野生咨询|内容教练|🎙空无一物/有效失败 亲密关系|多元思维|认知升级|成人教育 DAO/Crypto|🌍 世界公民 B站/公众号:范米索| 微博:斜杠少女范米索

A speck of dust

The reason for writing this article is that I have seen different things recently:

1. Pan Luan's live broadcast to discuss whether it is his own ability or the dividend of the times that created him

2. An article about the dialogue between the charm KTV boss and his son

3. The employment rate of fresh graduates has dropped

4. Dissatisfaction and opposition to "business owners, capitalists", etc.

This article mainly wants to talk about some of my personal thoughts on the above phenomena. I was looking at these issues before, and I will focus more on micro discussions, individual efforts, etc. There is no doubt that "micro" efforts are to some extent. It does work.

But now I am more and more aware that when discussing micro issues, macro factors are really inseparable, and even many results, phenomena, ideas, etc. presented in individuals are precisely caused by macro forces.

(1)

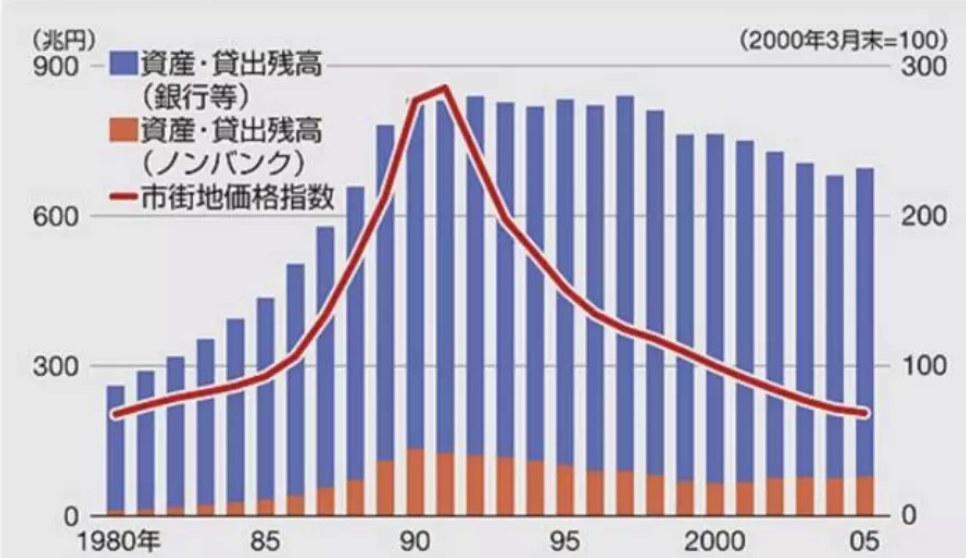

In 2017, I became very interested in the economic crisis in Japan in the 1980s and 1990s. At that time, I checked a lot of materials and tried to pull myself back to that era. I wanted to know more about some social phenomena in Japan today, such as low birthrates. change, low desires, the elderly living alone, etc.

I was in Japan at the time, and my Japanese teacher impressed me very much. He was a very humorous and interesting old man, and his age can be said to have experienced a series of changes in Japan's economy since the end of World War II - post-war reconstruction. When the economy climbed to its peak, it declined rapidly after the 1980s and 1990s.

Therefore, as an eyewitness of the era, he can describe in detail what happened in Japan in that era.

I remember that afternoon, when we were in class, he mentioned the bubble economy, and then took out a 10,000 yen note from his wallet, which was equivalent to more than 600 yuan at that time. He waved the banknotes in his hand with one hand, and put the other hand on his hips, and said to us excitedly:

"Do you know how far Japan's economy has developed at that time? We stopped a taxi on the street, took out 10,000 yen and waved it at the taxi. People ignored us at all, and they didn't care about the money at all."

In the 1980s, Japan replaced the United States as the world's largest creditor country. However, Japan's export-oriented economy brought a huge trade surplus to Japan, but it also exacerbated trade frictions, while the United States became the world's largest debtor country and faced huge losses. Fiscal deficit, for the sake of self-interest, hopes to enhance the competitiveness of the country's exports through the devaluation of the US dollar to ease the debt pressure, which led to the signing of the "Plaza Accord" .

After the agreement was signed, the exchange rate of the Japanese yen against the US dollar doubled in three years, leading to a direct decline in exports. Therefore, banks continuously lowered interest rates and expanded currency issuance to maintain economic growth. However, over-expanded monetary and fiscal policies have caused a sharp increase in domestic excess funds and asset prices have soared.

In that exaggerated era, you may not have imagined that fresh college graduates could choose at will from different big-handed companies, and companies would reimburse applicants for travel expenses. Some of them will even give Armani, Rolex, imported cars, etc., and they will also be invited to Ginza to enjoy the top entry benefits.

In the 1980s, the Japanese government adopted various preferential policies for real estate investment through legislation and executive orders, and attracted private funds to the real estate market and stock exchange market by revising the securities exchange law and relaxing the eligibility criteria for listing companies.

Since about 1984, Japan's land prices and stock prices have risen, borrowing to buy stocks, buying houses, mortgages, and mortgages, and then speculating in stocks and properties.

As a result, land prices have risen rapidly, especially in big cities. The prices have become so high that they cannot be purchased with labor income. In this case, the assets of laborers who own real estate are far more than those who do not have real estate. At the peak of the bubble, total land prices in just Tokyo's 23 wards exceeded the national land price in the United States.

But it is precisely because there are so many speculators during the formation of the bubble economy that once the asset bubble bursts, it will directly affect millions of enterprises, residents and financial institutions. Financial institutions were deeply trapped in the stock market and property market by collateral, asset prices plummeted, and the value of bank collateral shrunk sharply, leading to natural bankruptcy.

(2)

Why do you think of this story?

Two days ago, I heard the live broadcast of Pan Luan's video account, mentioning layoffs in large factories. Many people look back on the past ten years and realize more and more that perhaps their personal efforts are only a drop in the bucket in front of the dividends of the times. It's "time".

In the early days of Internet development, most outstanding fresh graduates chose to go to foreign companies instead of the Internet industry. The strength and background of fresh graduates who entered Internet companies at that time can be said to be far less competitive than today's fresh graduates.

Once the top executives of the big factories are laid off, they will face middle-aged unemployment, the front-line who can't stay, and the foreclosure houses that are forced to enter the market. They were created by that era and took off rapidly, but they are now abandoned in this era. .

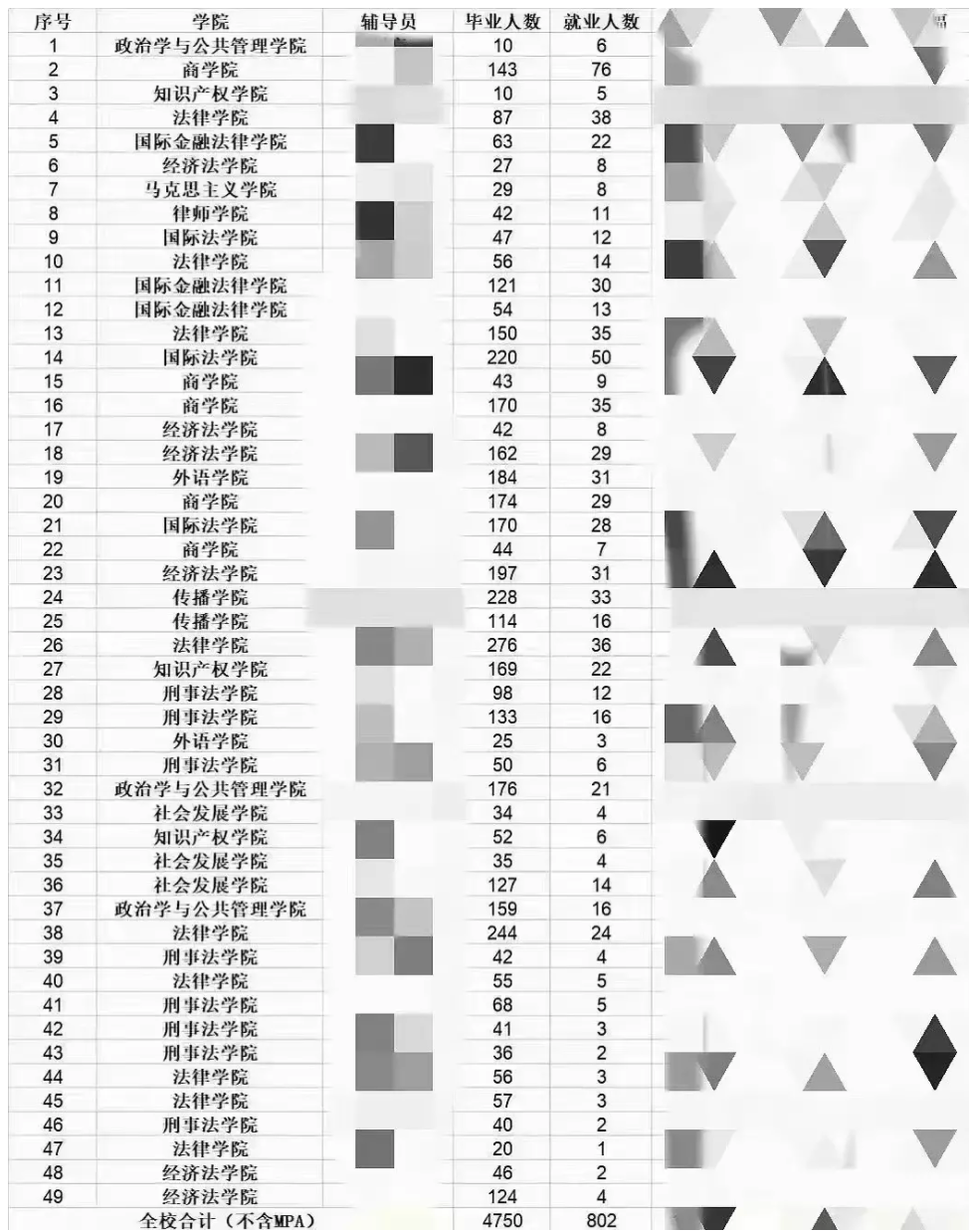

A while ago, I myself also saw in some groups that college teachers asked former students (people who have companies now) to help new students create a tripartite employment agreement, including the employment rate table of East China University of Political Science and Law that has been circulated on the Internet. The side reflects some dilemmas in the current society.

When I was reading the Great Depression story before, I didn't really experience this kind of crisis. If 2008 was an important global economic crisis when I was born, but for me as a junior high school student, I was under the pressure of exam-oriented education. There is no concept of money in my mind, no experience at all, let alone the so-called "empathy".

Even if I know the stories of the Great Depression, can I really learn from them, avoid losses, or even earn higher returns?

In the past, I thought that after watching so many bloody historical events, there is a high probability that it can be avoided, but now I will change "high probability" to "maybe".

For example, I met some Japanese peers in the 1990s, and their reactions were completely different when it came to getting married and buying a house.

Most of the Japanese choose to rent a house instead of buying a house, but the Chinese tend to buy a house and cannot tolerate renting. Getting married without a suite is a shameful or even shameful thing for both men and women, and "owning a room" has become a rigid indicator of marriage, and it has become a "capital" when dating.

Writing here, I can understand one thing in particular -

Even as a generation born in the 1990s, it will be completely different from that of the same generation. But the year of my birth and the country, the values instilled in me by my parents and teachers, and allowing me to explore the way forward, are not in my own 100% control. This is a probabilistic event.

Even though I have read a lot of past books and historical materials, and have spoken to eyewitnesses and witnesses, I may not be able to fully empathize with those who have experienced major events.

In the same way, even if I know the thoughts and choices of some Japanese young people of my age, it does not mean that I will apply the same logic to myself.

For example, the Japanese in the 1980s would definitely choose to invest a lot of money in real estate. After the bubble burst, Japan’s real estate was cut in half, but now if you ask those Japanese people, few people are willing to invest their money in real estate.

There is a book called "Lost Thirty Years", which tells about the Heisei era (1989-2019), Japan's 30 years from the collapse of the bubble economy to the sluggish economic growth. The economic crisis that Japan encountered in that year can be seen from the book.

So, even knowing the true story of Japan, will it change the investment thinking, investment logic and investment behavior in your mind? I don't think so, because we are not witnesses.

The lesson of history is that people never know to learn the lessons of history. I think this statement is indeed reasonable.

(3)

I have seen a report by an economist who studied how Americans spend their money, and there is a conclusion in the report:

In theory, people should make investment decisions based on their goals and the characteristics of the investment options available at the time, such as valuation and expected returns. But research shows that people's lifetime investment decisions are largely determined by investors' experiences investing in different generations of their generation -- especially their early experiences.

For investors, the economic volatility brought about by these times will be more sympathetic to them. Whether it is today's top investors Buffett, Munger, Graham..., if not born in that era, can they really make them today?

Of course, the impact of the times on people is not limited to investment, but also includes people's views on economic policies and social issues.

I remember when e-commerce first emerged and gradually developed in the 2000s, you will find that thousands of e-commerce merchants who benefited from Jack Ma are all grateful to him. This influence has lasted for a long time, and Jack Ma has always been positive The image appeared in the media reports and the public.

But now, when we go to some platforms, especially Bilibili, you will clearly feel that "Jack Ma" has become an ugly capitalist, and the most aggressive group will probably not be over the age of 30. People, basically after 95.

Yale economist Lisa Kahn found in a study of men who graduated from college between 1979 and 1989—

Those who entered the labor force in bad times earned 7% less than those who graduated in strong times, and the gap persisted indefinitely. Seventeen years after graduation, it is still the same.

As a result, groups that graduate in recessions meet groups that graduate in good times, and they have very different views on current policies, social issues, identities, careers, and so on.

Of course, it’s hard to judge whether the two sides have their own opinions or their lack of understanding. It’s not entirely a question of right and wrong, nor is it a question of who is smarter and more capable than the other, as I mentioned in the Panran podcast. As the guests said.

The consideration of the general background must be inevitable, whether it is the year in which they were born, or the place where they were born, these are the sources of opportunity.

You can't expect Japanese, Americans, and Chinese to have similar views on some of the policies, social behaviors, etc. that we approve of. After all, the policies, economics, and stages of the countries they go through are not necessarily the ones we go through.

People who have experienced a crash or recession tend to be conservative, whether in investment, the workplace, or in some policy behavior, while those who grew up in times of peace and prosperity are more inclined to take risks.

I think of the article "Dad, don't accompany me" written by the boss of Charming KTV I saw today, which vividly shows some of the ideas of several generations.

Children learn quickly, even if they don't know much, and they are good at asking questions and learning from what they can experience and observe firsthand. He definitely doesn't know how nucleic acid works with his father for free, his grandparents retire and get social security...and how a series of things work together, and he doesn't have a grand economic map in his mind.

But it is precisely through the observed phenomenon that he builds his mental model little by little to explain the current phenomenon, but if he realizes that "Dad should go to work, but Dad never goes to work" , he will feel uncomfortable. understanding and frustration.

Then he needs to try again to match his life with the mental model in his head, because it does not match his original cognition, so he has to continue to use the "known" to tell a coherent story.

The same story applies to us as well.

The many problems and dilemmas we face today have even broken the system in our minds, and the impact of this experience and memory on people of different eras and the choice and planning of life paths in the future will be re-implemented Adjustment.

If not experienced, then the inertia of thinking will continue.

(4)

At the time of writing this article, I failed to return to China to board the plane, and the loss was quite large.

From a microscopic point of view, it is indeed the airline company, but from a macroscopic point of view, the disasters and traumas caused by the epidemic in recent years, and the policies of different countries on epidemic prevention are all things that we, as small individuals, cannot change.

I know that I am in the middle of a powerful trend, and it is difficult to reverse this situation, and the power of individuals is negligible, and it is not purely external forces that can really reverse the situation. On the contrary, when the side effects continue to manifest, it is precisely the moment when the opportunity is born.

Just like if there is no economic recession, investors will have full confidence in the market, hot money will flow, and more people will take risks and start businesses. Just like Zhongguancun Street 10 years ago, there are roadshows for entrepreneurs everywhere, but it is precisely the risk of taking risks. With the increase of the number of people, it will inevitably enter a recession cycle.

If markets never crash, valuations keep rising, and when valuations rise, markets are naturally prone to crashing.

All things follow the same principle, and when things go to extremes, they will be reversed.

This is like a flowing yin and yang gossip diagram. At a certain moment, it will always enter the yin side, and it will always enter the yang side, and so on.

In any cycle of history, there will be prosperity and recession, but we happen to be in this era, and we are faced with such crises and dilemmas, but in the long history, what we have experienced may be in different historical stages of other periods People have experienced it too.

Bad things can cause havoc, but they can also create new dynamics.

Each of our thoughts, cognitions, behaviors, choices, and lifestyles are inseparable from the background of the times we live in. It is understandable to say that they are "products of the times".

Therefore, I often think about a few questions:

If there was a time machine, I would travel back to ten years ago and tell her (the younger self) what I was thinking as a stranger. Would she really be willing to listen? Will you refute me? even resent me?

After all, I have experienced many things, but for her, she has not experienced it yet, and the information she received in the era she lived in will be shaped into the "she" at that time. She may not understand me. "It may not be easy to change her mind.

So everyone has their own blind spots about how the world works, and when you think you're thinking at odds with other people's opinions, maybe you're just discovering an experience you've never had.

Everyone is a product of their own life experiences, and what makes sense to me may not make sense to you because you don't know what experiences shaped me and vice versa.

A lot of things are determined by probability, but people's thoughts are black and white, right or wrong - did it happen or didn't it happen? - It's easier to think this way after all.

If some people experience parts of the world that you haven't, then it's hard for you to understand other people's beliefs.

All the current events will become the common memory of those who have experienced it in this era, and will also change the lives, decisions, and thinking of many people. However, the propositions that the next generation will face may be the same or different. Accumulating experience and learning from events is not a bad thing.

Reminds me of a famous saying:

A speck of ashes of the times falls on everyone, and it is a mountain.

A generation has a long march of a generation.

Telegram group: https://t.me/misso0513

Tabloid Subscription (Wisdom Magazine): https://xiaobot.net/p/Misso

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…