"Silicon" sun goes down: the depression of silicon intellectual wealth in Britain

The original text was published on 2021/8/5 " Multidimensional News "

Since the Trump administration launched a trade war with China in 2018, China and the United States have fallen into a trend of intensifying confrontation, and Huawei, China's most representative technology company, has been suppressed, and the confrontation between the two countries has continued from Trade has escalated into a financial and technological war, and the trend of decoupling between the two sides in the technology system seems inevitable. Since the beginning of 2021, German and Japanese auto companies have sought support from Taiwanese semiconductor companies such as TSMC through their governments, and there has been a "chip shortage". The concerns of the industry have exploded in major industries, and major companies are actively seeking to supply their own chip production capacity with priority. As the world's leading chip foundry company, TSMC is in such a vortex, and it is difficult to stay out of it. It originally maintained its neutrality and never set a political stance to refuse a business model for a specific customer. However, the semiconductor companies that dominate half of the sky in Taiwan are obviously becoming more and more difficult to resist the pressure of the US government. They must choose sides between China and the US, but the Taiwan government does not have the ability and willingness to do so. stop this.

The drama of the fight between the gods did not only affect Taiwan. The United Kingdom, as far as the western tip of the Eurasian continent, was also forced to take a stand in this maelstrom, although its Prime Minister Boris Johnson was initially expected to remain neutral. From the perspective of watching and maximizing national interests, Huawei did not refuse Huawei to build its telecommunications system, but it was later pressured by the United States, and Huawei was excluded from the construction of the telecommunications system. In the nuclear power plant construction projects in the UK, the trend of the UK moving closer to the US is becoming more and more obvious.

Although the UK's presence in the silicon-based intellectual property project, which is regarded as an industrial upgrade, is getting weaker, the UK is not without a killer. There are still some attractive silicon-based intellectual property assets in its hands, which are eyeing in China and the United States. At the same time, it is still trying to protect these assets, but whether it can be protected and whether it has the ability to protect it is one thing, and the British government regards it as a national security issue, which is another issue.

ARM: Will Britain's crown jewel fall into the hands of Huida?

ARM, established in Cambridge, England in 1978, can be described as a leader in the British technology industry and one of the few pearls in the hands of the United Kingdom in the future-forward silicon intellectual property industry. ARM specializes in low-power, high-performance and low-cost chip architecture. It does not manufacture its own chips, but authorizes IC designers to charge licensing fees by selling its source code. Its customers include many world-renowned IC designers, such as Apple, Qualcomm, MediaTek, Huawei HiSilicon, Nvidia, etc. Although in the PC era, the chip market is dominated by Intel's X86 architecture, but the features of ARM-based chips are more suitable for mobile devices. As mobile devices gradually replace PCs, ARM architecture replaces X86 It seems that it is only a matter of time. ARK Invest, under the leadership of "Goddess" Cathie Wood, in the "Big Idea 2021" report published at the beginning of this year (2021), even boldly predicted that ARM chips will grow. Replacing the X86, it will reach a market share of more than 80% in 2030. After Apple launched the M1 chip based on the ARM architecture for Mac use, Intel's X86 seems to be about to lose its share of the PC market.

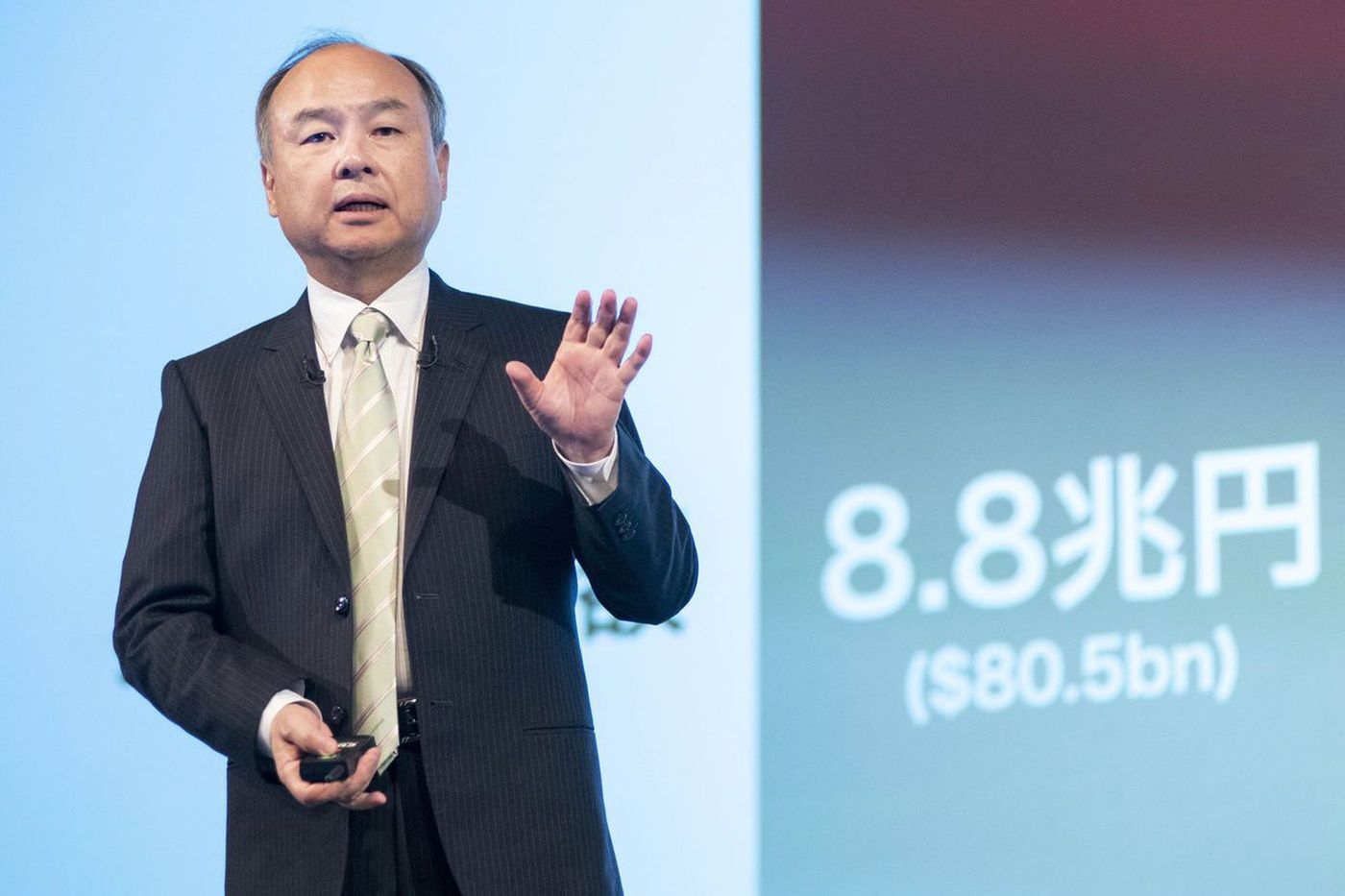

On July 18, 2016, ARM was acquired by the Softbank Group (Softbank) under the Japanese entrepreneur Sun Zhengyi at a price of 31.4 billion US dollars. Due to the Brexit, a large number of capital fled the United Kingdom, and the severe depreciation of the pound relative to the yen made Masayoshi Son sees an opportunity for value investment, and based on his optimism about the development prospects of the AIOT industry, Masayoshi Son believes that this is a value-for-money transaction.

However, in 2019, other projects invested by Sun Zhengyi, such as Uber, Lyft, WeWork, etc., did not go well, and the losses continued. The new crown epidemic in 2020 caused the bankruptcy of the satellite network startup OneWeb he invested in, forcing Sun Zhengyi to reduce his holdings in Alibaba and other high-quality assets, also considered selling ARM, and the US semiconductor company Huida took this opportunity to make a purchase invitation to Softbank at a price of 40 billion US dollars in September 2020.

ARM is controlled by foreign companies, which is unbearable in the eyes of the British. Although the British Conservative government was criticized in 2016, it was believed that in the process of ARM being acquired by Softbank, the British government did nothing, but because Softbank is not a semiconductor company, The acquisition of ARM is based on financial investment. This acquisition has indeed added local employment opportunities in the UK, and SoftBank has indeed maintained a neutral attitude, allowing ARM’s source code to be licensed to a number of semiconductor companies, and its business expansion is considerable. It went well, so this acquisition is considered to be able to bring better economic benefits.

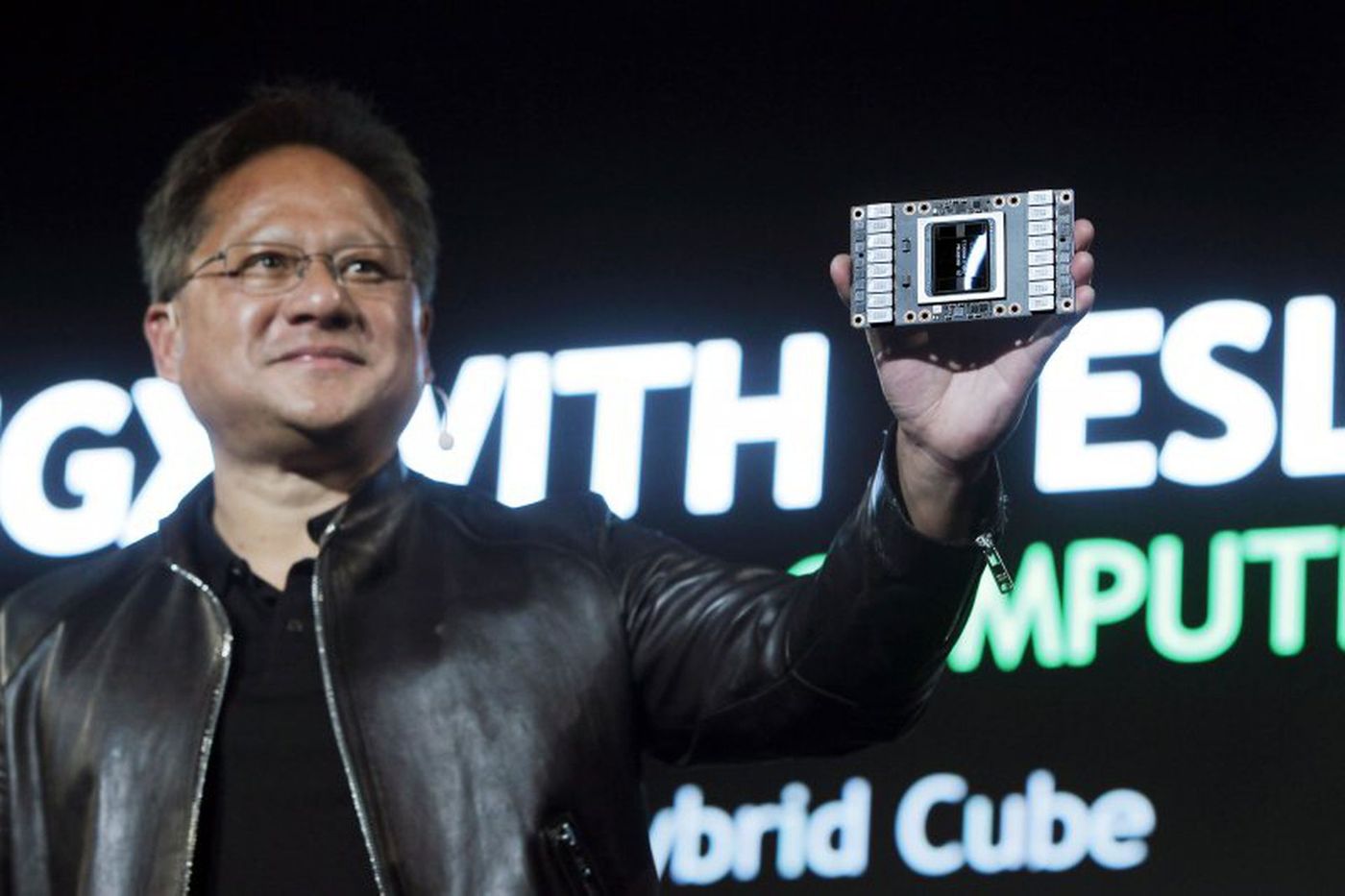

But Huida's acquisition of ARM is another matter. Huida, a leading GPU company, is itself a semiconductor company and one of the players using the ARM architecture. Huida's acquisition of ARM is like a player buying a referee. ARM Whether huida will "self-fertilize" huida has aroused the doubts of apple, Qualcomm and other companies, thinking that this will allow huida to monopolize the IC design track and promote unfair competition, so it began to lobby the US government and expressed its financial investment in ARM In order to maintain its independence, try to prevent the acquisition from being successful.

On the other hand, Huida, as a US semiconductor company, its acquisitions have also aroused suspicions from the British and Chinese governments. As one of the few jewels in the hands of the UK, ARM naturally hopes that ARM can stay in the UK and promote local employment opportunities. After Huida's acquisition, ARM may relocate its headquarters to the United States, which runs counter to the British government's calculations, and the resulting Anti-competitive concerns have forced the UK to examine the deal more carefully from the perspective of "national security issues". The current tendency of the British government is not to approve this transaction, and there is also a small chance of approval with conditions. However, even if the British government passes the threshold, there will be a mountain of government regulators such as the European Union, the United States, and China to pass.

The biggest obstacle to Huida's acquisition of ARM is probably the Chinese government. Since many IC design companies in China, led by Huawei HiSilicon, also use ARM architecture, under the pattern of Sino-US technology war, Huawei HiSilicon has been difficult to obtain ARM authorization. The new architecture, in this case, the Chinese government will naturally not trust Huida CEO Huang Renxun's claim that ARM can maintain neutrality, and it is unwilling to add another big stick to the hands of the United States to destroy China's IC design industry. According to Article 2, Paragraph 1 of the "Guiding Opinions on Declaration of Concentration of Undertakings" issued by the Ministry of Commerce of China: "The total global turnover of all business operators participating in the concentration in the previous year exceeded RMB 10 billion, and at least two of which Each operator's turnover in China in the previous year exceeded 400 million yuan." The turnover of Huida and ARM in mainland China far exceeded this standard, and their mergers and acquisitions must be approved by the Chinese government, otherwise they will face For the risk of losing the Chinese market, this is an unbearable loss for both Huida and ARM.

And the Chinese government does have a precedent for whether or not to allow technology mergers and acquisitions to fail. In 2016, Qualcomm tried to acquire NXP, a Dutch semiconductor giant, for $38 billion. After two years of lobbying, it won the United States, Japan, The European Union, Russia and other countries approved the merger, but because of the guidance in the preceding paragraph, the approval of the Chinese government has not been obtained for a long time. In the end, the two companies did not want to lose the Chinese market, and the merger fell through.

ARM CEO Simon Segars said that being acquired is better for ARM than going for an IPO, but if the acquisition fails, an IPO will also be considered.

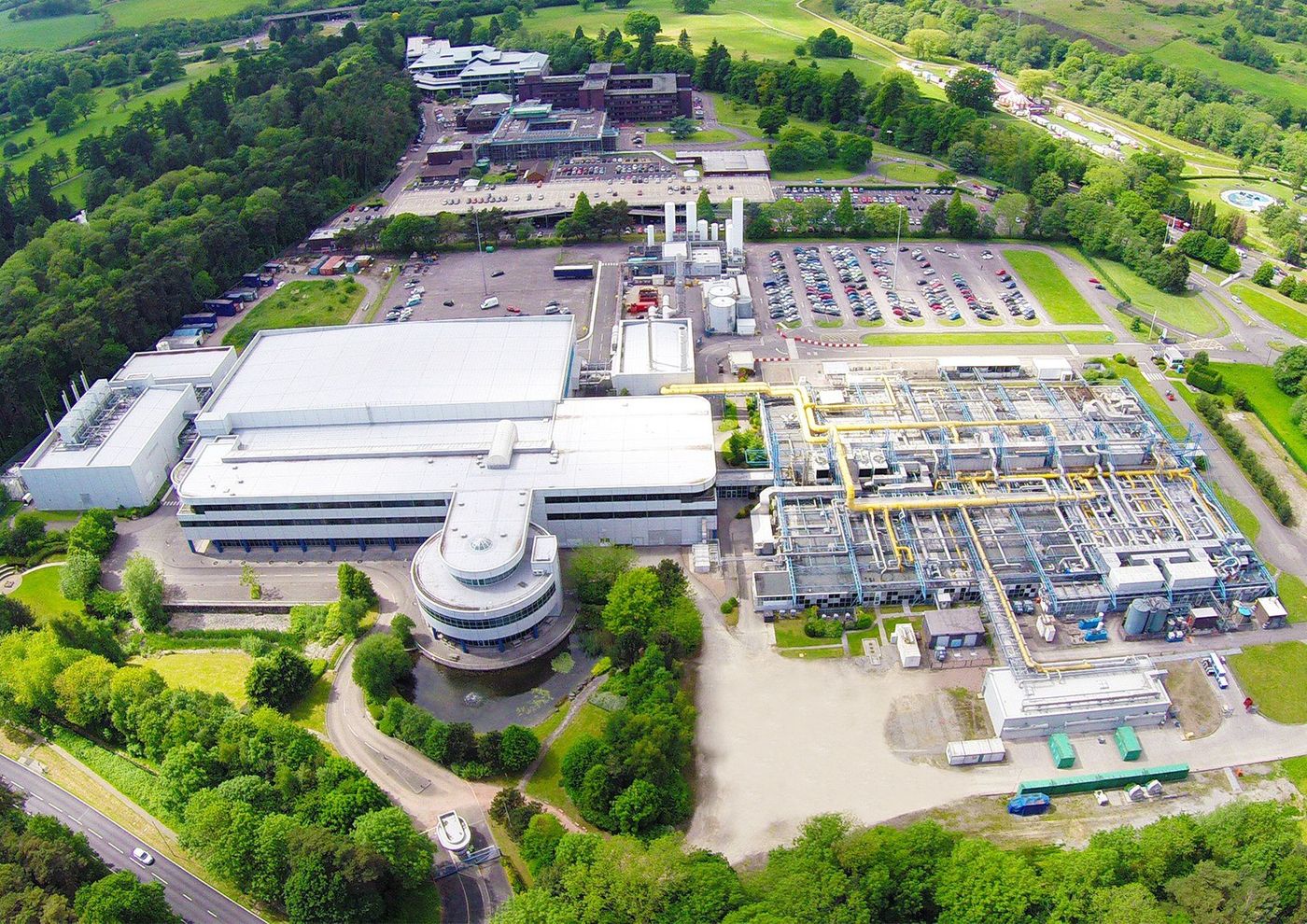

Newport: Can an "ugly girl" marry a good man?

It is not only huida in the United States that wants to take control of the British semiconductor industry. Chinese company Wingtech Technology also intends to enter the British semiconductor industry. Its subsidiary Nexperia, in July of this year, sold 63 million pounds (contract 5.64 100 million yuan) acquired a 100% stake in NEPTUNE, and took control of Newport Wafer Fab, the largest wafer foundry in the UK. Although the factory in Wales is the largest semiconductor foundry in the UK, it actually only has a monthly output of 32,000 to 40,000 wafers of 8 inches, and the process technology is 0.18 microns to 0.7 microns, while the products are application MOSFET, IGBT, CMOS and other chips for car companies.

In terms of finance, Newport Semiconductor had total assets of 44.7076 million pounds at the end of fiscal year 2020, net assets of -5.1773 million pounds, operating income of 30.911 million pounds, net profit of -18.611 million pounds, and debts owed to HSBC and the Welsh government £20 million and £18 million each. No matter in terms of process, production capacity, and financial ability, it can be described as an out-and-out "ugly girl".

Such a transaction has been questioned by many people whether Wingtech Technology is stupid and rich, why did it acquire a company with less advanced production capacity, less diligent workers than Chinese people, financial losses, small scale, and may be subject to the British government at any time? Repent", a company that was nationalized at a low price?

Xingang Semiconductor has the development capabilities of silicon carbide (SiC) and gallium nitride (GaN) materials, which are the focus of the third-generation semiconductors, while Nexperia's fabs do not yet have the development capabilities of IGBTs, so this acquisition Obviously, it is to make up for its own lack of ability and extend its product line; on the other hand, Xingang Semiconductor has established a compound semiconductor cluster "CS Connected" under the leadership of the Welsh government in 2017, bringing together local Welsh compound semiconductor companies and policy makers In early 2019, the European Commission approved a plan to invest in third-generation semiconductors, providing 1.75 billion euros for related research activities, and the Welsh government promoted its semiconductor company. To participate in this project, Xingang participated in it, and Wingtech Technology obviously took a fancy to these research projects.

This acquisition of Wingtech Technology may be compared with the case of SMIC, a leading wafer foundry in mainland China, which sold its LFoundry factory in Italy in March this year. SMIC sold 70% of its stake to Microchip semiconductors produced in Wuxi Tin, the factory is valued at about 161 million US dollars (contract 1.042 billion yuan), with an 8-inch monthly production capacity of 40,000 pieces, which is comparable to that of Xingang, and the process capacity is 150nm to 110nm , slightly better than Xingang. In contrast, Wingtech's acquisition of Xingang seems too cost-effective on the book.

However, local people believe that Newport is the only remaining semiconductor factory in the UK, and that if the British government arbitrarily agrees to sell at this price, it is trampling on the British industry. They believe that the UK should at least try to get $1 billion from this transaction; It may also lead to the bidding of local British institutions, so that Wingtech Technology will not hold more than 25% of its shares; and the British government also has national security concerns about this acquisition, and the review department will come in at any time to review the investment case; even in 7 In late June, it was reported that the UK Research and Innovation Agency (UKRI), which is in charge of scientific research funding investment, cut off investment in Newport.

Newport also holds more than 12 orders for local cooperation in the UK, most of which are from Innovate UK under the British government, and cooperates with Cardiff University (Cardiff University) to develop radar system chips, which will be supplied to British aerospace chip manufacturer Arralis and other companies . Involving sensitive projects such as aerospace companies means that it is difficult to expect the British government to approve and let companies with Chinese-funded backgrounds take over the factory.

In the free market environment, Xingang may be able to obtain further research and development capabilities through the acquisition of Wingtech Technology, and can also give back to Wingtech Technology and provide more local job opportunities. However, in the current situation where the confrontation between China and the United States is heating up, the concept of national security has been generalized, and protectionism has been restarted, multinational mergers and acquisitions are becoming more and more sensitive, and some companies with development prospects may not get enough funds to develop their development. Restrictions, whether for ARM, Newport or the UK government, will not end well.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More