財經傳媒三十年老兵, 歷任香港經濟一週社長/道瓊斯中國地區總編輯, 在香港成長, 在內地創業, 在美國上市, 曾旅居英國, 但最愛在台灣流連,

Is the US going from stagflation to recession?

The latest weekly report of Bank of America predicts that the U.S. economy will enter a recession from stagflation in the second half of 2022, and the S&P will pull back to 4,000 points. High-quality defensive stock markets, energy and real assets should be allocated.

Facing negative credit and stock market returns in 2022, from stagflation to recession:

- Facing interest rate shocks in the first half of the year and recession fears in the second half.

- Affected by the global epidemic, supply bottlenecks continue, the labor market tightens, and inflation remains high.

- The Federal Reserve (FED) acted too slowly. In order to avoid panic in the financial market, it did not raise interest rates by 50bps at the FOMC meeting in January to curb inflation.

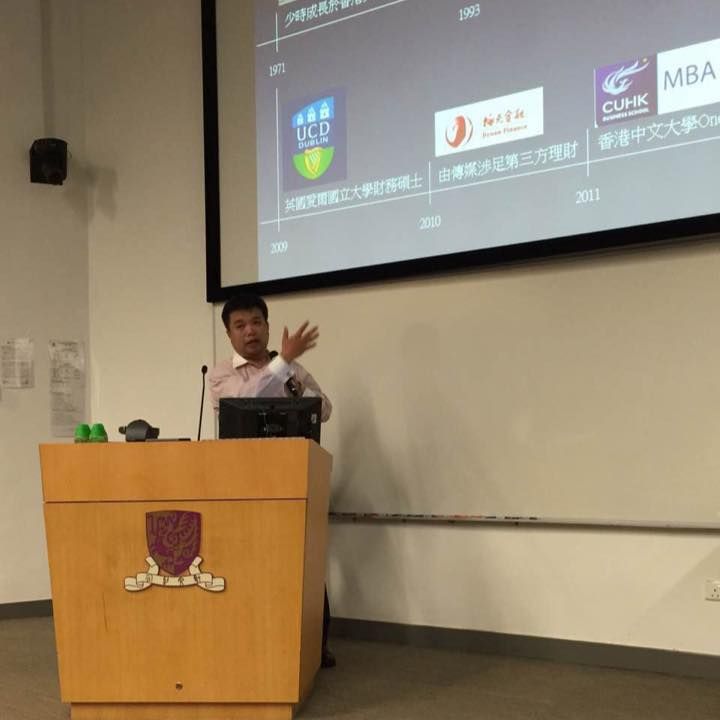

- In a high inflation environment, with reference to past experience, cash outperformed the bond market and credit in nearly half of the years (Figure 1).

2. The stock market faces three major negative factors, and the S&P 500 returns to 4000 points:

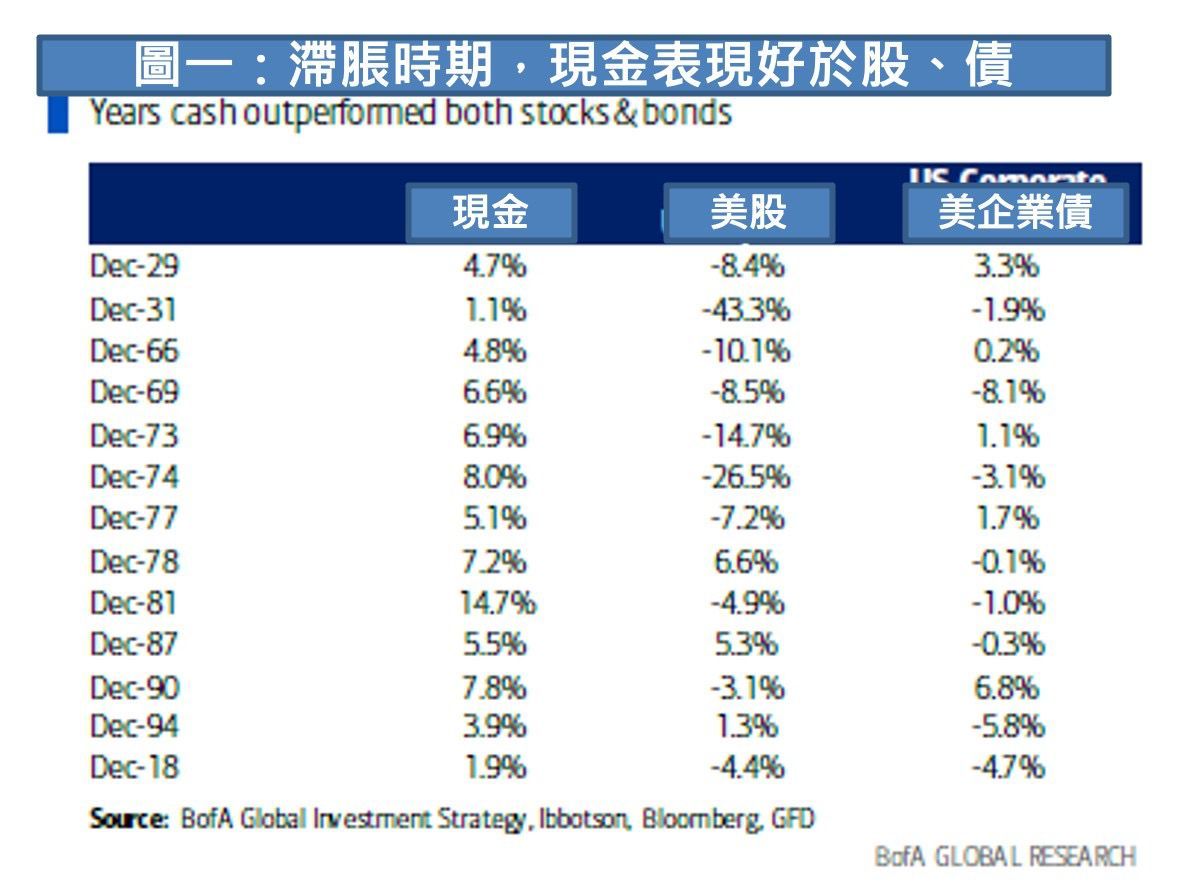

- SMEs face recession: SMEs face inflation, rising wage costs, and the severity of declining sales is at its highest level since 2010 (Figure 2).

- Profits continue to decline: Profit growth will drop from 40% last summer to 5% this summer and then fall into negative territory.

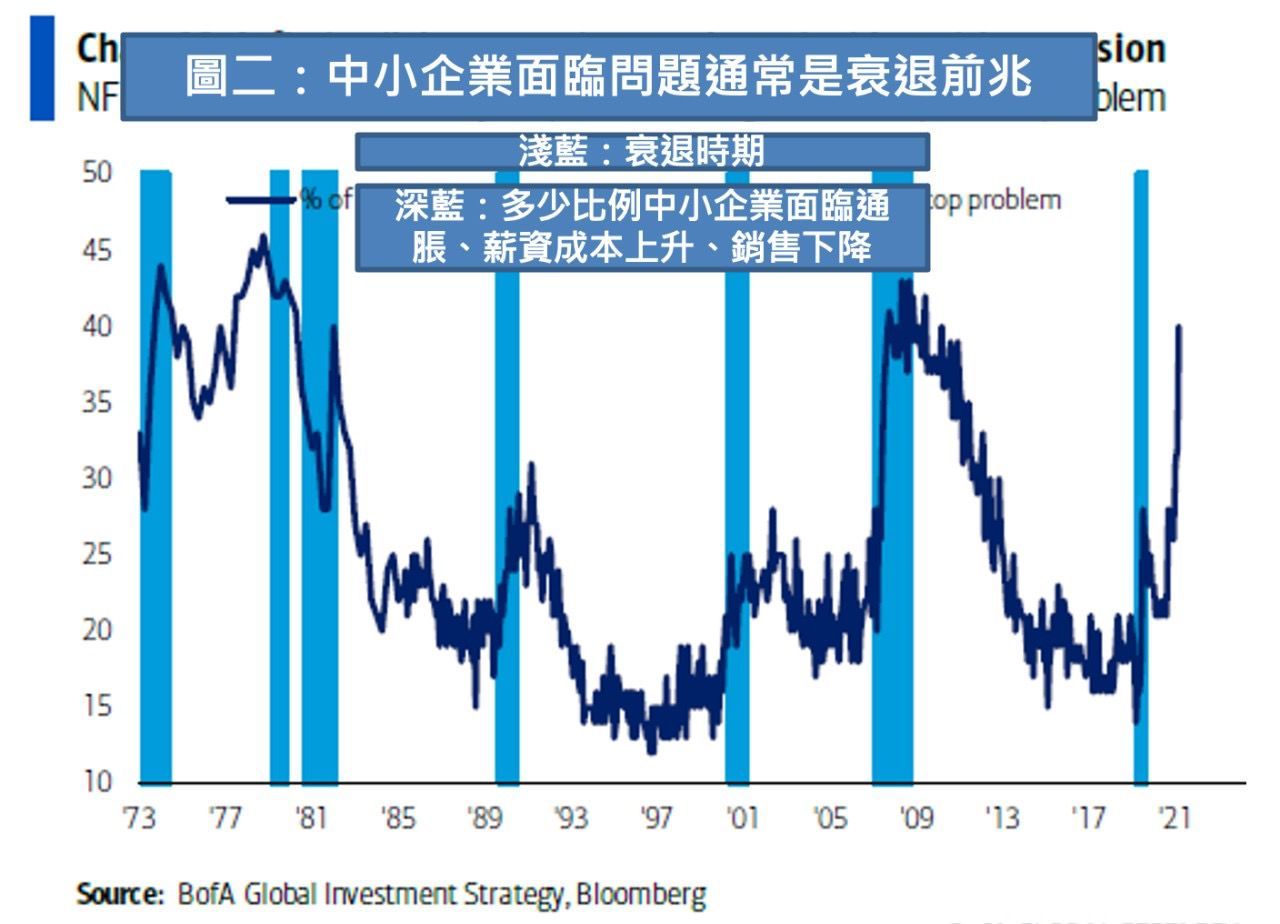

- Declining consumption: Real wages grew by a negative 2.4%, similar to the situation in past recessions (Figure 3); excess savings are mainly held by HNWIs, with limited transformation.

Asset allocation strategy:

Do a good job: high-quality, defensive stock market, corresponding to economic recession; oil, energy, and other commodities, corresponding to inflation; emerging market bank stocks, corresponding to unblocking; Asian credit bonds, to cope with excessively panicked interest rate pricing

Short: Short high-yield bonds and investment-grade bonds that underperformed during the debt reduction period; short technology stocks or the Nasdap index in response to reduced inflows from Europe and Asia

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…