Crypto Investment Diary 12/18 - Where is the global monetary system headed?

When I was discussing cryptocurrencies with my friend (the founder of Changren Fund ) last week, I started from the perspective of the global reserve currency — the US dollar, if there is a crisis of confidence in the U.S. dollar, it would be fatal to establish all economic markets in the world, but we both have one. There is a big difference: the US dollar is only one of the major currencies in the world, and there are also the euro, the yen, the renminbi, etc., which can continue to be used as a medium of exchange for economic activities.

I also don't have a clear answer, but some ideas can be shared and discussed.

I clearly feel that the U.S. dollar is not just "one" of the major currencies. The U.S. dollar is the basis for the price anchoring of all currencies in the world today. The world's major economies hold huge U.S. dollar assets, which is not the case in other major currencies.

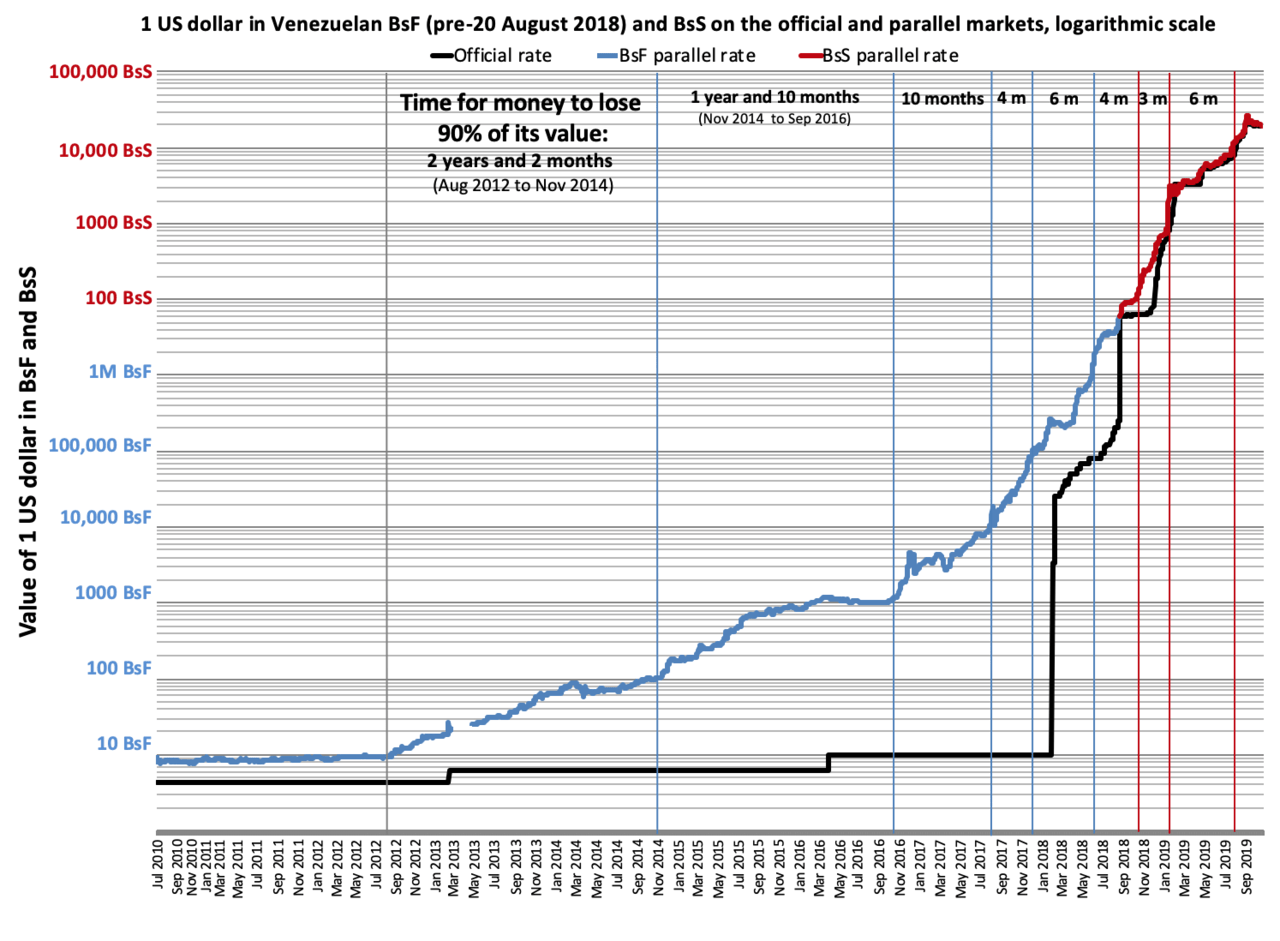

Then I want to use the more extreme Venezuelan fiat currency: the Bolivar as an example to see what happens when monetary policy gets out of control. When Venezuela's monetary policy got out of control, the result was that the exchange rate of the Bolivar against the US dollar skyrocketed wildly. Food, the price of Bolivar has risen more than ten thousand times a year , but the price of US dollars has been much more stable.

You read that right. It has risen more than 10,000 times within a year. The money for a house a year ago can only be bought for one meal today. This is the tragic situation after the monetary policy is out of control. Needless to say, the crazy depreciation of the Bolivar against the US dollar is no longer described by several times, but directly measured by the order of magnitude.

This is when there is another currency (the US dollar) that can be relatively stable as a price benchmark.

Now imagine the world as a large country and the underlying currency is called the US dollar. What would happen if the US dollar policy got out of control?

First, will the regional currency become the stable price benchmark? I don't think so, because when a structure disintegrates, it collapses down instead of looking up for support . The U.S. dollar is the foundation of regional currencies. Looking at the impact of the U.S. dollar policy on the exchange rates of various countries, it is clear who is on top and who is on the bottom . Therefore, the disintegration of the dollar needs to find a more basic unit of measurement.

2. Looking at the history of mankind for thousands of years, money has come and gone, and the only constant medium of exchange is gold. Although human beings left the gold standard in 1971, the status of gold is irreplaceable in people's hearts. Therefore, the disintegration of the structure will go down to find gold. .

(I know this is a cryptocurrency diary, but I am deliberately avoiding Bitcoin today. Only those who understand the dollar-based monetary system and its crisis will have the opportunity to understand the value of Bitcoin as digital gold.)

The question is, has the U.S. dollar's monetary policy been out of control? Let's hear what the experts have to say.

- The root cause of the global financial crisis in 2008 has not been solved, but has been temporarily suppressed by means of palliative measures, resulting in a financial system that is now seeing more and more instability. (The fundamental reason is that the economic model based on inflation and credit expansion over the past century has encountered problems such as population structure and long-term economic growth slowdown, and its basic structure needs to be significantly adjusted.)

- An important phenomenon of this unstable financial system is the global shortage of US Dollar (Global Shortage of US Dollar).

- In September of this year, the Federal Reserve (FED) held its regular interest rate decision-making meeting two days. Without warning, the REPO interest rate soared to 10+%, the first time in ten years. The reason is unknown, but the obvious problem is that there are not enough dollars between banks. Borrowing, so interest rates soar.

- Since that day, the FED has launched an asset repurchase program, which simply means printing money to banks to make up for the funding gap. You don’t believe it, no one knows how big the gap is! It has been nearly three months in mid-December today. The FED needs to inject as much as 100 billion US dollars per week to barely suppress the funding gap, but the REPO market shows no signs of stabilizing, so that the repurchase needs to continue and the amount is increasing.

- What the experts in the film mainly talk about is that no one knows not only how big the funding gap is, but also why banks are reluctant to lend money to their peers. As the saying goes, no one does a business that loses money, and someone who kills (but makes money) must dare to do it, but now it is obviously profitable. The REPO interest rate is soaring, and there is a high interest rate to make money immediately, but there are not enough banks willing to do so. Lend dollars, what happened?

- The expert said that only the top executives of the bank knew about it, and we had no way of knowing it from the outside world, but it can be inferred that things must be so big that people are afraid (or unable) to take advantage of obvious money-making opportunities.

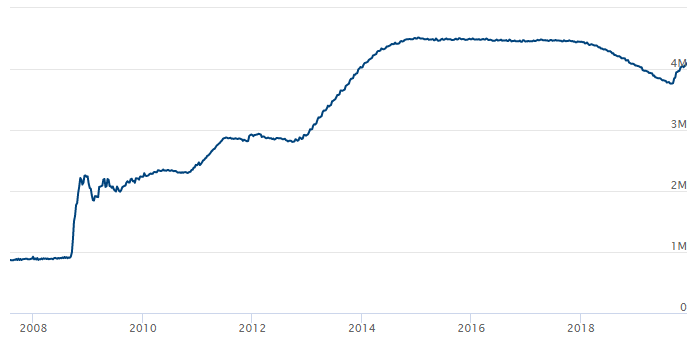

When the global financial crisis occurred in 2008, the Fed quickly lowered the interest rate to 0%, and with a lot of money printing, the banking industry that was on the verge of bankruptcy was rescued. One of the effects is that the Fed needs to buy huge assets. The balance sheet shows the magnitude of asset growth:

This is the official FED information , everyone can check it. It can be seen that since the quantitative easing started in 2008, assets have first risen in a straight line, and then slowly increased until 2018, when the Fed tried to reduce assets and raised interest rates, and wanted to return to the so-called normal situation in the long run: interest rates 2-3%, FED assets gradually shrink and even stabilize.

As a result, it was discovered in September this year that this was a serious mistake, because the current financial system can only rely on the ever-increasing dollar to support the illusion that the economy is still growing on the book, so the Fed has returned to the only means since the 2008 financial crisis: lowering interest rates (Three cuts since the end of the year, the base interest rate was lowered from 2.25% to 1.5%, trying to release the deposits hidden in the bank), restarting quantitative easing (although the Fed insists that this time can not be called quantitative easing, but from the balance sheet See, it matches all QE effects).

Fed assets are expanding at the current rate and will reach new all-time highs early next year. In other words, we are at a point in history when the dollar is the most circulating in the market, yet what the REPO is telling us is that there is still a shortage of dollars in a functioning market.

Faced with this question, there is a simple answer: uncapped and constantly adding dollars to the market. But the Fed is very clear that the end of this road is the collapse of people's confidence in the dollar, so it can print money, but it cannot be unlimited.

I look ahead and suppose what happens after a crisis of confidence in the dollar?

In fact, the global reserve currency will be replaced every hundred years or so. It is not unusual. The last time people lost confidence in the British pound , which led to the United States, which has a stronger military force, replaced it as the global reserve currency with its national currency, the US dollar. .

But today's world is very different from a hundred years ago: globalization , the economic structures of countries in the world today are heavily interdependent, and no one of the major economies can truly be self-sufficient behind closed doors. The main reason why the policy-led dollar is becoming more and more out of place in the era of globalization: American interests do not represent global interests.

What about this time? Switch to Euro, or RMB? It doesn't work. National or regional currencies are all following a monetary policy that is beneficial to the local area. Isn't this the old way of the US dollar? The basis for the crisis of confidence is still there.

Unless we can find a currency that all human beings trust, gold is an option that must be considered, so there is a group of economists who propose to return to the gold standard, but it is easier said than done, the era of globalization/digitization/internetization , How to achieve fast/cross-network clearing for gold? It is definitely not possible to move physical gold all the time. It is not necessary to go to paper gold (Paper Gold), do digital settlement through the Internet, and then move physical gold after the total settlement at regular intervals.

But do you believe that this will be the currency settlement system of mankind in the 21st century?

The era of physical material as a reserve has become increasingly maladaptive as early as human beings have begun to use paper money. In 1971, they withdrew from the gold standard. Humans decided that currency and physical gold must be settled, which is just an inevitable step in the process. The next step in the era of globalization/internetization is how to create a network native base currency that everyone can trust.

As early as the beginning of 2009, we already had a currency clearing network with a global level , open and transparent monetary policy, unmodifiable due to decentralization , and continuous operation for 11 years. Yes, it is a blockchain-based Bit coins .

Bitcoin Tip: 3QqoDDrvWNZs6Gf9ZfD2gdbidhcdKs4kxJ

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More