It doesn't matter if you don't have rich dad, become rich dad yourself!

The first class of the Blockchain Promotion Association last week was "Common Trading Misunderstandings for New Investors". For those who haven't taken it, you can refer to my key sorting and experience "Examine Your Own Long-Term Investments - Share the Importance of Value Investing" . Last night was the second class "How to choose a coin with a high winning rate in the blockchain". Although I have taken it before, I have strengthened my concept again every time I am in class, and even heard additional supplements from the teacher.

The principle of investing - spending money

The consumption of the poor is subtractive consumption, and the consumption of the rich is additive consumption. The poor buy debts, and the rich try to buy assets. The so-called additive consumption, although spending money, but spending 1 yuan can earn 2 yuan or more, of course, you have to work hard to spend!

Two years of investment and financial management concepts have made me keep this principle in mind. Every time I spend money, I ask myself, "Can you help me make more money after spending this money?" If the answer is Yes, I will Spend it without hesitation. Over the past two years, I will see more and more assets instead of liabilities, and I will feel more and more stable in my heart.

How to choose investment commodities?

First of all, it is necessary to recognize whether the product is to make money or preserve its value, and then clarify what the goal of your consumption is. Looking at my current investment commodities, there are both value-preserving and profitable. Of course, because I am still young, I can take higher risks, and I put more money on commodities than preservation.

If you know the investment products you need to make money, you must know how to distinguish the products that make money. Grasp the two principles

limited

Not copyable

Just pick a limited-edition product that can be recognized as an asset in the future !

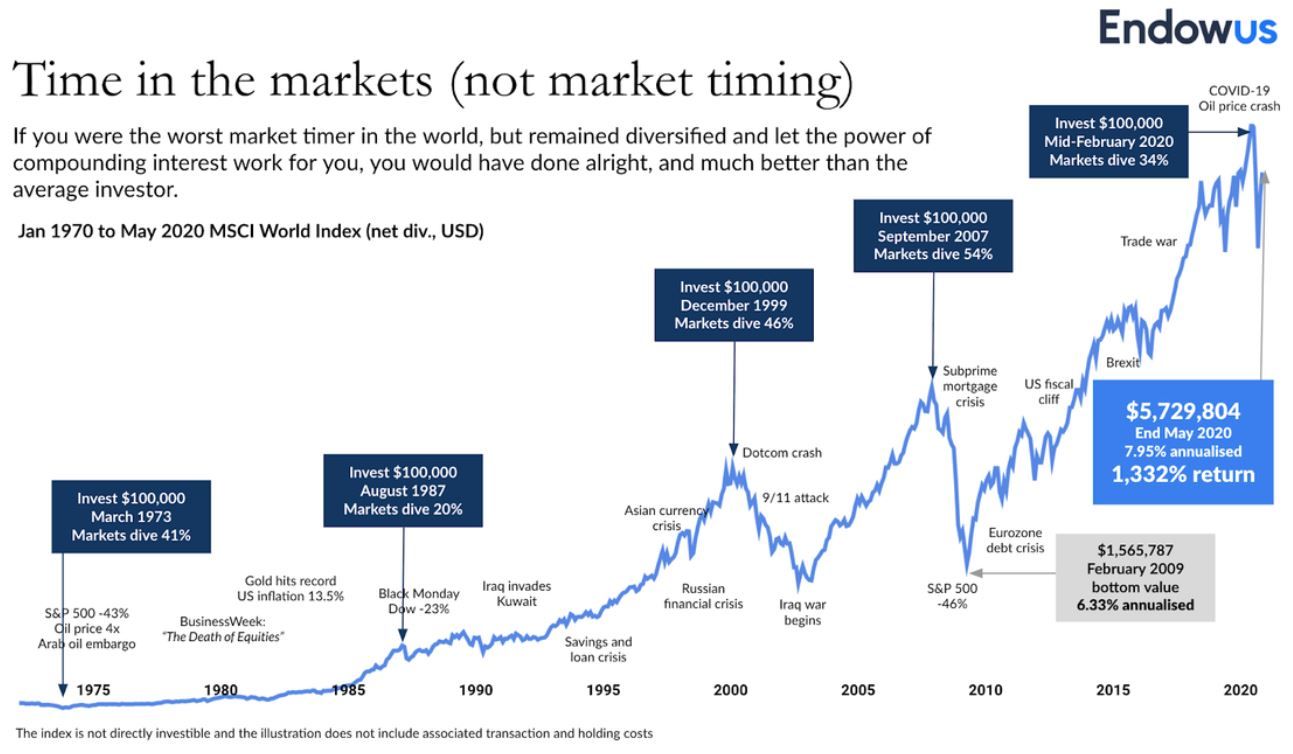

Do you want to buy something that everyone has heard of or an emerging investment commodity that has just emerged?

Buying commodities that everyone has heard of means that the market is mature, such as stocks, insurance, funds, etc., but it also means that it is only a preservation of value, and it is unlikely to earn multiples of money. For example, TSMC's stock is now more than 600 yuan. No one in Taiwan does not know about TSMC, but if it has to increase tenfold, it means that the original TSMC of 600,000 has become more than 6 million. Even the salary is not bad. I'm not willing to buy one. With tens of thousands of TSMCs, who would buy a TSMC of more than 6 million? Even if you want to buy it, you can't afford it!

But if it is a $1 cryptocurrency today, and it increases tenfold to a $10, many people should still be willing to buy it. This is why the previous lesson emphasized value investing for the long term and cheap. As long as it is cheap enough, many people can afford it, and naturally some people will be willing to buy it.

If you don't have rich dad, be on your own!

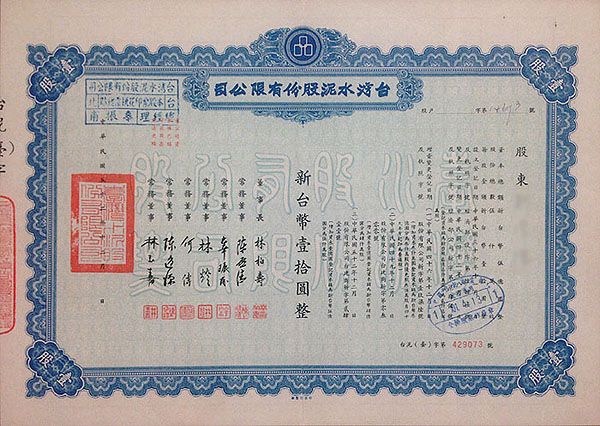

In 1962, "Taiwan Cement" became the first listed company in Taiwan. At that time, the stock of TCC was only $10. Today, the stock of TCC is about $46, which is at least 4 times. Investors can even sell at 70 yuan, even 7 times!

It's a pity that I was not born at that time, and my grandpa and grandma probably didn't know anything about stocks at that time, otherwise I wouldn't have to study so hard to invest and manage money now, hehe! But it doesn’t matter if my grandparents miss it, I am lucky to have another opportunity, that is, blockchain and cryptocurrency, I can rely on myself to be the backer of future children and grandchildren, which is why I have to allocate money no matter how busy I am. I have time to study in class, and even read every day. After all, what I regret most is not that I didn’t meet the opportunity, but that when the opportunity came, I missed it perfectly! Just like my dad would tell me nonsense every time: "I knew that the Nangang house and TSMC would rise like this, so I bought it!"

Are emerging investment commodities safe?

There is no 100% winning investment, but you can find ways to improve your winning rate and reduce your risk. Many people worry about the high risk of emerging investment commodities because they haven't taken the time to recognize and understand them. People are always afraid of the unknown, just like if you walk into a completely dark tunnel, you don’t know when you can get out of the tunnel. Even if you know that there are many gold and silver treasures at the entrance of the tunnel, many people would rather choose not to go in; but if you know that you can walk out of the tunnel for 10 hours , No matter what, we must try our best to go to the end!

The following provides the attitudes of the governments of the United States, Singapore, and Taiwan on cryptocurrencies. The world power - the United States has begun to recognize cryptocurrencies, and the US President - Biden even issued an order in March 2022 to study cryptocurrencies, and financial institutions in the United States have also begun to provide Investors in cryptocurrency-related commodities, I can't think of the reason why cryptocurrencies will bubble. When financial institutions put money into it, how could they, who are tens of millions of times richer than me, let the cryptocurrency bubble?!

U.S. government’s attitude toward cryptocurrencies

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the Office of the Comptroller of the Currency (OCC) have successively issued cryptocurrency regulatory policies. The OCC released the 2022 Bank Supervision Operational Plan, which included cryptocurrencies for the first time. OCC even officially announced that state-owned banks and federal savings institutions can use virtual currency to participate in the blockchain financial accounting and settlement network. In other words, the legal status of blockchain finance is equivalent to the current SWIFT, ACH and FedWire. Even by giving U.S. financial institutions the freedom to offer cryptocurrency custody services to the masses.

Singapore government's attitude towards cryptocurrencies

In January this year, the Singapore Parliament passed the Payment Services Act Amendment (PSA Amendment), which requires all local digital payment currency (DPT) service providers, whether they provide cryptocurrency trading or custody services, to first pass through the Monetary Authority of Singapore. (MAS) audit and obtain a license. In addition to clearer regulatory measures, Singapore’s sovereign wealth fund (GIC) has expanded cryptocurrency-related investments. Singapore's sovereign fund Temasek Holdings (Temasek) is also actively investing in cryptocurrency and blockchain companies.

In early November this year, MAS director Ravi Menon said in an interview at the Singapore Fintech Festival that Singapore is trying to become the world center of blockchain and Web 3.0, and the best way to respond to the trend "is not to ban or ban these activities. ". While banks and other traditional financial institutions will face some of the challenges and risks of decentralization, the Singaporean government still wants to be ready in 2030 when the cryptocurrency economy becomes a reality.

The Taiwanese government's attitude towards cryptocurrencies

On April 7, 2021, President Su Zhenchang of the Taiwan Executive Yuan issued Yuan Tai Fa Zi No. 1100167722. The order defines the scope of virtual currency platforms and trading businesses in accordance with the FATF guidelines, and clearly regulates the money laundering prevention obligations that VASPs need to comply with. The ordinance is expected to take effect on July 1.

The Executive Yuan ordered that businesses that fall within the scope of virtual currency platforms and trading businesses must comply with Article 5 of the Money Laundering Prevention Act and implement KYC (know your customer) and AML (anti-money laundering), including transaction monitoring. , suspicious transaction notification, etc. Even in 2022, because NFTs are too popular, Executive President Su Zhenchang promised to "finalize the NFT supervisory unit" in one month, and the Minister of Finance mentioned that NFTs are commodities and can be taxed.

Reference article:

Biden Orders Cryptocurrency Research, Regulations, and Exploring the "Digital Dollar" Possibility

The Biggest Risks of Value Investing

The biggest risk is time, because it takes time to wait, but I am lucky to be in my thirties, and there is time. As long as the timing is right, there is a better chance of winning. The premise is that it will not be easily sold by market sentiment. A valuable coin!

I visited a client a few weeks ago. As a second-generation small boss in a traditional industry, I kept mentioning that if I knew how to invest my money when I was young, I would find a good investment product instead of using the money to buy a car and change it. Che is handsome, and now it doesn't have to be so hard. He sincerely hopes that the young people today can know the sooner the investment, the better. Unfortunately, many young people just want to enjoy the moment and don't want to delay eating cotton candy.

Reference article: [Minimalist long-term investment] To increase the winning rate to 100%, you must do these 3 "break up"

I am Little Frog, and I like to study all things in the blockchain. If you don’t know me, please read “Where is Little Frog Sacred (Self-Introduction) ”.

If you are new to blockchain and cryptocurrencies, you can start by reading the following articles.

Blockchain and Cryptocurrency Lazy Pack for Beginners

Advanced Lazy Pack for Blockchain and Cryptocurrencies

Thank you for your patience in reading the article. The following is a series of introduction articles I wrote for another platform that makes money, Potato Media. If you agree with the concept of common good and want to earn extra income, welcome to register Potato Media, you can use my registration code , Let's make a fortune together! If you want to know this platform, you can refer to this official introduction .

Potato Media series of articles

1. Get to know the platform Potato Media: Introduction to Potato Media Lazy Pack

2. Potato Media's business opportunities: Looking at Potato Media's business opportunities from FB

3. Potato Media related information and Q&A summary

4. Four months of experience sharing: Potato Media is a good concept platform for me

5. Potato Media in continuous improvement: My thoughts on the official Potato Media

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More