Is the recent rise in house prices a normal rise caused by rigid demand?

The housing market has risen like this, and a bunch of industry players are saying that the recent rise in housing prices is a normal rise caused by rigid demand.

To use a less accurate analogy, this is actually a bit like a mobile game with class gold. The theoretical class length is the most important. A large class length is worth the income of tens of thousands of micro-lecture players, but the foundation of the game is still no class players. There is no way for a class leader to have a good time without a classless player. Therefore, investors are of course the most important, but it must always be said that only if they are strong enough, someone can take over.

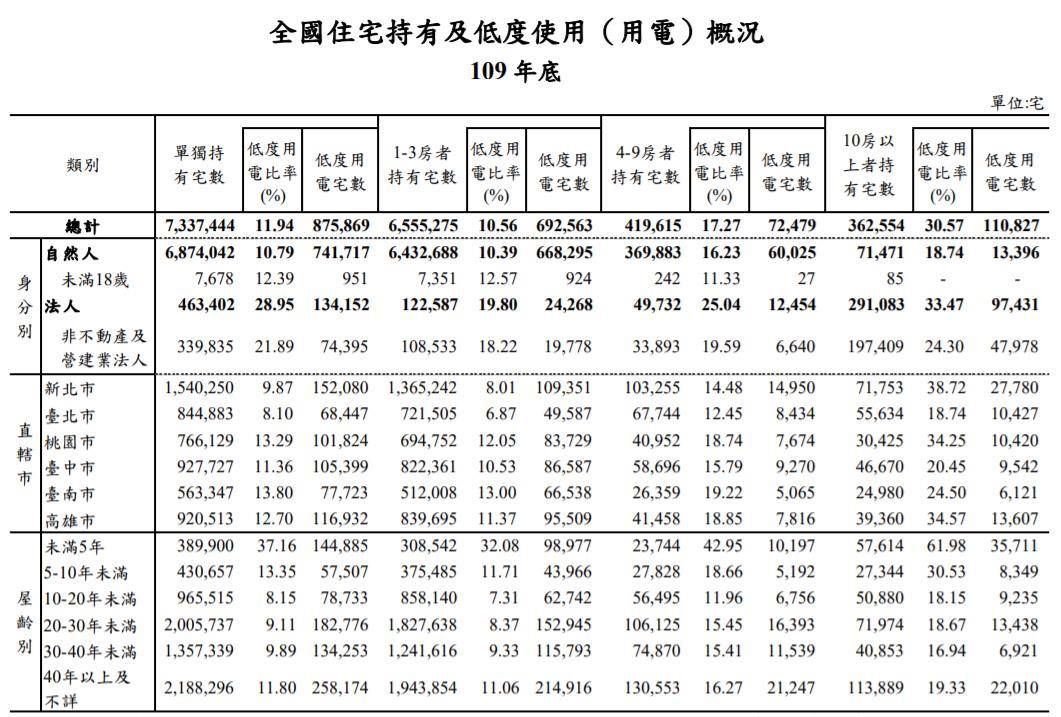

Speaking with data, I talked about housing stock more than the average number of households in Taiwan, so the rise in housing prices is not entirely just a need. However, according to the Ministry of the Interior’s July Statistical Weekly Report, which checked the age of houses and vacant houses, the vacancy rate of newly built houses “less than five years old” was the highest, with an average of more than 30%. I look forward to the next statement. .

In fact, on the other hand, I am also very curious. The proponent is that the increase in housing is a rigid demand. How do you know that these demands are just a rigid demand? Not everyone likes to be inquired about the purpose of buying a house. Could it be that these business owners are willing to take the risk of performance to help the government do policy investigations?

If that's the case, then there really should be a medal for them.

Well... it's called "gong in the housing market"

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More