我是JUN,是一名研究員,在Matters分享我對環境政策、氣候變遷、能源轉型的想法,也會分享韓國時事、政策評析,希望帶給讀者們深度好文,以及認識不一樣的韓國,並紀錄著研究員的工作日常。 若您喜歡我的文章,請幫我拍手按讚、分享或是follow我的帳號,這些都是對我莫大的支持與鼓勵。Thank you.

China's carbon trading system: crossing the river by feeling the stones from local pilots to the national carbon trading market

As Chinese President Xi Jinping promised at the 75th United Nations General Assembly in 2020 that China will strive to achieve the goal of carbon peaking by 2030 and carbon neutrality by 2060, the national carbon trading market is seen as promoting the realization of the "dual carbon goals" "an important policy tool. China officially launched the online trading of the national carbon market on July 16, 2021. It covers more than 4 billion tons of greenhouse gas emissions, accounting for about 12.39% of global carbon emissions. China has therefore become the world's largest covered greenhouse gas emissions carbon market. As of the end of September this year, the cumulative trading volume of carbon emission allowances in the national carbon market has reached 17.649 million tons, and the cumulative trading volume has reached 801 million yuan.

1. The ins and outs of carbon trading in China

The "Twelfth Five-Year Plan" period (2011-2015) is an important turning point for China to achieve a green and low-carbon transition. At the COP15 conference in 2009, China announced its quantitative reduction target for the first time, that is, the carbon dioxide emission per unit of GDP in 2020 will be reduced by 40% to 45% compared with 2005. In March 2011, the CCP announced the "Outline of the Twelfth Five-Year Plan for National Economic and Social Development (Full Text)", which not only clearly listed the quantitative reduction target of "reducing carbon dioxide emissions per unit of GDP by 17% in 2015", The establishment of a carbon trading market has also been listed as a key policy item in the "Twelfth Five-Year Plan".

China began to pilot carbon trading from local pilots, laying the foundation for the implementation of a national carbon trading market in the future. On October 29, 2011, the National Development and Reform Commission of the Communist Party of China (hereinafter referred to as the National Development and Reform Commission) announced the "Notice on Carrying out the Pilot Program of Carbon Emissions Trading", and selected 7 cities including Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong and Shenzhen. Provinces and municipalities, as carbon trading pilots, explore how to use market mechanisms to control and reduce greenhouse gas emissions, and cultivate carbon trading professionals and accumulate practical experience to make full preparations for promoting the national carbon trading system. On June 18, 2013, Shenzhen took the lead in launching carbon trading, followed by other six provinces and cities. Then, in 2016, Sichuan and Fujian also joined the ranks of local carbon trading pilots.

On December 10, 2014, the National Development and Reform Commission announced the "Interim Measures for the Management of Carbon Emissions Trading" for the first time, establishing a preliminary operational framework for the national carbon trading market. On December 18, 2017, the National Development and Reform Commission announced the "National Carbon Emissions Trading Market Construction Plan (Power Generation Industry)", which means that the construction of the national carbon trading market has officially started. After several years of preparation, the Ministry of Ecology and Environment of the Communist Party of China officially announced the "Carbon Emissions Trading Management Measures (Trial)" on January 5, 2021, establishing a management mechanism for carbon emissions registration, trading, and settlement, as well as corporate greenhouse gas emission accounting. , verification and other technical specifications. On July 16 of the same year, the online trading of the national carbon market was officially launched. The carbon trading center was established in Shanghai, and the carbon quota registration system was established in Wuhan. Beijing will undertake the construction of the national voluntary greenhouse gas emission reduction management and trading center.

2. Development status of local pilot carbon trading

According to the "Notice on Carrying out Carbon Emissions Trading Pilot Work" issued by the National Development and Reform Commission in October 2011, carbon trading pilots will be launched in seven provinces and cities including Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong and Shenzhen from 2013 After that, Sichuan and Fujian successively became non-pilot areas in China in 2016. This article only conducts an in-depth analysis of the development status of pilot carbon trading in seven provinces and cities.

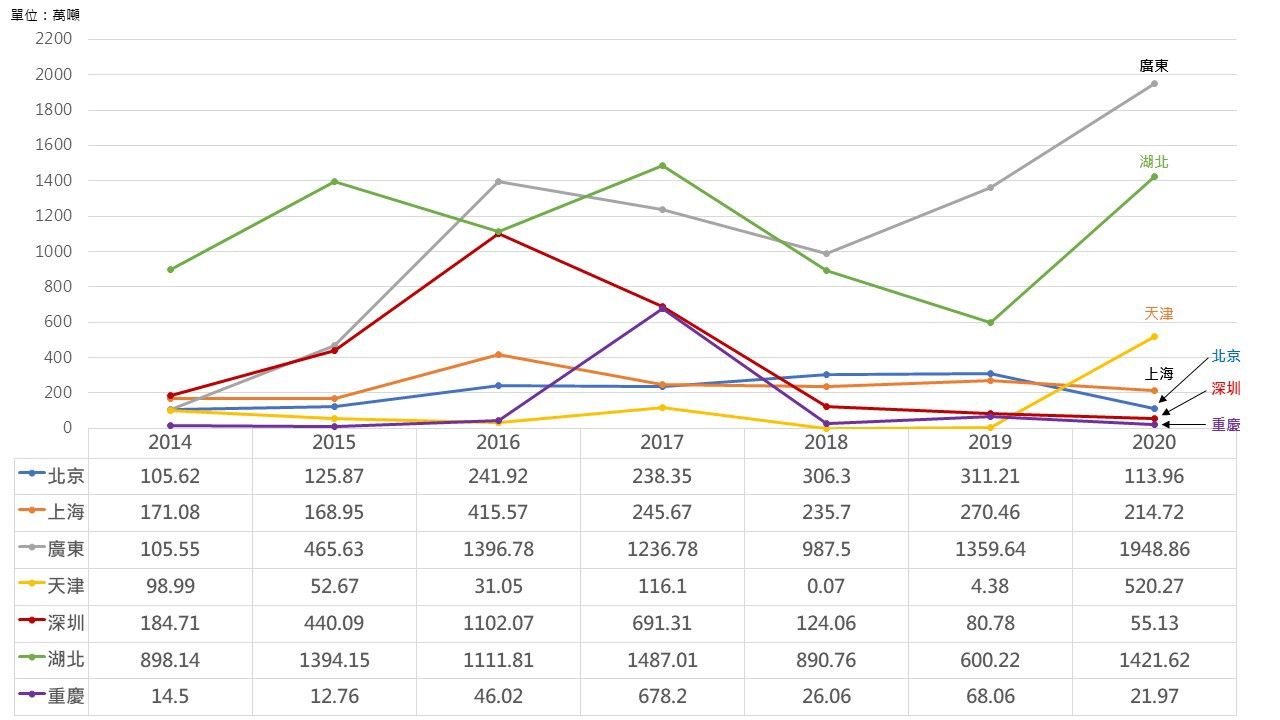

Looking at the total trading volume of each pilot project over the years, as of the end of 2020, the cumulative total trading volume of China's seven pilot carbon trading markets exceeded 200 million tons, and Hubei's cumulative trading volume ranked first, followed by Guangdong, Shenzhen, Shanghai, Beijing, Tianjin, Chongqing. Judging from the changes in the trading volume of each pilot in 2020, Guangdong's carbon trading volume ranks first and has the highest growth rate. Last year, the total trading volume was 19.4886 million tons, making it the only carbon market in the pilot market with a trading volume exceeding 15 million tons. The second is the carbon trading market in Hubei Province. In 2020, the trading volume will return to the level of 10 million tons, which is 14.2162 million tons. Among the pilot projects, the activity of Shenzhen's carbon trading market has shown a clear downward trend. Since 2016, the transaction volume of the Shenzhen market has declined year by year, and in 2020 it will only be 551,300 tons. (see picture 1)

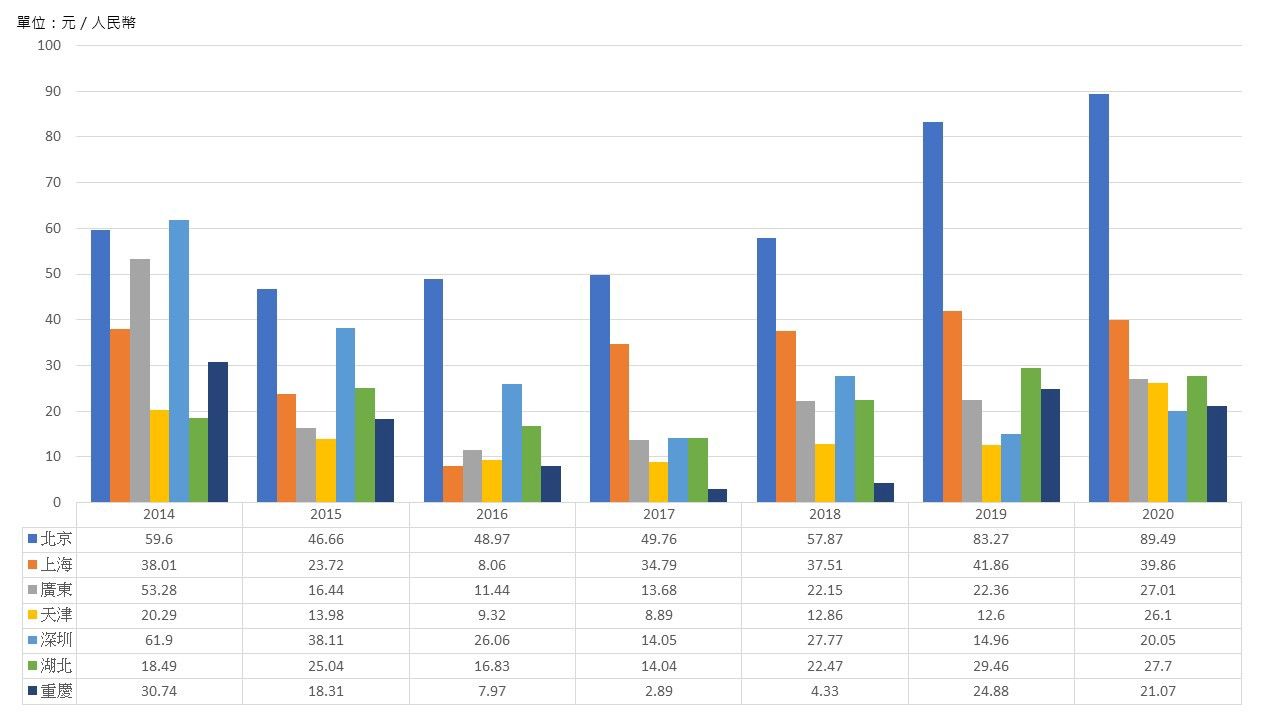

In addition, as far as the allowance price of the carbon trading pilot is concerned, the method of determining the total amount and the allocation plan of the allowance are different in different regions, resulting in a large difference in the price of carbon. The average price of allowances in the Beijing carbon trading market is the highest among all pilots, and the average market price in 2020 is 89.49 yuan per ton. The average price has a clear downward trend. (See Figure 2)

In fact, the market performance of the pilot carbon trading in these seven places varies greatly, which is mainly related to the energy consumption structure, economic development level, and government supervision of the local pilots. Therefore, each of them has also explored different trading models. For example, unlike other pilots, Shenzhen takes the total emission as the upper limit, but takes the carbon intensity upper limit as the emission control goal. The allocation of quotas in Shanghai sets up "advance emission reduction quotas" to encourage advanced enterprises, and includes the civil aviation industry, airports and ports in the subject industries of control. Beijing was the first to release the implementation rules for over-the-counter transactions, and in addition to opening up natural persons to participate in transactions, it also moderately relaxed the conditions for non-compliance institutions to enter the market. Guangdong is the first pilot project that combines free and paid allocation mechanisms. Emission-controlled companies must first obtain part of their quotas through auctions before the government grants them the remaining quotas for free, and the ratio of paid and free quotas varies from department to department. . [1] Tianjin is the only pilot that has not imposed fines on enterprises that fail to pay the corresponding carbon allowances in full during the performance period. It only stipulates that they will not be able to enjoy Articles 30 and 31 of the "Interim Measures for the Administration of Carbon Emissions Trading in Tianjin" within 3 years. policy stipulated in the article. Hubei ranks first in China in terms of transaction volume and transaction value, and is also the first to implement innovative carbon financial products and services such as carbon asset custody, carbon quota mortgage loans, carbon spot and forward products, carbon crowdfunding, and carbon insurance. Chongqing is different from other pilots that only include carbon dioxide, but includes six greenhouse gas emission rights, including carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride. At the same time, institutional investors and Individual investors enter the trading market to improve the liquidity of transactions.

Today, after the opening of the national carbon trading market, enterprises that have not yet been included in the national carbon trading market continue to trade in the local carbon market. As for companies that have been included in the national carbon trading market, they no longer participate in the local carbon trading market. The trading pilot is also preparing to connect with the national carbon market.

3. How does China's national carbon trading work?

The National Development and Reform Commission announced the "National Carbon Emissions Trading Market Construction Plan (Power Generation Industry)" on December 19, 2017, officially announcing that China has launched a national carbon emissions trading system. After the start of the carbon market construction, China plans to first promote the construction of three major systems, namely the monitoring, reporting, and verification system of carbon emissions, the quota management system for key emission units, and the market transaction-related system. On this basis, the establishment of carbon emissions Data submission, registration of carbon emission rights, trading and settlement of carbon emission rights are four supporting systems, and the power generation industry is used as a breakthrough point to gradually expand the market coverage. After much anticipation, the national carbon emissions trading will finally open on July 16, 2021.

The national carbon market adopts a "two-city" model. Shanghai is responsible for the establishment of national carbon trading institutions and systems, while Wuhan in Hubei Province is responsible for the establishment of national carbon registration and settlement institutions and systems. In other words, key emitters participate in carbon emission rights trading on the unified trading platform in Shanghai, and then the registration system handles the clearing and settlement of allowances and funds based on the transaction results provided by the trading system on a daily basis. According to the operational characteristics of China's carbon trading system, make a key sorting out.

▲Carbon emission quota calculation and allocation method: The national carbon market adopts the baseline method, [2] all allowances are issued free of charge in the initial stage, and it is expected that some allowances will be auctioned after 3 to 5 years.

▲Scope of participating industries: In 2021, a total of 2,225 power generation companies with an annual emission of more than 26,000 tons have been included. It is expected to include other industries with high carbon emissions during the 14th Five-Year Plan (2021-2025).

▲Trade type: At present, China's carbon trading mainly has two types of transactions, namely "capacity control quota trading" and "project emission reduction trading". The trading objects of the former are mainly carbon emission allowances allocated to emission-control enterprises, while the trading objects of the latter are mainly “Chinese Certified Emission Reduction (CCER)” obtained through the implementation of projects to reduce greenhouse gases.

▲Trading products: carbon emission quotas (spot) and CCERs at the beginning, and other trading products will be added in due course later. Carbon emission quota refers to the greenhouse gas emission limit produced by key emission units. CCER is to quantify and verify the greenhouse gas emission reduction effects of projects such as renewable energy, forestry carbon sinks, and methane utilization in China. Greenhouse gas emission reductions registered in the emission trading registration system.

▲Trading method: According to the "Carbon Emissions Trading Management Measures (Trial)", carbon emissions trading is carried out through the national carbon emissions trading system, and "agreement transfer", "one-way bidding" or other methods that meet the regulations can be adopted.

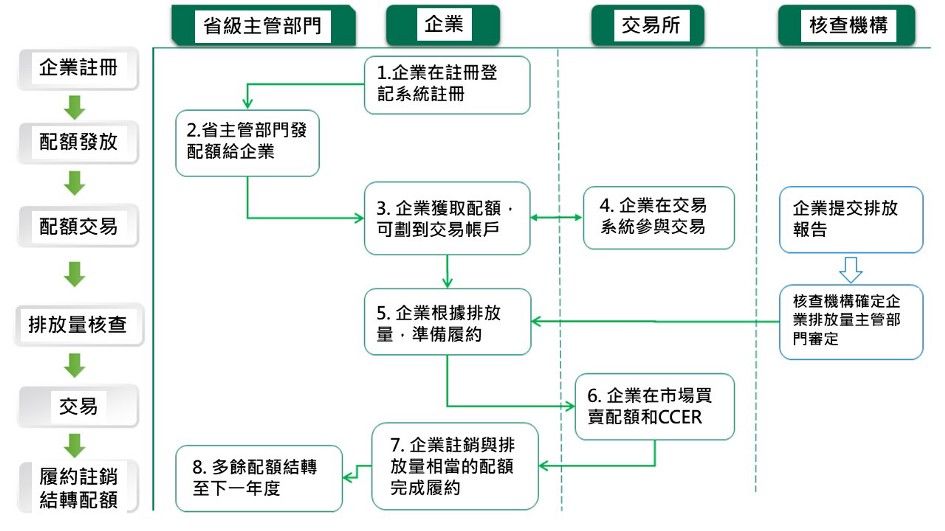

▲Trading process: Carbon emission rights trading involves multiple subjects, including government departments, verification agencies established or hired by government departments, trading agencies, and emission control companies (mainly key emission units in the initial stage). (image 3)

4. Carbon trading with "Chinese characteristics"

China is different from the carbon trading system of other countries and regions. Since the construction of China's carbon market is very different in terms of economic development stage, international emission reduction responsibility, carbon emission industry distribution and power marketization degree, etc., China is gradually Explore and build a carbon trading market with Chinese characteristics. In view of the characteristics of China's carbon trading system, make a key arrangement.

■ China's carbon trading is regulated by "carbon emission intensity", which is different from the carbon trading of the European Union and South Korea which implements "carbon emission total" control. Carbon emission intensity refers to the amount of carbon dioxide emissions produced by the growth of a unit of Gross Domestic Product (GDP). Total cap control is made by the government legislation to control the total amount of greenhouse gas emissions and the "Certified Emissions Reductions (CER)" (Certified Emissions Reductions, CER) rules. According to their own emission reduction situation, decide to buy more allowances in the trading market, or sell excess allowances. The control methods of the two will also have an impact on the reduction effect of greenhouse gas emissions. The total amount control can make the allowances more scarce by continuously lowering the "total emission ceiling", thereby effectively ensuring the reduction of carbon dioxide emissions; on the contrary, in Under the "carbon emission intensity" control, since the carbon emissions of enterprises are not subject to the absolute upper limit of the total carbon emissions, if the economic growth rate exceeds the increase in emissions, the total emissions will not decrease but increase. In the "14th Five-Year Plan and 2035 Long-term Goal Outline" published in March 2021, China plans to implement carbon trading in the future that will "mainly focus on carbon intensity control and supplemented by total carbon emission control". Some scholars said that China's carbon peak and carbon neutral road map and timetable are not clear at this stage, so it may not be realistic for China to implement an absolute cap before 2025.

■ Unlike South Korea, China launched carbon trading nationwide at the beginning, but started with local pilots first, and then implemented it nationwide. This is one of the unique characteristics of China's political system. Since all important political reforms or public policy decisions in China must conform to China's national conditions, through pilot policy experiments, we will explore how to implement them according to the specific conditions of each locality and department. Policies provide experience for the comprehensive promotion of policies, and explore and understand the laws of "crossing the river" in the practice of "touching the stones".

■ The operation of China's carbon trading adopts a "two-city model". Shanghai is responsible for the construction of national carbon trading institutions and systems, mainly providing a platform for buying and selling. Confirmation and registration of emission rights, transaction settlement, distribution performance and other services. Wang Zhongmin, former vice chairman of the National Social Security Foundation of the Communist Party of China, said: "In the future, the trusteeship center and information database center for carbon trading may be implemented in different provinces and cities and different companies." This is also unique to China's carbon trading The mode of operation is different from that in South Korea, which integrates the carbon trading platform, carbon registration system, carbon trading custody center, and clearing and payment system on the same platform, that is, the emission market information platform of the Korea Exchange located in Busan Metropolitan City, South Korea ( Korea Exchange ETS Market Information Platform).

■ China's carbon market only included the power industry at the beginning, unlike the EU or South Korea's carbon trading market, which included emission control companies from different industries at the beginning. For example, the first phase of South Korea's emissions trading includes petrochemical, steel, power generation and energy industries, automobiles, electronics, aviation and other industries, while the European Union includes energy-intensive industries such as electricity, steel, and paper. The reason why China chooses to give priority to the power industry is that the historical emission data of the power industry is relatively complete, which is conducive to the formulation of targeted quota allocation plans, and the power industry is a large carbon emitter. ─2025) will expand the scope of control objects, and gradually include industries with high carbon emissions such as steel, cement, chemicals, electrolytic aluminum, and papermaking to accelerate green transformation.

[1] The proportion of paid and free quotas is also different for each sector. For example, the paid quota for the power sector is 5%, and the free quota is 95%, while the paid quota for other sectors such as cement, steel, civil aviation, paper, and petrochemicals is 3. %, the free quota is 97%.

[2] If the emissions per unit of product are above the baseline, the more products produced, the larger the allowances will be. On the contrary, enterprises below the baseline need to increase investment to make the emissions per unit of product higher than the baseline Otherwise, every time a product is produced, carbon emission rights must be purchased from the market, or they can only withdraw from the market.

※This article is the original manuscript, which was simultaneously published on the Medium of the National Taiwan University Risk Center .

references

1. Beijing Institute of Technology Energy and Environmental Policy Research Center (2020). 〈 2020 Carbon Market Forecast and Prospects 〉. Retrieved 10/14/2021.

2. Tianjin Municipal People's Government (2020). < Tianjin Interim Measures for the Administration of Carbon Emissions Trading >. Retrieved 10/14/2021.

3. World Wide Web (2009). " The State Council Researches and Determines China's Greenhouse Gas Emissions Control Action Goals ." Retrieved 10/14/2021.

4. China Government Network (2011). < Outline of the Twelfth Five-Year Plan for National Economic and Social Development (Full Text) >. Retrieved 10/14/2021.

5. China Government Network (2012). < Notice of the State Council on Printing and Distributing the "Twelfth Five-Year Plan" Work Plan for Controlling Greenhouse Gas Emissions >. Retrieved 10/14/2021.

6. Prospective Industry Research Institute (2021). 〈 Analysis of China's carbon trading market scale, regional pattern and development prospects in 2021. The future carbon trading market is expected to accelerate development 〉. Retrieved 10/14/2021.

7. Securities Times Network (2021). " The single-day trading volume of the national carbon market exceeds the sum of two months, and the price discovery function of the carbon market gradually emerges ." Retrieved 10/14/2021.

8. Sina Finance (2021). < The single-day trading volume of the national carbon market has reached a new high, and the cumulative trading volume has exceeded 17 million tons >. Retrieved 10/14/2021.

9. China Communist Party News Network (2014). "Policy Experiments and China's Institutional Advantage ." Retrieved 10/14/2021.

10. China Government Network (2020). < National Carbon Emissions Trading System Officially Launched >. Retrieved 10/14/2021.

11. Sinolink Securities (2021). "Utilities and Environmental Industry Report: The Complete Handbook for the National Carbon Market ." Retrieved 10/14/2021.

12. Carbon Emissions Trading Network (2021). "The Market Status of Carbon Emissions Trading in China ". Retrieved 10/14/2021.

13. CarbonBrief (2021). “ In-depth Q&A: Will China's emissions trading scheme help tackle climate change? ” Retrieval Date: 2021/10/14.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…