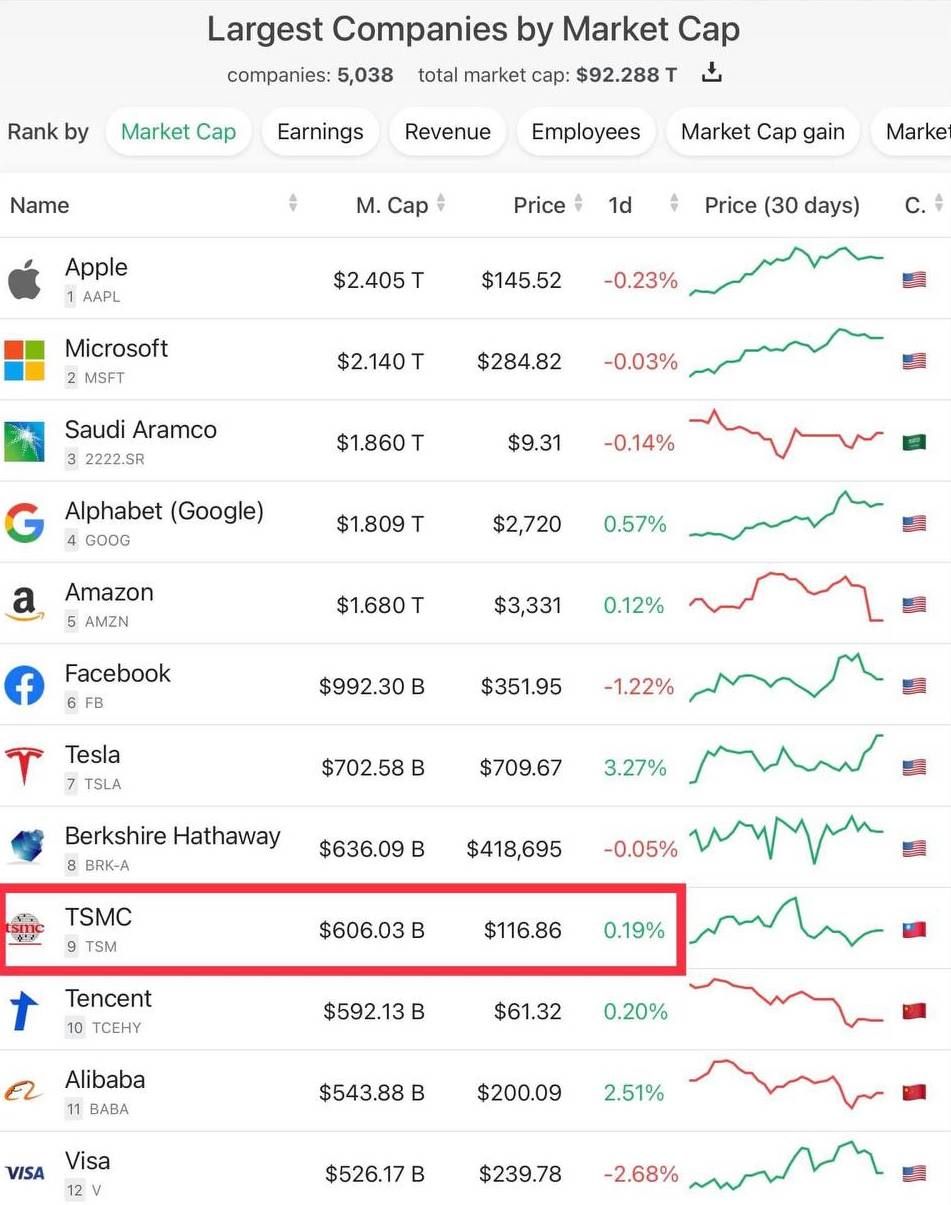

TSMC's market value overtakes Tencent: Semiconductor is the "oil of the new era"?

When I saw this picture from a colleague, I realized that the party's saying "Online games are spiritual opium" has caused China's Tencent's stock price to plummet in the past few days, and its market value has been overtaken by TSMC.

A closer look at this global market capitalization ranking is actually very interesting: in addition to the United States and China, the only top ten companies in the ranking are Saudi Arabia's Aramco Petroleum Company and Taiwan's TSMC (Note 1).

From this point of view, it is not unreasonable for some media to call semiconductors "the oil of the new era" recently (Note 2): Today's semiconductors and chips, like the oil of the past, are the key raw materials for maintaining economic production. Or basic components, are also very important strategic materials - Aramco's perennial market value, and TSMC's recent rapid market value, probably also reflect this fact.

And it is very interesting that TSMC is the same as Aramco, if it is not because of the trade war, chip shortage, or geopolitical crisis such as the oil crisis, the average person will not know the names, popularity and other lists of these two companies at all. Well-known big brands (such as Apple, Facebook) are simply incomparable.

This phenomenon may once again reflect the "infrastructure" nature of foundry and crude oil production: although they are very important, they are usually hidden under the surface of daily life or at the front end of the industrial chain. , so it doesn't go directly to the consumer, so unless something goes wrong, no one will notice at all.

However, just like TSMC is a household name in Taiwan, the company Aramco is actually a jingle in the Arab world: when I was learning Arabic in Kuwait, the word Aramco (أرامكو) was actually listed in the first-level Arabic textbook. In the vocabulary list - I wonder if "TSMC" will be included in the vocabulary list of Taiwanese Chinese textbooks one day in the future?

Also coincidentally, Aramco’s life experience is actually inseparable from the United States: although Aramco was nationalized by Saudi Arabia in 1988, the company was originally an American company—“Ar-am- co" is the abbreviation of "Arabian-American Oil Company" (Arabian-American Oil Company), and at the beginning of its establishment, TSMC also recruited many technicians who returned to Taiwan from the United States, and to a certain extent, it was also a "Taiwan-American" company.

Since its inception, Aramco has always been a key player in the geopolitics of the Middle East, and has often been involved in geopolitics—it can even be said that this company and oil resources are the ones that Western powers have been continuously intervening and operating in the Middle East for nearly a century. one of the reasons.

If we look at the development from last year to now, TSMC's role in the world's geopolitics seems to be more and more like Aramco.

However, semiconductors are not oil after all, nor do they "emerge from the ground". Geographically, there is no such unshakable "fixation", and the United States, Japan, and Germany have indeed already reported that TSMC is required to set up factories. news.

But then again, is TSMC's plant, technology and business model really so easy to copy to other countries? Or is it that the "service" of professional wafer foundry, like oil, has a certain "geographical fixation" and is deeply restricted by a place's natural environment and cultural factors? (For example, it is very popular recently that "there must be a culture where obedient and high-quality engineers are willing to sell their livers".)

More importantly, for Taiwan's survival and prosperity, is TSMC an opportunity or a crisis? I feel that the economic geography of semiconductors will really be a hot topic in the next few years...

Note 1: However, it is not so easy to determine the "nationality" of an enterprise today. For example, TSMC has a large part of the shares, which are in the hands of foreign investors...

Note 2: For articles or reports referring to semiconductors as "new oil", you can refer to the following articles:

〈 China Turns Semiconductors Into The 'New Oil' While GM Runs Out Of Chips 〉

〈 Semiconductors are the new oil 〉

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!