Introduction to the Taipei City Hoarding Tax Act: From the Dispute between Guaji and Chen Jianming

A while ago (probably in October this year), I saw the dispute between the two members, Guaji and Chen Jianming, over the house hoarding tax. I am not familiar with the internal ecology of the parliament, so I will briefly introduce the current house hoarding tax bill.

[Why does Taipei City have a hoarding tax, and Shili also has a hoarding tax? 】

First of all, the revision of the hoarding tax in Taipei City this time is not the same as the hoarding tax mentioned by the power of the times before.

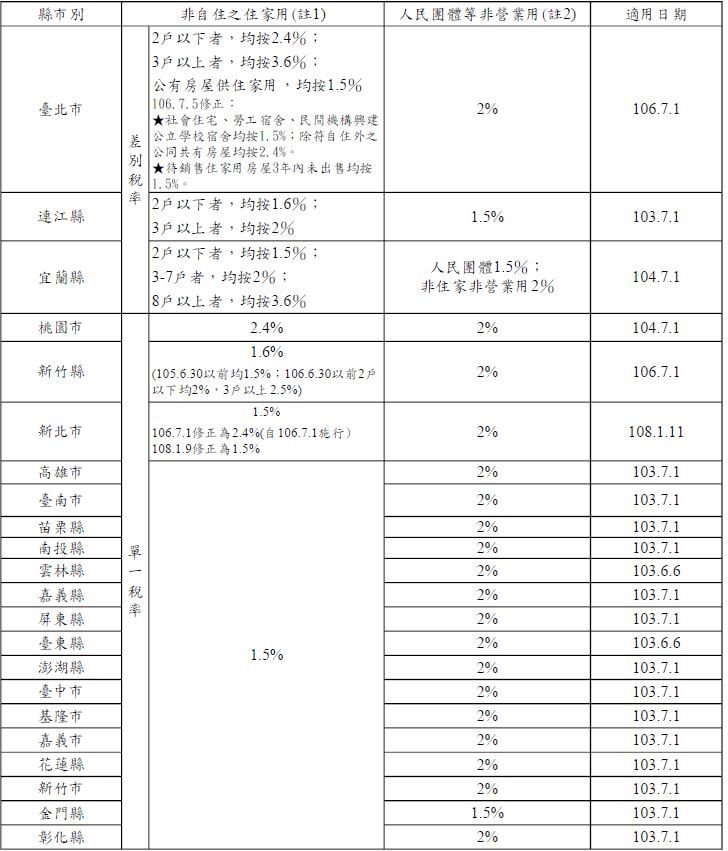

The power of the times is pushing the "Housing Tax Regulations", which belongs to the central regulations. At present, Article 5 of the Housing Tax Regulations provides a tax rate range of "1.5%~3.6%" for non-self-occupied houses and can formulate differential tax rates. However, most counties and cities only set the lowest tax rate of 1.5%, and only Taipei City, Yilan County, and Lianjiang County have set differential tax rates.

Therefore, it was originally a range that considered local autonomy, but when housing prices soared, they were only willing to set the tax rate on the floor. The reform idea of the power of the times is "then the central government will raise the floor and ceiling for me. The more houses you store, the more taxes you will pay. Don't expect the localities to raise them yourself." Of course, the house tax of Shili also has Other designs are not expanded here. In short, the basic logic is like this.

By the way, the main reason for the Ministry of Finance’s refusal to reform the hoarding tax is “Ah, I have not exhausted the scope of taxation that I have given you. Local governments must use them first. If they feel that they are not enough, we will change the central regulations.”

In fact, it is really difficult for local governments to increase the tax rate, because the parliament will block it based on various interests. In May 2019, the "Tainan City Housing Tax Collection Rate Autonomy Regulations" planned to change the housing tax in Tainan City to the differential tax rate in Taipei, but it was returned by the three parties of the Tainan City Council during the second reading.

And even if it passes, there may be a situation in which the vehicle is reversed. For example, after the local elections in 2018, New Taipei City immediately lowered the tax rate for non-self-occupied households from 2.4% to 1.5%; to extend the time further, in 2017, the Hsinchu County Council reduced the non-self-occupied housing for other housing The tax rate for family homes was revised from 2.5% to 1.6%, which also led to the resignation of two lawmakers, Gao Weikai and Zhou Jiangjie, in protest.

Therefore, "don't expect local governments to raise the bar on their own, and let the central government do the work." There are indeed practical reasons.

【What is the hoarding tax in Taipei City? 】

Although there is no way to expect local governments to raise tax rates in the general environment, there are still local governments that raise tax rates on their own, the most standard of which is Taipei City.

At the end of Hao Shifu in 2014, the "Taipei City House Tax Collection and Autonomy Regulations" was revised into a differential tax rate, that is, "non-self-occupied residential houses with less than 2 households will be taxed at 2.4%, and more than 3 households will be taxed at 3.6%." Because more houses are held, the tax rate is high, so it was later referred to as the "hoarding house tax".

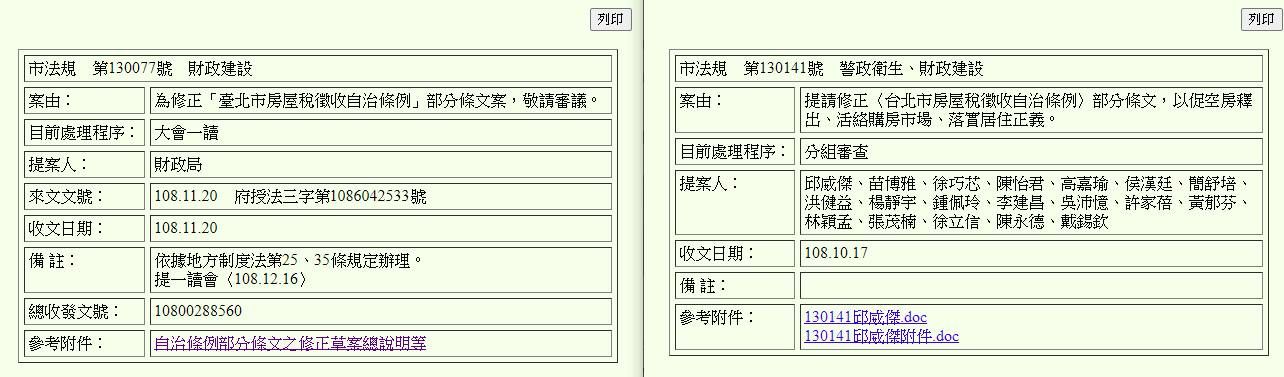

Later, in 2017, the city government felt that this was too ruthless, and proposed to give the builders a one-year grace period. During the grace period of this year, the tax rate of the houses that the builders have not yet sold has been changed from 3.6% to 2%. The proposal has other contents, but it will not be launched here.

As a result, the bill was sent to the parliament, and the parliament was unhappy with Taipei City's housing tax for a long time (the minutes of the meeting at that time: https://disp.cc/b/163-a83E ), of course, it was overweighted by the parliament Add to burst. In the end, it became the current grace period of three years, with a preferential tax rate of 1.5% for houses that builders cannot sell within three years, which is the current system.

Therefore, Mr CHAN Kin-ming said that this bill "has been amended three times in 2017." He seems to be saying that the housing tax was only amended a few years ago, which is actually a bit confusing. The regulations were changed at that time, but instead of making the hoarding tax better, it gave builders a preferential period.

[This time, the hoarding tax bill is actually a grace period for remodelers]

Because Taipei City's tax rate has already used the ceiling (3.6%) authorized by the "Housing Tax Regulations", in fact, this time the Taipei City House Hoarding Tax Act amends not the tax rate, but a grace period for remodelers.

After all, if the builder has a three-year preferential tax reduction period, then of course, he will not be in a hurry to sell the house, and will wait for the price to reach the ideal price in his mind. are all unfavorable. The following is a comparison of the current system with the city version and councilor version:

The current system: After the builder builds the house, the preferential tax rate will be 1.5% within three years, and will be restored to 3.6% after three years.

Guaji and other MPs' versions: After the builder builds the house, the preferential tax rate will be 2.4% within one and a half years, and will be restored to 3.6% after one and a half years.

City version: After the builder builds the house, the preferential tax rate will be 1.5% within one year, and will be restored to 3.6% after one year.

It can be seen that, in fact, the municipal version and the councillor version have their own strengths. Although the council's version has a longer concession period, the tax rate is higher during the concession period; the city's version is the opposite.

So which version is better? In fact, no matter which version it is, it is better than the current system, and the content may be changed again when censored. In short, I hope that everyone can have a more overall understanding of the current housing tax controversy, and I hope that the case can be reviewed and approved as soon as possible.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More