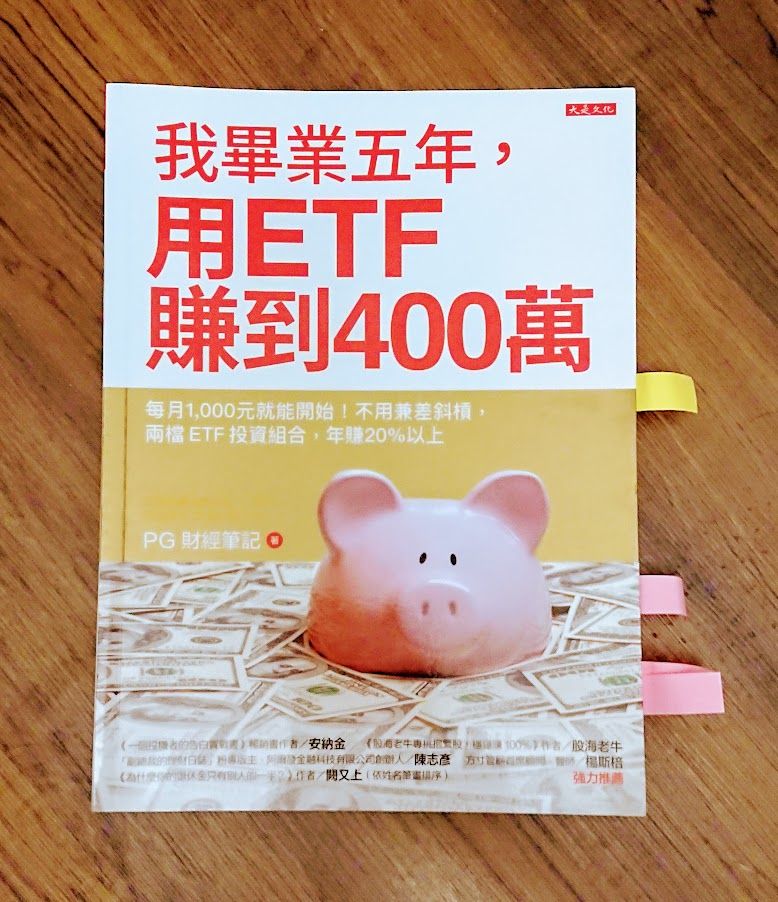

"Five years after I graduated, I made 4 million with ETF": I can earn passively, a book to understand indexed investment!

Do you feel like you've spent a lot of time investing and the payoff isn't as good as expected? Even though you work hard to read financial reports, track industry news, or follow various linear K-sticks in and out, you can only watch other people sing away from the table, but you are stuck in a sigh?

There are hundreds of investment paths, and there are no absolutes. But if you are tired of the days of floating and sinking stocks and watching the market, you may refer to this book "I graduated five years ago and made 4 million with ETFs", which will lead you to passively invest with the tool " ETF " instead of researching and watching the market. Enjoy profit.

The author, Cai Zhicheng, is a former police officer who is currently the assistant manager of the financial advisory department of Alpha Securities Investment Consultants (Shares) Company. The fan group has more than 40,000 followers, and also operates the PG Finance Notebook website to share financial knowledge with the people. He was once fluctuating in the stock market, and was deeply inspired after reading "Walking Wall Street" , and finally adopted indexed ETF as his investment core.

The concept of indexed passive investment has been shared in several financial management books in the past. If you don’t understand it, you can refer to the article “8 Lessons in Green Corner Funds” . And this book can be said to be more focused on the operation side, specifically guide you to use ETF to practice indexed investment, it is recommended to take it with the book of Green Corner.

The following will first introduce what ETFs are, and briefly describe their three major types; then, they will tell you the precautions for buying ETFs, and will guide you to build your own investment plan; finally, I will share the investment examples in the book, which will share with me the current investment method.

【How much do you know about ETFs】

[What is an ETF]

The full name of ETF is Exchange Traded Funds, which is "index stock fund" in Chinese. As the name implies, it has the characteristics of both stocks and funds.

Think of it this way, an ETF is like a fund that buys a basket of securities at a time, so it has the effect of a fund to diversify risks, but the trading method is like a stock, so it is more free and convenient to enter and exit.

An ETF tracks an index, making its return as close to that index as possible. As we all know, 0050 tracks the Taiwan 50 Index.

[Three types of ETFs]

ETFs have many targets, and they are often as dazzling as individual stocks. The book helps you sort out three common types of ETFs:

- Equity <br class="smart">In Taiwan, the most well-known stock ETF is probably 0050. Buying it is equivalent to investing in the top 50 companies in Taiwan. If you want to invest in the global stock market, you can also buy VT and enjoy more than 8,000 global stocks at a time.

- Bond ETF authors recommend buying government bonds or synthetic bonds, not high-yield bonds. If you are more conservative, you can consider VGSH (US short-term government bonds), and if you are a little more active, you can buy BND (US investment grade bonds).

- Real estate type <br class="smart">Want to be a chartered public servant, but what should I do? Maybe try REITs, or real estate ETFs. Simply put, it is to pool everyone's money to invest in real estate projects. Reference subject such as VNQ (US not real estate) or VNQI (global excluding US real estate)

Generally speaking, we will want to take the risk position is the stock, in order to get a higher return. The bond position is used to protect the investment portfolio as "insurance" in a market downturn. That's why Treasury or investment grade bonds are recommended above.

The introduction of these three types of ETFs is quite detailed in the book, and at the same time, it shares the details and recommended targets of many targets, which is quite worth reading.

【How to operate ETF】

[Notes on choosing ETFs]

Understand the meaning and types of ETFs, and then introduce how to choose them. The book has organized 6 key points to let you choose the target without taking the thunder:

- Total Expenses <br class="smart">The lower the investment cost, the better, so we have to be very careful about the deductions of ETFs. For US stock ETFs, the author recommends that the total overhead should be less than 0.3% , and Taiwan stocks should be less than 0.5% as much as possible.

- Index Tracking Performance <br class="smart">As mentioned earlier, an ETF tracks an index, as closely as possible to its return. Of course, there must be errors. The author suggests that the indicator of "tracking deviation" can be observed, and the deviation should not exceed 3% at most.

- Asset size <br class="smart">Selecting an ETF with a larger asset size is more secure, and the risk of liquidation of ETFs issued by large companies is relatively low.

- Volume and Liquidity

ETFs also need to consider liquidity issues to avoid overflow and discount. Therefore, it is more reliable to choose ETFs with larger trading volume. The author recommends choosing an underlying with a daily trading volume of more than 100,000 shares. - Established <br class="smart">The longer the established, the more historical data can be viewed and proven to survive market volatility. The book recommends picking targets that have been established for more than 3 years.

- Market Leadership <br class="smart">Just as buying appliances picks big labels, so does buying ETFs. The book mentions that the "rule of VI" can be used, and you can't go wrong with ETFs issued by two big companies, Vanguard and iShares.

[ETF Investment Plan]

Learn to pick a target, and then you can start building your own investment plan. The author provides 5 steps of his investment plan for your reference:

- Designing an Investment Plan <br class="smart">Anything requires a plan to be executed in order to have a basis, and investment is naturally the same. You can first establish your own investment goals and the length of time you want to invest, and then plan according to your salary, career or family factors.

- Determining Asset Ratios <br class="smart">The next step is to determine asset ratios. This is related to everyone's risk tolerance. If you have a high tolerance, you should allocate more high-risk assets (such as stocks), and if you are worried about fluctuations, you can deploy more low-risk assets (such as bonds).

- Deploying a Global Portfolio <br class="smart">After setting up an investment strategy, it is time to think about how the proportions will be allocated across different regions. If you are optimistic about the United States, should you invest more in US stocks? If you are worried about the China factor, should you reduce the relevant targets?

- Consider stocks and value <br class="smart">If you're just not interested in investing or don't want to spend too much time, you can use global stock markets with short-term bonds. If you want to be active, you can invest in small caps or value stocks.

- Whether or not to invest additionally in industry stocks <br class="smart">If you have the last mile, consider whether you want to invest in a specific industry, such as real estate investment or precious metals.

【Example sharing of ETF investment】

With all that said, you may still be a little unsure about how to implement it. So here are three investment options for your reference:

[1. The author's portfolio]

The author's book mentions that his portfolio is quite simple, which is VT (80%) plus BND (20%). One share, one debt, one defense and one attack, and the 82-share-to-debt ratio is based on the fact that he is still young and can bear greater risks.

[2. Permanent Portfolio]

This approach was developed by well-known investor Harry. proposed by Brown. The gist is that the funds will be invested in quarters:

25% stocks + 25% treasury bonds + 25% cash (short-term money market funds) + 25%

Gold stocks provide the main source of compensation, Treasury bonds can bring stable returns, and cash and gold are the umbrellas in extreme market conditions. The book directly provides four corresponding ETFs for your reference:

25% stock → VTI

25% national debt → IEI

25% cash → SHY

25% Gold → IAU

[3. My Investment Portfolio]

Finally share my current way. I was messed up by a bunch of targets, but seeing that the author only used VT and BND, made me understand that investing doesn’t have to be complicated. I ended up using VT (80%) plus BNDW (20%) for my portfolio. It is actually very similar to the author, except that BND (U.S. debt) is replaced by BNDW (global debt).

【Summarize】

It's time to wrap up. First of all, we learned that ETFs are tools for bundling a large number of securities, with the diversification of funds and the ease of operation of stocks; there are three types of ETFs that can be paid special attention to, namely stocks , bonds and real estate ; when choosing ETFs, pay attention to their expenses , track performance and scale; finally, three simple configurations are provided for your reference.

This book briefly introduces the method of using ETF to operate passive investment. In addition to understanding the logic behind it, it also provides operation diagrams for account opening, remittance and order placement. Of course, these things are also available on the Internet, but one book will help you do it, or save money A lot of searching time.

And for me, this book is more important because it really got me into the market.

I gradually realized the importance of investment after working. Although I have learned techniques such as technical line chart analysis or fundamental value estimation, I still dare not really invest. Later, I read "8 Lessons on Funds in Green Corner", and my heart began to tilt towards passive investment. It was not until I finished reading this book last year that I opened an account inFirstrade and put real money into the market.

It's a bit late to start, but better late than never. At present, my approach is to put the short-term expenses (down payment, car purchase fee) and emergency reserve funds that may be needed in the short term and keep them alive, and then put other cash flows into ETFs as much as possible. Take a quarterly investment and rebalance once a year. I put it up here as a reference for everyone, although I'm still a rookie (laughs).

Finally, I would like to talk about the issue of active and passive investing. In fact, the disputes between the active and passive parties have never been less, and from time to time, you can see the criticized and kicked stock version and quarreled. I basically believe that the market can be beat, but it won't be me. The reason for choosing passive investing in the first place is actually the same as the author of this book: there is no time .

In the semiconductor industry, my working hours have always been variable. Although foreign businessmen can use mobile phones, they cannot read disks as long as they enter the clean room. In addition, I have to write and read when I go home, and I really can't find time to study. For me, passive investing, simple allocation and investment, allows me to spend my spare time on things I love.

If, like me, you are reluctant to invest too much time researching investments and want to get some kind of compensation, I believe passive investing will be a good fit for you. And this book will be the right key for you to enter the door of passive investing!

Articles you may also be interested in:

- "Walking on Wall Street": The most beautiful financial management classic? ! (Part 1)

- "Walking on Wall Street": The most beautiful financial management classic? ! (Part 2)

↓↓You are also welcome to follow the Facebook and mourning of "Mrs's Reading Space"↓↓

James' reading space FB

James' reading space IG

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More