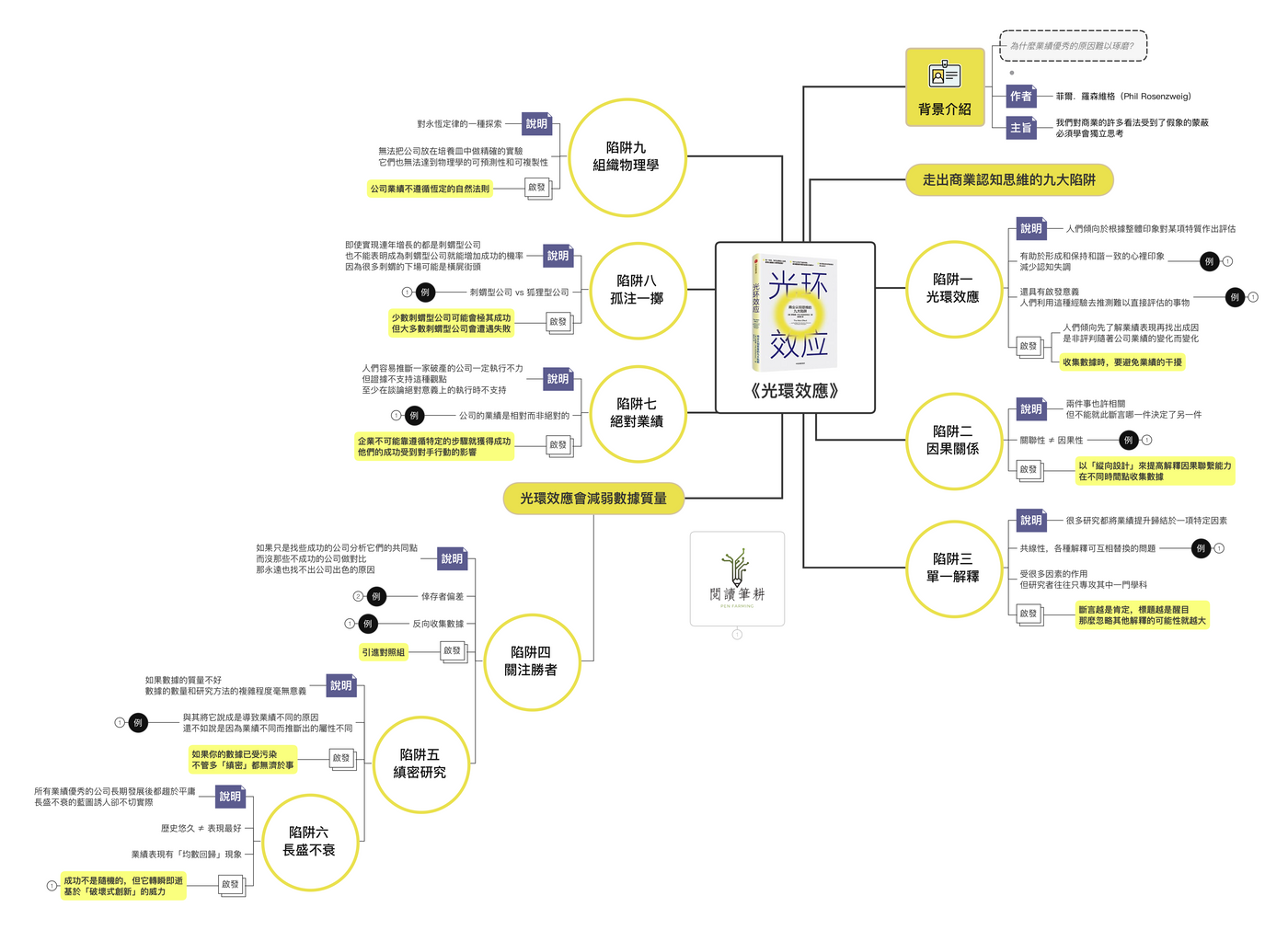

Nine common pitfalls in cognitive thinking in "Halo Effect"

Author: Phil. Phil Rosenzweig

Translators: Xu Shaomin, Wu Yizhen Publisher: Business Week

Over the years, experts and scholars have tirelessly searched for the secret of business success. What is the reason behind the excellent performance? " Halo Effect " asks a different question: " Why are the reasons for good performance difficult to figure out? "

The central idea of this book is that much of what we think about business is deceived by illusions... . To show the nine common pitfalls in business thinking, in addition to the refreshing brought about by doing the opposite, the strong recommendation of Taleb , the author of " Antifragile ", is a highlight. Come and find out.

■ Halo effect

As the first of the nine traps (my feeling), it is necessary to talk about the proper term [ ①Halo Effect ] that runs through the whole book.

⚠️ Simply put, it is based on the general impression to judge the trend of a specific feature .

For example, the customer service center of a company receives thousands of calls every day. According to statistics, 58% of customers whose questions were answered immediately felt that their calls were answered "immediately or soon", and only 4% thought they had waited "a long time"; those questions were not answered immediately Only 36% of the guests thought the call was answered "immediately or soon", and a whopping 18% thought they waited "a long time."

In fact, the company has an automated answering system, and there was no difference in waiting time between the two groups. It's just the overall impression of customer service that creates a powerful halo effect that influences people's judgments about how long they wait.

Seeing this, you might think the halo effect is negative, but I'm neutral on it. In fact, the halo effect reduces cognitive dissonance and is a heuristic, a rule of thumb for guessing things that are not directly measurable. It is our nature.

■ Aura in the business world

"What about business?"

There is a little bit of hindsight in it.

In conclusion, if people already know how good or bad the results are, they cannot be expected to evaluate impartially . Whether it is the people involved or the observers on the side, once they think the result is good, they are willing to look for positive factors as the reason; if the result is bad, they tend to look for some negative factors as the explanation.

⚠️ Rather than saying that people are rational animals, it is better to say that they are animals that like to find reasonable explanations.

Can not help but think of the popular Clubhouse App at the beginning of the year.

I locked a date range and compared the winds I found on the web in February and April. As a result, the invitation system has changed from the original "sense of honor of social elites" to "limited user base"; the live chat has changed from "no archives and no pressure" to "unstable gold content"; the function of Yangchun has also changed from "focusing on satisfying The need for sound" became "the insufficiency that can only be communicated with sound".

The words are said on both sides, and the wall falls and everyone pushes. Right and wrong judgments change with performance (halo).

■ Eight more traps

First attach the organized Mind Map, and also excerpt the analysis of eight other common delusional phenomena, which not only influence the judgment of business research, but also play out in our daily life:

📈 Related to statistical methods

First, it is mentioned [② causality] . Two things may be correlated, but correlation does not equal causation . For example, ice cream sales are positively correlated with the chance of drowning, but the discerning eye knows that they are jointly affected by a third factor - the heat; in addition, it is sometimes difficult to determine what exactly What is the cause, what is the effect? such as the relationship between employee satisfaction and company performance.

It is followed by 【③ Single Explanation】 . It is not mentioned in the book, but this is a phenomenon of " collinearity ", which means that there are countless reasons behind the performance of the company, and they are both inside and outside of each other (replaceable), and you want to assert that a certain factor is decisive. Influence is very dangerous ; however, today’s business management research is delicately classified, and only focuses on specializing in areas that they are good at, such as leadership, market positioning, corporate social responsibility, human resource management, etc., but few people pay attention to how to unravel Various possible entanglements in these indicators.

Summary ⚠️ Causation: Correlation does not equal causation.

⚠️ Single Explanation: Ignore issues where various factors overlap.

⋯

📑 Related to empirical data

【④Focus on winners】 is the concept of " survivor bias ". If you just find some successful companies to analyze their commonalities, but do not compare the failed companies, you will never find the reason why the companies are good; here is the book "The Pursuit of Excellence ".

The successor, " Building Evergreen ", improved the sample, collected a huge amount of data, and conducted [ 5 ] rigorous research on 18 "groups" of companies (yes, there was a control group this time), and was severely criticized. If the data is tainted with halo (performance), no amount of it makes any sense, at best it's a bunch of adjectives to describe a great company.

The author also pointed out that the far-sighted companies selected by "Everlasting Business" can outperform the market average by 15 times in 1964. How can more than half of them become mediocre within 5 years after the end of the study? Looking at the performance of companies on the S&P 500 in 1957, 40 years later, in 1997, only 74 were still on the list, 62 of which were long gone, and only 12 outperformed the index. growth rate. [ ⑥ Prosperity] It turned out to be an illusion, but countless managers still flocked to it, just like Qin Shi Huang seeking elixir.

Summary ⚠️ Focus on the Winner: Survivor Bias.

⚠️ Thorough research: It doesn't help if the data is tainted.

⚠️ Prosperity: It is like Qin Shi Huang seeking elixir.

⋯

🔎 Related to myths

Businesses cannot succeed by following specific steps, and conversely, a bankrupt company does not necessarily have poor execution. Because the company's performance is relative , it is necessary to consider the actions of competitors, rather than just looking at individual [⑦ absolute performance] .

The authors also question that the observation that the 11 great companies in " A to A+ " are all "hedgehogs"—focusing on a clear core—doesn't mean that being a hedgehog increases the odds of success. Some hedgehogs may make a fortune by [⑧ all-or-nothing] , but most hedgehogs lose everything; on the whole , "fox-type" companies that spread risk perform better.

Finally, don’t treat business research as [⑨ tissue physics] , neither can companies put companies in petri dishes to do experiments, and they can’t achieve the accuracy and reproducibility of physics. There is no so-called immutable rule about company performance.

Summary ⚠️ Absolute performance: Competitor actions must be considered.

⚠️ Go for it: There are more hedgehogs to lose.

⚠️ Organizational Physics: Company performance does not follow constant laws of nature.

■ Postscript: Think critically, take the middle way

During the reading process, every time the author complained about a book (four books in total), I went to the blog to check the profile of the "victim" and found that James. Collins (Jim Collins), a master of management, has been selected twice, accounting for half of the works. I hope the two will not forge a relationship.

Haven't read the business management book since then? Not necessarily, but I have to bring a critical thinking angle and read it as a story, not as a bible and blind worship; in fact, I don’t usually read books on “legal persons”, and I feel that these business giants are too far away from me. , tend to focus on "personal" issues.

Perhaps, we can use the inspiration of " Moderate Mean: Avoiding Extremes " in "The Mentality of Getting Rich " to echo how to view these business management books:

It can be dangerous to focus on a specific person and case study, such as a billionaire, a corporate CEO, or a case study with sky-high prices that dominates the news pages. Such outcomes are often driven by extreme luck or risk, making it difficult to apply these lessons to yourself. in life.

Instead, look for broadly applicable patterns of success and failure, closer to reality, and take the middle.

Thank you for seeing this, and I attach my link to [ Appreciate Citizen 2.0 ] [ Iron ] [ Other Platforms ]. Welcome to visit!

🌱 Become my appreciative citizen👇

https://liker.land/leo7283/civic was invited to enter the fireplace ❏

🌱 Follow [中书 Nervous System ] Broadcast information does not miss good book quotes / Book Market News / Short Experience / Mind Map ❏

🌱 I am on other platforms👇

【 Facbook | Mastodon | Medium | Vocus 】

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More