工程師。 常常為自己的冒牌者心理所困擾,只有書寫的時候才能感受到寧靜。

The distance between us and financial management - experience sharing for beginners in financial management

I personally think that financial management is a word that makes people feel very distant. This word often reminds people of a lot of money or some very complicated financial concepts, which makes it difficult for beginners to get started, and they fall asleep just reading those articles. . When I used to have insomnia, I would open a forum about stocks to help me sleep, and the effect was outstanding (?! )

But in fact, after working for more than a year, I don’t think financial management is so far away. I gradually found some simple ways to get started. In this article, I mainly share that the funds are not very strong, but I want to accumulate a little wealth of my own. How to easily enter the door of financial management for those who do not want the moonlight to be flustered~

The whole article will be roughly divided into four parts, namely accounting , savings , credit cards , stocks and foreign currencies . This is also all the financial management behaviors I am currently carrying out.

accounting . I think that this is the way to start financial management, and it is also a process of understanding yourself. I started accounting myself about two years ago, and then after work I went a step further to budget for each expense item.

But in fact, after asking friends around me, this seems to be a habit that is not easy to develop? In fact, there are a lot of accounting apps on the market. Open the App Store of your mobile phone and find the one that you think is the most pleasing to the eye. Download and slide the one that feels smooth. You can also use excel for more simple and unpretentious ones. It's just a manual account book (I really don't recommend it, it will be counted and I want to cry). I have also used several different accounting apps one after another. Currently, I continue to use the accounting city. The things in it are so cute that I can't help but open it when I don't want to book an account. XD As long as there is love, it can be cultivated. Get used to it, I've been using it for about two years straight!

My billing behavior is that no matter how small the expenses are, I will try to record them as much as possible. For example, taking the shuttle bus, or the cost of tens of dollars such as vending machines and photocopying fees, I will try my best not to let them go. I will also record. Detailed records are not to put pressure on yourself, but to let you know more about your consumption habits and situation

No matter what accounting app it is, it will almost help you with statistics. The following is an example of my own expenses in April. This statistic is the essence of accounting!

After about two or three months of continuous billing, you can start setting your own budget for each project. I used excel to make the following table

With the monthly summary and your own budget table, you can know which projects you have overruns. Don't worry too much about the overruns, just look at the reasons for overruns and whether the reasons for overruns are acceptable (ex. Increase in cost -> OK/ Drinking too many beverages will cause the beverage cost to explode -> No), if you can't accept it, you must find a way to improve it in the next month.

savings . When I still work, I will transfer the money in the payroll account to various accounts with a higher survival rate on the pay day (generally, there are quite a few transfers in the payroll account free of charge). When I was still hesitating about what project to invest in, I just put the money in my account to earn interest rates silently, and I could receive a few hundred yuan in interest rates a month, which is not without a small supplement!

Many digital banks now have very high interest rates for living, even higher than fixed deposits. When choosing which digital bank accounts to open, in addition to whether the interest rate is high or not, they will also pay special attention to the number of free transfers. Is it right? The daily interest calculation, the day of the month to receive the interest, and the range of the high survival rate are used to make decisions. I myself have used richart (currently 1% survival rate below 300,000), Yongfeng large households (currently 1.1% survival rate below 500,000), Wangdao (at that time, the activity was 1.2% survival rate below 100,000 a year) .

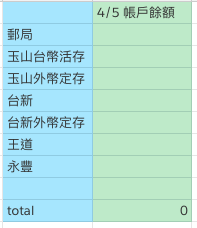

I will use excel to record the amount of each account every month, so that I can grasp how much funds can be used at present. It will be very fulfilling to watch the number increase XD

credit card . After I have the habit of keeping accounts and knowing the funds I have at hand, I think that getting a credit card is a relatively safe, even good thing. The reason is that spending with a credit card is actually relatively safe, and it has a lot of rewards, which saves a lot of money compared to cash consumption.

Taking myself as an example, after accounting for a period of time, I analyzed my main consumption as follows:

- Food: Panda, Uber Eats (yes, I'm lazy), go to Carrefour to buy the ingredients I cook, I often eat convenience stores when I work (bad habit QQ)

- Daily necessities: online shopping, Carrefour

- Other consumption: my parents and myself insurance premiums, gas, bus tickets... etc.

For these habits, my current credit card combination is as follows:

- Yushan Uber: 5% for online purchases, 8% for convenience stores, and 5% for Carrefour’s linepay payment

- Yongfeng Big Account Card , Panda, Uber Eats 7% Rebate

- Yushan Pi Card , use it in other places where there is no special discount but you can swipe the card, 2% Pi points back (especially recommended for premium payment!)

There may be some more favorable credit cards, but because I don't want to make it difficult to manage a lot of credit cards, I use these three for now~

stock foreign currency . I have to say that I actually don’t know much about this aspect. I am currently in a state of testing the water temperature, and my behavior is still very conservative.

In terms of stocks, I used to buy a financial stock for a month when I was working. When I encountered a bonus, I decided whether to increase the stock price depending on the stock price. The main concept is to save the stock and then wait for the annual allotment to pay dividends. I am too busy at work. May be in and out of the stock sea. Every time I buy a stock, I will use excel to record the purchase date, the purchase quantity and the purchase price at that time (the apps that seem to be stocks will also help to record, but I will make another record myself)

Foreign currency is also very conservative to buy in the way of fixed deposit. I use Yushan and Richart respectively for foreign currency transactions, both of which can be traded on the Internet, very convenient! When purchasing, I will also use excel to record the purchase price, fixed deposit period and fixed deposit interest rate. Usually, I directly set the automatic transfer at maturity, so every time I arrive, I will check to see how the new interest rate becomes. .

I myself think that I can try a variety of different investment products to see which one is the most convenient and most comfortable to use, and then continue to study profit-making methods. It’s just that at present, because of the epidemic, I’m stuck in the state of stocks and foreign currencies. I can only convince myself that I keep the stocks and will not sell them (but I still feel heartache, QQ), and foreign currencies are to convince myself that I might go to that country in the future. There is no need to exchange foreign currency... The investment experience is really made with money (wipe my tears

The above is my experience sharing as a beginner in financial management. I hope that after reading it, you will feel that the distance between us and financial management is not as far as you imagined, and it can even be quite close!

Welcome to share your financial management methods with me below. If you like this type of article, don't forget to pat me to support me~

(Yeah, it was my first time to participate in a community activity, and it was a success~)

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…