Reading pen farming | I spread my assets, but put "time" in the same basket ft. Cryptocurrency Bear Market Survival Guide

Recently, the cryptocurrency market has been turbulent. The elder brother (BTC) and the second brother (ETH) have "fallen down" one after another, falling below the $20,000 and $1,000 mark respectively. contract" ah!

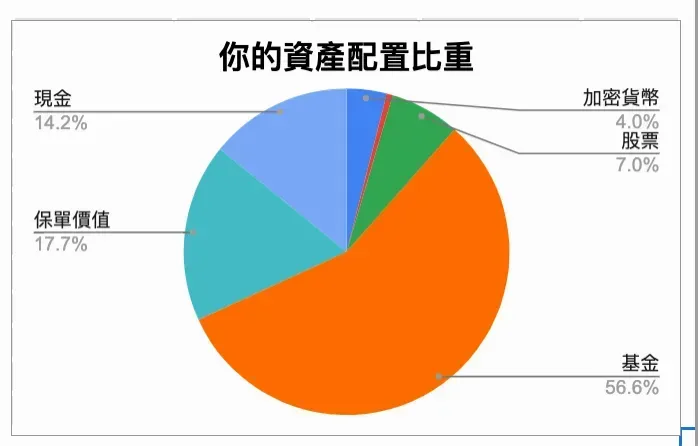

In fact, in the face of this bear market, the impact I have suffered in the "physical world" is relatively serious. According to the article on how many cryptocurrencies are in your asset allocation ratio , I calculated for myself how many “digital world” positions were held, which only accounted for 4% of the total assets, and most of them came from the output value of Write-to-Earn. It's a pity that I didn't get out of the high point in the bull market (a thousand gold is hard to buy and I knew it earlier), but I don't feel heartache .

Calculate your asset allocation ratio 👉 from here.

■ Don't put "time" in the same basket

Looking back at the UST/LUNA death spiral incident , I am also a small disaster victim, and the part I touch is the LUNA/OSMO liquidity pool of Osmosis , a decentralized exchange (hereinafter referred to as DEX). After the incident, they had to wait for 14 days to unbind, and then they were released directly .

During the heyday of Chizi (bull market), I had an impression of holding positions worth 800+ US dollars, and in the end it was not even less than 1 US dollar. In the process, it was also found that OSMO has been "moving bricks". It means that the OSMO that contributed half the value of the pool was also dragged into the water by LUNA and buried together, and only 0.06 pieces were left. I have real feelings about Impermanent Loss .

What is impermanent loss? 👉Theoretical articles | Measured articles .

*

Fortunately, I have practiced the matter of "dispersion". There are nine ponds. Although the leeks are cut, the green hills are still there, and there is still firewood.

There is still room for review. In this event, or in a bear market, I dispersed my assets, but put "time" in the same basket, which means that I have too much (almost all) cryptocurrencies to do 14 For more than a day of pledge binding, there is no way to respond immediately to the sudden shock of the market . To put it an exaggeration, 14 days in the currency circle is equivalent to 14 years in the world. In short, it is like living a year (laughs).

■ Bear market mentality adjustment

I have listed three points, which are my thoughts (and changes) on the recent ups and downs, which may not be correct. I only share my personal views:

*

✅ Survival and financial management in the currency circle

Continuing the discussion on the dispersion of "time" in the previous paragraph.

At present, some of the encrypted currency assets (anchor coins) have been allocated to live stocks that can be redeemed at any time , so as to make the movement of funds more flexible and not all tied up. Here are some of the platforms I'm currently using, after screening (there are four criteria to ignore for now):

- Binance Exchange <br class="smart">Keywords: Binance treasure, quota 4000 magnesium, 10%.

- FTX wallet (not FTX pro exchange)

Keywords: quota 10,000 mg, 8%. - Nexo Asset Management Platform <br class="smart">Keywords: no upper limit, guaranteed 8%.

Maybe some people (including me) will doubt these "centralized" facilities, let's talk about the second point.

*

✅ Spectral shift

If there is a spectrum, I can see that "centralization" and "decentralization" are located at the left and right ends respectively. Now, my beliefs have shifted to the left, especially when many projects have been hacked and sniped... …

In terms of technology and management, "internal" decentralization has to meet the intervention and collision of "external" centralized (possibly malicious) - because the "people" factor always exists .

This idea is still in its infancy, and I haven't figured it out yet. In short, some funds have also been moved from decentralization to centralized platforms . As long as DYOR passes the "I feel safe" level.

*

✅ Not picky eaters to learn

In the past, during the bull market, I didn't pay much attention to technical analysis. On the one hand, I didn't believe it, and on the other hand, it did not meet my long-term Buy-and-HODL investment style.

Now, because of the relationship between the new identity and the appalling net asset value, I save a lot of time to open the exchange (out of sight is the net ), so I use it for learning, and I don’t usually have much contact with (technical analysis) learning, not picky eaters. study.

The hibernation is raging, and the heart is calm. It is the most suitable for Da Yin to do some deep ploughing and lurking in the city, waiting for the cattle to be awakened.

🌱 Join [ Zhongshu Nervous System ] around the fireplace👇

The special topic #Reflections on writing and #頭内心話is being serialized.

🌱 I am on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocus 】

🌱 My teaching text and invitation link👇

≣Sign up for noise.cash | Become a "noise coffee" and experience social finance together .

≣Sign up for Presearch | The search to earn that kills three birds with one stone.

≣Sign up for MEXC | Go and jump on the Matcha Exchange, cash out OSMO and run wool .

≣Sign up for Potato | Three things to learn from Potato Media .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More