Hands-on | Crypto Investment Tools | Ghost Beethoven

Invest in Beethoven?

What I want to introduce today is Beethoven-X ( https://beets.fi/#/ ), an investment tool in the Fantom ecosystem. The Fantom ecosystem is a blockchain, and the token used to run on it is FTM, @ Matthew Duke once wrote an article about the Fantom Ecosystem of the AC Universe👈If you are interested, you can click to learn more.

Beethoven - BEETS tokens, but it’s a pity that I used the tool Balancer too late and missed the opportunity to receive the airdrop!! Because I invested money in Balancer, the biggest advantage of Balancer is that you can invest in a single currency, and it will directly help you exchange for other currencies in proportion. form a Liquidity Pool, and then you can share the transaction fees of that pool based on your capital ratio.

Take projects that can be seen in life as an analogy. A liquidity pool is like a stock exchange. There are a bunch of stocks for people to trade, and handling fees will be charged during the transaction process. In the currency circle (currency circle == playing crypto or currency The group) provides liquidity, just like buying shares in a stock exchange in the real world. You can get a share of the transaction fees on it.

A more straightforward metaphor would be that on a toll road, you invest money in the construction of a certain toll station. After it is completed, the tolls paid by vehicles passing through that toll station can be divided into 😁

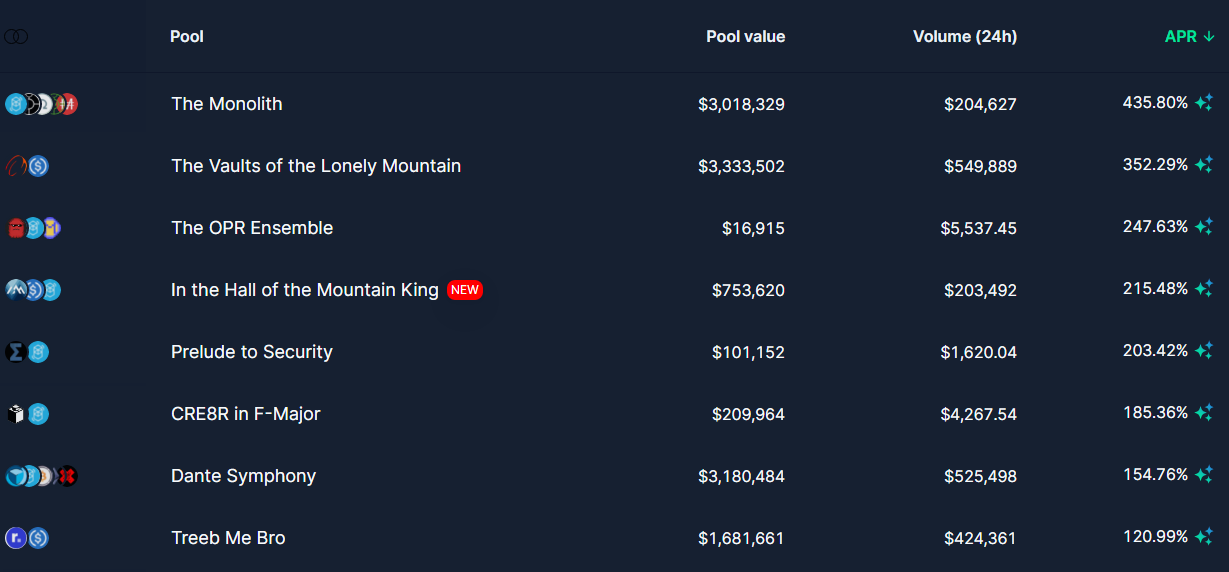

There are many pools to choose from on Beets, and the names are quite creative.

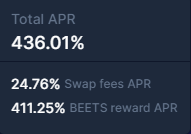

Because I sorted APR (Annual Percentage Return) from high to low, it looks pretty amazing. Move the mouse to the star, and the APR component will pop up. Take The Monolith pool as an example. Its APR consists of two parts. Swap fee refers to the handling fee dividend collected through the exchange of currencies through this pool. ; BEETS rewards APR are BEETS given by the platform. Generally, it is platform rewards that make the pool’s income particularly high!

Some pools also have multiple rewards, such as The Vaults of the Lonely Mountain, which has an additional RING coin reward.

Step by step instruction

The process is divided into the following steps

- Buy cryptocurrency and transfer the coins to your wallet

- Pick the pool you want to invest in

- Store the obtained BPT in the farm to earn BEETS

- Harvest BEETS

- Get BEETS to Stake to earn more BEETS, or exchange BEETS for other currencies

- Repeat steps 2~5

Buy coins and transfer money to wallet

I use Ace Exchange, but you can also use MAX, which I recommended before. Anyway, it is to exchange Taiwan dollars into cryptocurrencies. I purchased FTM coins directly and then transferred them to the Fantom network through the Little Fox Wallet.

For the Little Fox Wallet, please refer to this article written by @readbigeng which is very detailed .

For Little Fox Wallet, you can transfer coins to Fantom by adding Fantom network. You can refer to Phantom’s graphic instructions.

Network Name : Fantom Opera

RPC Url : https://rpc.ftm.tools/

ChainID : 250

Symbol : FTM

Block Explorer URL : https://ftmscan.com/

Choose a pool

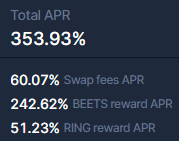

The pools I currently choose are the following four, basically stable, high-yield, and platform-related.

- The Fidelio Duetto is a pool of 20% of FTM and 80% of BEET, which is regarded as an investment in the Beets platform.

- A Late Quartet is a pool with 25% each of USDC, FTM, ETH, and BTC, which is considered a large-cap stock.

- Beethoven's Battle of the Bands is a public chain pool, including 20% FTM, and the remaining 80% consists of MATIC, BNB, SOL, AVAX, and LUNA. Currently, the major popular public chains are available!

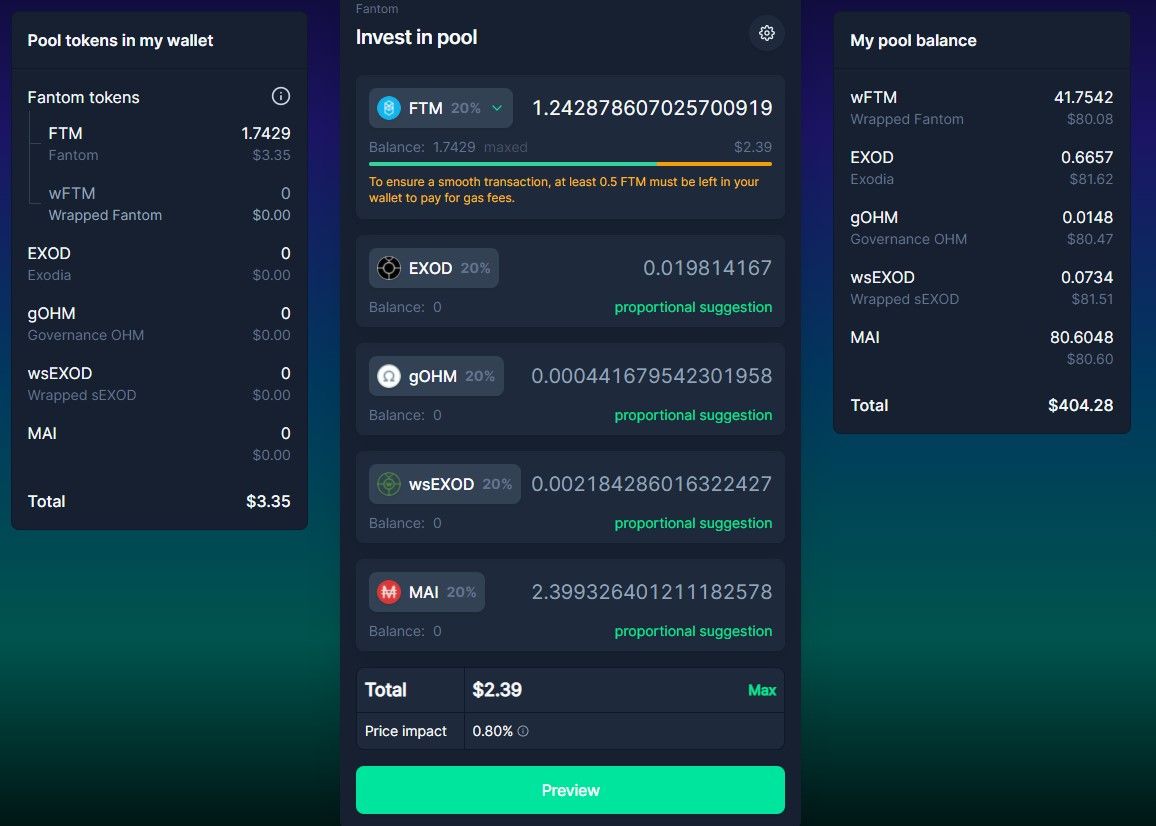

- The Monolith is currently the one with the highest revenue, with FTM, EXOD, gOHM, wsEXOD, and miMATIC each accounting for 25%. EXOD is considered a basket of stable coins, but it seems to be part of the Fantom ecosystem. gOHM seems to be the governance token of OHM. These are all coins that I don’t understand much about. I allocated them because of their high returns😁.

invest

Select the pool, click Invest , and enter the number of coins you can invest.

You can just enter one and it will automatically change it for you, or you can throw in all the change you have on hand, which can save some transaction fees. After filling out the form, click Preview and then Invest !

Reinvest

After you complete the above steps, you need to deposit the assembled pool combination (Liquidity Provider token, commonly known as LP) into it to obtain BEETS tokens. Just go back to the pool, scroll to the bottom, click Max, click Deposit BPT , the platform will ask you to confirm twice, once to agree to the contract to call your assets, and once to deposit. At this point, it’s basically done, all that’s left is to wait for time to brew the wine!

harvest

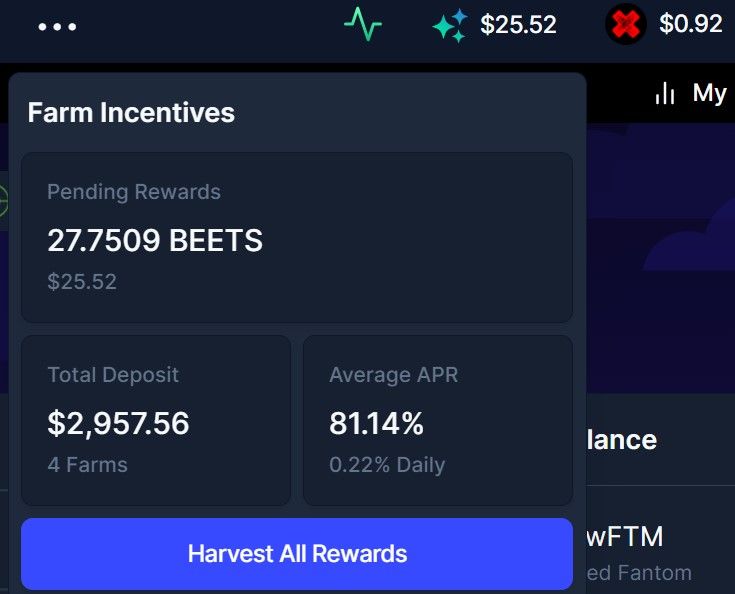

Harvesting is very simple. Go back to the Beets homepage, and then you can find the picture below in the upper right corner. The red X in it represents the current price of BEETS, just for reference. The important thing is that on the left side of the The BEETS are taken back.

Harvesting BEETS in each pool requires GAS, which consumes FTM coins. Since I invested in four pools, I will first go to each pool to see if enough has been accumulated to harvest again. Or simply harvest it for a longer period of time, such as once a month.

The harvested BEETS can be put into Stake to earn more BEETS, or they can be invested in other pools to create new income.

automatic rebalancing

The pools on Beets have a fixed ratio. When a certain currency rises too much, it will be sold into other coins, which feels like automatic rebalancing. The risk is that when a certain currency gradually returns to zero, the investment in the entire pool may also return to zero. It's not impossible to happen, but I think we should be able to play for at least another year!

Although Beets comes from Balancer, I think it is more suitable for my needs than Balancer because its Portfolio is quite good. Click My Portfolio in the upper right corner of the interface to display your current asset status and changes in detail (especially I think this is great, it saves me the need to record and track it myself)

The picture below is my portfolio. The upper left corner shows the current types and ratios of coins in the total pool. The upper right corner shows the asset changes in the past few months. The lower left corner shows the daily swap fees received. That is, the profit share from investing in the Beets platform, and the lower right corner is the proportion of the current investment pool. At a glance, this one is clearly better than Balancer.

Above ~ I hope the above step-by-step instruction will be helpful to you. 😎😎😎😎😎

If you have any questions, please leave a message for discussion. If you think it is good, please also give it 5 thumbs up and a full thumbs up , thank you.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More