為自己的投資負責~

Repeat the simple things, and judge the trend turning from the chips of the three major legal persons and retail investors. (8/9~8/13)

The chips of the three major corporations in the stock market change like the four seasons, and have the password of spring farming and winter possession. Just like the beating of people’s hearts, they have the rhythm of contraction and expansion. If this rhythm is abnormal, it will seriously endanger the life of the individual. , not accidentally. So, have you found it? Does the rhythm of the contraction and expansion of people's hearts resemble the long and short changes in the stock market? It is really appropriate to say that the stock market has its own life.

stock market vitality

How to say the stock market has a rhythm that contracts and expands like the heart of people?

If you carefully scrutinize the long and short positions of the stock market, you will find that the stock market has an upward trend and a downward trend. This obvious long and short trend is the performance of the stock market expansion, and when the expansion trend is completed, the stock market consolidation will follow. The contraction period, and once the consolidation contraction is completed, the next expansion will be ushered in.

When you master the expansion and contraction cycle of the stock market, you will make the right decision at the right time. For example: in the period of long expansion, you can boldly hold on to the asset, and when the long contraction is waiting, you can leave with peace of mind On the contrary, in the period of short expansion, you can bravely short the market or stay away from the market, wait for the short contraction period to appear, and then enter the market boldly.

Last week, we mentioned the 2B structure on the technical side of Taiwan stocks . If the rising trend line cannot be maintained, it is possible to complete the 2B structure. So last week we saw a five-day decline in a row, and there was a drop of 237 points on the 13th. On Black Friday, the important neckline was also broken in one fell swoop. Now that 2B is completed, the bearish expansion trend has taken shape. As long as the future rises but the previous high is not reached, and the bottom is lower than the bottom, it is telling us that the bearish trend continues. , be careful not to catch a falling knife.

As for how the chips between legal entities and retail investors changed last week?

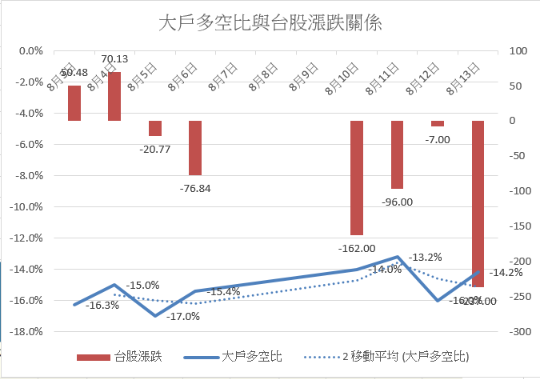

Big trader's long-to-short ratio

It can be seen from the long-to-short ratio of large households that in fact, large households have been bearish for a long time (the foreign capital fell 23.681 billion yuan on 8/13 ). Therefore, the long-to-short ratio of large households has always been less than 0. In the future, we will observe when the long-to-short ratio of large households can take risks. When it comes out of the water, it is the time when the market turns empty.

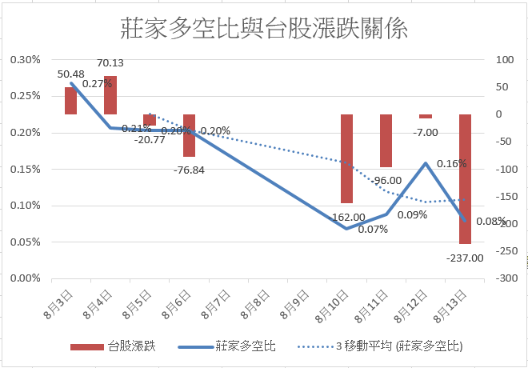

bookmaker's long-to-short ratio

It can be seen from the bookmaker's long-short ratio that although the value remains greater than 0, the trend has already developed downwards, which shows that the bookmaker expects the market to decline or flatten in the future.

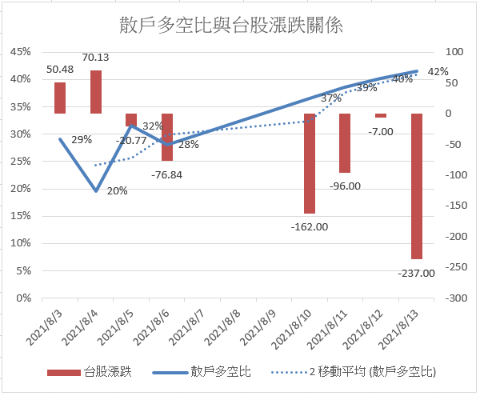

Retail long-short ratio

From the long-to-short ratio of retail investors, it is found that retail investors are still bullish, so that the long-to-short ratio of retail investors continues to rise, even if it fell by 237 points on Black Friday on the 13th, and when the long-to-short ratio of retail investors is positive, it means that retail investors are overweight. The index is prone to fall.

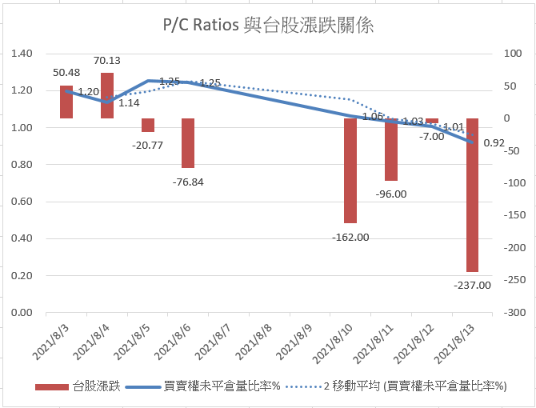

Option Open Interest Ratio %

Although the open interest ratio % of the options has not officially turned negative, and the value is still within the range of the consolidation range, the open interest ratio % of the options has a downward trend. The volume ratio % has officially turned negative, and the market has entered a short trend, so we must be careful.

Legal Person and Retail Investor Chip Observation

To sum up, last week's observation of the chips between legal persons and retail investors shows that the trend of legal persons going short is still different from the bullish direction of retail investors. You can't be careful if you are smart.

Further reading:

1. Simple things are repeated, how to use a moving average to avoid stock market disaster?

2. Simple things are repeated, how to use moving averages to judge trends and turning points?

3. Simple things are repeated, how to use the 2B rule in Dow Theory to catch the trend turning?

4. 00888 Yongfeng Taiwan ESG ETF and 2884 Yushan Gold, Daughter Education Fund Program.

5. 00692 Fubon Corporate Governance ETF's University Fund Program.

Disclaimer:

The information provided on this website is for reference only, and is not intended to recommend trading. Investors should bear the trading risks themselves.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…