半導體外商的小小螺絲釘,遊走於廢青與社畜之間。熱愛閱讀,喜歡透過書本探索外在、內化自我。希望藉由書寫打開與世界交流的一扇窗。 個人部落格:https://maxjamesread.com/

"Investing in 5 Minutes a Year": A must-see for petty bourgeoisie, passive investment 7 questions and 7 answers!

If an investment "master" tells you that there is a way to make money without thinking about it, nine times out of ten it's a fraud. But the book "Investing in 5 Minutes a Year" that I want to introduce today is a really good investment book that can take you without looking at the market or picking stocks, and you can "lie down and earn" in just 5 minutes a year.

The author, Chen Yipu, is the head of the petty bourgeoisie YP investment and wealth management notebook . He is committed to promoting the concept of passive investment and asset allocation to the petty bourgeoisie. The blog traffic has exceeded 3 million people.

I've written a few books on passive investing before, but I find it difficult for my friends to understand when I introduce them to them. Therefore, I want to try a new way of writing this experience, using the 7 questions I am often asked as a guide, and answering the content of this book, so that you can understand why passive investing is very suitable for petty bourgeoisie who do not have many resources.

【1. Why invest? 】

The first question often heard is: Why invest?

Many people have heard ghost stories of all kinds of investing and draining their wealth, and regard it as a dreadful way, but this is a bit of a waste of food. The book uses two reasons to tell why investing is a must:

[1. The inflation thief]

Even if you keep your money in the bank, there is an invisible thief who is stealing your hard-earned money. The thief is inflation .

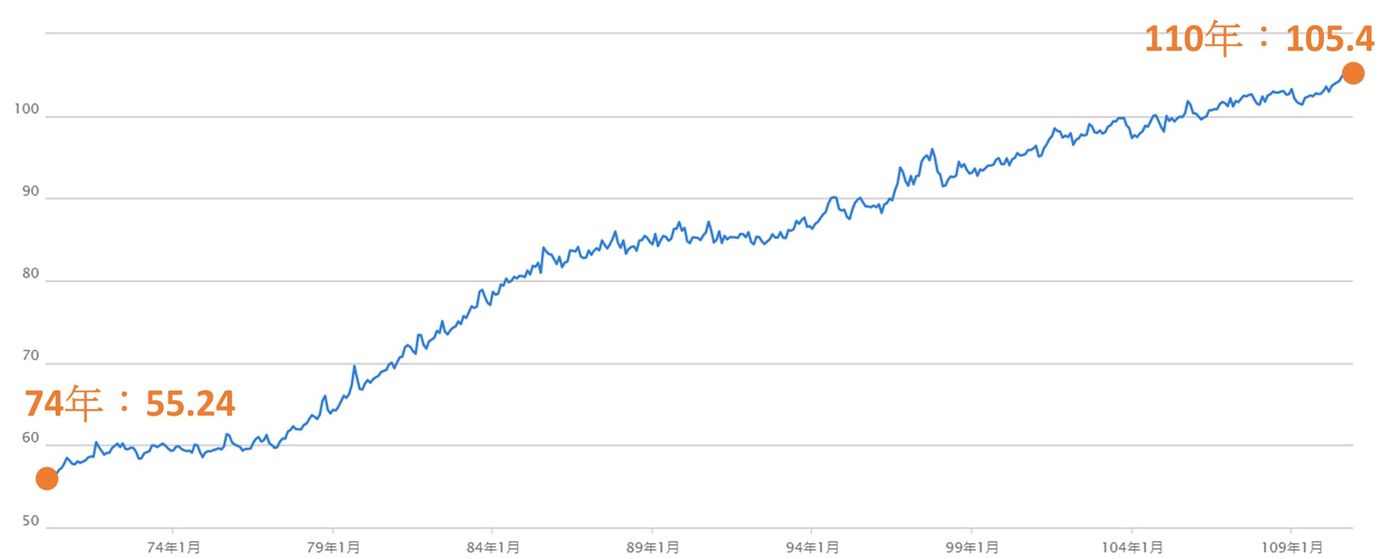

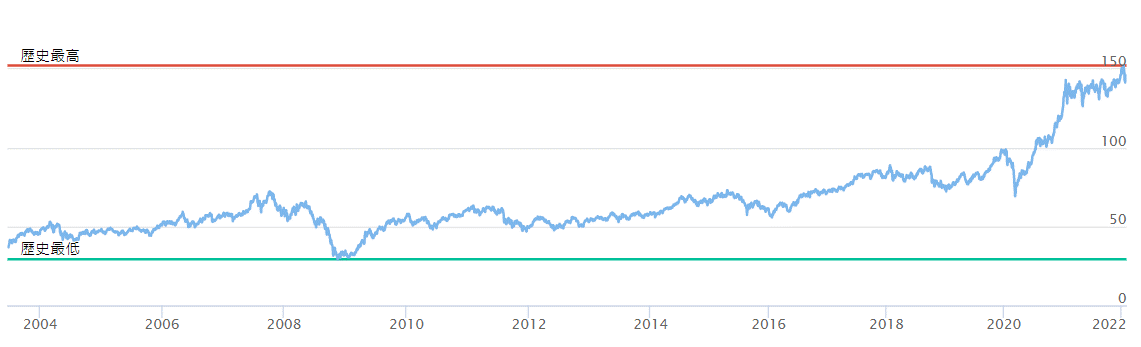

Inflation keeps prices rising. From the figure below, we can see that Taiwan's consumer price index was only 55.24 in 1974, and has climbed to 105.4 in 110. That is to say, the purchasing power of the same money will decrease year by year. If you don't invest and let inflation eat away at your savings, you're probably going to retire and realize you don't have enough money.

(2. Limited active income)

No one can work for a lifetime. If you rely on salary alone, I am afraid that you will not be able to live safely after retirement. And investing is a way to break through the dead salary limit.

In fact, even saving money in the bank is an investment, because you are putting all your money in fiat currency , and this is not a smart way to "invest". As YP said, in places we didn't expect, there are often better alternatives. Choose, don't miss opportunities out of fear.

【2. When do you start investing? 】

Another common question is: When is the best time to start investing? The answer is simple, the sooner the better . why? because of the compounding effect .

An example from the book:

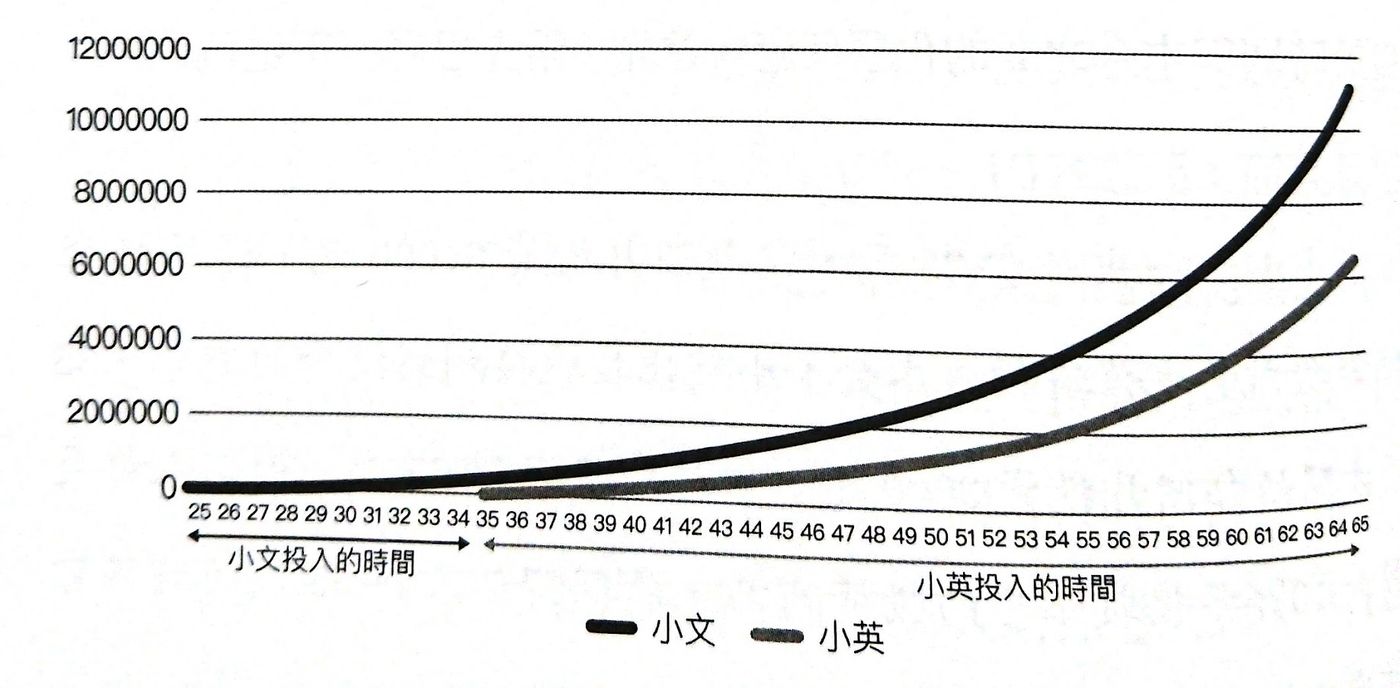

From the age of 25, Xiaowen invested 3,000 yuan per month to commodities with an annual return of 10%, but after 10 years of continuous investment, he did not invest any new funds; Xiaoying started from the age of 35, and invested 3,000 yuan per month. , but he was more persistent and continued to vote until the age of 65. At the age of 65, who has more assets?

At first glance, Xiaowen only invested 360,000 yuan in 10 years, but Xiaoying spent 30 years and invested more than 1 million yuan, but in fact, Xiaowen owns more than 4 million yuan more than Xiaoying, which is 68% higher. asset.

From the above example, it can be concluded that time can make small principals roll into great wealth through the power of compound interest. So if you have the money to invest now, don't hesitate to get in right now!

【3. What is passive investment? 】

So how do you start investing? This brings us to the topic of this book: passive investing .

Passive investing is also known as indexed investing . Hundreds of indices, such as World Index, Taiwan High Dividend Index, etc. Passive investing, on the other hand, buys a market index that is expected to bring positive returns. Different from active investing, passive investing has the following three characteristics:

- No stock selection

Buy a basket of stocks that track the entire market, without picking individual stocks. - at any time

Don't predict ups and downs, just invest when you have spare money. - long-term holding

Adopt a Buy and Hold strategy. Usually invest 5 years, or even more than 10 years.

It is now very convenient to operate passive investing, as long as you use ETFs , you can easily invest in the subject of tracking various indexes. The use of ETF is explained in detail in the book, and a large number of reference targets are provided. You can study it yourself.

Profits from passive investing come from the average return of market development. For example, if you invest in 0050, you are optimistic about the future economic development of Taiwan; if you believe that the United States will continue to be the locomotive of the world, you can invest in the US stock VTI; if you believe that human beings will continue to progress and the economy will continue to grow, you can also invest in tracking FTSE VT of the global stock market index.

In addition, passive investing will reduce risk through asset allocation, such as equity and debt allocation is a common method. Those with a high risk tolerance can add more stocks to increase long-term returns, while those with a low risk tolerance can consider buying more bonds to reduce asset volatility. I am currently using the configuration of 80% VT and 20% BNDW for your reference.

【4. Why passive investment? 】

Next you might ask, why invest passively instead of actively picking stocks? Look at those Nautical Kings and Iron Kings, who all cut the seas to get rich in a short time, is it stupid to only earn the average market remuneration?

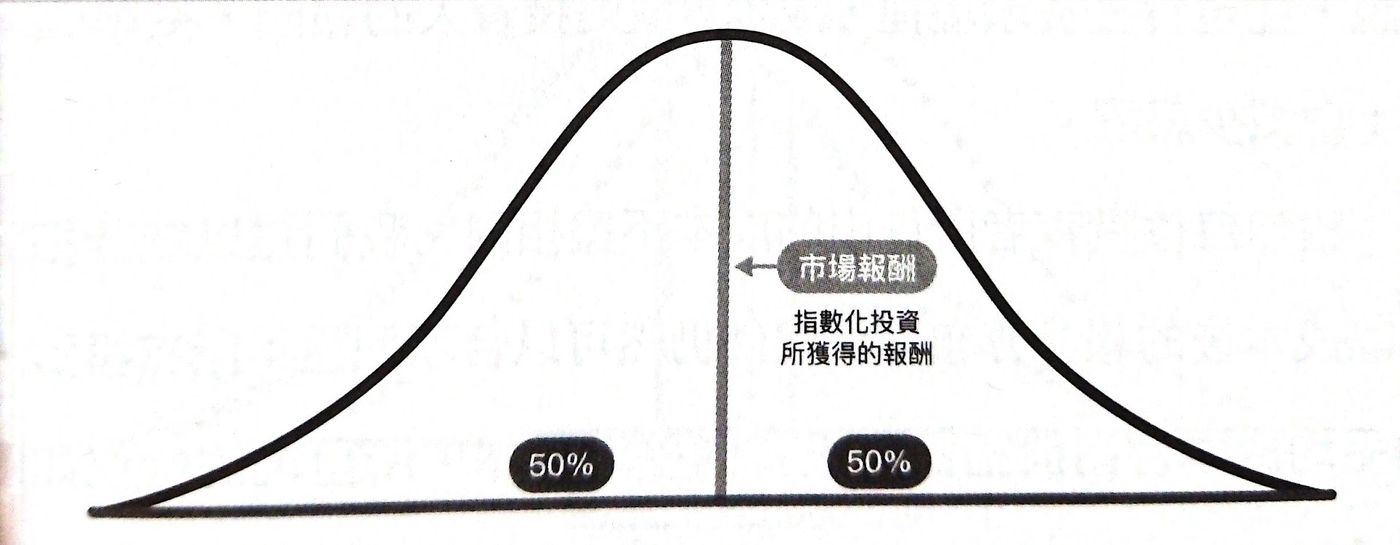

First of all, the biggest advantage of passive investment is time , because it does not need to study the financial report, and it does not need to keep track of the entry and exit operations. Don't forget, the market is a zero-sum game, and if someone wins the market, someone must be beaten by the market. Assuming that the profits of the overall investor are normally distributed, passive investing is equivalent to directly defeating 50% of the investors.

Furthermore, because most active investors in the market will need to enter and exit frequently, after considering the handling fee, the number of people you have won will actually exceed 50%. If you take into account the monsters that eat a lot of money (such as One Piece), passive investing will win more people. Because their high pay is based on a lot of leeks.

In fact, even Warren Buffett, the stock god, believes that general retail investors should invest in index funds, because even many professional fund managers are not opponents of the broader market in the long run. If these top-notch people possess a lot of confidential information, it will be difficult to beat the market. Generally, it is not easy for retail investors to beat the market by relying only on known information (such as financial reports and industry news) in the market.

Before you envy One Piece or the leader, you might as well think about your ability and investment of time. Is it really enough to beat the market?

【5. Can you buy it at a high point now? 】

Another question I often get asked is, "But the stock market is very high now , can I buy it?" As YP said, many people are very concerned about the timing of buying and selling, and they are worried that buying at a high point will become a big loser; when they encounter a bear market, they tend to Wait and see, I am afraid that the stock price will continue to drop as soon as I enter the market.

Regarding this question, if you adopt passive investment (individual stocks do not hold), YP gives a clear answer:

Don't wait for any moment, invest it best when you have the money.

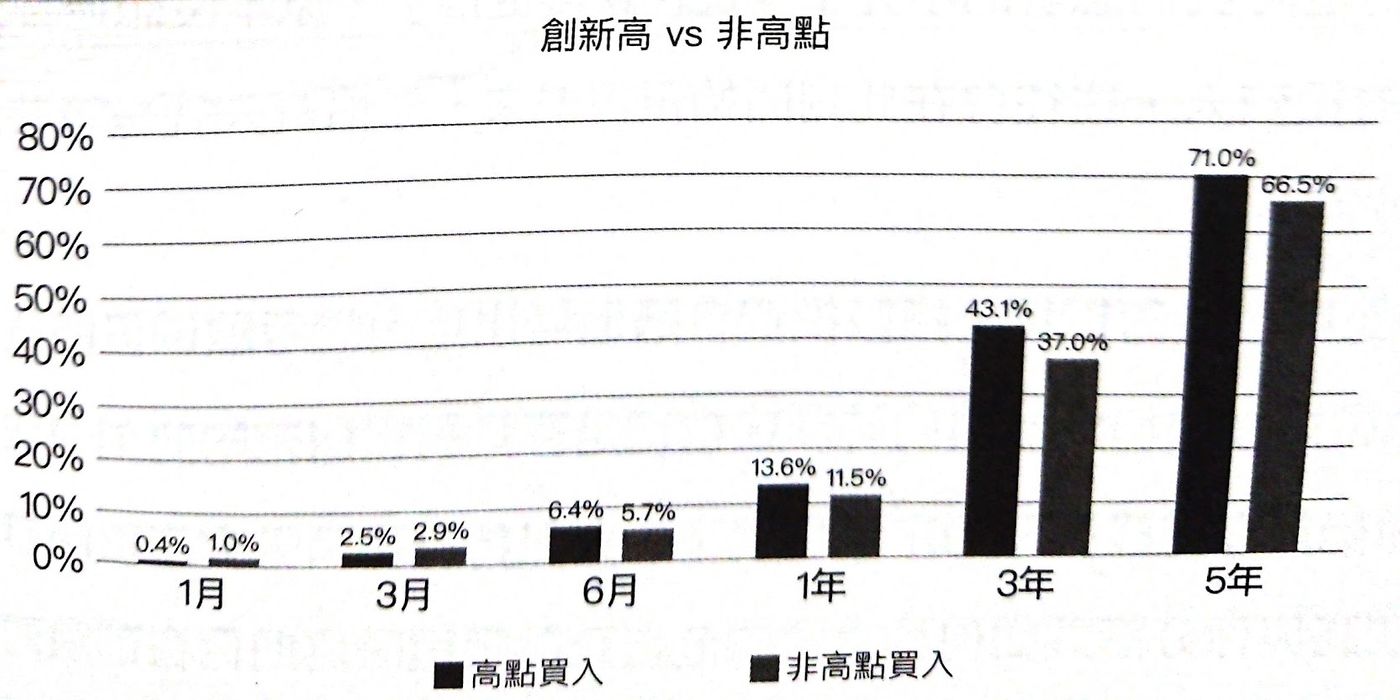

Take the U.S. market as an example, even if you buy when the stock price hits a new high, the reward you get is not inferior to buying at a non-high point, and even if you hold it for more than half a year, you will win. Because the current high stock price is compared with the past, but the price you buy is compared with the future.

What about when it goes down? Is mindless buying still possible? The answer given by YP is still in the affirmative. Because the essence of indexed investment is to believe that human beings will overcome difficulties and reach new heights.

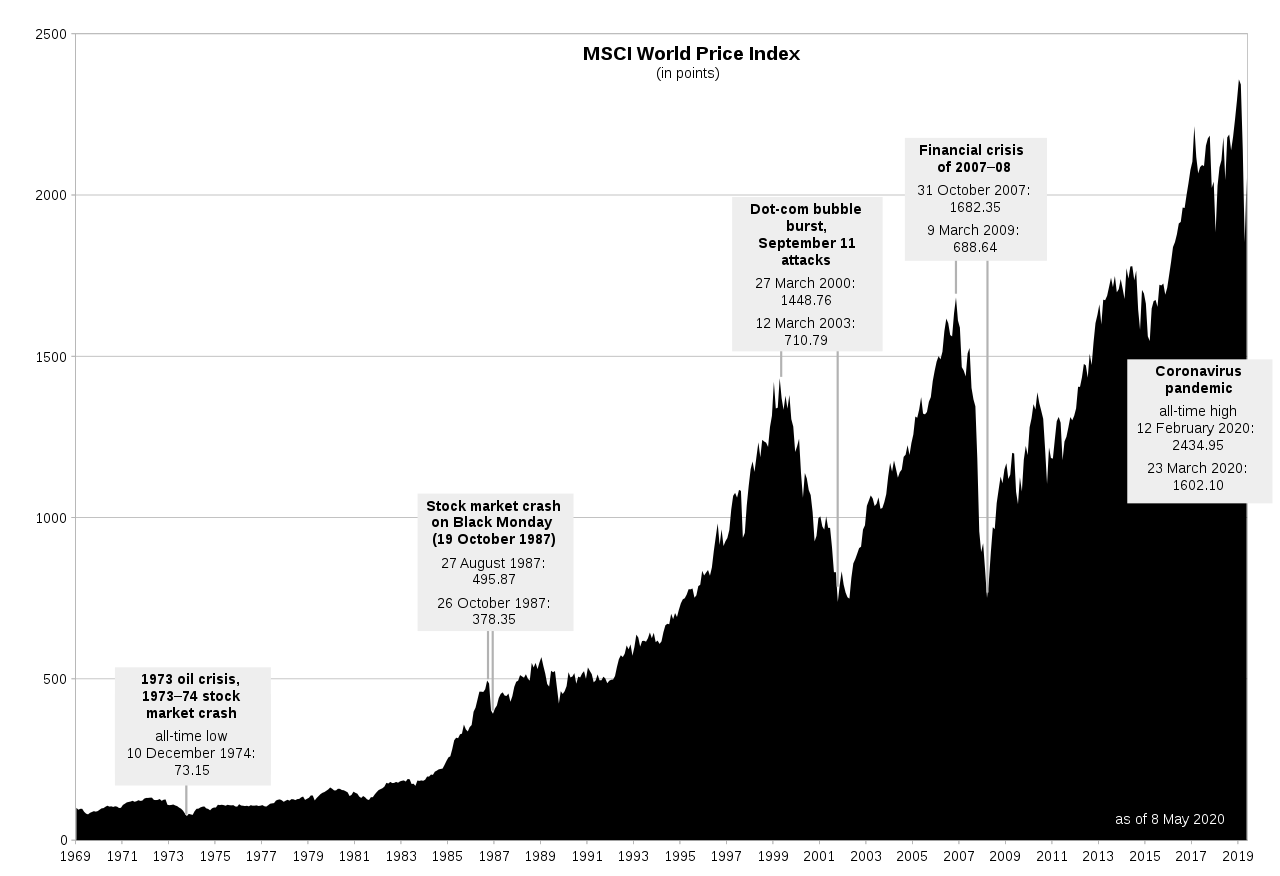

Historically, although the market will fluctuate violently in the short term, the fundamental trend in the long term is upward. The MSCI World Index as shown in the figure below has experienced various crashes (such as the 2020 epidemic), but in the end it has soared.

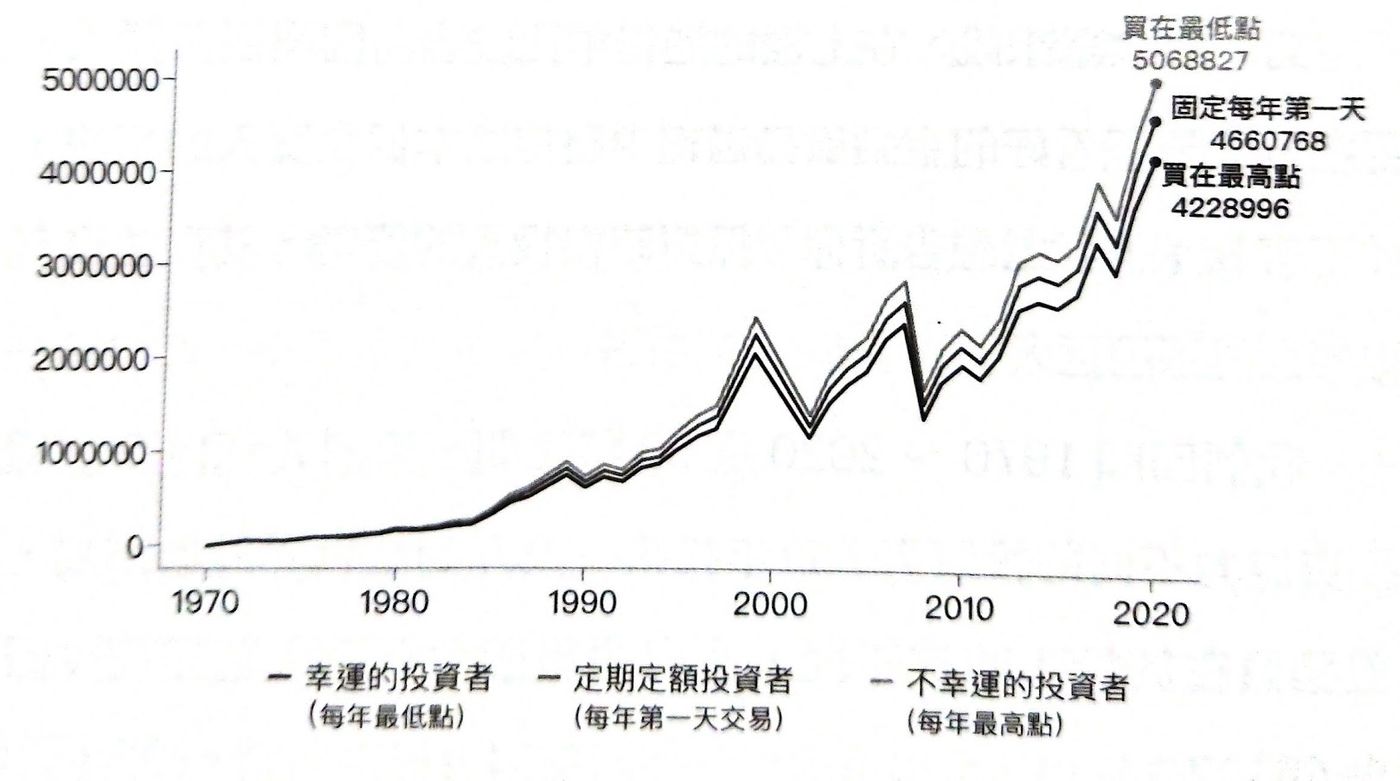

End the paragraph with the following example. Suppose that during the 50 years from 1970 to 2020, there are three types of investors, A, B, and C, with different abilities, who invest 10,000 yuan in the world stock market every year:

- A: Perfectly predict the high and low points, and buy at the lowest point of the year every year

- B: No prediction at all, fixed investment on the first trading day of each year

- C: The unfortunate ghost of hell, every time I buy it at the highest point of the year

As can be seen from the above figure, in fact, there is only a 0.5% difference in the annualized remuneration between strong players and bad ghosts. Buying at the lowest point every year is actually an impossible task.

In short, the best time to invest in passive investing is now. As long as you invest long enough, the market will pay you handsomely. Like me at present, except for the funds that may be used in three to five years (the down payment and the money for buying a car) and the emergency reserve funds, which are kept and survived, other spare funds are put into the market.

【6. Want All in? Or regular quota? 】

If you have some spare money today, do you want an All in or a regular fixed amount? To say the answer directly, a single investment would be a better choice.

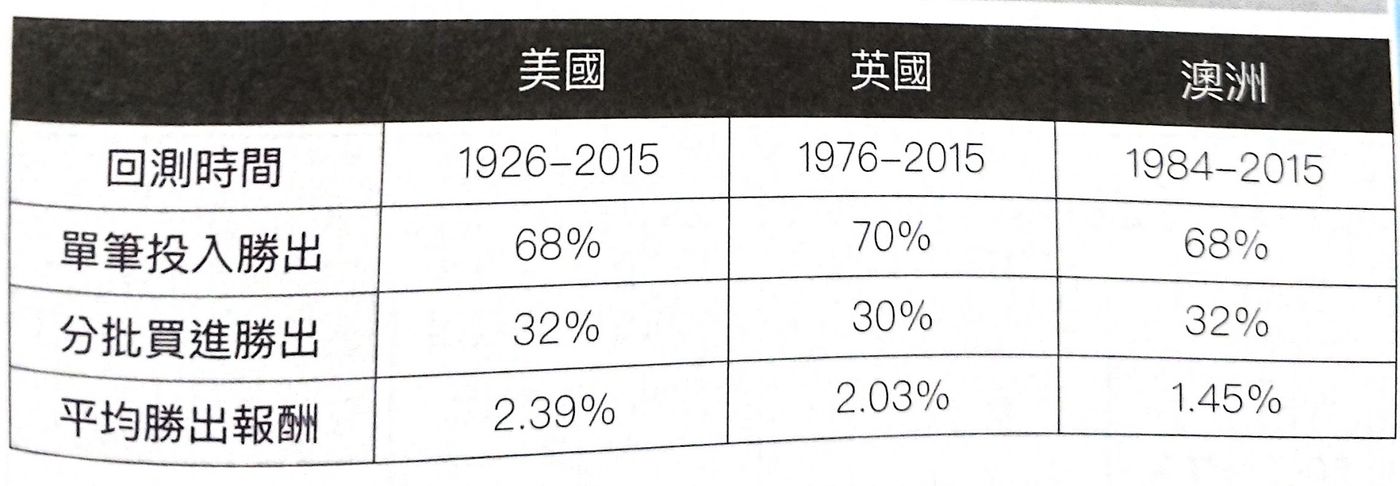

The book compares the odds and returns of single and tranche investments in the U.S., U.K., and Australia markets when taking a 60-to-40 equity-to-debt ratio:

As can be seen from the above table, no matter which market, there is almost a 70% chance that a single investment will outperform a batch investment. If you still have doubts, you can watch this video of Qingliujun:

https://www.youtube.com/watch?v=uTXwhTTIuMw

Of course, if you feel that All in has psychological pressure, it is still possible to buy in batches. But YP recommends that even if it is invested in batches, it should not exceed one year. After all, leaving cash on the sidelines will drag down performance.

【7. How to implement passive investment? 】

Okay, if the above convinces you, let’s finally talk briefly about how passive investing is executed, using the following five steps:

- The first step is to establish investment goals <br class="smart">Think about the purpose of your investment. What is the target amount? Want to save for retirement? Or want to save a down payment in a few years? Different goals will determine the amount and target you need to invest.

- The second step decides to invest in the market

Then decide which market to invest in. In Taiwan, investing in 0050 or 006208 is a good choice. It can also be invested in the global market for more diversified investments. - The third step selects asset allocation

The next step is to determine the asset allocation ratio. YP suggests that you can use 110-age to determine your own equity-to-debt ratio (for example, I am 80% equity and 20% debt). However, the book also emphasizes that asset allocation should be determined according to risk tolerance, and you must choose according to your own situation. Also, remember to rebalance regularly to make sure the configuration doesn't deviate from the original settings. - Step 4: Establish Purchase Frequency

Then you need to set the frequency of investing your money. Usually, a certain amount of money will be accumulated and then invested, because there will be a handling fee problem when using a Taiwanese brokerage, and a wire transfer cost will be borne by using an overseas brokerage. Like myself I choose to put in quarterly. - The fifth step has been to buy, it is right!

Finally, the principle of passive investing is to keep buying . As YP said: until the end is reached, it is not easy to let go. Unless you have reached the original set goal, it is right to buy without thinking. As long as the first four steps are set, you only need to spend a little time every year to invest money, which is the origin of the title of 5 minutes.

【Summarize】

Okay, this is the passive investing question and answer collection I put together from this book, I hope it will convince you (laughs). Let me do a quick summary. First of all, investment is necessary, and it is necessary to enjoy the greater compound interest effect as soon as possible; and passive investment is a very time-saving and efficient way. As long as you choose the asset allocation and continue to invest, you can beat most people in the market. The petty bourgeoisie of multi-resource research.

In fact, "Investing in 5 Minutes a Year" is a very comprehensive financial management book. This article omits a lot of content for the purpose. YP can be said to be hands-on, from the preparation before investment, to the method and logic of passive investment, to how to plan for retirement. There are even teachings on how to open an account, which is very close and practical for beginners in investment.

I also share a great Podcast here: Life is not difficult, Life Lab . There are only sixteen episodes, and it is quite comprehensive about the mentality and practical operation of passive index investment. Recommended to friends who like to absorb with hearing.

Finally, as the English title of this book is: How to start investing today! I hope this article will give you more confidence in starting investing and know how to execute it better!

Articles you may also be interested in:

- "Five years after I graduated, I made 4 million with ETF": I can earn passively, a book to understand indexed investment!

- "The first time you get a salary, you should know how to manage money": 3 key points that a financial novice must understand!

- "Walking on Wall Street": The most beautiful financial management classic? ! (Part 1)

- "Walking on Wall Street": The most beautiful financial management classic? ! (Part 2)

- "Green Corner's Fund 8 Lessons": teach you the passive investment method that Wei Lian is also using!

↓↓You are also welcome to follow the Facebook and mourning of "Mrs's Reading Space"↓↓

James' reading space FB

James' reading space IG

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…