元宇宙人

Return to Canada Diary Chapter 16: SIN, MSP, RRSP, TFSA, RESP, CCB (Milk Gold)

When you enter Canada with a COPR, you are a permanent resident (PR) of Canada. Generally, within 180 days, you will receive a PR Card.

Next, most friends will get license plates as soon as possible to facilitate travel. After all, no car in Canada means no feet.

When you enter BC, you may receive a leaflet asking you to apply for an MSP card. The full name of MSP is Medical Services Plan, which is the medical insurance in BC. You can apply after you enter the country, but because you want to prevent patients from misusing BC medical resources, according to regulations, MSP can only take effect in the 3rd month after entry. Like the license plate, the photo of the MSP was taken in ICBC. MSPs can apply online: https://my.gov.bc.ca/msp/enrolment/check-eligibility .

Whether you plan to work or not, you must apply for a SIN in order to file your taxes in Canada. The full name of SIN is Social Insurance Number. With a SIN, employers can hire you. Even if the PR Card has not been issued, you can apply for SIN online with COPR: https://sin-nas.canada.ca/en/Sin/ . A week after you apply, a letter will be sent to you with the SIN number on it. Remember not to give your SIN number to anyone other than your employer or bank.

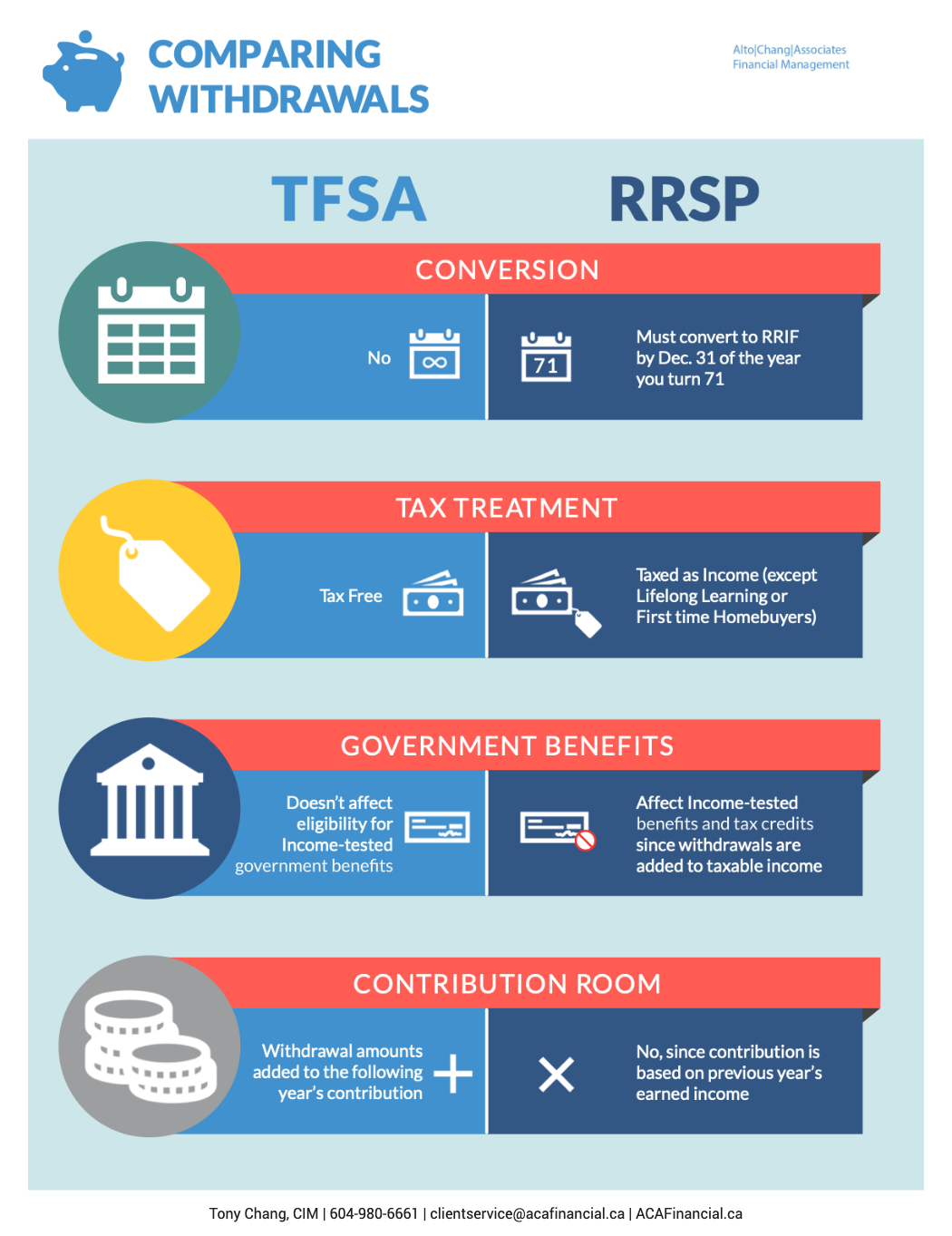

With work, there is income. You need to think about how to reduce your taxes. You need to understand RRSP and TFSA.

The full name of RRSP is Registered Retirement Savings Plan. As the name suggests, it is a deposit set up for retirement protection. The money put into the RRSP is tax-free and can be used for investment, and each person can put a certain amount into the RRSP every year to avoid tax. Please Google the detailed upper limit, the regulations may change every year.

TFSA is short for Tax Free Savings Account. Investment returns earned in a TFSA account are tax-deductible. Unlike RRSPs, TFSAs are more flexible and can be withdrawn at any time without having to wait until retirement. You can Google the annual limit, or you can ask the bank account manager, they are very happy for you to open a TFSA account with the bank.

Friends who have a little way need to know about RESP and CCB.

RESP is the Registered Education Savings Plan. Canada is really worried that people will not save for the future and come up with various savings plans. An RESP is a savings account that parents set up for their children to go to college in the future. The advantage is that the government will match a certain amount of money to your deposit every year. It can be said to be the wool of the government. The annual RESP deposit limit, everyone continue to Google it.

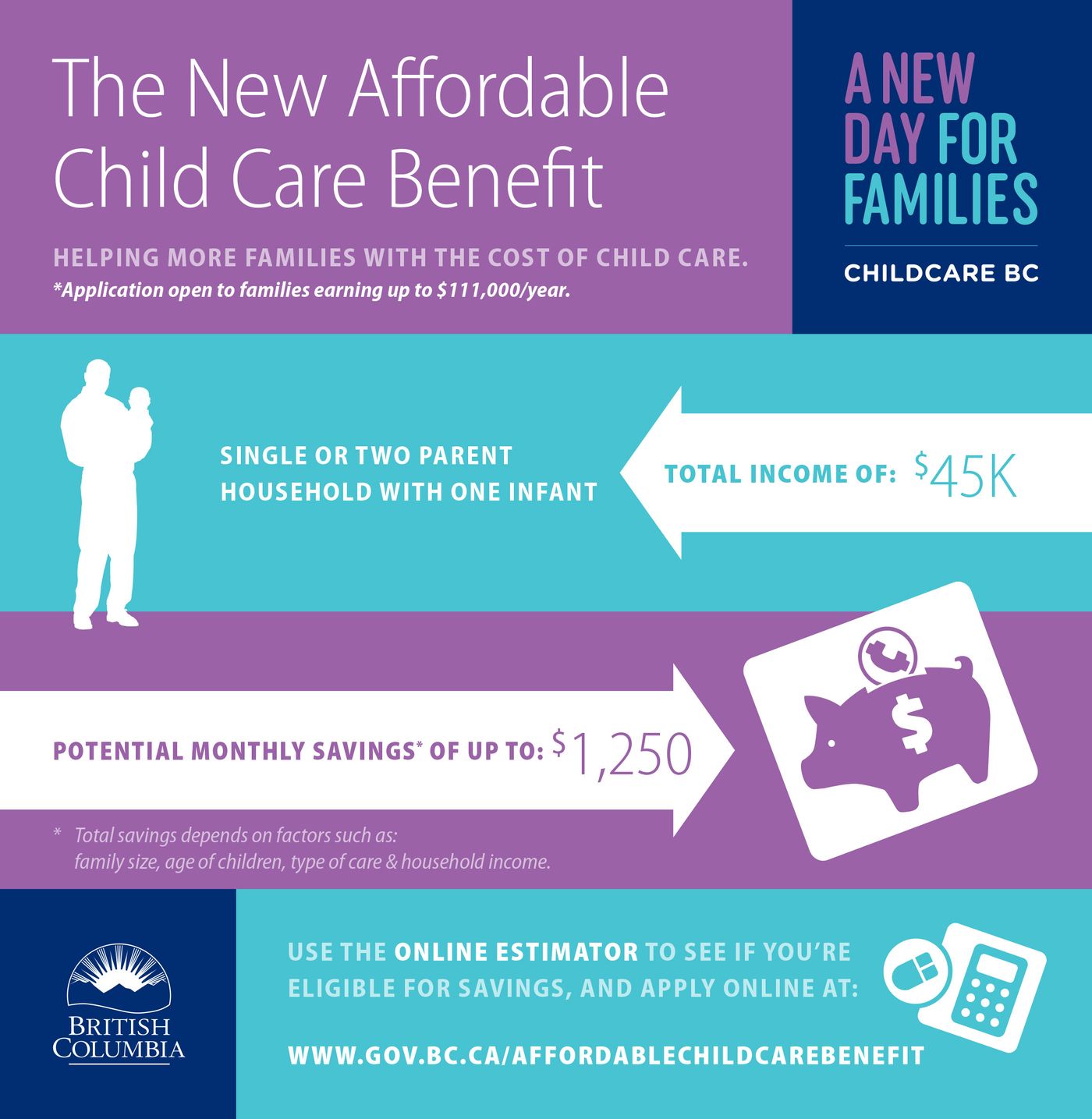

Many people talk about Canada's milk gold, and the more milk you have, the more milk you can receive.

CCB or Child Care Benefit is what everyone calls milk gold. The general applicant is the Care-taker, the mother. How much you can receive depends on last year's family income. If the family has a lot of income, in fact, the CCB is not much. It is recommended to file taxes first, and then apply for CCB the following year. This way there is a better reference. Otherwise, the government needs you to provide proof of income before you arrive in Canada, which is more troublesome.

There are many accountants in Canada who help individuals fill out their tax returns, and they have a better understanding of the tax implications of each plan. Friends who come out of Canada can talk to an accountant. Paying a professional may help you save more!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…