從 2020 年 8 月開始寫字 https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈教育平台【鏈習生】團隊成員 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

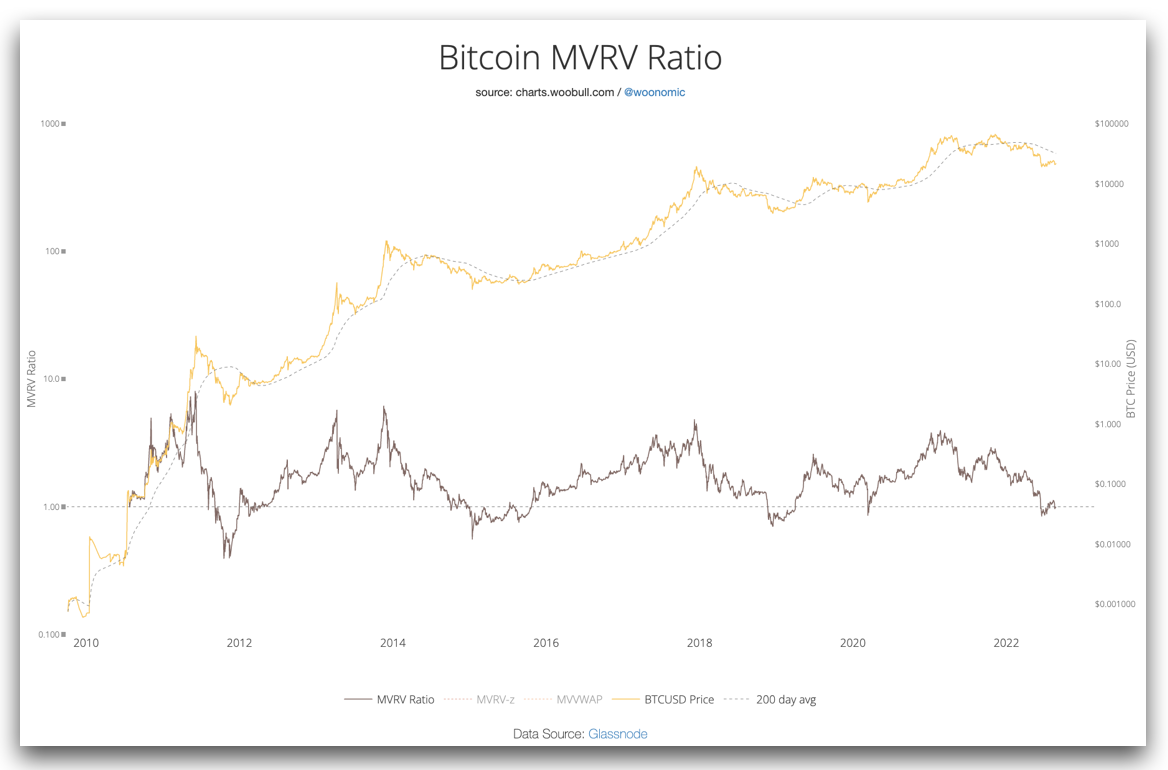

Reading pen farming | Falling in love with on-chain data 01: MVRV

After reading @Uncle Xin [ 3𝓐𝓾Learning 𝓦𝓱𝓪𝓽#1] on-chain data - 𝓝𝓤𝓟𝓛, I also did some popular science research myself. This article will be elaborated from the beginning, trying to "speak human words" as much as possible to make it easy for everyone to understand.

To understand the logic of the NUPL indicator, we have to start with MVRV....

■ Details from the beginning: MV, RV

MVRV was first proposed in October 2018 by two on-chain data analysts, Murad Mahmudov & David Puell , and was initially used to judge the Bitcoin market.

Among them, MV refers to Market Value , which is translated as "market value" in Chinese, and is the total number of bitcoins in circulation x market price . It can be imagined as the market value of the traditional financial market, that is, the stock price x the number of outstanding shares.

Tips: The MV reflects "current" market sentiment fluctuations.

RV refers to Realized Value , which is translated as "realized value" in Chinese. Everyone knows that the blockchain is a public ledger, and the cash flow of Bitcoin is clear and transparent. When each bitcoin is moved for the last time, the last time it is sent from one wallet to another, a price will be generated. All these prices are added up to take the average, and then the average price x the total number of bitcoins in circulation is RV.

Tips: RV is seen as a “more real” measure of value for Bitcoin.

*

Divide MV and RV, this number is called MVRV Ratio ; if it is subtracted, it is the source of NUPL ; if it is more refined, the concept of statistical "standardization" will be used to calculate MVRV Z-score … The essence behind these indicators and the phenomena they want to reflect are similar.

■ Where to inquire?

- Woobull Charts (preset MVRV Ratio, can be switched to MVRV Z-score) https://charts.woobull.com/bitcoin-mvrv-ratio/

- BITCOINITION (MVRV Z-score)

https://bitcoinition.com/charts/mvrv-z-score/

■ Operational Policies

The MVRV Ratio is used as an illustration.

A (seemingly) good practice is:

Buy Bitcoin when the MVRV Ratio value is less than 1. Sell coins when the MVRV Ratio value is greater than 3.

According to a report published by research institute Messari (see page 13), historical data show that the time for MVRV Ratio above 3 is gradually decreasing .

In 2011, the MVRV Ratio stayed above 3 for 4 months.

In 2013, it stayed there for 10 weeks.

In 2017, it stayed for 3 weeks.

In 2021, it will only stay for 3 days.

Does this mean that the price of Bitcoin, the asset, is reacting faster and faster to the "market consensus on 'good times'"? Bitcoin has entered the field of vision of more and more people (including institutional investors)?

🌱 Join [ Zhongshu Nervous System ] around the fireplace👇

The special topic #Reflections on writing and #頭内心話is being serialized.

🌱 I am on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocus 】

🌱 My teaching text and invitation link👇

≣Sign up for noise.cash | Become a "noise coffee" and experience social finance together .

≣Sign up for Presearch | The search to earn that kills three birds with one stone.

≣Sign up for MEXC | Go and jump on the Matcha Exchange, cash out OSMO and run wool .

≣Sign up for Potato | Three things to learn from Potato Media .

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…