"Habits and Get Rich: Practical Edition"

Author: Tom Corley

Translator: Yang Fujia Publisher: Yuanliu

Introduction to Financial Management "Fiction"

I am reminded of the book "Rich Dad, Poor Dad". If the title of the book were to be changed to "Poor Neighbor, Rich Neighbor", it would not be inconsistent (laughs).

The first half is presented in the form of a novel . Grandpa Jesse takes his three grandchildren on a summer vacation - a beach tour on the Jersey Shore, where he tells his grandson the story of "two neighbors". Grandpa Jesse is the projection of the author himself, and the role of grandson is the reader; the second half is a " movie critic " perspective, reviewing and analyzing the " plot " for us, and summarizing 22 smart financial management rules (habits).

It is easy and friendly to choose words, I think not only adults, but also Chinese and high school students can read all the way with great interest.

Part 1: Major Financial Decisions at Life Stages

In the beginning, the author told us that there are four ways to accumulate wealth, the first three have certain thresholds, but the fourth - save hard, invest prudently - is something that all ordinary people can do.

⚠️ The money you pay now is actually spending your future wealth

You should have heard: "Life is a series of choices, you are the result of your choices." This sentence can also be applied to financial management. Financial management is a long-term and continuous accumulation process in life, and has a " ripple effect ".

Bad money habits have little impact on the little things, but when we're making big financial decisions, like buying a house, these bad money habits can have serious consequences. When we have bad financial habits, we often don't understand that those bad habits can ripple outward and affect everything else we do.

On the contrary, if you develop good financial management habits, you will be able to retain more flexibility and flexibility to make reasonable decisions when you face a major financial decision in your life . On the road to financial management, a series of correct choices will eventually lead us to financial freedom. .

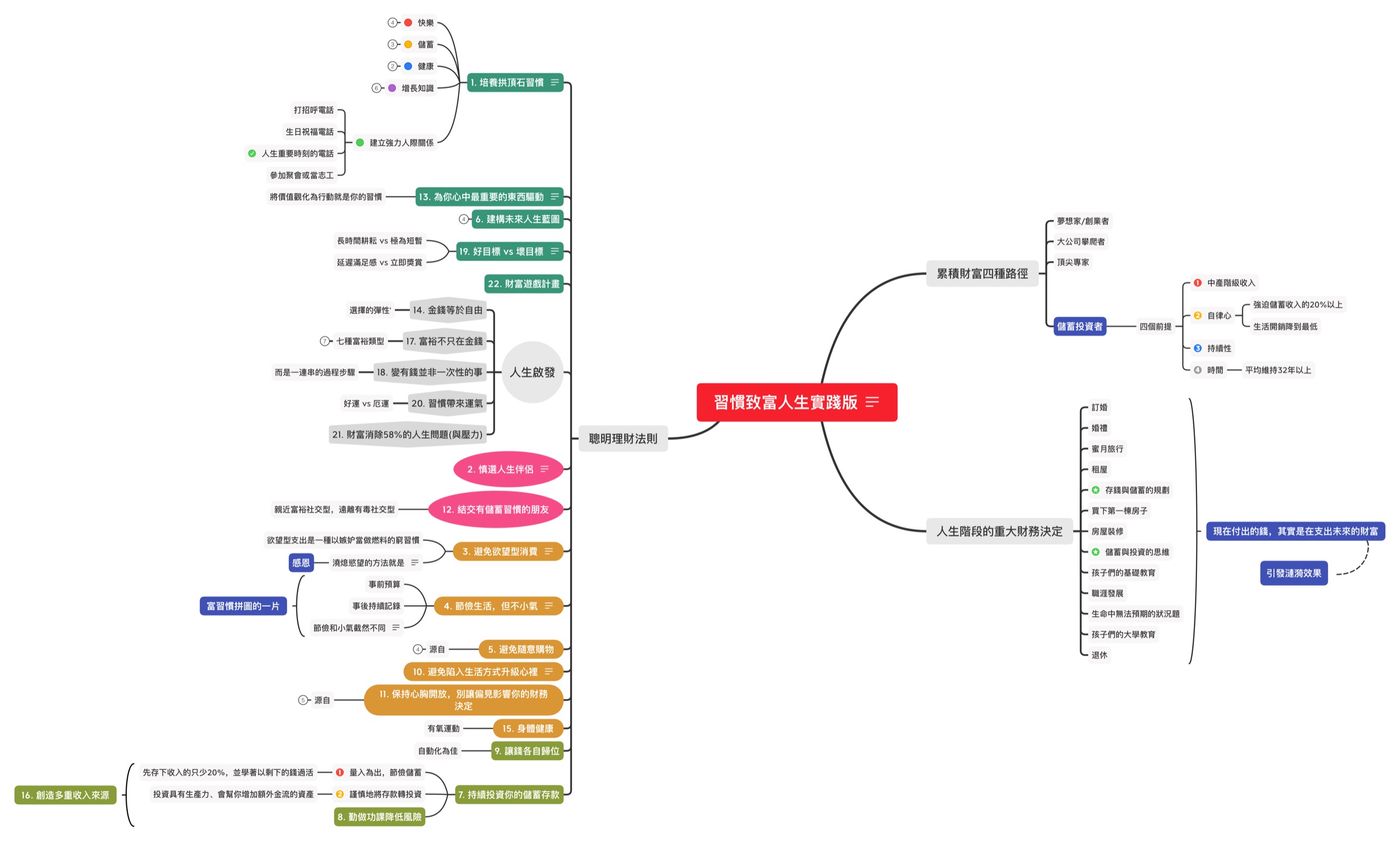

Before entering the second half, refer to the mental architecture diagram of this book. Regarding the 22 smart financial management habits, I did not arrange them according to the number in the book, but organized them according to the type and cause and effect:

Part 2: 22 Smart Financial Habits

The author, an accountant, spent nearly four years interviewing 233 rich and 128 poor people, asking each respondent 144 questions to summarize these " rich habits ."

It is not the first time that these research results have been published in a book. This book is a continuation of the previous book, " Habits to Get Rich ." In my opinion, the situation created this time is more engaging , and it also extracts the essence of the 30 rich habits from 30 to 22. Here are a few particularly interesting highlights for discussion:

keystone habit

It's a new term for me, so I'll give it a special mention.

Unlike ordinary habits, keystone habits allow you to develop additional or cooperative habits ; in addition, they eliminate reverse habits , which are old habits that interfere with keystone habits.

⚠️ The derived "subordinate habits" are like planets and satellites, revolving around the star "core habits"

I use my own reading habits as proof. Originally, I just wanted to say that reading one book a month is enough, but it has evolved into "read at least one book every week"; from reading it is enough, it has become "writing" the experience, and writing it in a private Google file is not enough, and then Published on the "public" blog platform, and I am afraid that the content is not structured, I use the Mind map to "organize " the framework and thoughts before writing.

But there are so many fixed hours each day. In order to make time for the above plan, it is bound to crowd out some existing old habits, such as the hours of chasing dramas and video games.

⚠️ Read 1 book a month → read 1 book a week → write → publish → organize the structure

Avoid "unhealthy" consumption

The first thing to avoid is " desirable consumption ", which is a poor habit fueled by jealousy. Sometimes jealousy and envy are just a thin line, which makes you want what others have, even if those things you Can't afford it at all.

⚠️ The way to quench desire-based consumption is "Thanksgiving"

Being content and grateful for what you have, this positive mental state is the cure for desire-based consumption. I thought of " The Magic of Tidying Up Your Life ", and I also held this feeling, from breaking up to the cultivation of minimalism.

Morning practice like this helps reset your mind from negative (jealousy) to positive (gratitude). In just a few weeks, you will start to see things make a difference, with positive thinking replacing negative thinking. In your eyes, your water glass will be half full, not half empty.

Another thing to avoid is the " lifestyle upgrade mind ," which means that when you get a raise, bonus, promotion, or a better-paying job, it's natural to want to buy a bigger house, a more luxurious Cars, luxury vacations and other luxuries to expand your lifestyle.

Rich habits are: actively choosing to let go of this inherent urge to spend, thereby delaying gratification. This way, you can save that money and turn it into an investment that you can use to maintain your standard of living in the future.

Details are given next.

Pay yourself first

The general thinking is that every time a salary is paid, the remaining money is spent as a savings, which is a poor habit.

The emphasis here is on "living within your means ", saving 20% or more of your income first, and learning to live with the rest . Saving first will force you to live up to an appropriate standard of living and support yourself with the rest.

⚠️ Automatically save 20% of your income and invest it carefully ⚠️ Invest your savings in productive assets that will help you generate additional cash flow, creating multiple income streams.

The steps to save money just mentioned require discipline . You can make good use of financial services, such as regular fixed debits, to achieve " automated " savings and investment.

Off topic, the figure of 20% may be a daunting challenge for Americans who are accustomed to borrowing money for consumption, but in Asia, the savings rate has always been high, and the national conditions are different, this reference value is relatively easy to accept and implement; The setting of the value is also related to age , which means how much time is left before retirement ? The later you start, the higher your goals must be set.

end

Schools don’t talk about “money education”, and the view of money that families can give us is often very limited. Quoting a passage from the book:

Nobody wants to talk about money. It is a sensitive topic full of emotions and privacy. A lot of people struggle with money, and that's one of the reasons. No one has made it clear enough about what to do and how to do it. Most people, including parents, tend to bury their heads in the sand and run away like ostriches, ignoring discussing money with their children. How would you know what to do if no one explained how to manage your money?

Therefore, most of us only started to get in touch with financial management after we left the society. Maybe we want to start with reading, but we often feel that the relevant books are too serious and difficult, and there is a long distance between the reader and the author. Fortunately, there is a book, which is quite suitable for Initiation teacher.

If " The Courage to Be Hated " is a stepping stone to a visit to Adler's psychology, then I would say that " The Practice of Habit and Grow Rich " gives us a glimpse into the magic of financial education.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More