https://linktr.ee/penfarming 金融職人|文案編輯|雜食性閱讀者|Heptabase 愛用者 🌐 區塊鏈科普網站【鏈習生】專欄作家 🗞️ 電子報【創作者經濟IMO】主編 👤 臉書專頁【閱讀筆耕】

Reading Bigeng|Coin News #11・Seriously neglected LikeCoin blue ocean with a yield as high as 162%

This is a system that receives "airdrop radar" reports under the Cosmos ecosystem. Its conditions and qualifications are nothing more than pledge, vote for the proposal, and liquidity provider (LP), so special emphasis is placed on the development and application of these three aspects.

Today, I put the information collected by "Airdrop Radar" in the appendix, focusing on "pool selection".

I often hear people ask, "Which pool should I choose?"

So I want to continue to explore the decision-making process from various aspects. The conclusions I get are not the truth , but are the measures I am willing to take under certain conditions. I will share them with you.

■ Go to places with fewer people

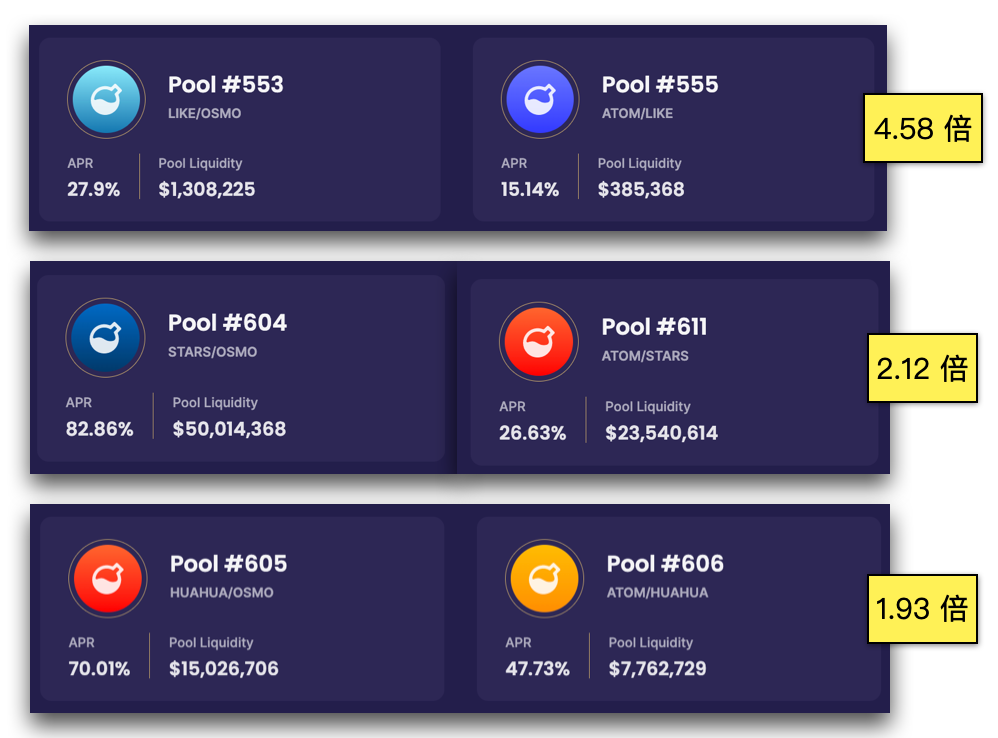

First, please pay attention to the following six liquidity pools. Can you summarize some common points?

Straight to the point, the observations are:

- When these three coins ($LIKE, $STAR, $HUAHUA) were launched, two pools were opened , forming trading pairs with $OSMO/$ATOM respectively.

- Compared with the pool with $ATOM, users prefer the pool with $OSMO . The differences in market value are 4.58 times, 2.12 times, and 1.93 times respectively. The reason is very intuitive and is reflected in the APR.

- These pools provide external incentives (External Incentives) .

The key point is that the total amount of external rewards invested in the two pools is the same, but the "denominator" involved in the distribution is very different.

Therefore, with the same amount of funds, I am willing to invest in a pool with a smaller denominator, because the evaluations of $OSMO/$ATOM are similar, and I am happy to hold them.

■ Physical test

I opened a new wallet and wanted to use the ATOM + LIKE pool with a denominator difference of 4.58 times to manually calculate the "external" annualized return rate. This is the Osmosis exchange interface (only showing the "internal" annualized return rate) is a value that cannot be felt.

It is estimated (view) that the principal value in the ATOM + LIKE pool is equivalent to 4,293 $LIKE. The most recent single-day external reward is 19.05 $LIKE, which infers that its "external" annualized return rate is as high as 162%; use the same method for OSMO + The LIKE pool is evaluated and its "external" annualized rate of return is only 48% because there are many people dividing it up .

The numerical value may not be accurate, but the general direction remains unchanged. Here is one aspect that we can refer to when "selecting a pool":

If two pools are opened for one currency and the same amount of external rewards are given, go to the place with fewer people.

*

The conclusion is obvious and seems like nonsense.

However, it is precisely because the Osmosis exchange interface does not provide an "external" rate of return, coupled with the fact that LikeCoin is not a mainstream currency, and the ATOM + LIKE pool has only an "internal" rate of return of 15.14% on the surface, which seems weak. These three factors (The right time, right place and right people ) It has been seriously neglected, which is reflected in the liquidity provision of less than 400,000 US dollars. The denominator is very small, it is a blue ocean!

■ Appendix: Notion form is online

Starting from 3/10, the information captured by "Airdrop Radar" has been included in the Notion form and is being continuously updated and optimized. There is a message function and appreciation button enabled, inviting everyone to come and have a look; search for recent news:

- CoolCat ($CCAT)

Eligibility for redemption was updated on 3/12 and has not yet been snapshotted.

🔗 Further explanation . - Elements of Cosmos ($EOC)

The airdrop plan was announced on 3/13, with no threshold and no snapshot yet.

🔗 Further explanation . - Cerberus ($CRBRUS)

Open for collection on 3/15, limited to certain users ($HUAHUA stakers).

🔗 Further explanation @Daisy. - EVMOS Name Service ($EVNS)

The airdrop plan was announced on 3/16, with no threshold and no snapshot yet.

🔗 Further explanation .

🌱 Reflections on special writing are being serialized👉 01 | 02 | 03 | 04 | 05 |

🌱 Follow [ Zhongshu Nervous System ] broadcast information and never miss it👇

Good Quotes from Good Books/Book Market News/Mind Map/Drifting Book/Coin Newspaper

🌱I appear on other platforms👇

【 Facbook | Mastodon | Medium | vocus | Potato 】

Like my work?

Don't forget to support or like, so I know you are with me..

中書神經系統

1. 關注各種有關書的消息。 2. 長文:專題 #寫作的反思 與 #爐內真心話 連載中。 3. 短文:每日「鏈習生幣圈日報」新聞的盤後觀點 murmur 眾聊。

Comment…