Tainan City's Road to Hoarding House Tax: How's the Version? Who is for who is against?

Tainan City plans to adjust the housing tax to a more progressive differential tax rate. The current single tax rate of 1.5% for non-self-occupied households is revised to "2.4% for each household with less than 5 households and 3.6% for each household with more than 6 households". The joint review has just ended. The next step is to enter into political party consultations. Interested friends can watch the video of the meeting ( https://reurl.cc/82Rjn7 )

If Tainan succeeds in its revision, it will become the fourth city to adopt differential housing tax rates, and it will also be one of the cities with one of the highest rates of improvement (second only to Taipei City). In addition, there is also the design of "multiple houses are subject to heavy taxation, and rental tax reductions", which means that "if multiple households join the chartered escrow, it will not be included in the hoarding." This alone is even more advanced than Taipei City.

However, at the beginning of 2019, Huang Weizhe led a significant reduction in the housing tax base as soon as he took office. In order to balance the reduction of the tax base, Tainan City also proposed to adjust the housing tax rate, and completely compared the tax rate to Taipei, but was blocked and returned by the three party groups. This time, although the design and details of the tax rate are much longer than the 2019 version, it is still unknown whether it will pass.

I guess few people are interested in watching the video of the nearly three-hour meeting, so just take a screenshot of who is in favor and who is against. I won't say much about the reasons and faces of the objections. You can record them directly to the time when they speak, and listen to what they are saying.

Finally, my personal opinion is that the Cai Yuhui/Cai Wangquan version seems to be more "detailed", but in fact it seriously weakens the effect of differential tax rates. First of all, there can be three self-occupied residences under the Housing Tax Regulations, so the "first non-self-occupied residence" is essentially equal to the "fourth residence" and so on.

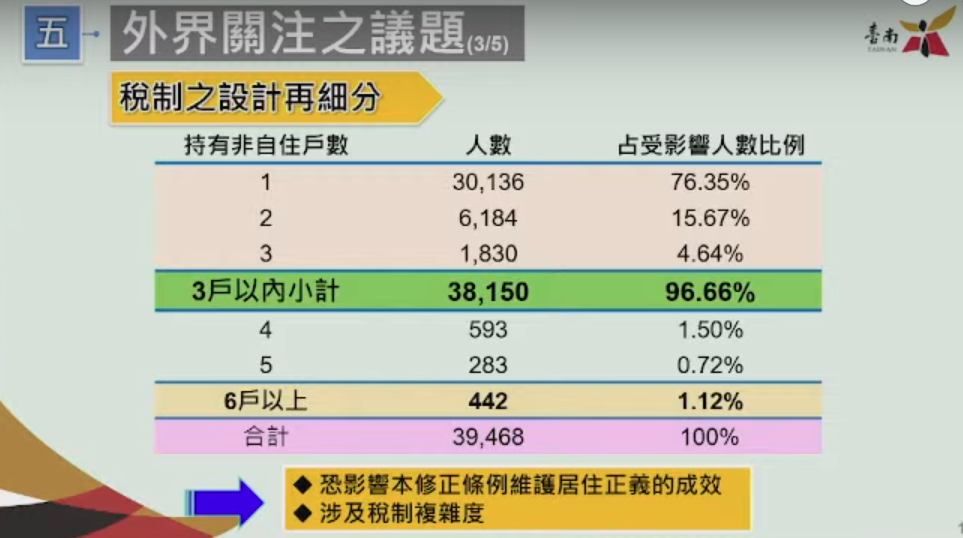

The Cai Yuhui/Cai Wangquan version lowered the tax rate for the first and second houses that are not for self-use, but in fact these two situations accounted for 92.02% of all multi-households, which could have affected 39,468 multi-households. The scope of the tax system is directly reduced to 3148, which can almost be said to be directly castrated.

Supplement: Draft of "Tainan City House Tax Collection Rate Autonomy Regulations"

https://www.tncc.gov.tw/warehouse/CD7BBD8C-9C46-4DBB-9D31-264FF4695884/A09D550A-A85D-40C1-808F-8EBCB6A18B13.pdf?fbclid=IwAR1EQo9B5CU2ZP9c_44IcinqOpvc3Xa6bza7fRZIc3XD8bza7fRZIb

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More