<TSMC Rocker> 4/11 Optoelectronics and semiconductors led the decline, while transportation stocks and financial stocks were fine-tuned in reverse. Ask Zhao Yaojing, is the most beautiful one in the world the one who took a bite of an apple?

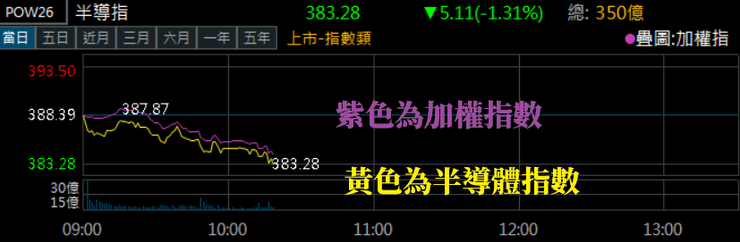

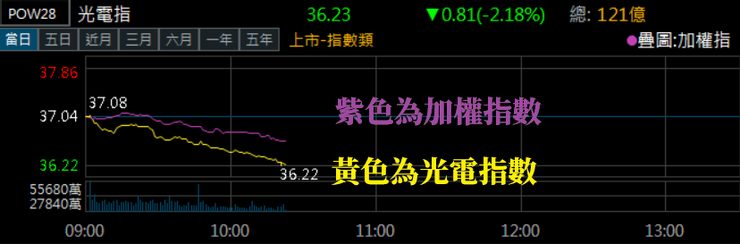

[TSMC seesaw board] This term is not created by me, but it is very efficient to explain the impact of weighted index on stocks. The daily trading volume of semiconductor, optoelectronics, transportation, and financial stocks exceeds half of the weighted index trading volume. , the two lines "follow the shadows" indicate that they are related to each other . If the two lines are "mirror refraction", they will be fine-tuned in the opposite direction. Semiconductors and optoelectronics are like shadows attached to weighted indices, and transportation and finance are like mirrors to mirror weighted indices. The distance between the two lines is a multiple reaction. If the distance is farther, the reaction multiple is larger. The vernacular means that the stock you hold will fluctuate more, and vice versa.

With the current lockdown in China, U.S. inflation, uncertain manufacturing cycles, and weakening final consumer demand, risk control is required for industries that are at the peak of the boom. The bubbles will burst, and stocks with abnormal or potential problems will all fall. Is it a multiple rise and fall, are technology stocks still shining stars? ~ Ask Zhao Yaojing

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!