The reason and influence of the depreciation of the Japanese yen against the US dollar

Yesterday (3/23), the news saw that the yen against the US dollar hit a record low of 121.14 yen to the US dollar in 6 years, and my heart was mixed.

Back then, when I came to Japan to study, although the first exchange of money was not much, the exchange rate was not as cheap as it is now. If you could exchange more yen at that time, the embarrassment of life should be improved. I remember that in order to save money, every day after school at noon, I would go to the stand-up soba stall in the station with my Taiwanese classmates to order a bowl of the cheapest noodles. As a result of eating every day, I lost my appetite when I heard the word soba for a long time. XD

Try to guess the reason for this wave of yen depreciation. It is believed that the US FRB decided to raise interest rates, and the Governor of the Bank of Japan, Kuroda Haruhiko, said at a press conference on the 18th that the devaluation of the yen is helpful to our country's economy, which means that It will not change the monetary easing policy, nor will it intervene in the depreciation of the yen. As a result, the interest rate gap between the two countries will increase, and hot money will flow to the United States. In addition to the global epidemic and the protracted war between Russia and Ukraine, the value of crude oil, grain and other raw materials has risen sharply, and global trade activities are mostly denominated in US dollars, resulting in strong demand for US dollars. The combination of these factors has made Japan, which has always been known as a safe-haven currency. Yuan is no longer favored during this crisis.

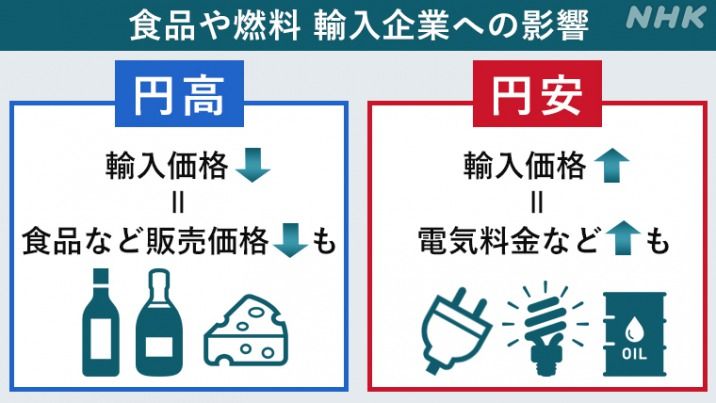

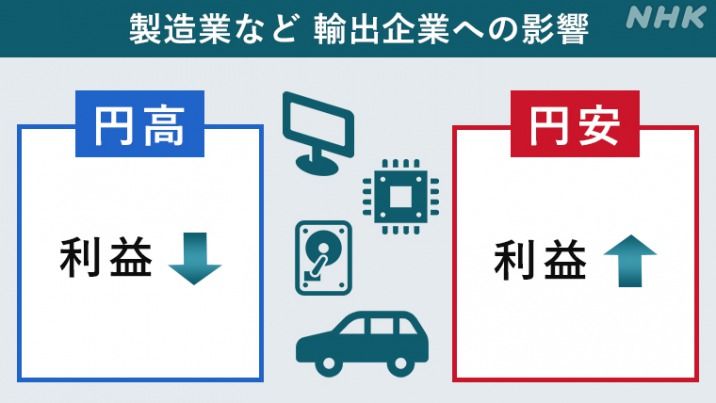

The devaluation of the yen is good or bad, depending on who it is. For local importers in Japan, the cost has been raised invisibly, and they certainly don't like it. The exporter is very happy, and the quotation to the customer can be lowered to increase the chance of a deal. Japanese people are closely related to the exchange rate of the yen even if they do not go abroad. Simply put, Japanese prices have been frozen for 20 years, and they rely on all kinds of imported goods needed for life. All kinds of daily necessities, food, energy, raw materials, etc., are almost all imported. Whether it is a foreign manufacturer or a Japanese company setting up factories overseas, they all need to use yen to buy.

When I lived in Taiwan, I often heard the phrase "everything goes up, but the salary doesn't go up!" After coming to Japan for so many years, it was only recently that Japanese people said this sentence more often.

Conversely, from the standpoint of the Taiwanese, taking advantage of this wave of weakening Japanese yen and the strong New Taiwan dollar (the Japanese dollar has fallen to a new low in nearly 23 years against the New Taiwan dollar), it should be a relatively good time to exchange foreign exchange. Those who are expected to come to Japan for tourism, shopping, and study abroad in the future can start to exchange foreign currency to buy Japanese yen in "batches". If the yen continues to depreciate, the cost of foreign exchange will become lower and lower. Assuming that it is already a recent low, once the yen suddenly starts to reverse and strengthen, at least the exchange rate is relatively cheap now, no matter how you calculate it, you will not suffer.

(The above exchange suggestions are just my own pondering. I can't guess whether the yen will continue to break low. Please consider and refer to yourself. XD )

Japanese Kanji translation

Yen high (えんだか) = appreciation of the yen

円an (えんやす) = depreciation of the yen

Gold spread (きんりさ) = interest spread

2022/03/24 posted.

Original link to Japan behind-the-scenes observation

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More