PayPal launches its own stablecoin: an open payment tool that connects two worlds

Let me announce the good news first. The Podcast program of Blockshield was recently selected by Apple's Apple Podcast editorial team as a featured program and recommended to listeners on the most prominent position on the Apple Podcast homepage. This is an important milestone for the block potential, and thanks to the paid support of members, we can continue to produce good content and get more recognition!

In addition, the Citizens' House of Optimism is currently selecting the Citizens' Representatives for the next RetroPGF 3. Although in fact it is not voted on, but appointed by existing citizen representatives. But Optimism has a self-recommendation section , and I encourage everyone to pitch in. In the future RetroPGF selection, there will be more citizen representatives who have seen the potential of the block to balance the resource gap between the Chinese and English worlds.

Finally, on Tuesday, I recommend everyone to verify Gitcoin Passport by hand. If you encounter any difficulties or your score is less than 20 points, you are welcome to ask questions on Discord and refer to the discussions of other members. Into the title.

This week, the third-party payment service provider PayPal announced the issuance of its own U.S. dollar stablecoin PayPal USD (referred to as PYUSD), adding a new option to the market. This article will first explain what business PayPal is doing and why they launched the PYUSD stablecoin?

PayPal

PayPal was founded in 1998. At that time, personal computers had just begun to be popularized, and people's main life and work were mainly based on paperwork. I remember back then, a mail-order catalog would be circulated in school classes to see if there was any stationery, books, or household items they wanted to buy. In today's words, it should be the "net auction" of paper work.

Mail order is very troublesome. Everyone has to wait for the product catalog to be passed on to them, and someone is responsible for counting who wants to buy what, collects the money, sends out the mail order form, and at the same time takes the transfer slip to remit the money. I believe that people of my age should have had this childhood memory.

Later, when people had computers and connected to the Internet, mail order was slowly replaced by online auctions. The things you can buy are no longer limited to a few pages of product catalogs, and you can also directly contact sellers on the Internet. It seems that only the catalog is digital, and the payment is still as troublesome. When I was shopping online for the first time, I went out to send money to the seller through an ATM immediately after placing the bid, and the order was completed. Even earlier, some people would send paper checks or even money orders to pay.

The same situation also happened in the United States. The two founders of PayPal, Peter Thiel and Max Levchin, discovered at the time that the way people bought online auctions on eBay was quite primitive, placing bids online, but paying with paper receipts. PayPal's original intention was to improve people's online auction payment experience-online bidding, online payment-and the first product was to let people replace their home addresses with email addresses.

Buyers only need to fill in the seller's email address, and the other party can receive the money. Since then, buyers no longer have to go to the post office to remit money, and the speed of remittance has also increased significantly. Seeing more and more people paying with PayPal, the online auction giant eBay acquired PayPal in 2002 for $1.5 billion.

By 2009, PayPal found that people's payment scenarios became more diverse, such as dinner parties among friends often have to transfer money to each other. Therefore, PayPal acquired Venmo, which has both social and payment functions, to further expand the payment landscape. The current Venmo can be said to be a must-have artifact for young Americans to eat and unwind their accounts. To put it bluntly, PayPal has only been doing one thing for more than 20 years since its establishment - digital payment - but PayPal will also launch different products as technology develops and people's habits change.

This week, PayPal announced that it will launch a new product, the PayPal USD (PYUSD) dollar stable currency, and its symbolic significance is self-evident.

PYUSD Stablecoin

According to PayPal's press release :

PayPal today announced the launch of the U.S. dollar stablecoin PayPal USD (PYUSD). PYUSD is held in reserve by USD deposits, short-term U.S. Treasury bills, and similar cash equivalents, and is convertible into USD at a 1:1 ratio. "People transitioning to digital currencies will need a stable set of tools that is both digitally native and easily linked to fiat currencies like the U.S. dollar," said Paypal CEO Dan Schulman.

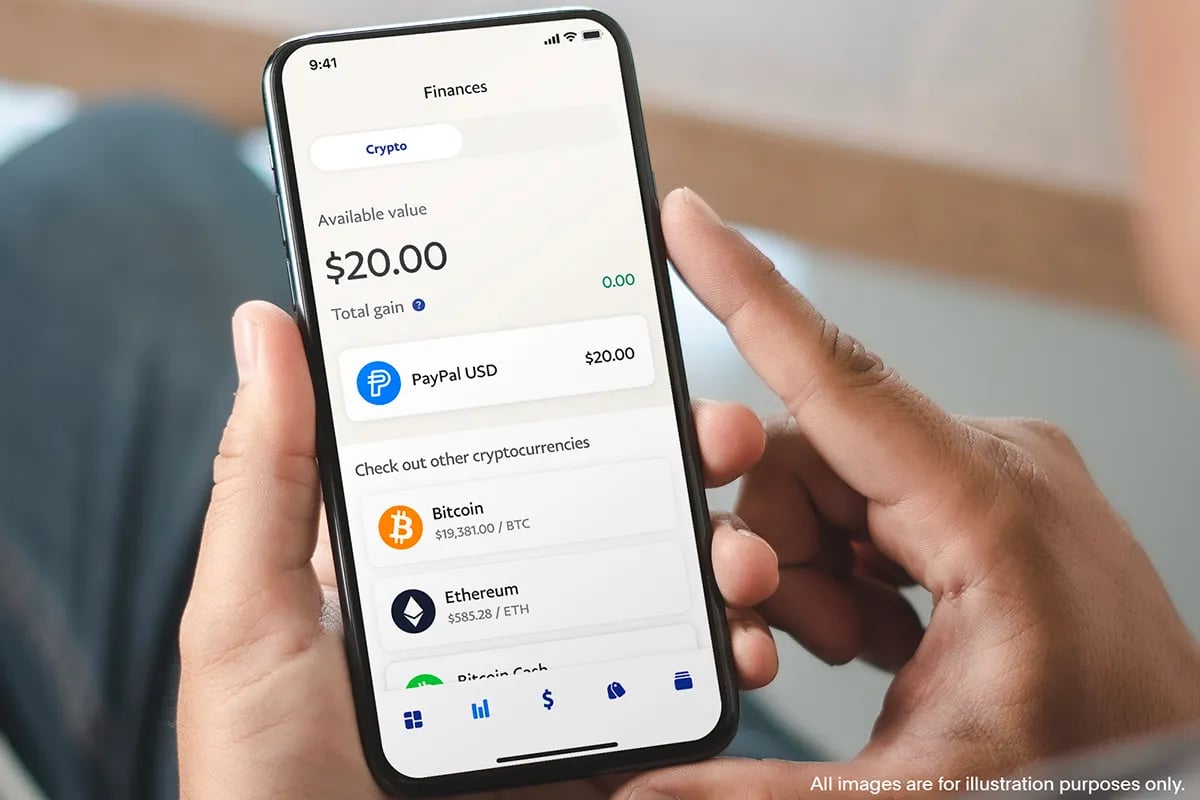

PYUSD was originally designed to reduce payment friction in the digital environment, allowing friends and family to easily and quickly transfer assets, send remittances or make cross-border payments. While most stablecoin transactions are currently limited to Web3-specific environments, PYUSD will be compatible with the PayPal ecosystem from day one and will be live on Venmo soon.

PayPal is not new to cryptocurrencies. When Facebook organized the Libra Association in 2019 to launch its own Facebook currency, PayPal was one of the 21 founding members of the association at that time. It was only later that the Libra project encountered many obstacles, and PayPal also fired the first shot and was the first to announce its withdrawal from the association.

The following year, PayPal announced the integration of cryptocurrencies, allowing people to choose to pay merchants in cryptocurrencies. As soon as the news came out, the price of Bitcoin jumped by 7%. It's just that I held a negative opinion at the time, criticizing this function as quite tasteless. On the one hand, buyers who pay can only buy cryptocurrency with PayPal first, and then pay the merchant in cryptocurrency. On the other hand, merchants who receive money cannot directly withdraw cryptocurrencies, they can only sell the coins back to PayPal to get US dollars.

Not only is it not cheaper to pay for things with cryptocurrencies, but you have to pay 2% more transaction fees just to buy coins from PayPal to pay bills. If the seller wants to sell the currency, he has to pay another handling fee. Either way, no one wants to use this feature. The key is that PayPal locks a set of open payment tools in its own closed ecosystem. PayPal not only controls the entry (deposit) and exit (withdrawal), but also charges users with entry and exit fees. It doesn't make sense at all.

But back then people didn't care that much. Heard that PayPal supports cryptocurrency? Who doesn't buy it! After 3 years, PayPal's USD stable currency PYUSD launched this time is much more reasonable. Not only is it fully in line with PayPal's digital payment industry, but it also finally uses cryptocurrency in the right place. The picture below shows the three main features of the PYUSD homepage, which are high-quality reserves, assets that can be transferred from outside, and the ability to integrate the PayPal ecosystem.

The biggest difference from the past is that PayPal has moved from closed to open. PayPal's main source of income is the 3% gold flow processing fee paid by merchants when they receive money. In the past, if buyers and sellers wanted to trade in cryptocurrencies, PayPal would say: "Welcome! But please buy coins with me first, and you can only sell coins to me in the end." This is a closed gold flow. No matter how much cryptocurrency people hold and how the money flows, it ends up in different pockets of PayPal. However, PYUSD is an open gold flow, which can only be circulated within the PayPal application, and can be withdrawn to a personal MetaMask wallet for storage.

Competitive Advantage

The biggest difference between PYUSD and other stablecoins (such as USDT, USDC) lies in brand recognition and usage scenarios.

PYUSD is a private-label stablecoin. It is not issued by PayPal itself, but is assisted by Paxos, the company that previously issued the BUSD stablecoin for Binance. It is conceivable that the technical architecture behind it is similar.

The first batch of people who hold PYUSD will not be old butts in the currency circle, but people who have a low sense of security for cryptocurrencies but hope to enjoy the convenience of blockchain technology. These people don't have a high sense of trust in USDT and USDC. Even if Circle spread out the entire treasury to the world, they are still worried about what might happen. Trust takes time to build. PayPal was founded when people were still mailing checks on paper, and it might not be easy to find a more reliable digital payment company than PayPal.

More important than brand identity is the usage scenario of the stablecoin. In the past few years, although USDT has not been the most transparent or the most legal stablecoin, its market value has always been far ahead of other stablecoins. The key is that it has the support of the most exchanges, and has the most abundant usage scenarios on-chain (DeFi) and off-chain (trade).

Take the BUSD stablecoin issued by Binance as an example. They know how to use their own ecosystem to "empower" their stablecoin. At that time, you can enjoy 0 transaction fees for the pending orders of BUSD trading pairs on Binance Exchange. If you want to use a sum of USDT to buy BTC, in order to save transaction fees, you will first exchange USDT into BUSD, and then use BUSD to buy BTC.

In addition, Binance has also automatically exchanged various USD stablecoins (USDC, USDP, TUSD) on the exchange for BUSD. Although people can switch back at any time, these measures have created more application scenarios for BUSD invisibly. By the same token, PayPal will inevitably create unique application scenarios for PYUSD. This part of PayPal can be said to have an absolute home field advantage.

At present, PayPal has 400 million users around the world and more than 30 million stores accept PayPal payments. Compared with the current people and stores using cryptocurrency, this number is definitely several orders of magnitude worse.

For consumers, it is difficult for USDT and USDC to be used directly for consumption, and it is better to exchange gold for legal currency. But in the future, as long as people convert USDT and USDC into PYUSD through the exchange, they can deposit it into their PayPal account to pay the merchant. Quite convenient. For merchants, the psychological threshold for accepting PYUSD payments is very low. Because PYUSD is essentially a digital point issued by PayPal, which can be exchanged back to US dollars at any time at 1:1.

However, PYUSD is actually not a competitive relationship with other stablecoins, because their usage scenarios are too different. Other stablecoins may be happy that PayPal is giving those who were looking at cryptocurrencies a reason to try. When you are worried about risks, as long as you change all your stablecoins into PYUSD, you will be safe!

I see PYUSD as an entry point into the world of cryptocurrencies for many people, and an exit point for using cryptocurrencies for physical goods or services. PayPal's issuance of stable coins is also likely to attract other Web2 companies to follow suit, issue various brand stable coins and focus on their own unique application scenarios.

Although there may be a dizzying number of stablecoins. But Vitalik Buterin, the founder of Ethereum, also said that future payments should be able to automatically exchange coins and cross-chain. Even if everyone holds different stablecoins and wants to receive different currencies, the decentralized exchange built into the wallet will automatically convert them into the designated currency for the recipient. Compared with now, each retail channel has its own XX Pay, but different Pay cannot communicate with each other. The issuance of stable coins will break the closure with openness and provide people with new options for digital payment.

Block Potential is an independent media that maintains its operations through paid subscriptions by readers. The content does not accept distribution by manufacturers. If you think the article of Block Potential is good, welcome to share it. If you have spare capacity, you can also support the block potential operation with regular quotas. If you want to check the content of past publications, you can refer to the article list .

Writing NFT

further reading

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More