Celsius Storm: Hidden Losses, Closed Withdrawal and Liquidation Cycles

The bear market itself is not terrible, what really makes people sleepless is the uncertainty caused by the falling price of the currency. Last week, the cryptocurrency savings service Celsius Network (hereinafter referred to as Celsius) was kicked out by the media and deliberately concealed a loss of 35,000 ETH that occurred in June 2021.

Although it has been a year since the incident, investors have been frightened recently, and bad news immediately triggered market panic and runs. Yesterday Celsius urgently announced the suspension of all asset withdrawals on the platform. Even DeFi lending service Aave has proposed to suspend some asset lending to prevent the domino effect. It can be said that the market is about to come.

This article discusses how Celsius lost 35,000 ETH in the first place, and how does it affect the market today?

cryptocurrency savings

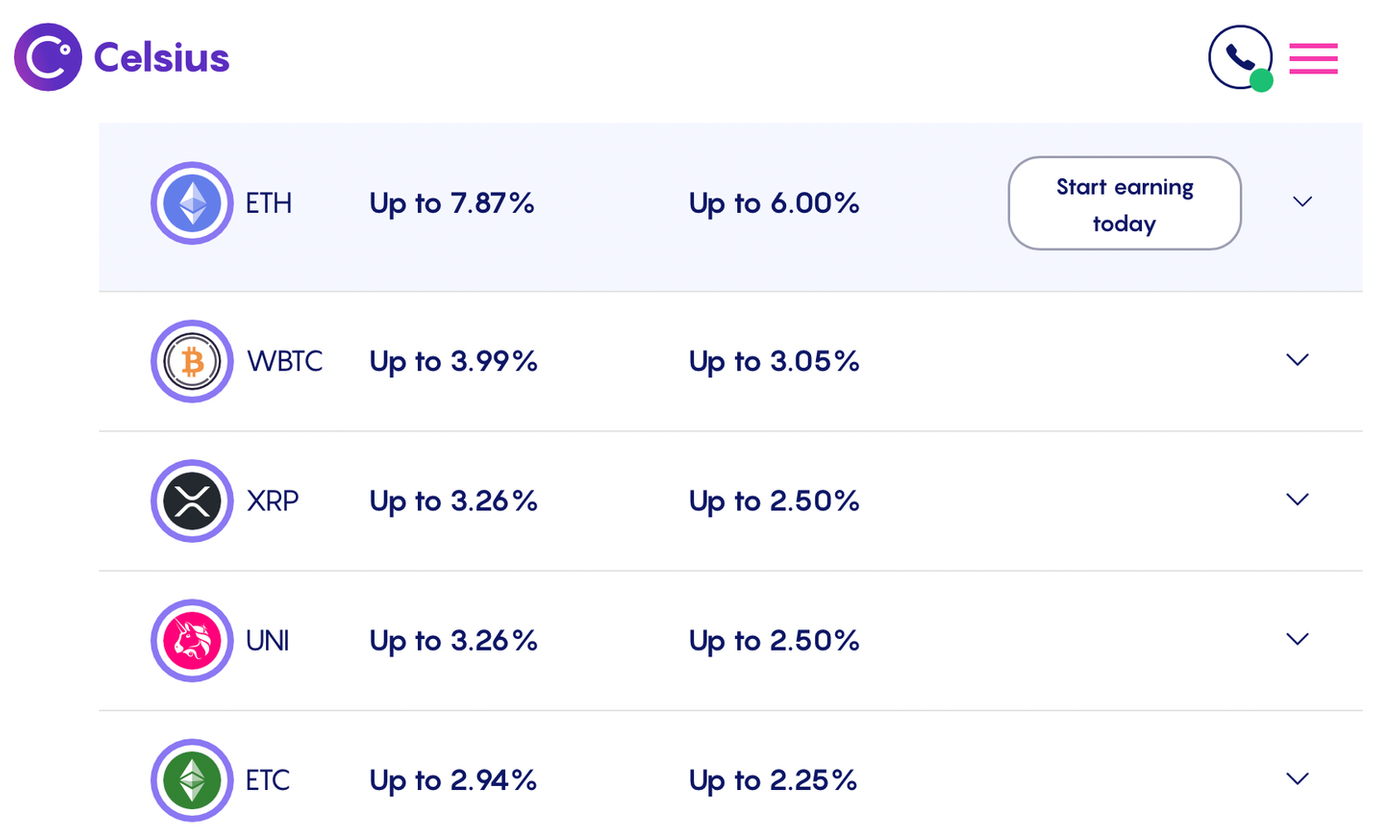

Celsius is a centralized cryptocurrency savings service, similar to BlockFi1, Nexo or the demand deposit wealth management function launched by many exchanges. It encourages investors to put their assets on the savings platform to earn extra income, and don’t lock them in their wallets. ".

For example, if investors put ETH in Celsius, they can earn up to 6% per year. That is to say, as long as an investor keeps 100 ETH in Celsius, the balance will theoretically increase to 106 after one year. This is a very convenient option for investors who want to hold cryptocurrencies for a long time.

But money doesn't come out of nothing. Once Celsius receives people’s ETH, it has to figure out a way to invest it and earn more than 6% to be profitable. Investors familiar with cryptocurrencies know that depositing ETH into Ethereum 2.0 mortgage mining 2 is a relatively low-risk, high-yield option.

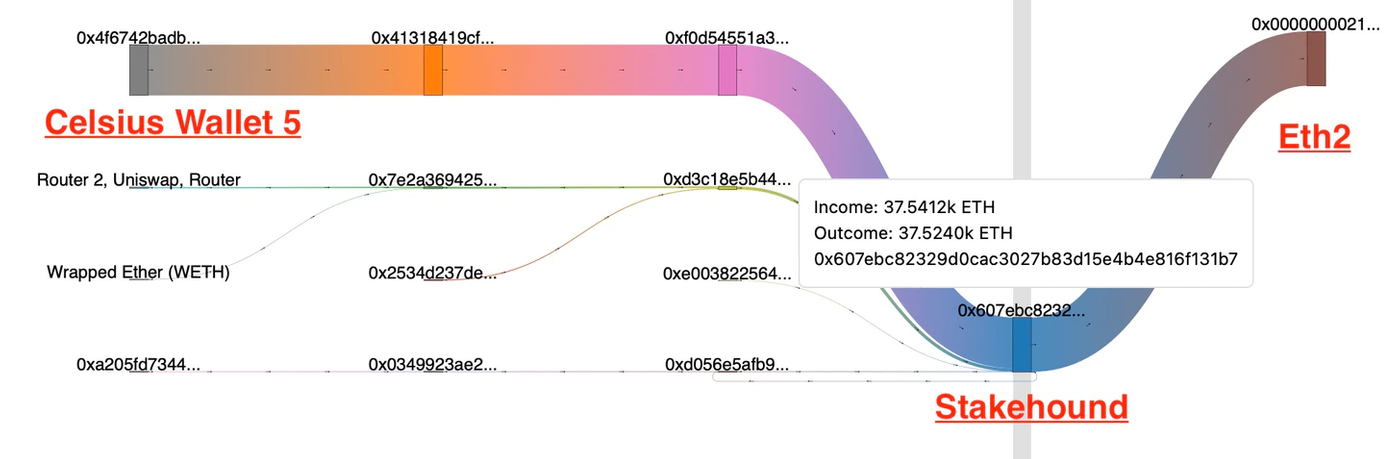

Celsius certainly knows it. It's just that Celsius does not operate the verification node of Ethereum 2.0 by itself, but outsources it to StakeHound , a company that provides mortgage mining services. Celsius is only responsible for "counting money". Celsius may seem savvy, but at the cost of relying on StakeHound to function properly.

That's the problem, and the origin of the Celsius storm.

hidden loss

On June 22, 2021, StakeHound issued an emergency announcement admitting that 2 private keys were lost. The assets managed behind these 2 private keys are exactly 38,000 ETHs entrusted by the customer, which accounted for 53% of the total asset management of StakeHound at that time. If the private key can't be found, then 38,000 ETHs will follow. It's just that StakeHound doesn't think it's its own mistake, but points the finger at the asset custodian service Fireblocks:

Fireblocks, our asset custodian, informed us on May 2 that we may have lost access to the 38,178 ETH pledged for users due to their failure to keep private keys as required. This is a loss due to a series of mishandling of Fireblocks.

StakeHound is responsible for operating Ethereum 2.0 validators and earning staking mining revenue for clients like Celsius. For the sake of security, StakeHound will also hand over the private key to Fireblocks, a professional asset custodian service provider, to ensure that the assets deposited by customers will not be hacked. Unexpectedly, before the hacker came, the private key was lost by Fireblocks.

But Fireblocks was not to be outdone, and immediately refuted StakeHound's allegations on the blog, saying that they discovered this situation during a routine information security drill. The source of the problem is likely to be that StakeHound did not operate according to the standard process at all.

The two sides have said their own words, and they have also started a lawsuit in Israel from 2021, and there is no conclusion yet. StakeHound has ceased operations.

Originally, this incident was about to end. Unexpectedly, some media recently dug up the transaction records from a year ago from the chain and found that Celsius alone had deposited at least 35,000 ETHs into StakeHound to participate in mortgage mining. It can be said that Is StakeHound's largest customer, of course, also suffered huge losses.

But Celsius never made the loss public. After the media hit last week, investors immediately panicked, worried that they would not be able to withdraw the assets in Celsius. As a result, assets began to be withdrawn from Celsius. However, this could also be a Self-fulfilling prophecy.

Centralized wealth management platforms are most afraid of panic runs by users. After all, most of the money may not be on the platform, but “work” outside to earn interest for users. Once users withdraw in large quantities, it is possible to “drain” the remaining assets of the platform. If the funds are too late to be dispatched, the withdrawal can only be temporarily closed, but it also confirms the prophecy that the platform has no money.

That's what's been happening to Celsius these days.

Withdrawal suspended

Celsius is a centralized platform, and only the company itself knows the actual financial status. Last week, the media counted 18 known Celsius wallet addresses and calculated that they held at least about $3.8 billion worth of cryptocurrency. But it is unknown how much all users have deposited in Celsius.

As can be seen from the on-chain records, the Celsius wallet alone has as many as 1 million ETHs. Among them, 270,000 ETHs are "spot" used to deal with users' daily withdrawals, and the remaining 730,000 ETHs are assets that "work outside". Some are stETH mortgage certificates that can be exchanged back to ETH at any time, and some are illiquid assets (ETH2 Staking) that must be mortgaged to the launch of Ethereum 2.0 before they can be unlocked.

If the user's withdrawal demand exceeds the spot balance, Celsius will have to start "recalling" the assets that were originally working outside - stETH - and exchange it 1:1 for ETH. However, it is not as easy as imagined to exchange stETH back to ETH at a 1:1 ratio.

stETH is an ETH mortgage certificate issued by Lido, a decentralized mortgage mining service. Users will get 1 stETH for every 1 ETH deposited to Lido. It can be said that behind stETH is 100% ETH reserves. In theory, this is higher than the reserve rate of the widely trusted USD stablecoins USDC and BUSD, and it is also supported by on-chain records, so 1:1 redemption is not a problem at all.

It's just that Ethereum 2.0 has not been launched yet. Before the upgrade of Ethereum, the ETH participating in mortgage mining at this stage will be "only in and out of 3". This makes the stETH mortgage certificate in people's hands to wait until the upgrade of Ethereum 2.0 in 2023 before it can redeem the ETH mortgaged behind it to Lido at a 1:1 ratio.

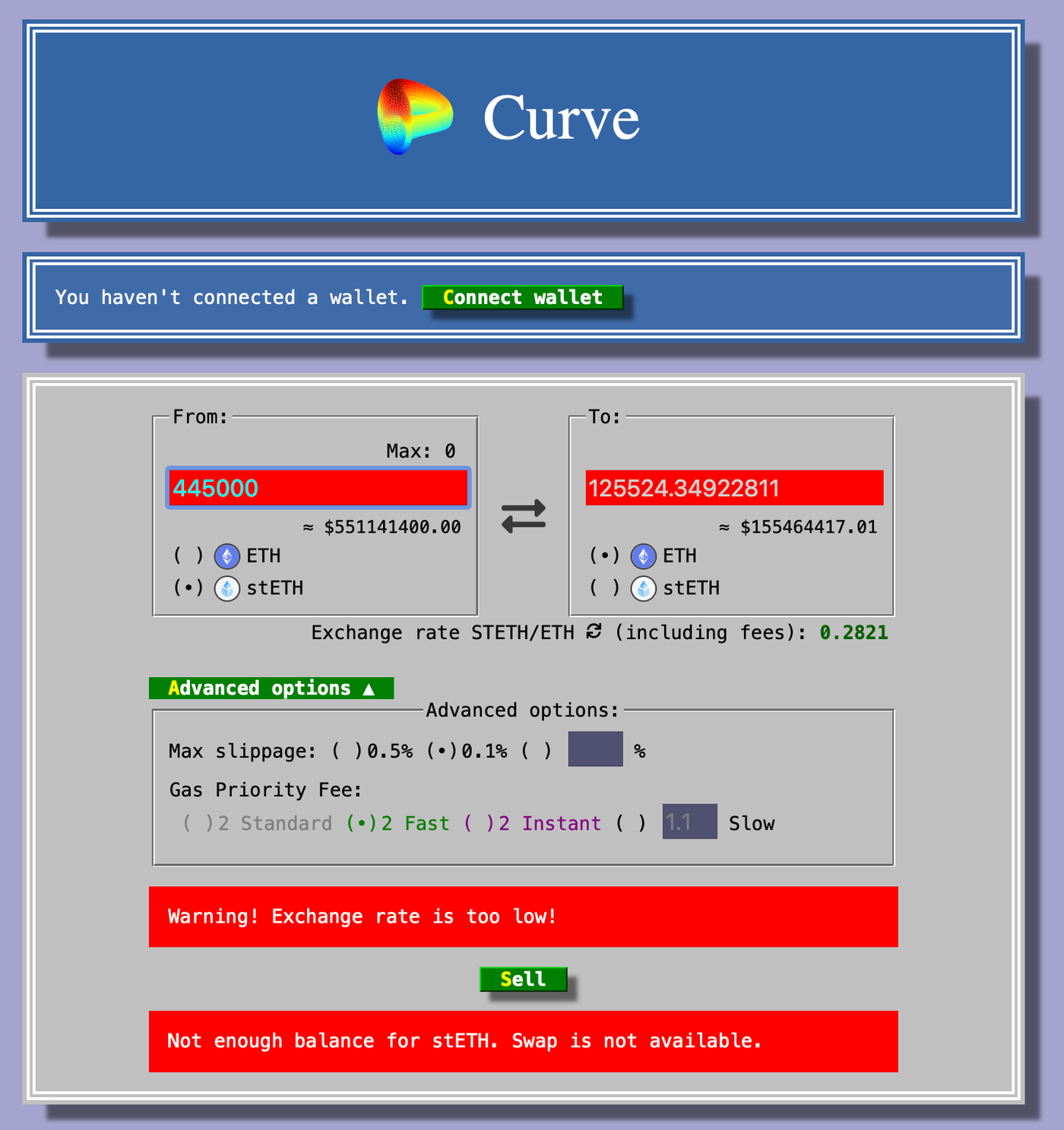

The mortgaged ETH cannot be redeemed temporarily. The biggest problem is that there is no room for arbitrage, and the price of stETH is likely to be decoupled from the reserve assets behind it. Once Celsius starts to sell stETH on hand and exchange ETH in large quantities, it will cause oversupply of stETH and the price will be lower than ETH.

Originally, each stETH could be exchanged for 1 ETH, but now it can only be exchanged for 0.95 ETH or even 0.9 ETH. As Celsius sells more volume, the trade slips more. Take the following figure as an example, if Celsius were to sell the 445,000 stETH held at one time, it may suffer a loss of 72%, and only 125,000 ETH can be exchanged in the end. The missing 320,000 ETH in the middle is Celsius' trading loss.

In other words, Celsius has to decide whether to sell at a loss, or simply suspend user withdrawals. Although the former can maintain the serenity on the surface, it will definitely not make ends meet in the end. The latter will immediately cause market panic, but it is possible to control losses within a certain range, so as not to let investors lose everything. In the end Celsius chose the latter.

According to Celsius' announcement yesterday:

Due to extreme market conditions, we are announcing the immediate suspension of all Celsius account withdrawals, purchases and transfers. We choose to take this measure in order to allow Celsius to more fully fulfill the obligation to withdraw user assets. Additionally, in line with our commitment to our customers, customers will continue to receive rewards during the suspension period.

This is an expected reaction, but it cannot be ruled out that Celsius has found a loophole that is difficult to fill. But it’s likely not just Celsius users, but cryptocurrency investors in general, are affected by this incident. The severity of the impact can be called a tsunami in the currency circle.

Liquidation Cycle

The block potential was mentioned in last month’s article4. Many investors see that the prices of stETH and ETH are usually closely linked, so they will use DeFi lending services to open leverage to increase investment income. However, if the price of stETH is significantly decoupled from ETH, investors may be forcibly cut off their heads (liquidation) if they do not have time to repay or replenish collateral.

Taking Lido staking mining as an example, the average investor will deposit 10 ETHs into Lido and exchange them for 10 stETHs, and they will be satisfied with about 4% of the annual staking mining income. But risky investors will put 10 stETHs into Aave again as collateral for borrowing, and lend an additional 5 ETHs and deposit them into Lido for mining.

If the rate of return remains unchanged, the risky investor is equivalent to earning 15 ETH of mining income with 10 ETH. In other words, it leveraged the original 4% yield to 6%. The scary thing is that such a lever can be operated repeatedly.

More risky investors will take the borrowed 5 stETHs to Aave for repeated mortgages, and lend 2.5 ETHs and deposit them into Lido for mining. This can once again increase the mining yield through leverage. Then, it can be repeated again.

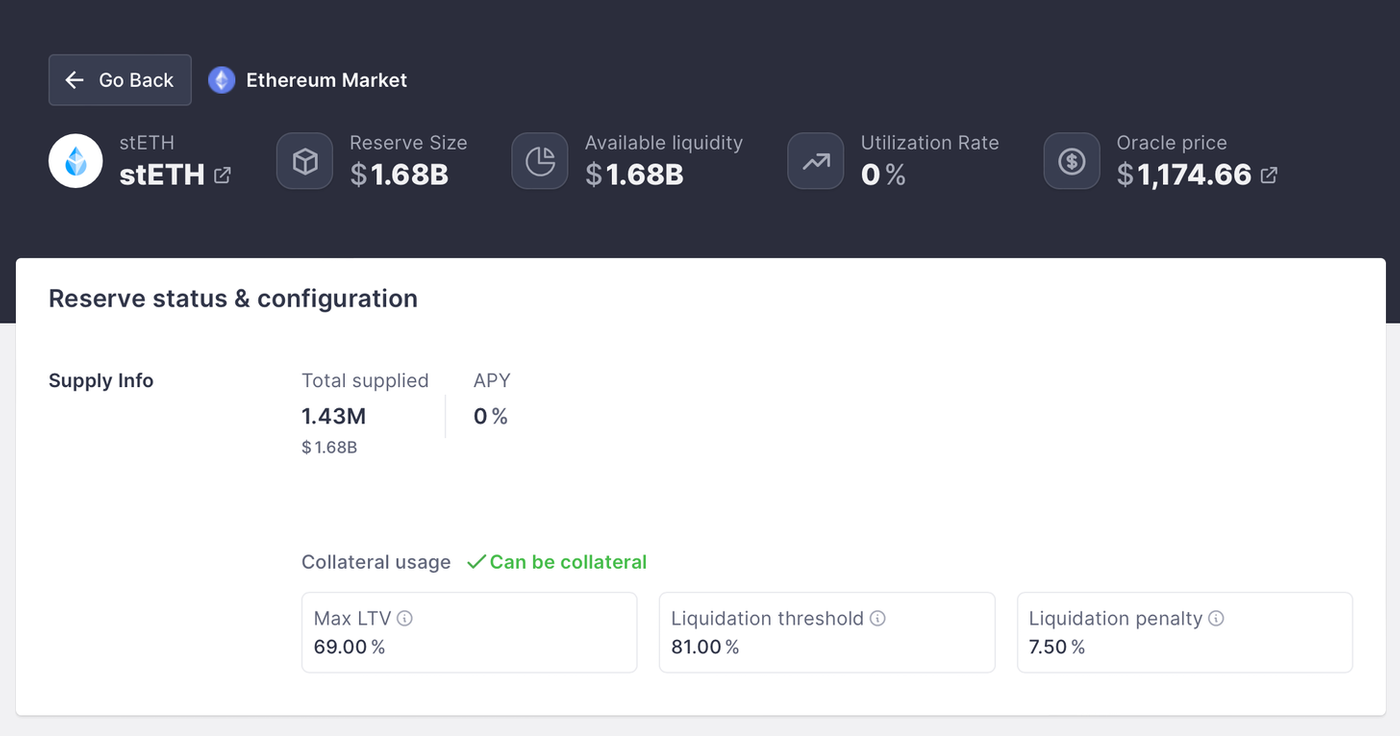

It's like a jerk. The higher the stack of blocks, the higher the mining income. However, if the foundation is not stabilized, it will easily collapse due to a little disturbance. This can explain why in Aave's lending market, the deposit rate and capital utilization rate of stETH are obviously zero, but there are so many "idiots" who put a total of 1.43 million stETH in Aave to grow dust.

In fact, they are not looking at the lending rate of stETH, but only as collateral for leverage.

Leverage is the secret behind many cryptocurrency wealth management platforms that consistently deliver attractive yields. But on the other hand, if the price of stETH is too different from ETH, it will put the 1.43 million stETH collateral at risk of being auctioned. Suddenly there is a lot of stETH in the market, which will inevitably further aggravate the price drop. It's a horrible blowout cycle.

Aave also knows the seriousness of this problem, so some people have proposed in the forum, hoping to suspend the stETH lending market first, and relax the liquidation threshold to avoid causing the domino effect in the currency circle. In addition to passively waiting for the currency price to rise, the final solution is to hope that these investors will actively reduce the leverage, or expect the Ethereum 2.0 to be upgraded as soon as possible.

The closer to the upgrade, the closer the stETH price will be to ETH. No one will be decapitated. Although I am not happy to see a tsunami in the currency circle, I also do not want to see Ethereum 2.0 being played with fire by investors who "drive the ducks to the shelves".

Celsius originally thought that as long as it didn’t say it, no one would find out about its past losses. But forget that there are no secrets in the world on the chain. Even hackers who rely on mixers to launder money may be caught by "Conan on the chain"5, not to mention the centralized financial management platform in charge of as much as 3.8 billion US dollars.

In the age of Web2, if you want to do bad things, "as long as" you hide from internal staff and prosecutors. But in the era of Web3, it has to avoid the eyes of netizens around the world. This can also be regarded as an alternative "economic incentive" to encourage companies to play steadily.

Block Potential is an independent media that is maintained by readers' paid subscriptions, and the content does not accept factory or commercial distribution. If you think the block potential article is good, please share it. If the bank has spare capacity, it can also support the block potential operation with a regular quota. To view the content of past publications, you can refer to the article list .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More