Taiwan's per capita GDP exceeds 30,000 US dollars, why can't the salary increase keep up?

I remember that when I was in middle school, I liked going to bookstores to watch Asiaweek ─ before the publication was suspended, the last page of Asiaweek would have a list of Asian countries' GDP per capita.

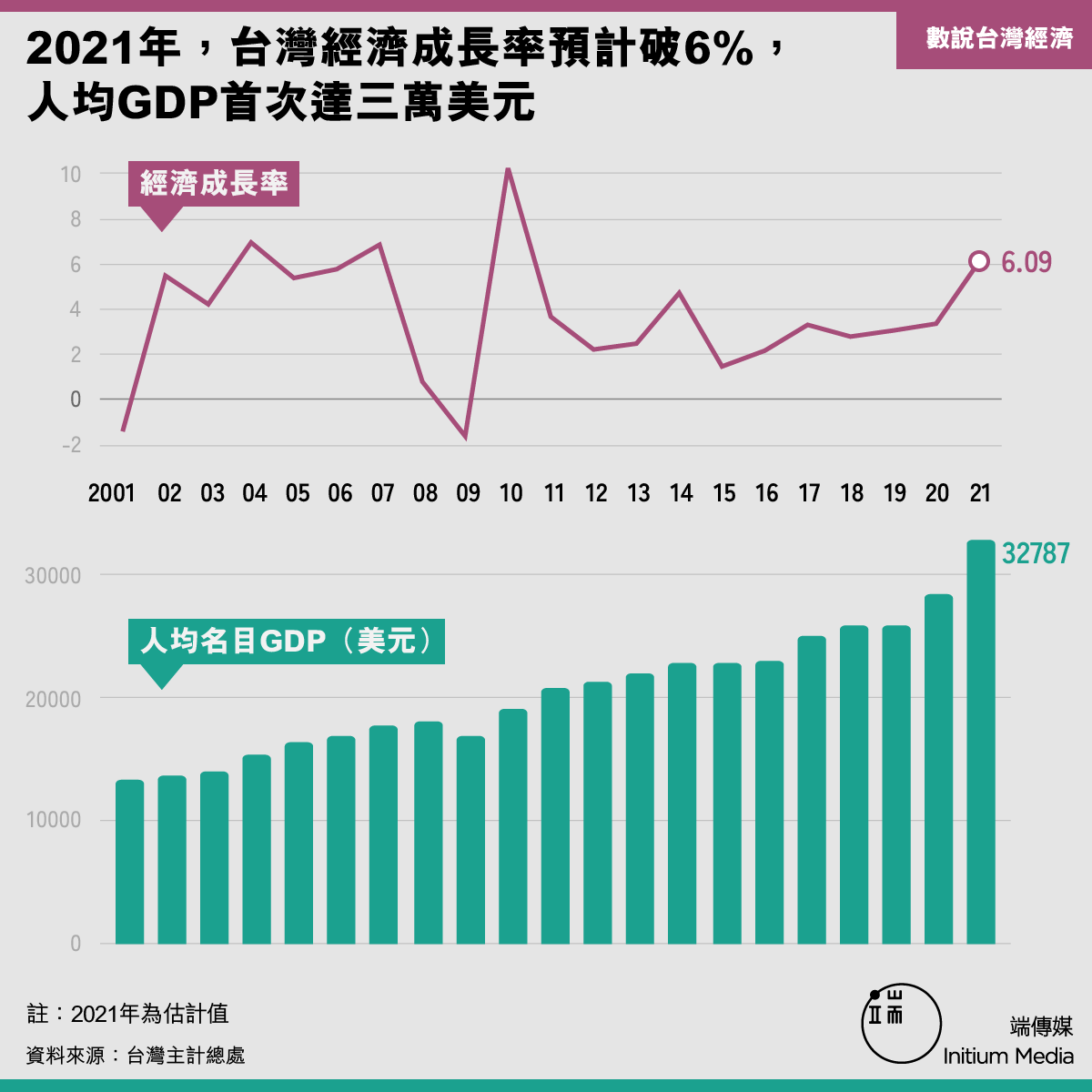

I was very impressed. At that time, Taiwan's per capita GDP was about 12,000 US dollars. When I was a child, I was worried about the country and the people.

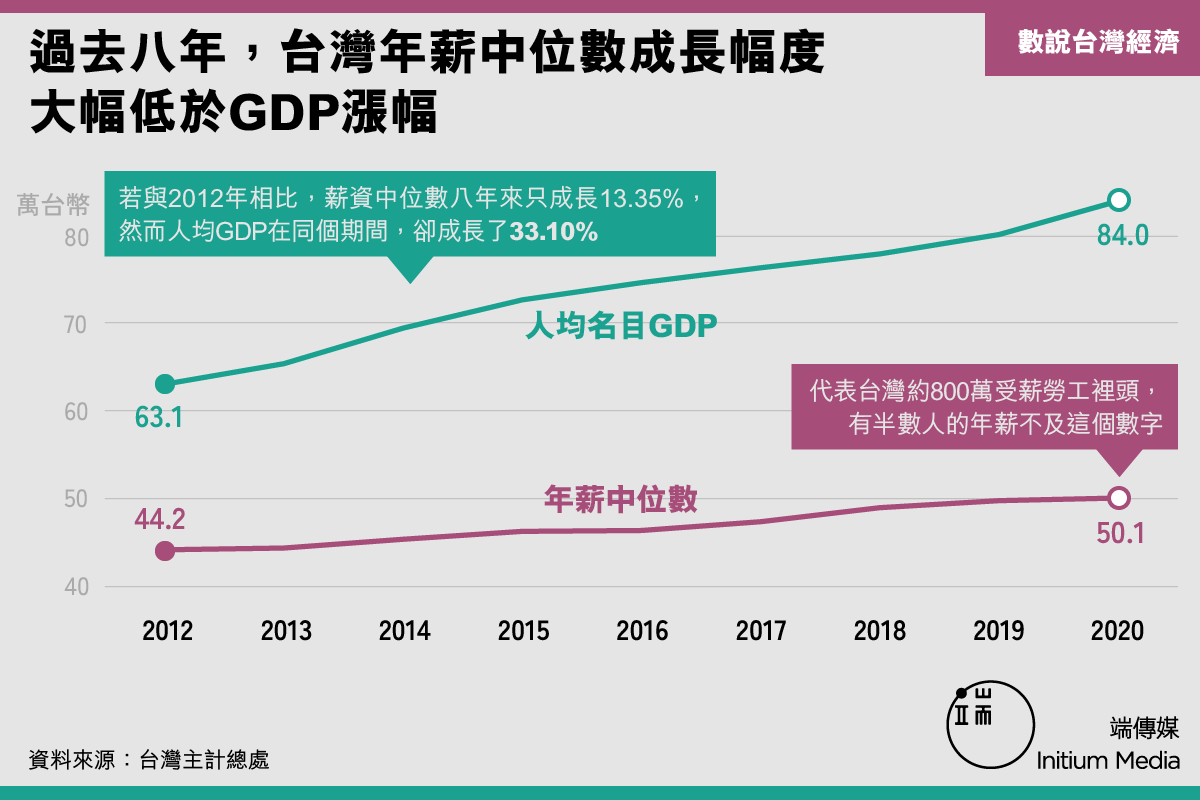

At that time, I must have never thought that the threshold of 30,000 US dollars was finally reached in Taiwan after 20 years, and I also wrote a report on this matter: " Counting Taiwan's Economy: Per capita GDP exceeds 30,000 US dollars, why? Wages can't keep up? 》

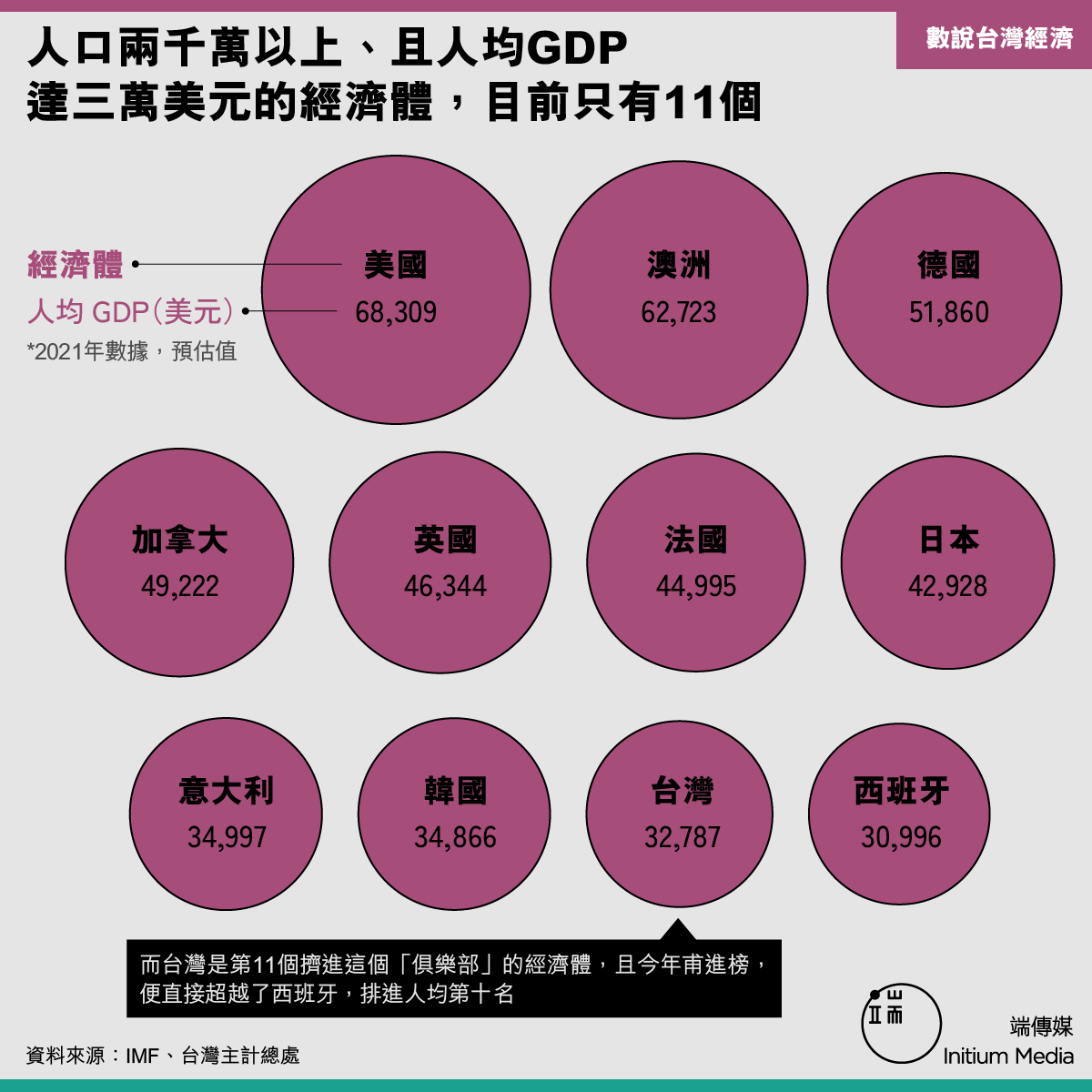

In this report, we would like to tell you that there are currently only 11 economies in the world with "a population of more than 20 million and a per capita GDP of over US$30,000" - and Taiwan is the 11th to squeeze into this "club" " economy.

In this "20 million people / 30,000 US dollars" club, Taiwan just entered the list this year, and it directly surpassed Spain, ranking tenth in one fell swoop; if you look at the per capita GDP and population, Taiwan does indeed It can be called a "developed economy", and it is no longer the "small economic country" that many Taiwanese habitually consider themselves.

The reason for choosing "20 million people/30,000 US dollars" as the threshold is to include the factor of economic size and exclude some very wealthy, but small countries with small populations and little international influence.

As for whether to use 20 million, this is indeed debatable, and I don't know which threshold is better; but if you change the population threshold to 10 million, the result is actually the same: "The population is more than 10 million. There are only 14 countries in the world with a per capita above US$30,000, and Taiwan ranks 13th.

In addition, we also try to clear up some common myths about Taiwan's economy for our readers. For example: Is Taiwan's GDP speculated by real estate speculation? Is Taiwan's GDP statistics also included in the production activities of Taiwanese businessmen in mainland China, so there is a suspicion of "irrigation"? Besides, is Taiwan's recent economic growth really at the expense of "becoming more dependent on China"?

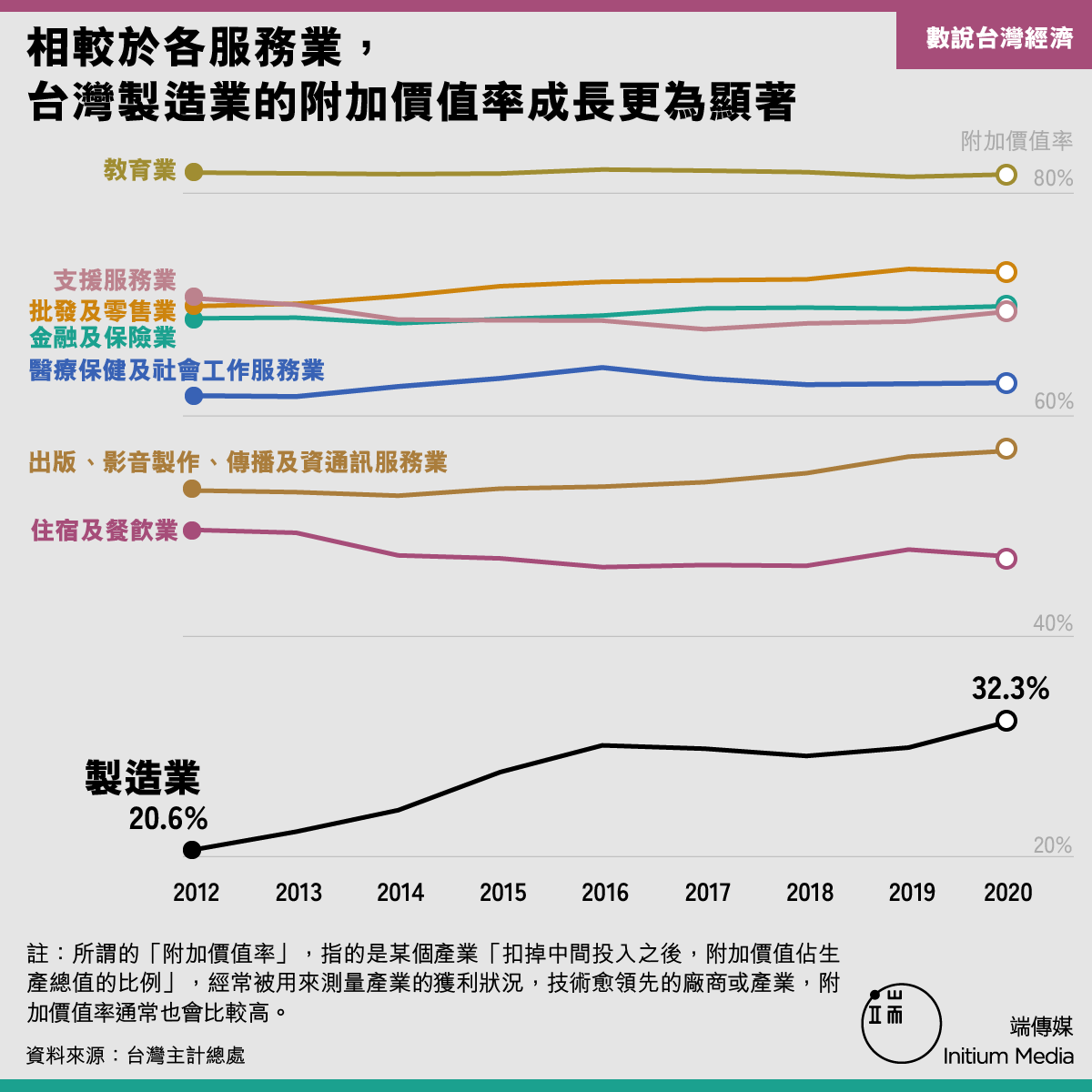

I am very grateful to Shao Yu, who is currently a research assistant in the Department of Economics and Economics and the Center for Econometric Theory and Application Research at National Taiwan University. This time, I spent a lot of time participating in this report, helping to clarify many economic concepts, and writing a report on the value-added rate of Taiwan's industries. In part, I tried to analyze why the overall median salary in Taiwan could not keep up with the growth rate of GDP.

Although it was not included in the report in the end, there is a common myth that I would like to clarify here: some people scoff at Taiwan's per capita GDP of US$30,000, thinking that it is just a numbers game created by the appreciation of the Taiwan dollar.

In fact, however, the appreciation of the Taiwan dollar is not meaningless.

First of all, if the appreciation of the Taiwan dollar is the result of market mechanisms, it may also mean that "foreigners are willing to pay higher prices to buy Taiwanese goods", which means that the value of Taiwanese goods has actually increased.

Besides, after reading this report, you will know that the value-added rate of Taiwan's manufacturing industry has actually increased a lot in recent years, so it is very likely that we no longer need to "use a low exchange rate to increase the prices of exporters" Competitiveness” and no longer need to “sacrific the purchasing power of all Taiwanese to subsidize exporters”—especially the latter point is very important.

Because the appreciation of the Taiwan dollar means that the overall international purchasing power of Taiwanese people can also increase - in the vernacular, it means that they can buy foreign goods at relatively cheap prices. At present, Taiwanese service workers who seem to be "low-paid" are in the international market. The value in the market can also be estimated more fairly, and it can even narrow the "rich-poor gap" between Taiwan's manufacturing and low-wage service industries, and increase the attractiveness of Taiwan's job market to international talents.

In addition, a reader pointed out in a keen message that this report can actually be read together with the book "Trade War is Class War". I agree with him to a certain extent, because Taiwan's low wages and dependence on exports are indeed a classic case of overproduction and underconsumption.

But after writing this, my biggest impression is actually another thing.

When I was young, I lived in Europe for a while, and one day I suddenly realized why these Western European countries don't pay much attention to GDP and rarely see local news discussing it?

Only then did I find that just like the really wealthy people don’t anxiously look at their bank deposit figures every day, the truly “developed” economies don’t stare at GDP all day long.

Therefore, although there are many ways to interpret the fact that Taiwan's per capita GDP exceeds 30,000 US dollars, I hope this figure can remind us of one thing: at this stage of Taiwan's economic development, the total GDP is no longer the most important Things have happened; how to make the economic results evenly spread, and how to improve Taiwan's over-reliance on the export of the electronics industry, may be the most important thing we should pay attention to at this moment.

The last thing I want to say is that the exchange rate of the Taiwan dollar has indeed been very strong recently. If you are Taiwanese, I have a good news to share with you:

The exchange rate between Hong Kong dollar and Taiwan dollar has been close to a new low of 3.5 recently. From another perspective, this is a good time for subscription media! Compared with five years ago, the Hong Kong dollar has depreciated by nearly 15% against the Taiwan dollar, which means that you will get a 15% discount when you order media now! And if you subscribe from here , you can also get another 15% discount~ Welcome to subscribe with a small amount of money, and support the media that is serious about news!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!