Reading Bigeng|Falling in love with on-chain data 01: MVRV

After reading the article @鑫Uncle 【 3𝓐𝓾Learn 𝓦𝓱𝓪𝓽#1】 Data on the chain - 𝓝𝓤𝓟𝓛, I also did some popular science research. This article will explain it in detail from the beginning, trying to "speak in human terms" as much as possible to make it easy for everyone to understand.

To understand the logic of the NUPL indicator, we have to start with MVRV...

■ Let’s start from the beginning: MV, RV

MVRV was first proposed by two on-chain data analysts Murad Mahmudov & David Puell in October 2018. It was initially used to study and judge the Bitcoin market.

Among them, MV refers to Market Value , which is translated as "market value" in Chinese. It is the market price x the total number of Bitcoins in circulation . It can be imagined as the market capitalization of the traditional financial market, that is, the stock price x the number of outstanding shares.

Tips: MV reflects the "current" market sentiment fluctuations.

RV refers to Realized Value , which is translated into Chinese as "Realized Value". Everyone knows that the blockchain is a public ledger, and the cash flow of Bitcoin is clear and transparent. The last time each Bitcoin moved, the last time it was sent from one wallet to another, will generate a price. Add up all these prices and take the average. Then multiply this average price x the total number of Bitcoins in circulation . RV.

Tips: RV is regarded as the "more real" value measure of Bitcoin.

*

Divide MV and RV, this number is called MVRV Ratio ; if it is subtracted, it is the origin of NUPL ; if you want to be more refined, you will use the concept of "normalization" in statistics to calculate MVRV Z-score ⋯⋯ The essence behind these indicators and the phenomena they want to reflect are all similar.

■ Where to find out?

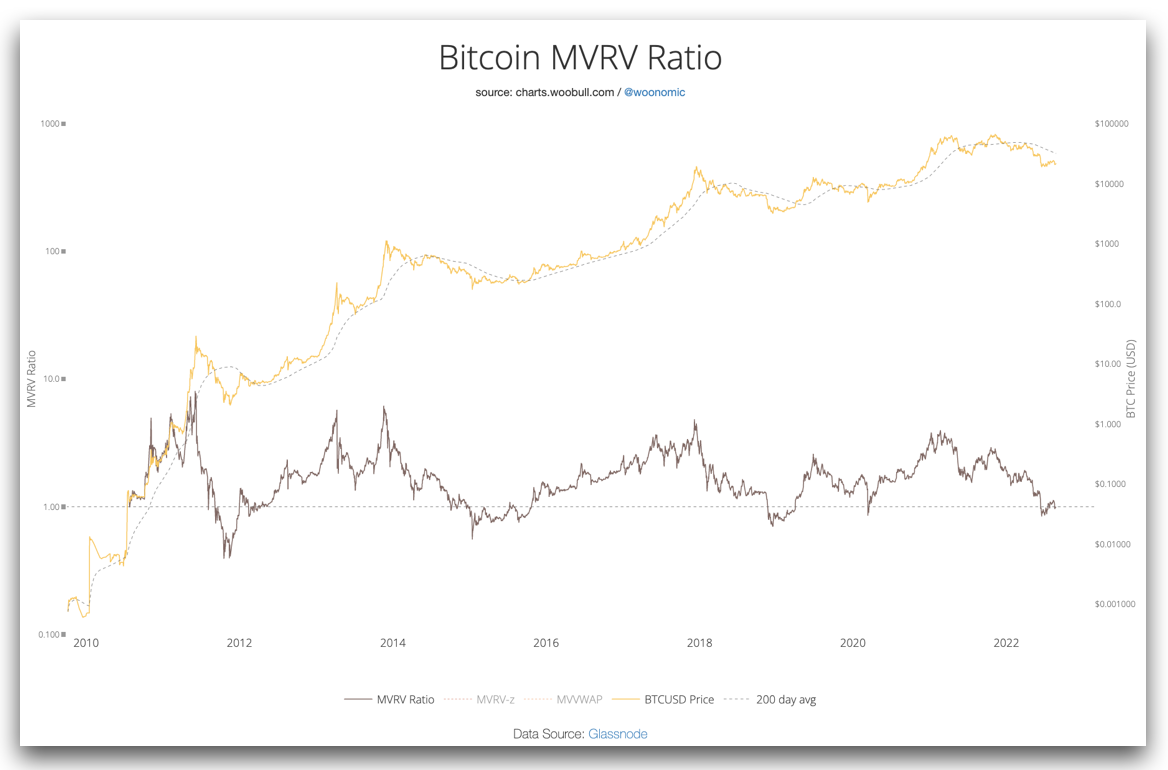

- Woobull Charts (default MVRV Ratio, can be switched to MVRV Z-score) https://charts.woobull.com/bitcoin-mvrv-ratio/

- BITCOINITION (MVRV Z-score)

https://bitcoinition.com/charts/mvrv-z-score/

■ Operational strategy

The MVRV Ratio is used as an explanation.

A (seemingly) good approach is:

Buy Bitcoin when the MVRV Ratio value is less than 1. Sell the currency when the MVRV Ratio value is greater than 3.

According to a report released by the research organization Messari (see page 13 for details), past data shows that the time for the MVRV Ratio value to be above 3 is gradually shortening .

In 2011, the MVRV Ratio stayed above 3 for 4 months.

In 2013, it stayed there for 10 weeks.

In 2017, it stayed for 3 weeks.

In 2021, it only stayed for 3 days.

Does this mean that the price of Bitcoin, an asset, reflects "the market's consensus on "good times"" more and more quickly? Bitcoin has entered the field of vision of more and more people (including institutional investors)?

🌱 Join [ Zhongshu Nervous System ] Wailuo👇

The special topics #Reflections on Writing and #热内真情are being serialized.

🌱I appear on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocabulary 】

🌱My teaching articles and invitation links👇

≣Register noise.cash | Become a "noise coffee" and experience social finance together .

≣Register Presearch | Search to earn three birds with one stone .

≣Register for MEXC | Go to the Matcha Exchange to redeem OSMO and play wool .

≣Register Potato | Learn three things from Potato Media .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More