Can NFTs Give Artists Breathing Space?

Since the 21st century, the art market, which has been flooded with capital, has frequently reported that art works are auctioned at sky-high prices.

Leonardo da Vinci's "Salvator Mundi" was auctioned for US$450 million, and Kaws' work THE KAWS ALBUM was also auctioned by Sotheby's for HK$115,966,000. However, how much can flow into their own pockets for emerging artists?

In fact, the art industry driven by money has already regarded artists who are "inexperienced in the world" as cheap labor in a semi-"slavery" style. "Money Storm" in the American art world, the book Big Bucks also depicts galleries with bright art surfaces, but squeezes the dark side of artists and collectors behind the scenes.

cloudy art market

Contemporary art has always been developing towards the commercialization and financialization of art. If the market is not restricted by relevant regulations and is allowed to develop freely during the development process, the final result will inevitably be the continuous squeeze of the interests of the weak. Why do financial markets need to prohibit insider trading and require all listed companies to publicly disclose financial reports? The purpose is to protect the interests of vulnerable players in the market. In the art market, the interests of artists and collectors also need to be protected. However, due to the imperfect development of the art trading market and its particularity as a commodity, the formulation and implementation of regulations has always been a problem. This also led to the original artistic pure land, mixed with disputes over financial interests.

In traditional primary market art transactions, galleries, as agents in primary market transactions, are responsible for connecting artists and collectors. But since ancient times, "middlemen" have always wanted to "make a profit and make a difference". There is also a lot of black box work in the gallery trade.

Most galleries don't put a price tag on the work. In New York's art trade-related regulations, even if it is clearly stipulated that art needs to disclose the price, most galleries turn a blind eye. One of the main reasons is that the relationship between galleries and artists, although collaborative, is also a "zero-sum" relationship. Usually, small galleries do not choose to train new artists to achieve a win-win situation due to cost problems, but adopt a profit-oriented pricing method, while suppressing the purchase price of artists’ artworks, while marketing with collectors to raise the price of collections, to Seek more profit in the middle.

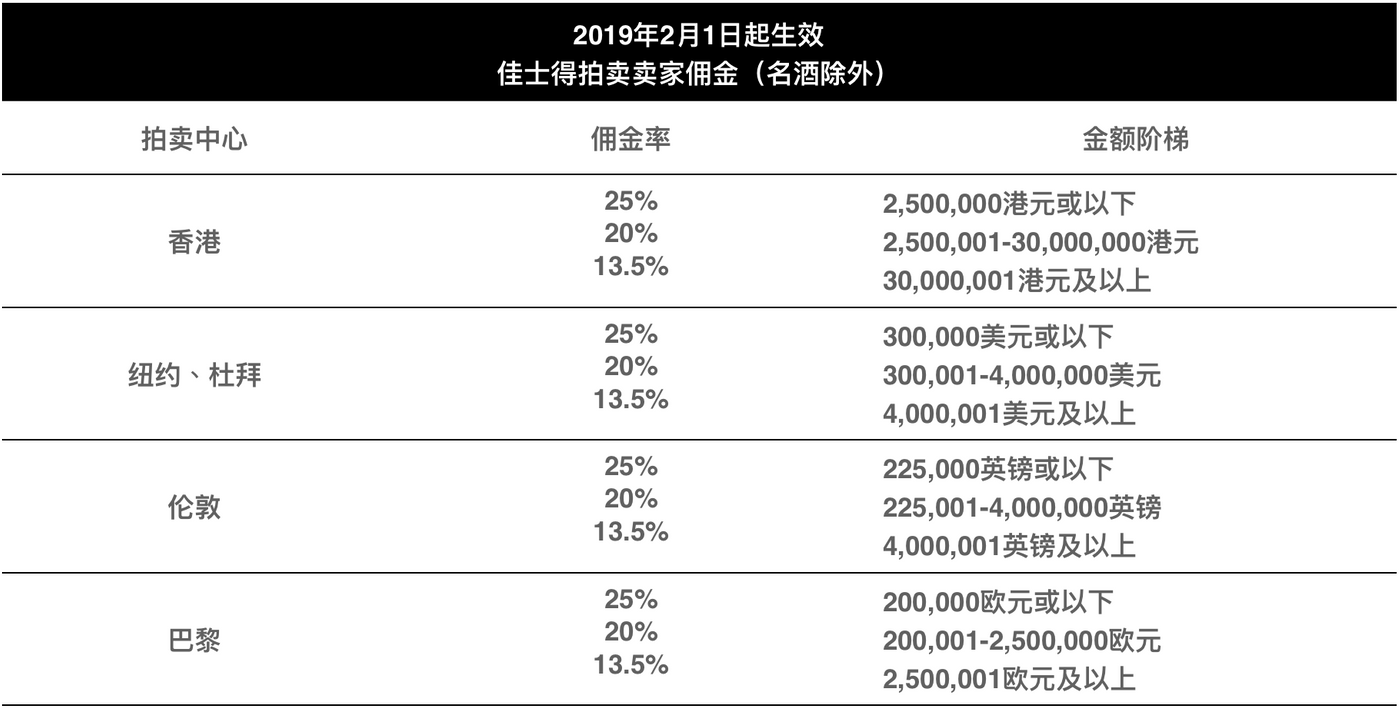

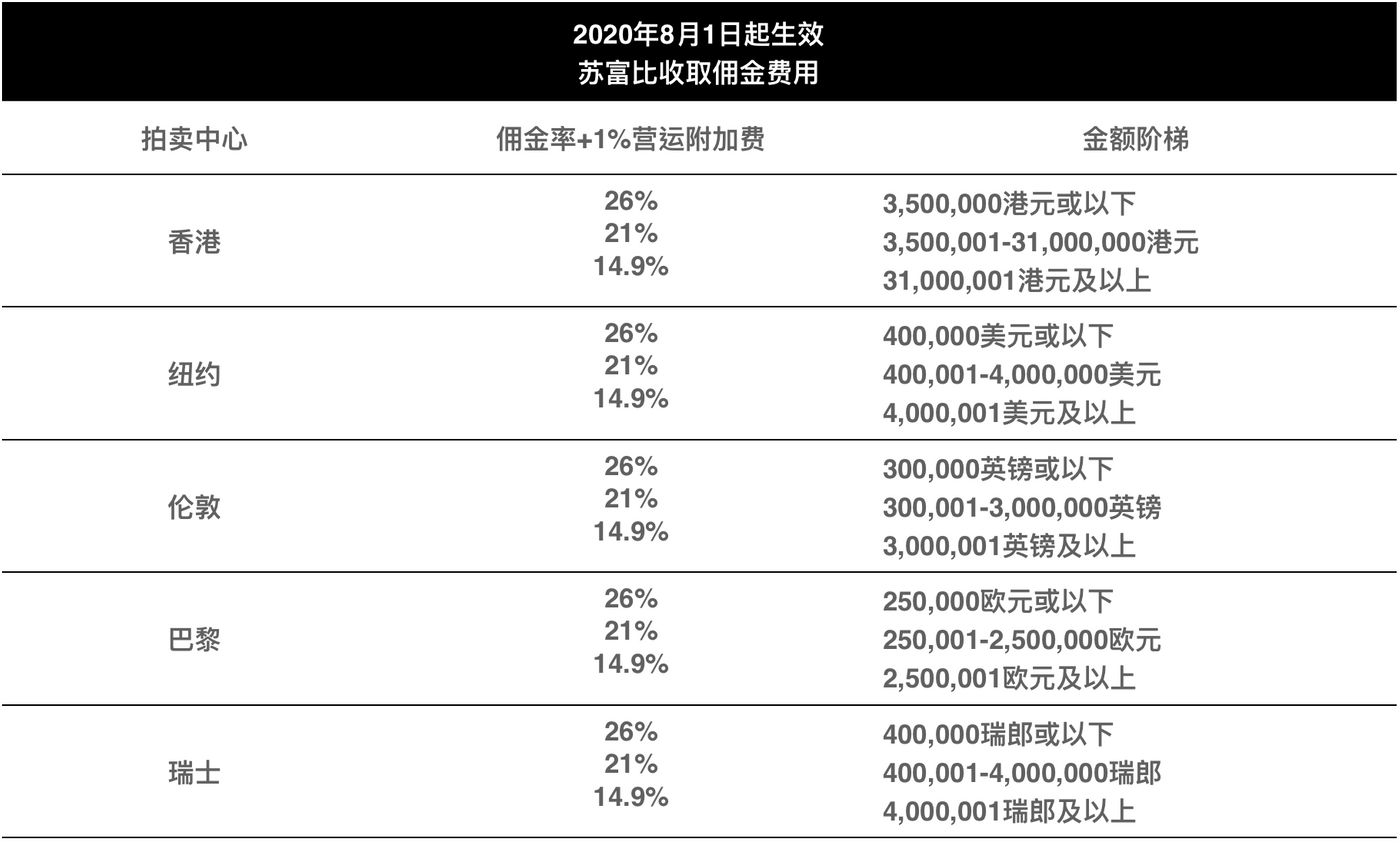

This kind of unequal money rights transaction is not only full of "black box" transactions in the primary market, but also hidden in the more open secondary market auction houses. Even the two giants of the art auction industry, Sotheby's and Christie's.

Often the transaction price that collectors think is not the final transaction price.

So how does the auction house move behind the scenes?

First of all, before the art auction, the auction house will find some third-party guarantors to ensure the lowest transaction price. If the auction is ultimately lower than this lowest transaction price, there will be a guarantor to trade at the lowest price. If it is higher than this lowest transaction price The guarantor can get a certain share of the income.

In addition, in the auction process, different collectors are not equal. Just like luxury purchases, auction houses will be divided into 3, 6, 9 classes according to the purchasing power of collectors. Only the top sellers with the most purchasing power can come to the scene, while those with lower purchasing power may be arranged to watch the live auction.

The judging criteria in the art world are originally subjective, but with the addition of capital, it seems to have become a one-dimensional world where money is paramount. It is conceivable that the most vulnerable new artists in the industry chain will be in what position.

The birth of NFT gives niche artists hope to break free

Recently, Christie's, a well-known auction house, has become popular by auctioning the works of NFT logo artist Beeple, and the new art form of NFT has also widely aroused heated discussions among insiders in the art circle. Some art practitioners dismiss it, believing that the emergence of NFT artworks cannot fundamentally solve the problems existing in art transactions; while others believe that it gives niche artists a new way to realize artistic value. To this end, the following article also analyzes the changes that NFT brings to artists from three points.

Increase the artist's revenue share

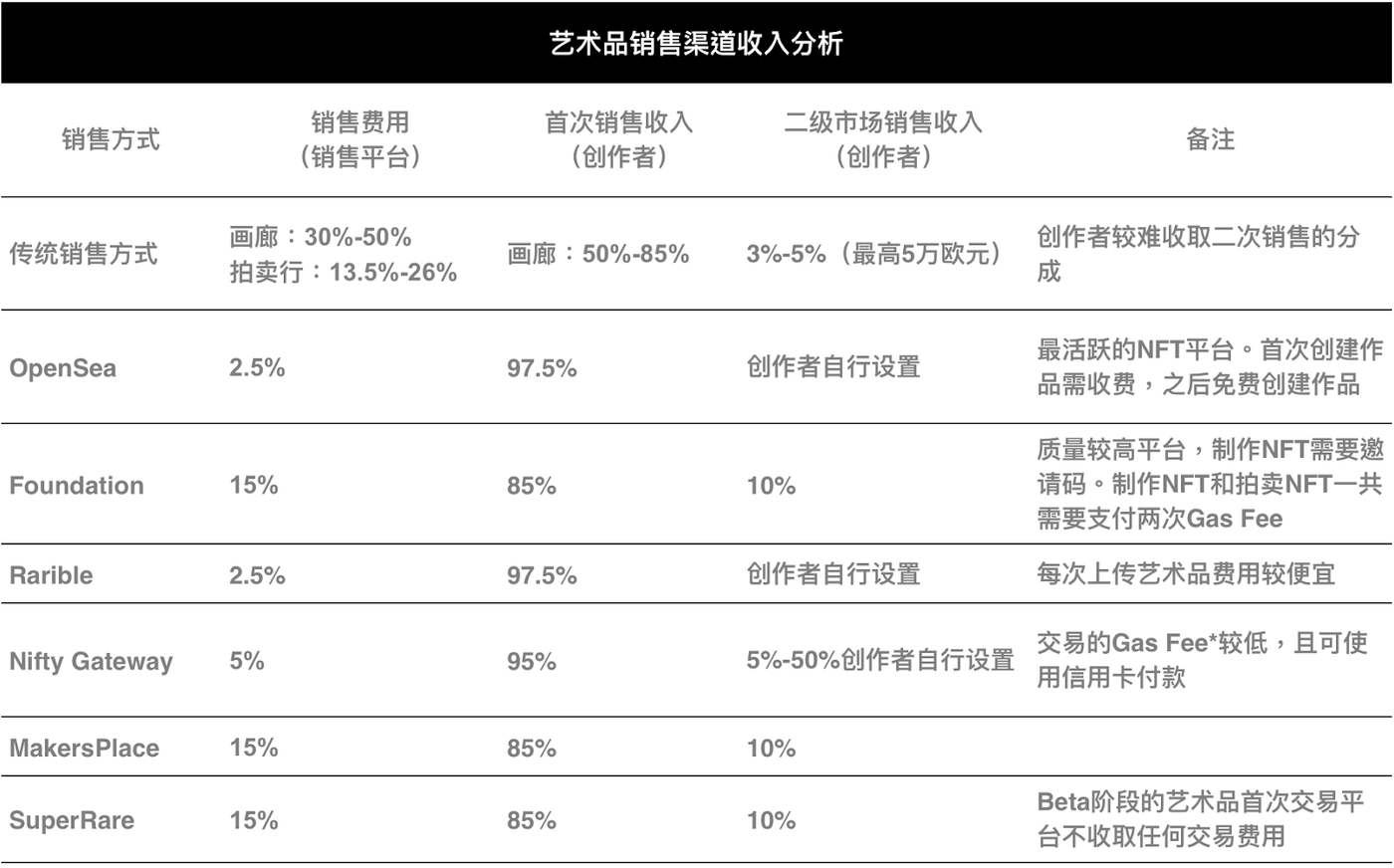

In the sales model of traditional artists, they generally directly connect with artists and collectors, and the average income accounts for about 3-50% of the income of the entire industry chain. In the secondary market transactions, foreign galleries generally entrust famous artists to auction houses for the secondary market sales of artworks. The two largest auction houses - Sotheby's and Christie's will be based on the transaction amount. The commission rate varies from 13.5% to 26%. In the process of cooperation with galleries, the bargaining power is generally determined by the reputation of the artist. Well-known artists can obtain a higher 85% ratio in the game with galleries, while artists who are not well-known may only receive about 50% of their income.

It can be seen intuitively from the data related to the most popular NFT trading platforms organized by the CyberFunkz platform below. When artworks are sold on NFT trading platforms, the common phrase in the retail market is to reduce middlemen to earn the difference, and the proportion of income earned by artists will naturally increase. For example, OpenSea has a lower handling fee on the platform, which is generally only 2.5% of the selling price, far lower than the 30% of the gallery. NFTs increase the direct income ratio for artists.

Solve the problem of copyright income from secondary sales of artists

In the art market, there is another issue that has been criticized by artists. If the collector wants to sell the artwork again after acquiring the artwork, this part of the income has basically nothing to do with the artist. Artists have been fighting for years to capture royalties on secondary sales to earn their due. Bills creating residual rights for artists are proposed almost every year in the United States, but none of them pass. And even though it's stipulated that artists can get a portion of the revenue from secondary sales, execution is a huge challenge. It varies by jurisdiction and often requires the involvement of the legal layer in order to be charged.

Traditional visual artists get 0% of secondary sales in the US, and in other countries things are better. The EU countries have the right to resell artists (also known as "the right of tracing", Artist Resale Right or Droit de Suite) was first born in France in 1920. Usually 3% to 5% of the value-added part of the sold art), but buyer/seller/auction house payment is still a problem, Christie's was accused in 2009 of transferring the resale fee to a seller at auction Go to court and won't win until 2019.

When an artist uploads an NFT platform to sell artworks, most platforms can set the income ratio of secondary sales by themselves. The general NFT trading platform recommends setting it to 10%. Among them, the Nifty Gateway trading platform can also be increased to 50% at the creator's decision. Even though everyone has recently criticized the Ethereum gas fee* of the OpenSea platform as high as $100, in the long run, it provides a monetization model for the artist's career development and increases the source of income for the artist.

Establish an open and transparent art trading system

The significance of the emergence of NFT is not only to increase the proportion of income, but more importantly, to break the existing art trading system, give new artists the opportunity to directly sell their art to the public, and create a relatively more open and transparent platform. In a traditional society, the pricing power is in the hands of galleries or auction houses, and artists do not even know the final price, but on the NFT trading platform, there are traces of every transaction process. NFT is generated based on decentralized blockchain technology. In the NFT platform, the manipulation opportunities of behind-the-scenes actors are reduced and fair transactions are returned to everyone.

Some people are also arguing about the chaos of the current NFT trading platform. A few random digital artworks are transactions of more than 2ETH (about 3,500 US dollars), and there is a phenomenon of random pricing, and there are behind the scenes behind the high-priced NFT works. The wallet addresses for the auction were found to belong to the same person. It is undeniable that NFT is still in the wasteland development stage, and many rules have not yet been formulated. Everyone is taking this opportunity to earn extra income, but this also proves that NFT transactions can allow everyone to see the evidence behind it, and only the Only by seeing it can there be the possibility of being regulated by the public.

Summarize

Reform in any form stems from dissatisfaction, and so does the emergence of NFTs. After all, the traditional art industry is a small circle that affects some people, and many problems left are always ignored. The "rules" established by the vested interests give new artists no bargaining power.

The birth of NFT has injected a dose of hope for the redistribution of rights and interests for the underlying art creators. Judging from the existing rules of NFT operation, it not only increases the income ratio of creators, but also guarantees the copyright income of secondary sales. More importantly, it is trying to give more voice to creators and their in the hands of a loyal audience. Although, during the reform period, there will be disdain or even obstruction from the vested interests, but no one can resist the trend of art democratization and art democratization.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More