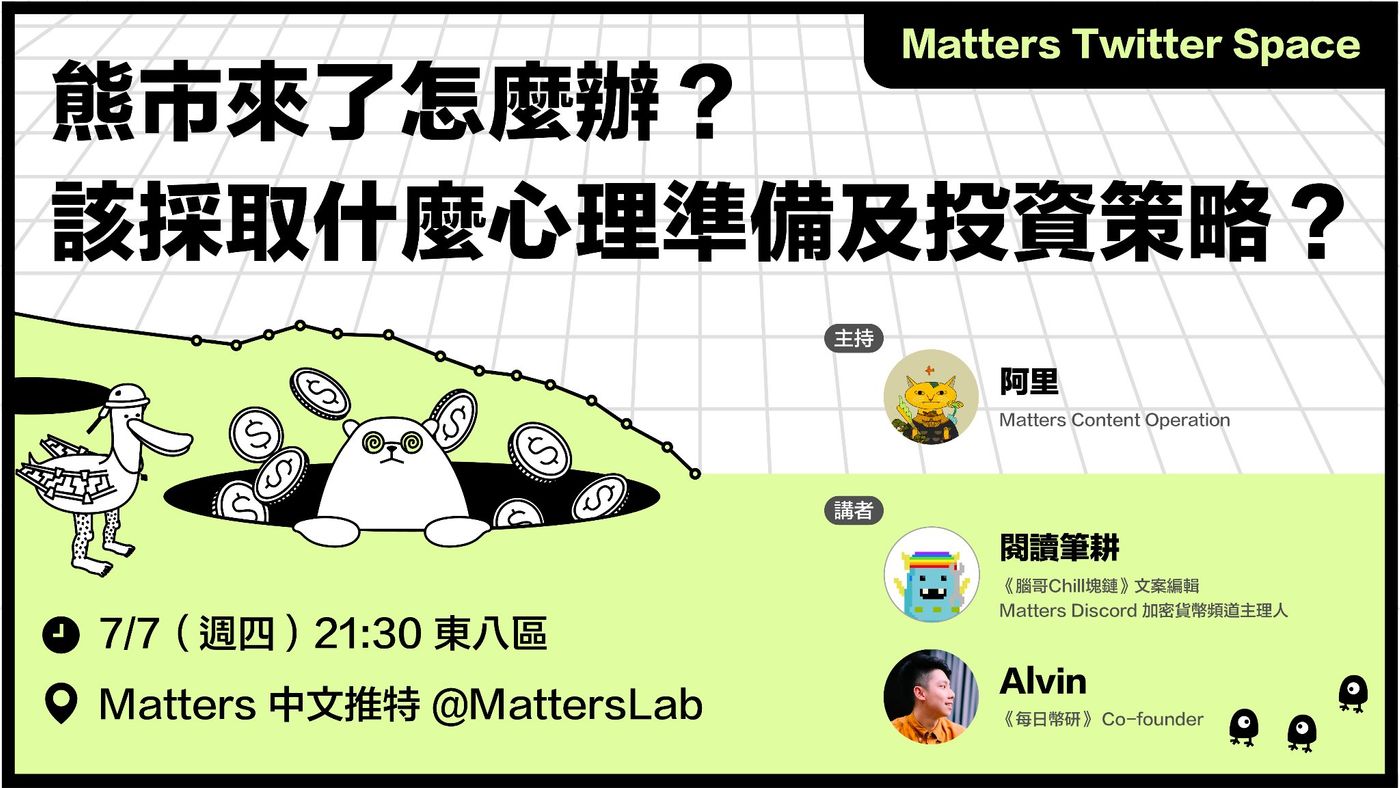

Read Bigen|Matters Twitter Space event <What should I do if the bear market comes? 〉Interview outline and belly draft

I attended the Matters Twitter Space lecture yesterday. I prepared a draft for the interview outline, briefly outlined the direction (short answer), made notes and shared it.

1. Please briefly introduce yourself and briefly share your participation experience in the crypto world/coin circle.

Hello everyone, my name is @Reading Bigeng, you can call me Leo, I am engaged in the financial industry.

Since August 2020, he has started to write in Matters, obtained LikeCoin, and then got in touch with the new world of the crypto world/currency circle; even by the end of March 2022, he will also usher in a new career , currently serving as the "brain brother chill block chain" > Copyediting.

*

2. Is this your first time experiencing a bear market? Do you have a bear market experience worth sharing, or a wake-up call for listeners?

For the first time, I experienced a bear market in the "currency circle".

*

3. Under the bear market, what principles do you personally have for survival or risk diversification? How has this bear market changed your investment strategy?

Regardless of bulls and bears, abide by the principle of asset allocation , control the proportion of their cryptocurrency positions in the total asset value, about 7~10% of the total asset value; as the belief value increases, the plan gradually increases the proportion, most of which are stablecoins (Anchor currency) intervenes, reaching 30% or 40% of the total assets.

The biggest change in my allocation strategy brought by this bear market is that in addition to dispersing "assets", "time" should also be placed in different baskets, and the "liquidity" of assets should also be well dispersed .

*

4. What is your observation on the current market environment? And predictions for the future?

Referring to the historical experience of the S&P 500 index in "Physical World", it has an average duration of 289 days in 19 bear markets in the past 140 years, so it is judged that the bear market (from the high point in November last year) will last at least until this year. October. This is a very crude statement, and it is to give a sense of the fact that it seems that it will take several months (or more) to usher in a turnaround.

*

After reading a lot of discussions on the correlation between Bitcoin and the stock market , from the original "safe haven, value preservation" function (digital gold), it is expected that it can do more, such as being bought as a technology growth stock, emphasizing the "value-added" space , prices also seep into the more investment/speculation component.

Continue to observe the linkage between Bitcoin and the traditional financial world in the "physical world".

*

5. Suppose a novice in the currency circle asks you how to survive the bear market, what advice would you give him?

Before listening to the "M Viewpoint" note sharing, add some of your own interpretations.

- Make sure you have enough cash (living funds) on hand

👉 No one will be "forced" to sell positions. - Cherish the stable cash flow you have (silver bullet)

👉 The key is to "continue" to enter the market. In order to overcome the weakness of human nature, it is recommended to intervene on a regular basis (reserving room for oneself to make mistakes). - Self-construction of mentality 👉 Tell yourself "it will fall after buying".

👉 Think in terms of "percentages" and think about the concept of the Risk Suitability Questionnaire . - Read less disks and read more books 👉 Calm your heart, and take advantage of this period to learn "fundamental" things.

*

6. Knowledge is the best fortress, please recommend three Web3 related information sources (not limited to investment) that you think are reliable.

- Matters Lab Discord Web3 study session every Friday.

- News aggregators (such as Binance Alerts).

- Follow twitter bosses.

- Block Potential (article).

*

7. What do you think is the main reason for this bear market: the chain reaction caused by the collapse of Luna in the currency circle? Or is it the general economic impact of Fed rate hikes, inflation, etc.?

Currency + Psychology = Trend.

I feel that the latter component is larger. If the funds are compared to water, the faucet is now tightened.

*

8. In this crash, you can see that CEXs have successive accidents (3ac, blockfi, celsius..etc), but DEXs are all right. Do you think this will allow you to move more assets to the chain?

Be neutral.

In addition to DEX, more assets will be moved to "giant" CEX (currency price tracking network - such as CoinGecko - CEX with better comprehensive evaluation).

*

9. Bankless said that this is not a bear market, but a build market. Have you seen any build projects that are worth paying attention to?

I don't particularly pay attention to a particular project, but I do have an idea that was put forward by Ethereum founder Vitalik Buterin :

- "Soulbound Tokens" (SBT ).

- "Learn-to-Earn".

If there are projects that actually embed these concepts in the future, I will take a closer look (laughs).

*

10. The currency circle emphasizes narrative. What do you think the next stage of Web3 narrative will be?

refer to

Web1: read

Web2: read, write

Web3: read, write, own

Imitation of the above format, my (self-created) annotation is:

Web1: loan

Web2: loan, security

Web3: loan, security, token

In the past, whether it was loan/security, for investors, the ultimate goal was related to "money" (interest, capital gains, dividends); while tokens can do more, and things other than "money" need to be more More description, this is the narrative I want to see in Web3.

🌱 Join [ Zhongshu Nervous System ] around the fireplace👇

The special topic #Reflections on writing and #頭内心話is being serialized.

🌱 I am on other platforms👇

【 Facbook | Twitter | Liker Social | Matters | Medium | vocus 】

🌱 My teaching text and invitation link👇

≣Sign up for noise.cash | Become a "noise coffee" and experience social finance together .

≣Sign up for Presearch | The search to earn that kills three birds with one stone.

≣Sign up for MEXC | Go and jump on the Matcha Exchange, cash out OSMO and run wool .

≣Sign up for Potato | Three things to learn from Potato Media .

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More