2020 gift unboxing, thank you Santa!

At the end of the article, there is a secret egg gift from Santa Claus 💛

Choice at the beginning of the year

The investment plan at the beginning of this year is to invest in technology products with a predetermined principal of $9,000. I googled information and watched countless investment videos. During the process, I reluctantly gave up some good companies. In the end, I ranked the top 3 technology categories in my heart, namely: TSMC, Tesla, and Bitcoin. It is a tangle to choose one of the three!

Tesla (US stock code: TSLA) and Bitcoin (Bitcoin) will be included in the investment pocket list because cryptocurrencies and environmentally friendly electric vehicles are new technologies and are promising stocks in the future, but these two products are extremely high-risk . TSMC is because I have a special belief in him and am very optimistic about this value growth company. And TSMC is considered a treasure in Taiwan's town store. Many people say that if you don't buy TSMC stock in Taiwan, don't say you are investing, ha.

Action at the beginning of the year

My final investment choice was to decide to spread the risk, so I split the principal equally among the 3 tech products. (Actually, there was a thread in my head that suddenly told me to buy Bitcoin with all the principal at once!)

mid-year wait

wait, wait, wait

Year-end results out of the box

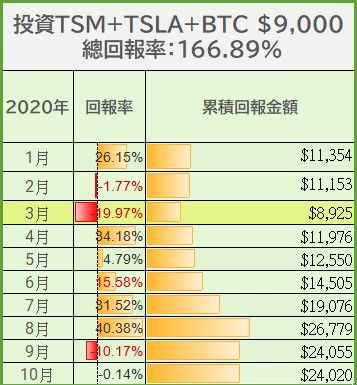

Now that the end of the year is approaching, let’s take a look at the results analysis of my 3 investment products from January to October this year:

if,

At the beginning, I invested $9,000 in TSMC at one time, (income including dividends):

if,

I invested $9,000 in Bitcoin in one lump sum:

if,

I invested $9,000 in a one-time investment in Tesla:

Congrats on the Best Progress award going to Tesla Inc!

In fact, I initially thought that Bitcoin would be number 1. Tesla, the dark horse, has too much stamina. Tesla CEO, Elon Musk has risen to become the second richest person in the world 👏👏👏👏👏

From the moment of investment, the idea was to prepare to hold Tesla for a long time, because environmentally friendly electric vehicles are after all innovative technologies in the new era. It may take some time for such companies to be seen and accepted by everyone, so I never thought that Tesla would Shares have more than doubled in the short term from their March lows. It can only be said that the trend of technology stocks this year is very mind-boggling growth.

Year-end re-selection

Because of Tesla's rapid growth, its percentage of my investment portfolio is too high, and because this stock is a high-risk growth stock, I made a choice again at the end of this year to put a portion of Tesla stock. Profits are taken, and the recovered funds are distributed and invested in other relatively stable low-risk dividend stock products, such as Starbucks, medical stocks, gold stocks, and index ETFs. So at the end of the year I restructured my portfolio proportions.

What have I learned about investing this year?

Choice → Action → Persistence → Outcome → Relearn from Experience

- It's worth the patience

It can be seen from the return data that the stock and cryptocurrency markets were in a big bear market when the outbreak began to spread across the country. The three products I invested in all showed a sharp decline. If I panicked and sold my investment products in March, the profits for the next few months would pass me by. The rewards are reserved for investors willing to wait patiently.

- Don't run out of money at once

In fact, many investors have suggested that no matter when, you must keep cash (bullets) on hand, because it is impossible for us to predict the future stock market, and no one expected that there will be a super bear market in March. If I did not invest the principal in one go at the beginning of the month, but entered the market in batches, I would have the opportunity to fire bullets at any time when the stock market fell sharply, and add more money at low prices. This is the advantage of buying shares in batches to spread the average purchase price evenly.

- Allocate investment portfolio and diversify investment risk

Don't put eggs in the same basket.

Just simply wanted to share my investment plan learning journey. The above is not investment advice, you still need to think independently before investing!

At the time of writing this article, Bitcoin has gone from breaking new highs to a downward trend. It really is the power of Black Friday 🖤. But every dip excites me because there is a chance to get back in and buy a good price. If you are interested in investing in Bitcoin (cryptocurrency) in the future, you can refer to this article before buying: Before you buy Bitcoin, please do this first!

Santa's Easter Eggs Are Here

Discover Matt City in 2020

November 26 is Thanksgiving in the United States, and the 27th is Black Friday, which is the annual crazy year-end shopping season in the United States. This year should be the crazy year-end online shopping season. I wish everyone can "buy smart" and "don't buy too crazy😆"

The epidemic may gradually change people's future work and consumption patterns. This year's Amazon business is particularly good, and Amazon's stock is also skyrocketing!

Black Friday is also my 1st month on Matters. Should eat a moon cake 🧁. Congratulations to yourself for persisting in sharing articles, and hope that your writing motivation will continue to improve in the future and defeat procrastination.

More thank you words for Matters to share another day, I have stayed up all night to write this, and if I continue to write it, I will not finish writing it today 😂. The last thing I want to say is:

Thank you Matt City. Meet Matters is my Easter egg from Santa Claus in 2020

Great gift. 💛

Good night and thanks for reading.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More