Australian immigrant buying procedures and regional property prices in Australia

Australia is famous for its good environment, pleasant weather and climate all year round, perfect medical system, high level of education system, and many high-level universities. Therefore, it has always been an ideal destination for many people to immigrate and study abroad. Coupled with the stability of the property market, the property market has maintained steady growth even during the epidemic, so it has naturally attracted the attention of many investors. share

Related content: If you plan to immigrate to Australia in 2022, you must share the lazy bag

Property Purchase Restrictions and Property Price Impacts for Non-Australian Citizens

Even if you are not an Australian permanent resident or citizen, you can buy a property in Australia. Then of course, there will be more restrictions than Australian residents:

1. You must obtain approval from the Foreign Investment Review Board (FIRB) before buying a property. Buyers need to apply and pay an application fee on the FIRB website before buying and selling, which is calculated according to the property type and price.

2. You cannot buy second-hand buildings. If you buy idle land, the building must be built within 4 years.

3. In some of the more popular property investment areas, the government will levy additional taxes.

Taxes that Australian immigrants need to pay in Australia

- Stamp Duty: Stamp duty rates vary from state to state. For example: Stamp duty in Sydney is 1.25%-7%; Melbourne is 1.4%-5.5%. You can use the Australian Government's Stamp Duty Calculator to estimate how much stamp duty you need to pay.

- Foreigner Stamp Duty (Surcharge Stamp Duty): Some state branches charge additional stamp duty for foreigners, such as 8% in Sydney and Melbourne; 7% in Perth and Brisbane.

- Land Tax: For investment in residential properties, commercial properties, holiday homes, and vacant land, as long as the value exceeds $250,000, the owner needs to pay land tax, but not for self-occupied houses and agricultural land. Tax rates vary from state to state, but generally range from a few hundred to three thousand Australian dollars.

- Land surcharge (Surcharge Land Tax): This is a tax levied by the Australian government on foreigners, and it is only levied on residential land. The tax rate varies from state to state.

- Vacancy Tax (Annual Vacancy Fee): This tax is set by the Australian government in order to keep the housing vacancy rate low. The tax rate is 1% of the annual increase in land. There is no need to pay if the property is occupied for 6 months or more in a year. In addition, if the tea owner holds property elsewhere in Australia, there is no need to pay for an apartment that is used as a holiday home or an apartment for work in the urban area.

- Capital Gain Tax: When selling a property that is held for less than one year, the seller needs to pay 50% of the difference between the sale and purchase as capital gain tax. When selling a property held for one year or more, the capital gains tax rate is 25%.

- Income tax (Rental Income Tax): If non-Australian citizens buy a property in Australia and rent it out, they need to pay income tax on rental income at a rate of 32.5%-45%. However, in fact, during the period of renting or leasing, some housing-related expenses can be deducted as part of tax, such as management fees, mortgage loan interest, basic renovation works, etc.

Australian Property Price Trends and Mortgage

What is Negative Gearing

Negative gearing is when the deductible expenses (including interest on mortgage loans) of a rented property exceed the income from the rental. Owners can save the negative gearing allowance for future VAT deduction when selling the property.

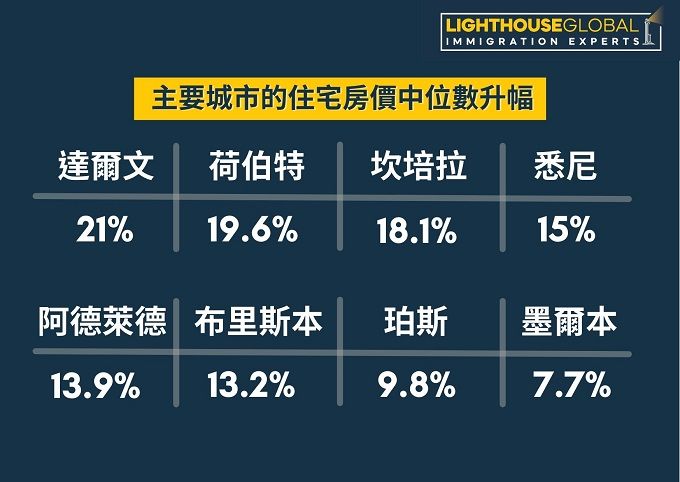

Residential prices in Australia's eight major cities rose by 13.4 per cent in the year to the second quarter of 2021, with an average price of $727,427 and a median of $645,454, according to Australian data. Compared with the first quarter, house prices also rose by 4.8%.

The median apartment price in the main cities of Australian immigrants

Median apartment price growth in major Australian cities

Buying Australian properties and real estate in Hong Kong

1. Australia building selection area

No matter which city you are buying in, it is also important to choose the area carefully. The most important thing for buyers is to consider their own needs, such as whether they need to be adjacent to school districts or urban areas, traffic environment, whether public services are perfect, etc., as well as their own budget.

2. Apply for FIRB eligibility

As mentioned at the beginning of the article, non-Australian permanent residents or citizens who buy real estate in Australia need to apply for FIRB qualification in advance.

3. Book Australia property

After you have settled on a unit, you need to pay a deposit to the estate agent first, which is about AUD 5,000 to 8,000, and then the agent will ask the developer to keep the unit. If the unit can be reserved for you, the developer will reply to the estate agent for confirmation. If the unit has already been sold when your estate agent makes a reservation, you can choose to get your deposit back, or pick another unit.

4. Hire an Australian representative lawyer and sign a provisional sale and purchase agreement

You will need to find an Australian lawyer to handle all sale and purchase documents on your behalf. For one thing, an estate agent can introduce you to some reliable law firms. The lawyer will send the relevant documents to Hong Kong for you to sign, and some lawyers can also arrange a video conference to explain the contents of the contract.

5. Australian property down payment

After signing the provisional sale and purchase agreement, it is normal to pay the down payment within 7 days, which is generally 10% of the property price. Overseas buyers need to pay the money to a lawyer in Australia, and the law firm will keep the money on behalf of the buyer until it is paid to the developer after the building is completed. If overseas buyers buy ready-made properties, they generally need to pay the final number of the property within 30 to 60 days, and then arrange for repossession and building inspection.

6. Australian building repossession and building inspection

After the property is completed, the developer will issue a notice to the buyer, who can then arrange for repossession and inspection procedures, and then pay the final amount. Some estate agents can take over and inspect the building on your behalf, and will issue a detailed inspection report to you. If there are any defects, they will ask the developer to repair them. You just have to make sure to pay the final amount within the developer's payment term.

When overseas buyers buy Australian properties, what is the maximum amount of Australian property loans that can be borrowed?

Depends on the buyer's situation and the bank, and like all banks on the planet, mortgage approvals for foreigners can be a little harsher than for locals. But generally speaking, overseas buyers can still get 60-70% mortgage loans. The annual interest rate for overseas buyers is about 6.5%-8%%. The most common term is 20 or 30 years.

Are lawyer fees expensive to buy a property in Australia?

Generally speaking, the legal fees for buying a property in Australia are around A$1,000 to A$4,000.

Contact Lighthouse Global Canada Immigration for a free immigration consultation!

source:

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More