𝓑𝓮𝓪𝓻 𝓜𝓪𝓻𝓴𝓮𝓽 | Little White Bear Market Survival Viewpoint

I'm just an investment novice, this article is just to record the bear market investment strategy and views formulated after personal investment has lost more than half, not investment advice! The main purpose is to make a record, which is convenient for review after the bear market has passed.

▶️ Investment direction

There are many types of investment, and putting money in a bank fixed deposit is also a type of investment. Although it should be the one with the lowest return, it is also the one with the lowest risk. If it is said that the risk of fixed deposit is the lowest in the bull market, there may not be many people who agree, but when the bear market hits, it is estimated that many people will agree (in fact, I also want to say: I will stop playing, return the money to me).

So if you feel that your heart can't stand the blow of the bear market, you should go to the bank for fixed deposit, or buy government bonds as a capital-guaranteed investment. Conversely, the bear market should be regarded as a good opportunity to buy on dips and rise to the challenge! I’m not talking sarcastic words, I only entered the market at the end of 2020, so now the funds in both the stock market and the currency circle have been cut by more than half. In the previous LUNA event, in addition to the original holdings, I bought a few hundred dollars on dips. , all reset to zero. Although it wasn't too much, I didn't know how many times I shouted "stop playing, return the money to me". Fortunately, although he is a novice, he also knows that investing can make or lose money, so he can only invest with spare money, so although he loses money, it does not affect the quality of life.

▶️ The bear market is both a crisis and a turning point

Whether a bear market is a crisis or not can be known just by looking at your own stock and currency holdings. What about the turnaround? This is to ask yourself do you still have confidence? If you feel that all this is like LUNA and can't stand up again, it must be only the crisis that has not turned around. On the contrary, this is a good time to buy. Although it may not be the lowest point, won't it be profitable when it returns to the previous high? For example, a bitcoin is now only less than 20,000 US dollars. If you buy one and wait for it to return to the high price of nearly 70,000, won't you make 50,000?

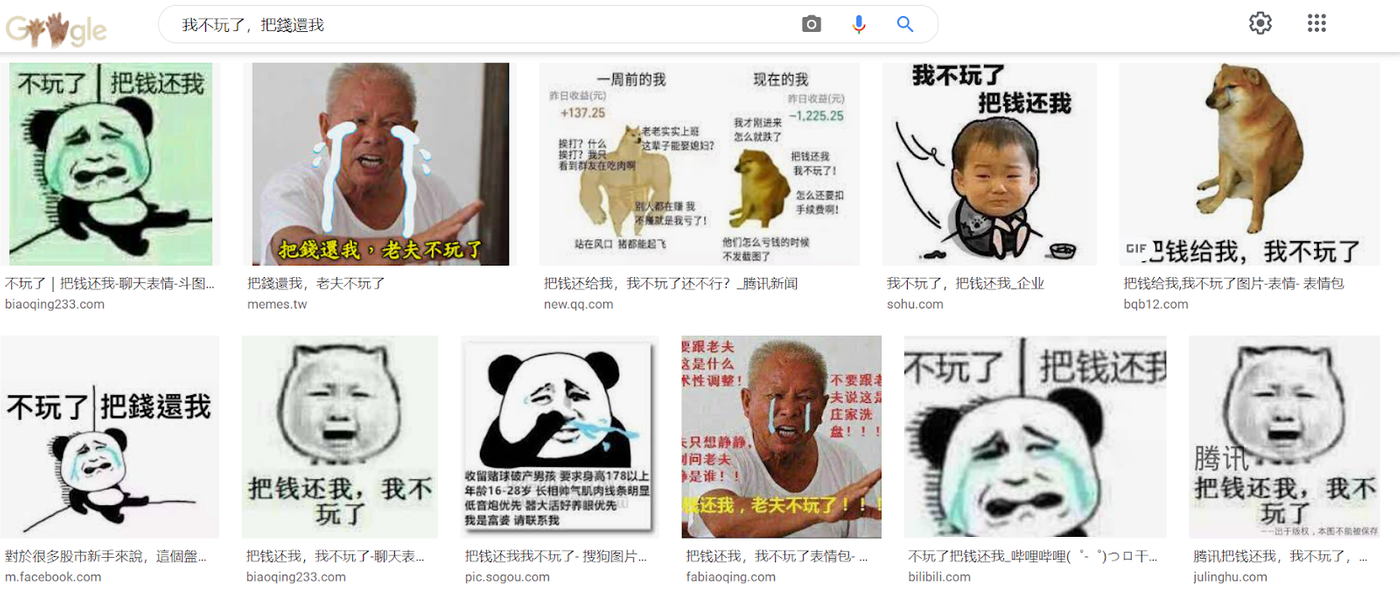

The superficial truth is over, let’s talk about value investing that sounds relatively high. The basic concept of value investing is that the bigger the margin of safety, the better.

Margin of Safety = Intrinsic Value of Stock - Stock Price

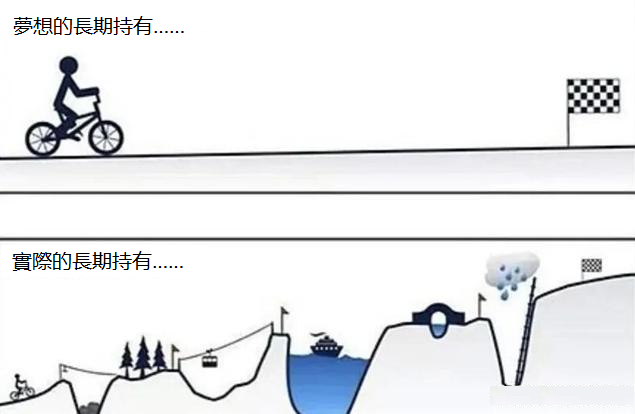

Stocks as defined above can also be exchanged for cryptocurrencies. Therefore, buying when the bear market stocks/cryptocurrency plummets can ensure that your margin of safety is larger than buying in a bull market, and it will also make you feel more at ease than others on the road to long-term holding. After all, long-term holding is not easy. thing.

▶️ What to buy?

It is said that investing cannot put all eggs in the same basket, so I personally choose US stocks and cryptocurrencies.

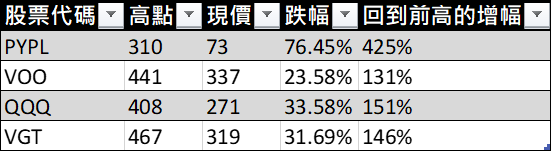

My expectation for U.S. stocks is stability

If you want to make more money, buy a single stock, and of course you will lose more. Like the Paypal I bought before, it has dropped from a peak of more than 300 US dollars to more than 70 US dollars. Therefore, in this turbulent market this year, it is generally recommended to buy ETFs. Although you earn less, you will definitely lose less, and you are not afraid of falling apart like a single stock. The most common U.S. stock ETFs are VOO, SPY, QQQ, etc. I personally choose QQQ.

The reason for choosing QQQ is that QQQ contains more than 100 companies, most of which are technology stocks, and the decline is relatively high, but I believe that human demand for technology will only increase and not decrease, so QQQ may continue to fall, but it will eventually recover. Back to the previous high.

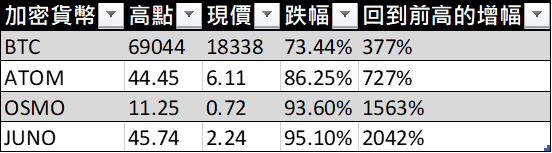

My expectation for cryptocurrencies is high returns

Cryptocurrencies are not as good as U.S. stocks, with Dow Jones, Nasdaq and S&P 500 indices. Personally, although the impact of Bitcoin on the entire currency circle is slowly decreasing, it is still the main guideline at present. If Bitcoin crashes, it is hard to imagine that other cryptocurrencies can survive, so if you still have confidence in cryptocurrencies, buying Bitcoin in a bear market is like buying a U.S. stock market ETF. It may not make as much, but it is relatively stable.

So my plan is mainly to buy Bitcoin, and then buy ATOM and OSMO from the COSMOS series that I am more confident in. In addition to preparing for future airdrops, I also expect them to return to the previous highs that can bring me. return.

▶️ How to buy?

Experts have a variety of ways to see when to buy. For a novice who knows nothing, I can only choose to buy on a regular basis or in batches.

Regular quota is an investment strategy that buys a fixed amount of money every fixed period of time; fixed deductions for each period, regardless of market ups and downs, use the long-term averaging method to reduce costs.

Buying in batches is to divide a sum of money into several parts, and only buy one part of money when the predetermined ups and downs are met. For example, 1000 yuan is divided into 200 yuan, and every time it is 10% lower than the last purchase price, it is bought.

I personally plan to deposit a fixed amount into the exchange every two months, but I will wait until it is 10% lower than the last purchase before buying, and each purchase is limited to the funds accumulated in two months, that is, if I wait four months When I wait for a buying opportunity, I will not use up the funds accumulated in four months in one go, but use the excess as a cash reserve. Personally, I think this strategy will be more able to ensure that I can buy a relatively low point than a simple regular quota. As for whether it is really suitable for a bear market, I can only wait and see.

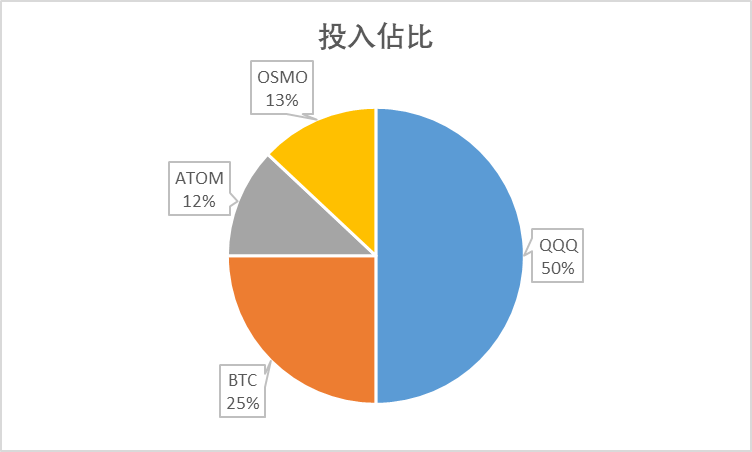

Each time the funds are divided in half to QQQ and cryptocurrency, the cryptocurrency part will be divided into two parts, one to buy Bitcoin, and the other to buy ATOM and OSMO. Exchanges such as FTX have a minimum purchase limit for Bitcoin, so they will buy and store Bitcoin from the Crypto.com App, and then slowly study the Bitcoin wallet to keep it by themselves.

▶️ Mentality adjustment

The bear market should not be very easy for everyone's accounts. We can only hypnotize ourselves. The bear market is a good opportunity for us to buy more cheaply. Let’s share with all the friends who are stuck, work hard together, learn more about investment knowledge, and then save money to continue to buy, and buy a spring! ! !

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!