A Brief History of Sales Tax in the United States for the Decade (2010-2020)

When I was browsing https://shopsolarkits.com/ , a professional online shopping site for solar modules recently, I noticed the big characters "* No Sales Tax On Most Orders - Ends June 30th, 2020 *" at the top of the site. Completely end the history of online shopping without sales tax.

Think about living in the United States for more than ten years and shopping online in the United States for more than ten years. Since I noticed the difference in sales tax about ten years ago, I began to consciously shop online, or carefully select local cities with lower tax rates, Or a sales store in a neighboring state to save money, in this regard, it is possible to write a brief history of the sales tax from a personal point of view.

Unlike store prices in other countries that include sales tax, store prices in the United States do not include sales tax, and the total price after adding sales tax is not known until payment at the cashier. So what is the percentage of Sales Tax? There really isn't a single answer to this. It depends on the address. For brick-and-mortar stores, it is the address of the store.

There is no federal (nationwide) sales tax in the United States, which means that the IRS does not collect taxes on sales. State, county, and city governments collect sales tax. Depending on the state laws, for example, Oregon, Montana, New Hampshire have no sales tax statewide, which is why Portland/Portland, Oregon has become the most popular shopping capital. And densely populated places like California and New York also tend to have high sales tax rates. Specifically for California, the state law defines the scope of taxes that the state government can levy, and the minimum amount is 7.25%, while additional levies are allowed at the county and city level, but the total maximum cannot exceed 10.5%. Generally speaking, the city council can pass a bill to increase the tax amount to support local additional expenses, such as better public schools, etc.; Arcadia, a city in Southern California, has a good public high school, and the total sales tax here is 10.25%, including the state 7.25% Los Angeles County 2.25% Arcadia City 0.75%. The entire Los Angeles County is an area with relatively high sales taxes. Since 2019, the first city in California with a total tax rate of 10.5% is also in Los Angeles County.

So what about online shopping? Use the shopper's delivery address. This is only now that all online shopping rules are clear. But that was not the case between these ten years, until 2018, two years ago.

So what happened in 2018? In fact, it didn't just happen suddenly this year, but since Quill Corp. v. North Dakota lawsuit hit the US Supreme Court in 1992. The Quill Company at the time was pitted against the North Dakota state government. In 1992, the Supreme Court ruled that Quill won, arguing that mail-order purchases delivered to North Dakota residents did not have to pay sales tax to the North Dakota government; The mail order market is still very small, and Quill is very small, with no physical presence in North Dakota.

The judicial system of the United States is a common law system, which is accumulated in the form of one specific case. It can be said that this case in 1992 was the key to Amazon's growth into an online sales giant. With the precedent that the company won in the 1992 case, these online stores can buy goods directly to out-of-state buyers without having to pay sales tax to the other state government. This is very attractive to consumers in those places. It's the equivalent of a trip to Portland for duty-free shopping without actually having to spend money on airfare to get there.

From my personal experience, shopping on Amazon was a paradise until 2014/2015. Buying from most sellers is tax free. Because in addition to the mainstream B2C model, there are many small and medium-sized third-party sellers on Amazon. As long as the sellers do not have business in my state of residence, they do not have to pay taxes.

But state governments, which have lost more and more sales tax revenue over the years, won't sit still.

In 2010, the Colorado state government passed a decree requiring out-of-state online sellers to submit online shopping reports of Colorado residents to the Colorado state government, so that the state government can settle the annual tax return for residents of the state, and recover when shopping from other states. Unpaid sales tax. Then the DMA agency sued the Colorado state for its attempt to overturn the conclusions of the 1992 Quill case. Several court sessions were held in federal court between 2012 and 2015, each with a winner and a loser, culminating in a settlement in 2017; the DMA agency dropped the case and the Colorado state waived its recovery from past years.

(I haven't investigated the nature of the DMA in depth here, but it is probably a research-based think tank. It is not difficult to guess that it is the strong support of the online shopping group.)

In 2016, the South Dakota state government directly passed a bill requiring all out-of-state sellers to collect sales tax according to South Dakota state standards when selling online to South Dakota residents. This is actually a direct request to overturn the 1992 Quill case.

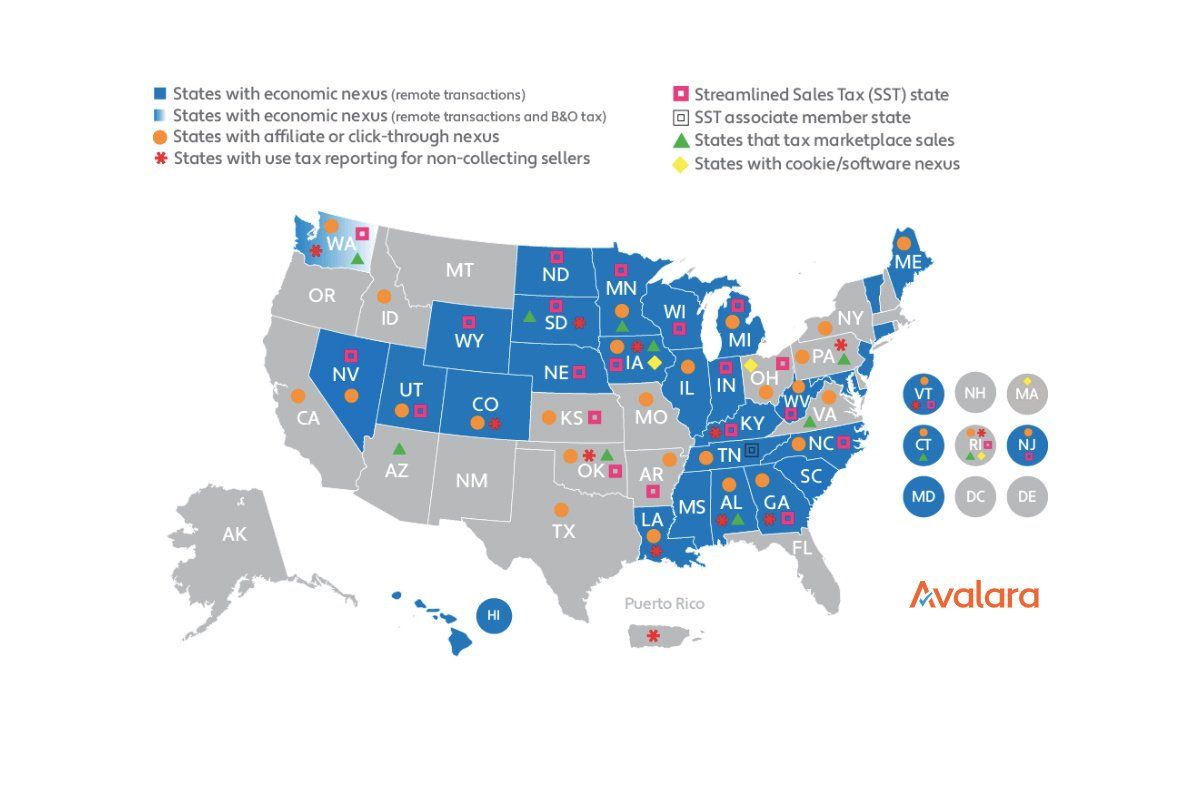

By 2017, 20 other states had similar bills either passed or pending.

In fact, this South Dakota state's bill is still a big deal, with some reservations. It is mainly aimed at giants such as Amazon, large and medium-sized online sellers, and it is too harmful to the state government's tax source; small sellers ( Annual South Dakota state turnover of less than $500,000, or 200 transactions) is exempt.

In the United States, in addition to online shopping giants such as Amazon, there have always been small and medium-sized online sellers in vertical fields such as Wayfair (furniture), Overstock.com, Newegg (electronic appliances), and Systemax. After all four received tax orders from the South Dakota state government at the time, the smaller Systemax went ahead and started taxing new purchases, while the other three refused to concede. Prosecution continues in federal court against South Dakota State.

Until the decisive moment: In 2018, the Supreme Court ruled that the South Dakota state government won by 5:4. The focus is on economic considerations. Online shopping in 2018 is not comparable to 1992. If no tax is allowed, many state governments will go bankrupt. So far, the impact of the 1992 Quill case has been completely reversed. After the buffer period is April 2019, all sellers must pay additional taxes to the state of the consumer.

https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf (For those interested, you can directly read the original text of the Supreme Court decision)

Aftermath (Post-2018)

Because Amazon has self-operated warehousing and has established warehouse systems in many states to meet faster delivery systems, it has begun to gradually increase sales tax several years before the 2018 South Dakota v. Wayfair, Inc. case. Because it also knows that a big tree attracts wind, no matter how powerful a company is, it is impossible to fight against most state governments in the United States by itself.

And those small and medium-sized online sellers (Wayfair, Overstock, Newegg, B&H PhotoVideo) can choose to continue fighting on the basis of the 1992 Quill case in the past few years. turnover, annual profit.

Personally, before 2018, B&H PhotoVideo was my first choice for SLR cameras, lenses, Laptop computers, etc. After all, you can save about $100 in tax on $1,000 worth of goods, which is very attractive. powerful.

This is purely from the point of view of a consumer, of course choosing no tax or a low tax. Take the example above. Arcadia City is located in Los Angeles County, so the sales tax of 10.25% is high, but it is actually on the edge of the territory of Los Angeles County. Go east on Highway 15 to Ontario Mills, a large shopping mall, where you can shop at a 7.75% tax rate. That 2.5% difference isn't worth a daily trip, but a monthly, or quarterly trip is still worth it when you're on a big-ticket shopping schedule. This can also be seen as an alternative vote with feet.

B&H PhotoVideo also had to levy sales tax on all online shopping after 2019, but it has played a new trick. By using a bank co-branded credit card, you can pay tax first, and then return the equivalent tax to the card in the form of rewards. , to encourage re-consumption. Whether the credit card is worth it is another question.

Note: Arcadia is a place I used to live in and have been away for a long time now. I've been canceling my Prime membership for years since Amazon also had to pay sales tax, and non-members can still continue shopping on Amazon, it's just that shipping is slow to 5-7 days or more. In this way, I appreciate the traditional way of shopping in brick-and-mortar stores or even small stores, which is a more direct support for the local economy.

I also made a small tool, a data visualization web page, showing the sales tax amount of various places in shades of color. When I showed it to my friends, it seemed that I had discovered the New World. It was the first time I realized that the difference in tax rates was so intuitively presented, and I said, "Aren't you encouraging everyone to evade taxes?" It's not that simple. In fact, duty-free shopping havens like Portland have been around for hundreds of years and are a priority shopping destination for Washington state residents. The 5-hour interstate road trip can be well worth it; then Canadian residents along the border know the whole of Canada Both are higher than the US sales tax, often visit Washington state, and even buy gasoline in large quantities. It's all the same vote with your feet.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More