIRE, I also have a clearer outline of how to practice FIRE, especially the book cites a lot of real stories in podcasts, from the motivation of first contacting FIRE, In the struggle and contradiction between the pursuit of financial freedom and social expectations, should we give up the existing life and pursue a life of freedom and freedom?

Finally, the FIRE ideal of "financial freedom and early retirement" is not a simple goal or time point. Before and after it is achieved, it will produce earth-shaking changes. On the contrary, FIRE is a continuous process, in the pursuit of financial freedom. On the road, enjoy the freedom and strength on the way, redefine the ideal retirement life, no longer have to wait until the statutory retirement age of 60 or 70 before leaving the workplace, but can freely enjoy life.

Latest articles are first published on Potato Media

Join and enter my exclusive promo code: BrpHdFu0a

Each other can get an extra 100 points

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…