窩在倉庫打雜,還是要做點文青夢~ 認真活成孩子會想成為的大人❤ 記錄下值得珍藏的書籍+趣活點滴! https://www.facebook.com/joylivechyi/

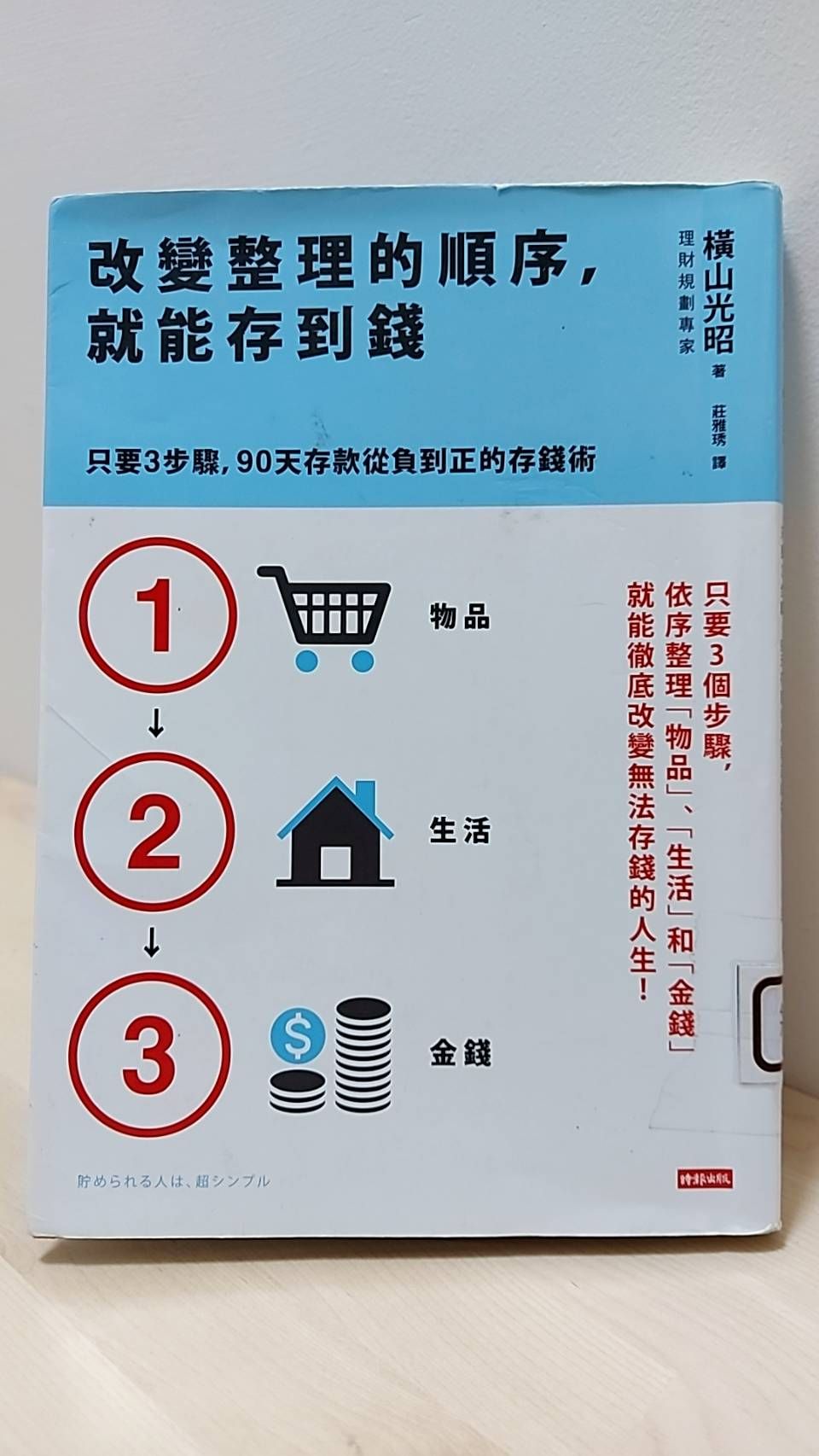

Reading experience | "Change the order of sorting, you can save money" is worth a try!

Does the title and Slogan look great?

Ha, plus I saw someone in the book group sharing it, I'll look for it too!

After a little research on the background of the author of this book, Hiroaki Yokoyama, he was a well-known financial planning expert who had to support his family with a single salary shortly after he came out of the society, and then used his self-created "household three-division method" and borrowing to start a business.

Yokoyama started his own name with the title of "Family Regeneration Consultant", and his previous work "The monthly salary of 22,000 has to be saved! 90 days 10 times the gold saving technique super practice book , with the personal original "household improvement system", using three passbooks to save money "Yokoyama-style money saving technique" is widely praised; although I have not seen that This book, but this book "Change the order of sorting, you can save money" also focuses on "through interviews with tens of thousands of people, evidence-based and effective methods" , self-organizing life and changing the way of saving money, simply making saving money into a habit, the third Zhang also mentioned opening three accounts, apparently including the previous work.

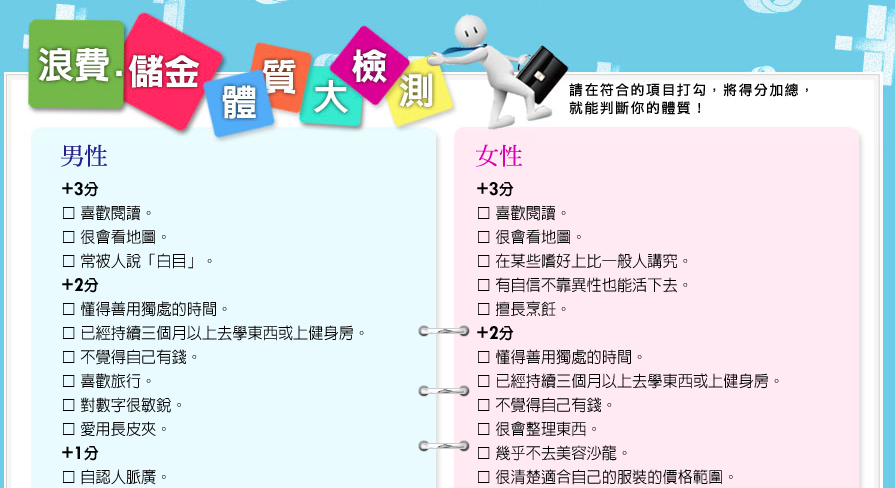

When I checked the author's background, it was quite interesting to see the page below, which is "The monthly salary of 22,000 has to be saved! 90 days 10 times the gold saving technique super practice book" and the quiz about "spending physique", you can follow the questions to check, before reading the book, can you save money by yourself?

(Click on the link to see it!> https://www.suncolor.com.tw/event/salary2/index.html )

The previous work focused on finding blind spots in family finances. You can still save money with a low salary. In comparison, this book may be easier to read and easier to implement. In 90 days, organize ① "Items" → ② "Life" →③ "Money" is enough.

Why 90 days?

The author believes that if it is too short, you may slack off after a sigh of relief, and if it is too long, you will not be able to remember things that have been too long. The focus of three months is to "review". The key ; therefore, September happens to be the right time to read this book, review it well when it expires, and welcome the new year... It's beautiful to think about, and it's worth trying!

The first month☆Distinguish between "want" and "necessary"

1. It can be said that almost all financial management books remind that you must learn to distinguish, but as the author said, it is easy for adults to deceive themselves: what is "wanted" in front of them is "necessary"...

2. A recent popular sentence: "Money has not disappeared, it has just changed into a shape you like" , just like the author's painstaking reminder - items are another form of money, as long as you replace them with items, the money will eventually decrease!

3. For a month, use photos/notes to record "all" items in the home, write down how you feel, and then reflect on yourself through seven questions.

4. After shopping, have you achieved the purpose of purchasing?

This is very touching! Especially when buying clothes, I used to go shopping for a long time and hesitated for a long time before buying it. I was satisfied with the purchase now, but I don’t necessarily remember to take it out and wear it later, or I don’t like it so much when I go home... The author reminds you to verify whether you are satisfied or not, and pay attention to how you feel. Gap.

This part is matched with the ""Five Most Beautiful Sets" Textured Life Outfits" and "Simple Life Selection Proposal" I watched before, and it is still said that there is little progress!

The second month☆ "Visualizing" life

1. When life is cluttered, finances are cluttered - find your "simple boundaries" (minimum possessions) and see what you really value. (Can be used with "The Meaning of Life" to return to the heart)

2. Write down nine important aspects of life

★Mind - what is the source of stress? Mostly relationships, work, family, others (society as a whole, world environment, etc.) ★Body - digitized, embodied. This month, you can add your diet/weight/work-rest records, observe your own wear and tear, and find ways to increase the number of days with good results. ★Invest in yourself - divided into "offensive" (eg: study, social interaction) and "defensive" (saving). The author reminds that if you are too defensive at the beginning, it will be difficult to take the initiative to take the offensive in the future. ★Diet - control the content of food, the condition of the refrigerator, and avoid waste. ★Socializing - If you can't think of a good reason to convince yourself, don't go! ★Mobile phone - try to convert the mobile phone fee into a daily amount, is it worth it? People who are too dependent on their phones often have trouble saving money. ★Utilities, electricity and gas costs - take "10% less than last year" as the goal of killing monsters, you will be more motivated! ★Residence - according to the current values and lifestyle, weed out unnecessary things and clear the space. ★Transportation - Beware of the black hole of electronic payment, so as not to ignore this daily expense.

The third month☆ Build your own "money rules"

1. It's easy and sustainable for a long time.

2. Step by step: only record the amount → amount + item (making accounting a habit) / can additionally record the consumption you care about

3. Category management: consumption, waste, investment.

Investment also includes "investment in self" and "savings". Usually, people who can save "one-sixth" of their monthly salary will be able to save more money in the long run; waste must be controlled within 5%, face their desire to spend money, and moderate it. Waste to avoid over-suppression.

4. Prepare three accounts:

A spending account: about 1.5 monthly salary, including the account used for daily consumption such as rent; after the salary is recorded in the next month, the excess can be included in the "savings" account. Savings Account B: With the goal of saving 6 months' monthly salary, it will be used as a "Life Defense Fund". (That is, the "emergency reserve fund" advocated by Sandy Rabbit's "Family Budget", the amount of each person's target should be determined according to the "needs of family responsibility") After reaching the target, the excess amount can be included in the "value-added" account. C Value-added account: You must wait for the first two to be more than enough before you can transfer to this area, and choose the investment target according to the risks you can bear.

The most important thing, of course, is not to get rid of "personal practice"!

I was just starting to record the items in my house. I thought that after the move, there were not many items in the nest. I didn’t expect that it would take a few days to list them all, especially many stationery and toys. Space, I have silently decided to skip it... I hope I can finish it in two weeks!

If it's not like we just moved, we recommend taking a look at the actual records. Maybe you can find a lot of things that you forgot you already owned and save money on repeated purchases!

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…