"Get Rich Mentality" a picture to understand the key points, the most recommended financial management book this year

Two months ago, when I stepped into Nanfang Eslite Bookstore to hang out, what caught my eye was the wealth management book "The Mentality of Getting Rich", which is piled up on the first row of bookshelves and "Touted by Five Stars of the Chairman of the Stock Cancer Podcast". Such a mad advertiser caught my attention, estimated the reasons for the strong recommendation by the chairman, and the high score of 4.4 stars on the Goodreads book review website. I bought this book immediately that day.

What is this book saying?

The author of "The Mentality of Getting Rich " is a well-known columnist for The Wall Street Journal and the popular financial website " The Motley Fool ", Morgan. Morgan Housel , who believes that people always think and learn the concept of money by understanding knowledge, rather than learning investment and financial management by understanding mental and behavioral patterns. He hopes that through this book, he can help us understand the nature of investing, recognize our own biases and misunderstandings, and make better financial decisions.

The book does not talk about boring trend charts, technical lines, and profit and loss statements. The author pulls back to the core of our views on "money" and "wealth". He makes good use of fascinating and short financial stories, one after another, to guide us to re-examine Our own financial view, to get rid of the misunderstanding we have always held about investment. Reading this book can not only straighten out your "money", but also sort out your "heart".

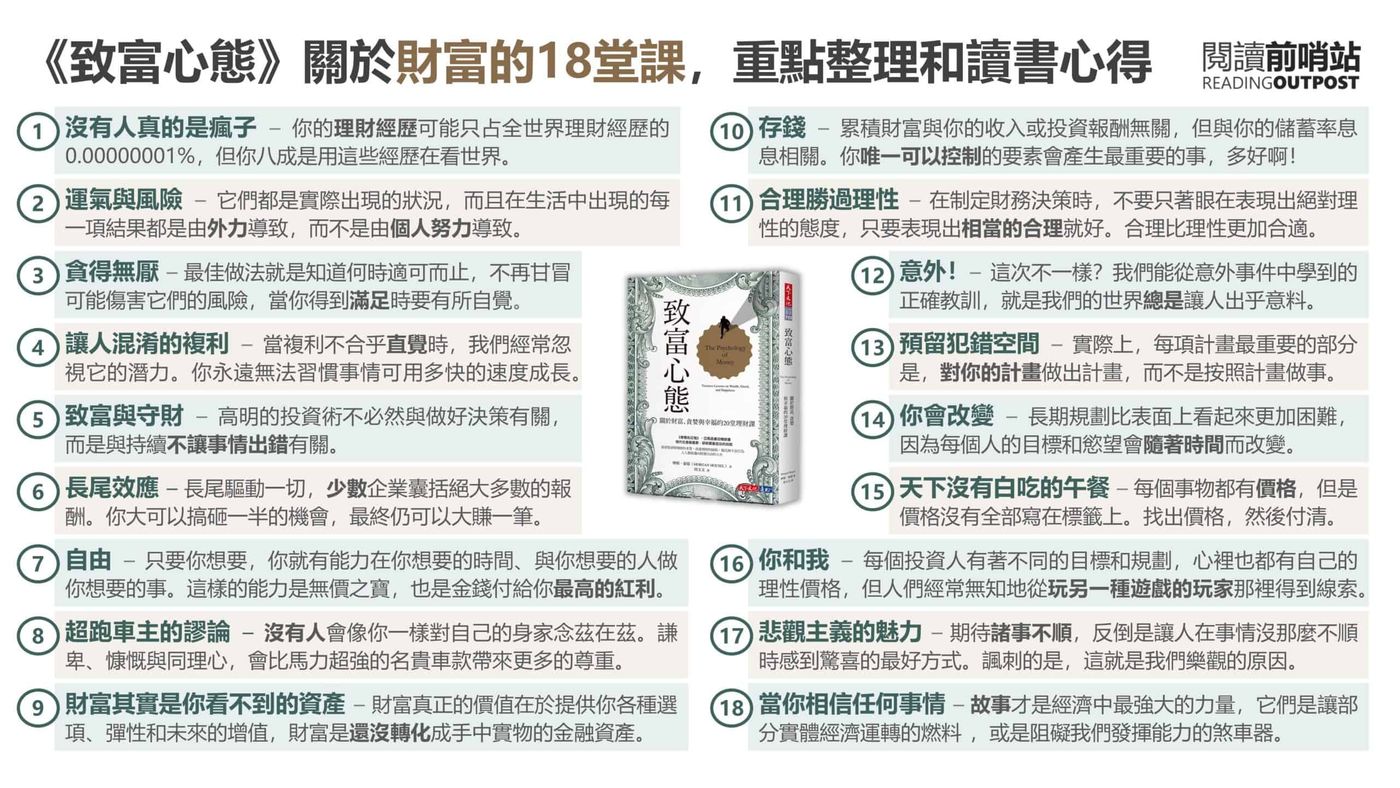

I think this book is very worth reading. The stories quoted by the author are full of morals. Coupled with his clean writing style and witty narrative style, the whole book is interesting to read, and at the same time it brings me a shock and an impact on thinking. Solid harvest. The whole book covers 18 chapters on the subject, plus 2 chapters summarizing and sharing the author's personal experience, which constitutes this wonderful book that you can't put down once you start reading . The following is a picture I compiled to understand the 18 key points, as well as the inspiration from some bridges in the book.

- No one is really crazy - your financial experience may only be 0.00000001% of the world's financial experience, but 80% of the time you are seeing the world from those experiences.

- Luck and Risk – They are both actual conditions and every outcome that occurs in life is caused by external forces, not individual efforts.

- Insatiable greed – The best thing to do is to know when enough is enough, stop risking that you might hurt them, and be self-conscious when you are satisfied.

- Confusing compounding – When compounding doesn't feel intuitive, we often overlook its potential. You can never get used to how fast things can grow.

- Getting Rich and Keeping Money – Good investing isn't necessarily about making good decisions, it's about consistently keeping things from going wrong.

- The Long Tail – The Long Tail drives everything, with a few companies capturing the vast majority of rewards. You can screw up half your chances and still end up making a fortune.

- Freedom - You have the ability to do what you want, when you want, with the people you want, whenever you want. This ability is invaluable and the highest dividend money pays you.

- The Supercar Owner's Fallacy - No one is as obsessed with their own net worth as you are. Humility, generosity, and empathy command more respect than a supercharged luxury car.

- Wealth is actually an asset you can't see - the real value of wealth lies in providing you options, flexibility and future appreciation. Wealth is a financial asset that has not yet been converted into physical goods.

- Save Money – Accumulating wealth is not tied to your income or investment returns, but is tied to your savings rate. The only elements you can control produce the most important things, how wonderful!

- Rationality trumps rationality – When making financial decisions, don’t just aim to be absolutely rational, just be reasonably rational. Reasonable is more appropriate than rational.

- Accident! – This time is different? The true lesson we can learn from the unexpected is that our world is always surprising.

- Leave room for error – In fact, the most important part of every plan is to plan for your plan, not to do things according to the plan.

- You will change – Long-term planning is more difficult than it seems, as everyone’s goals and desires change over time.

- There's no such thing as a free lunch - everything has a price, but it's not all on the label. Find out the price and pay it off.

- You and I - each investor has different goals and plans, and has his own rational price in mind, but people often ignorantly take clues from players playing another game.

- The Charm of Pessimism - Expecting things to go wrong is the best way to be pleasantly surprised when things don't go so well. Ironically, this is the reason for our optimism.

- When you believe anything - stories are the most powerful force in the economy, they are the fuel that keeps parts of the real economy going, or the brakes that hold us back.

What is the real value of money?

What struck me in the book was the discussion of money and freedom. The author believes that the most valuable asset is the ability to wake up every morning and say, "Today I can do whatever I want." , that " gives you the ability to control time ". In order to obtain this ability, it only makes sense to continuously save and invest, so that you have control over time and calmness in life in the future.

Specifically, when you have accumulated a small amount of wealth, it means that you can take a few days off when you are sick without worrying about running out of savings; when you have a little more wealth, it means that you are not worried about being laid off, because at the next job You still have plenty of money and time to prepare before the opportunity arises; when you have more wealth, you can even retire when you " want ", not when you " need ".

As the author points out, the highest dividend money can bring is time , and I have a little story in my own life that resonates with it. My girlfriend recently bought a robot vacuum cleaner and an automatic dishwasher. At first, I thought it was a bit of a waste of money. But after using it, I changed a lot. These high-tech products help us do it for us, and the time freed up allows us to spend more time together.

Gradually, I began to understand the concept that money can be exchanged for time. As long as it is within the range of financial burden, any consumer item that can save time and save more energy, I will start to evaluate carefully, instead of always being frugal before. and resistance. As the author said: " Being more in control of your own time and options is becoming the most valuable currency in the world. " In addition to the luxury goods that can be bought with money, the idea of knowing how to exchange money for more time may be more important. Valuable way to spend your money.

What I admire about this author

The wonderful process of reading this book has made my curiosity continue to increase. How does the author manage his money? Fortunately, at the end of this book, the author uses two chapters to compile, and finally reveals his investment method. He first cited the medical school professor Ken. An interesting article by Murray , " How Physicians Die ," shows how physicians choose to end their lives for themselves, as opposed to the treatments they recommend to their patients.

Murray mentioned that physicians, faced with the way they die, often choose to receive less treatment. "They've spent their lives fighting death for other people, and they're in a daze when they're faced with the same issues. They know what's going to happen next, and they know what options are available. But they go very peacefully." Treating cancer patients, but choosing palliative care for themselves.

As a financial expert who has been in the financial industry and the media for so many years, how did the author choose? He has no interest in pursuing the highest pay or leveraging his assets to live the most luxurious life. He just wants to wake up every day knowing that his family and himself can do whatever they want. Every financial decision he makes revolves around this goal.

He keeps 20 percent of his cash at hand to cover any surprises and risky situations, and he puts the rest into passive index funds, while maximizing retirement accounts and continuing to save for his children's college accounts. He said he is optimistic about the world's ability to generate real economic growth, and is confident that this growth will pay off for his investments over the next 30 years.

Instead of picking the right industries or betting on the next economic ups and downs, he relies on high savings rates, patience, and optimism that the global economy will continue to grow for decades to come. He said: “ If you can achieve everything without taking the extra risk of trying to outperform the market, what’s the point of trying to do that? I can afford to be the best investor in the world, but I can’t afford to be the worst investment. People. " Seeing through the essence of money and knowing how to be humble and correct, this is his " get rich mentality " that we should learn from.

Postscript: Deal with your heart before dealing with wealth

"The Mentality of Getting Rich " is not just a traditional financial management book. Through the stories in the book, we can find that the way to get rich is often not absolutely related to logic and ingenuity. Instead, the focus is on inner stability, humility and intelligence. patience.

Investment and financial management not only need rationality, but also deal with the emotional side of our hearts. When we are chasing the sentiments of the market, we are likely to make moves to chase highs and kill lows. When we think that hard work will pay off, we are likely to be overconfident and ignore risks. The more we want to get excess returns, the more likely we are waiting for excess losses.

Looking back, it turns out that getting rich refers not only to financial prosperity, but also to spiritual prosperity. The author quotes the well-known financial author Nassim Taleb as explaining: " Real success is to withdraw from a never-ending competition, adjust your activities, but seek peace of mind. " The investment wisdom in the book is not something we are born with" Common sense" sometimes sounds "anti-intellectual", but after careful chewing and thinking, you will find another world of financial perspectives.

Other articles you may also be interested in

- "Financial Freedom Practical Edition" You are already free, but you don't know it yet

- "Rich Dad Poor Dad" Highlights, and 5 things the author didn't tell you

- "Money Super Thinking" 9 financial management concepts, decide whether you will be trapped by money or financial freedom

- "Golden Law of Investment" I really hope to understand at the age of 20, the most common 10 questions about investment and wealth management

- "A Book to Learn Investing" 4 Common Senses You Must Know About Investing

If you like "The Get Rich Mindset: 20 Money Management Lessons About Wealth, Greed, and Happiness, " you can buy it through this link, and you have nothing to lose. The feedback fund obtained by this site will be donated in full to the family aid and scholarship . For details, please refer to the public welfare plan of this site.

Original linkreading outpost

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More