The little things about the bears

I explained the principles of contract trading and short-selling to you before. Today, I will discuss some small things about short-selling in depth.

Limited profit, unlimited loss

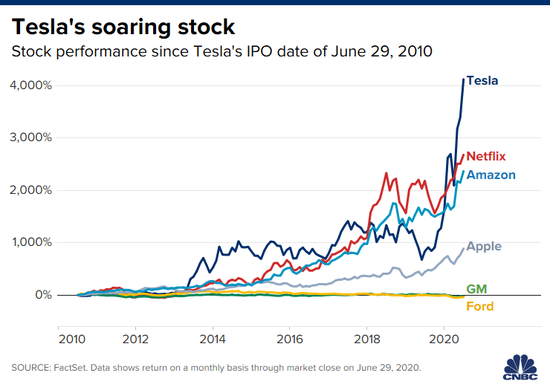

Since the short is buying and falling, even if a stock falls to 0 yuan, it still has a certain range. For example, if a stock worth 100 falls to 0 yuan, you can earn up to 100 yuan if you buy short, but there is no limit to its rise. For example, Tesla has been shorted since 2016, but he has risen 18 times in 6 years, which means that if the short does not give up, he will have to lose 18 times the principal!

There is a very exaggerated short event in history. Institutions started shorting the stock price of 20 yuan, but due to some strange reasons, the stock price rose to more than 1,000, which will be mentioned later.

short

Being short is a very thankless job. Normally, most people hope that the market will rise, and being short is equivalent to fighting against everyone. Therefore, the scale and number of short funds in the market are not large.

But after the bears select the target, they are not idle and waiting for the target to fall. As I just said, the bears are against the large numbers of the entire market. After selecting the target, they must use all means to make the target price fall. , this process is called "shorting".

A relatively healthy situation is that short-sellers select possible targets, and after analysis, find unhealthy companies. Such unhealthy companies often endanger the interests of the market, such as false financial reports such as false revenue, etc., etc., and collect enough. After the evidence, start to make short positions, and start to organize hundreds of pages of reports, and wait until the right time to make them public. The media is empty, for example, the valuation of so-and-so stock is too high, etc., why is the financial report unreasonable and so on.

When the market sentiment is brewing enough, the sell-off starts to drive the market panic and so on.

But there are also unhealthy ways, such as capital sniping, targeting overvalued stocks and conducting large-scale sell-offs through huge funds, causing panic and even stampede problems, allowing the stock price to fall below the reasonable price.

Capital sniping will trigger a chain reaction in the market, which will do great harm to the market environment. Companies that engage in capital sniping usually get a lot of infamy.

hedge

As mentioned earlier, the risk of short-selling is higher than buying (from the concept of expected value). Hedging is to reduce losses by investing in another target. For example, you think that company A will fall, so you short-selling company A. But if the entire market goes up, company A may go up. At this time, you buy the large market index, so that the losses caused by the rise of company A will be offset by the profits from the rise of the large market index.

Not only is hedging a basic standard for short sellers, but because of the characteristics of unlimited losses, it is very likely that a single mistake will bring down a company. Therefore, the asset allocation of short-selling companies is also very important. Usually, long-term short-selling companies will limit the share of each project in the company's total. The ratio of the asset and set a stop loss.

zakong

Since the shorts will have the so-called capital attack operation, the longs will naturally have the concept of capital counterattack. Since the principle of short-selling is to sell the borrowed stocks to the market, wait for the price to fall and buy back the stocks and return them to the lender. The manipulator takes advantage of this time to frantically buy the stocks sold by the short sellers, and then lend the stocks to the short sellers through the brokerage.

After it continues to a certain extent, the stocks financed by the shorts will be close to or even larger than the stocks circulating in the market. When the shorts find something wrong, the long manipulator will ask to close the position, but at this time most of the stocks have been controlled by the longs, and the shorts Buying all the shares in circulation in the market is not enough, so the market price is left to the bulls.

The following is a more extreme case. As mentioned earlier, there was an exaggerated short event in history. The stock price soared from 20 yuan to 1,000 yuan. At that time, there were actually two people fighting for the right to operate a company, resulting in an inflated price, but because of the competition Anyone who has read online articles about management rights knows that it was done on the table at the beginning. The bears saw that the price was inflated and thought that the opportunity was coming, so they began to buy short and sell short. As a result, the price has not fallen, and it is getting more and more. The higher it is, the shorts have to keep making up the margin, and keep covering their positions to reduce losses, until one day when something is wrong, it is too late, the stocks in the market have been bought by two parties, there are no stocks to buy, and the shorts cannot buy stocks. Come to pay back the financing, and watch the stock rise 50 times all the time...

Later, the parties realized that the market seemed to be screwed up by them, so they released some stocks to let the shorts solve the financing problem, but the damage has caused indirect serious damage to the US economy.

There is also a logic behind Zhakong. When there is a battle between long and short, as long as the multi-army lasts long enough until the Air Force gives up, the Air Force has to buy goods and finance. If you can't stand it and give up, this will lead to a large amount of spot to be bought in order to close the position, which will cause the market price to skyrocket rapidly, and many troops will take the opportunity to take profits.

This is also the reason why the market price will suddenly skyrocket when the air force is defeated.

Thinking of this for the time being, I will talk about it when I have a chance.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More