Taiwan's GDP per capita will surpass Japan's for the first time. Why do you and I believe it?

The International Monetary Fund (IMF) has updated its economic forecast for 2022 these days; in this data, Taiwan's per capita GDP reached US$35,510 this year, surpassing not only South Korea but also Japan.

This is the first time in history that Taiwan's per capita GDP has surpassed Japan, and it is also the first time that Taiwan has surpassed South Korea since it was overtaken by South Korea in 2003.

The reason behind this Great Leap Forward is explained by the Korean media as "the Taiwan government's strong support for the semiconductor industry" (this statement may also reflect the concern and anxiety of Koreans who also produce semiconductors), but of course it is also because of the Korean won and Japanese yen this year. The depreciation rate of the Taiwan dollar is higher than that of the Taiwan dollar, and the GDP data converted into US dollars will be much uglier than that of Taiwan.

Interestingly, this news was first reported by the Korean and Japanese media, and then it attracted the attention of the Taiwanese media and began to be exposed in a large number of Taiwanese media.

Unsurprisingly, many Taiwanese people left comments after reading "I don't get paid, will Tsai Ing-wen supply me?", "Laugh to death, how much of it is real estate irrigation", or very low-level boring "I On average, my wife and I each have one testicle.”

At this time, I felt that I would like to recommend this article " Speaking of Taiwan's Economy: Per capita GDP exceeds 30,000 US dollars, why can't the salary increase keep up?" 》

This report, in addition to popularizing some economic terms we often hear, is also trying to clarify some common myths among Taiwanese.

For example, many people tend to mistake "income" with "wage", but in fact, the GDP of an economy is not only composed of the wages of workers, but also the profits of employers; instead of production, it depends on rent, "Rentiers" who live on interest and dividends, their rent or interest are also included in GDP - in other words, unless there are no landlords and shareholders in an economy, the average salary cannot be equal to per capita GDP.

In addition, some people believe that a large part of Taiwan's GDP is an "illusion" created by "real estate speculation". But in fact, only the first transaction of a new existing home and the rent paid by the renter to the landlord will be included in the GDP.

As for the second-hand transaction of real estate, or the capital gains from real estate speculation, they are not actually included in GDP (but if there is a real estate agent involved in the resale process, then the real estate agent's service fee will also be provided by the real estate agent. added value, which is included in GDP).

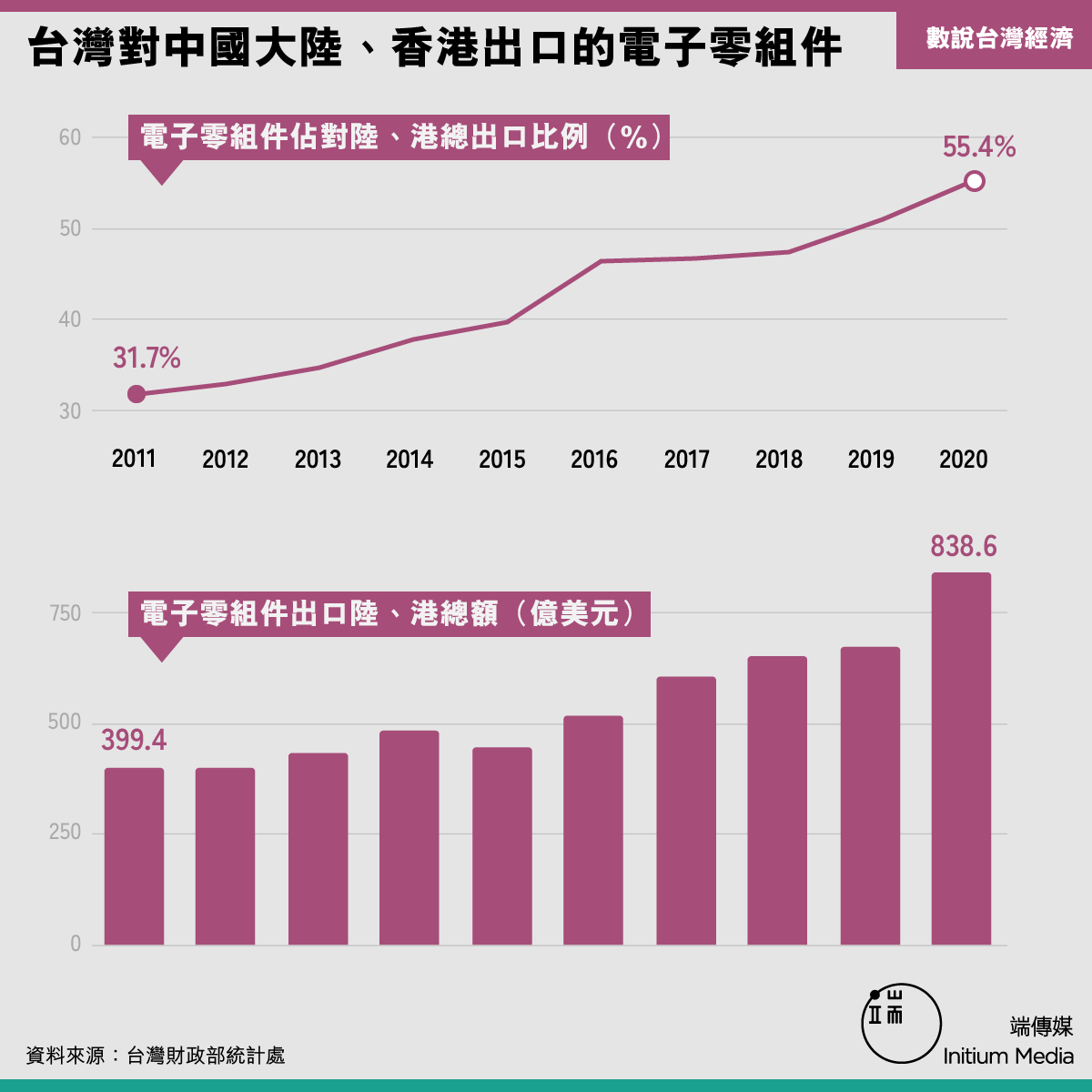

Some people will ridicule that Taiwan's GDP has performed well mainly because exports to mainland China have continued to increase, reflecting Taiwan's dependence on the Chinese market for manufacturing exports, which means that "Taiwan can never be separated from China."

But in fact, a large part of the growth of Taiwan's exports to mainland China actually comes from the growth of exports of "electronic components" (that is, chips). After being "processed" and made into electronic consumer products, it will be sold to markets around the world.

As a result, Taiwan's economic boom in the past two years and the growth of its exports to the mainland are mainly due to the strong demand for "products containing chips" from all over the world during the epidemic, which in turn boosted "businesses in mainland China's demand for chips from Taiwan". needs”.

That is to say, the real key is the overall terminal demand of the international market, not just the demand of the Chinese market - you don't say "Taiwan depends on the Chinese market", but rather "China depends on Taiwan chips" (but you also want to Emphasize that we exist in this world and are inherently interdependent).

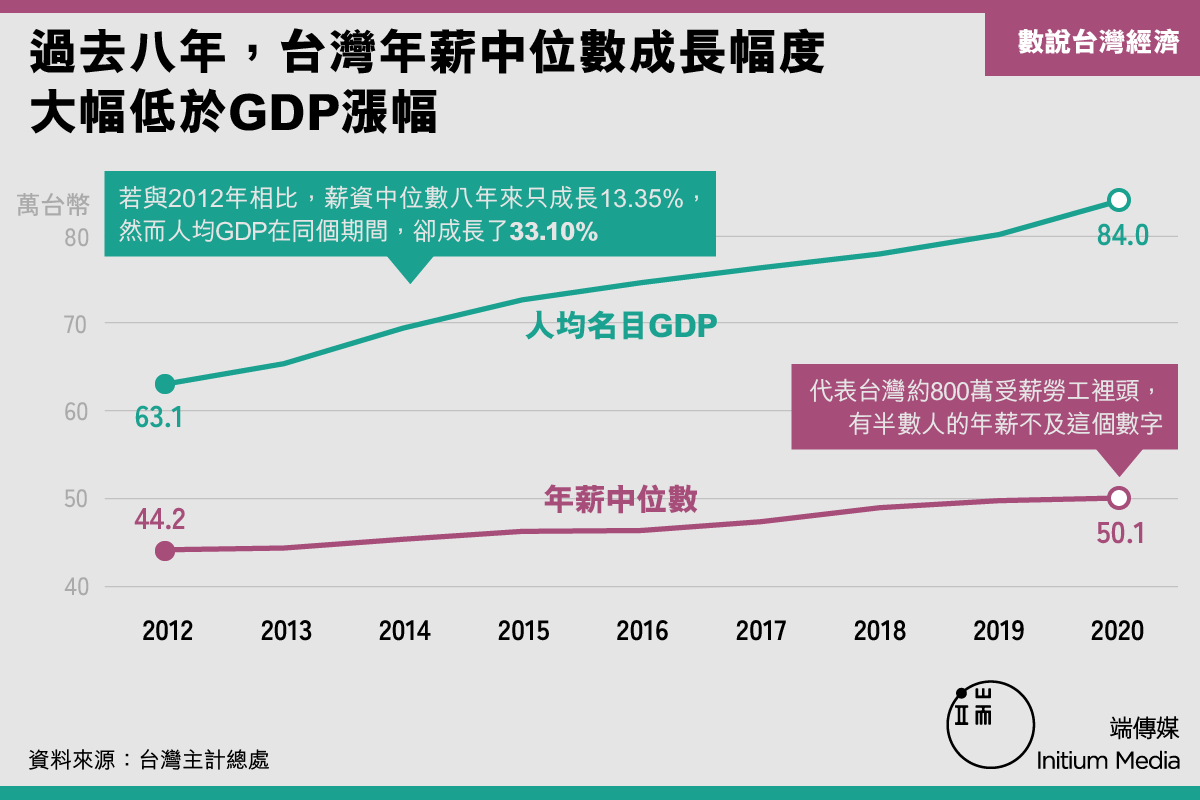

But one thing is an indisputable fact: the growth rate of the median salary of Taiwanese in recent years has indeed been unable to keep up with GDP.

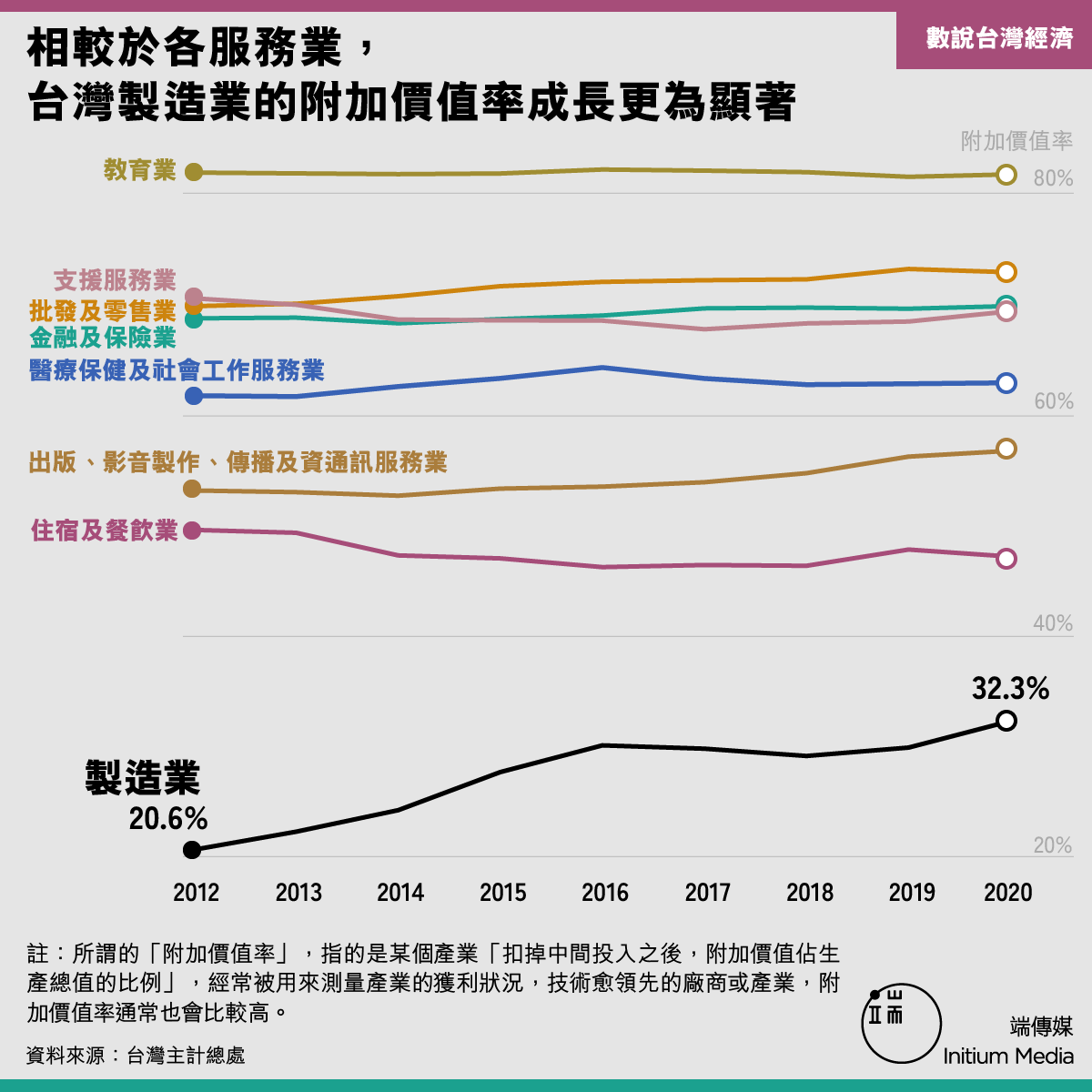

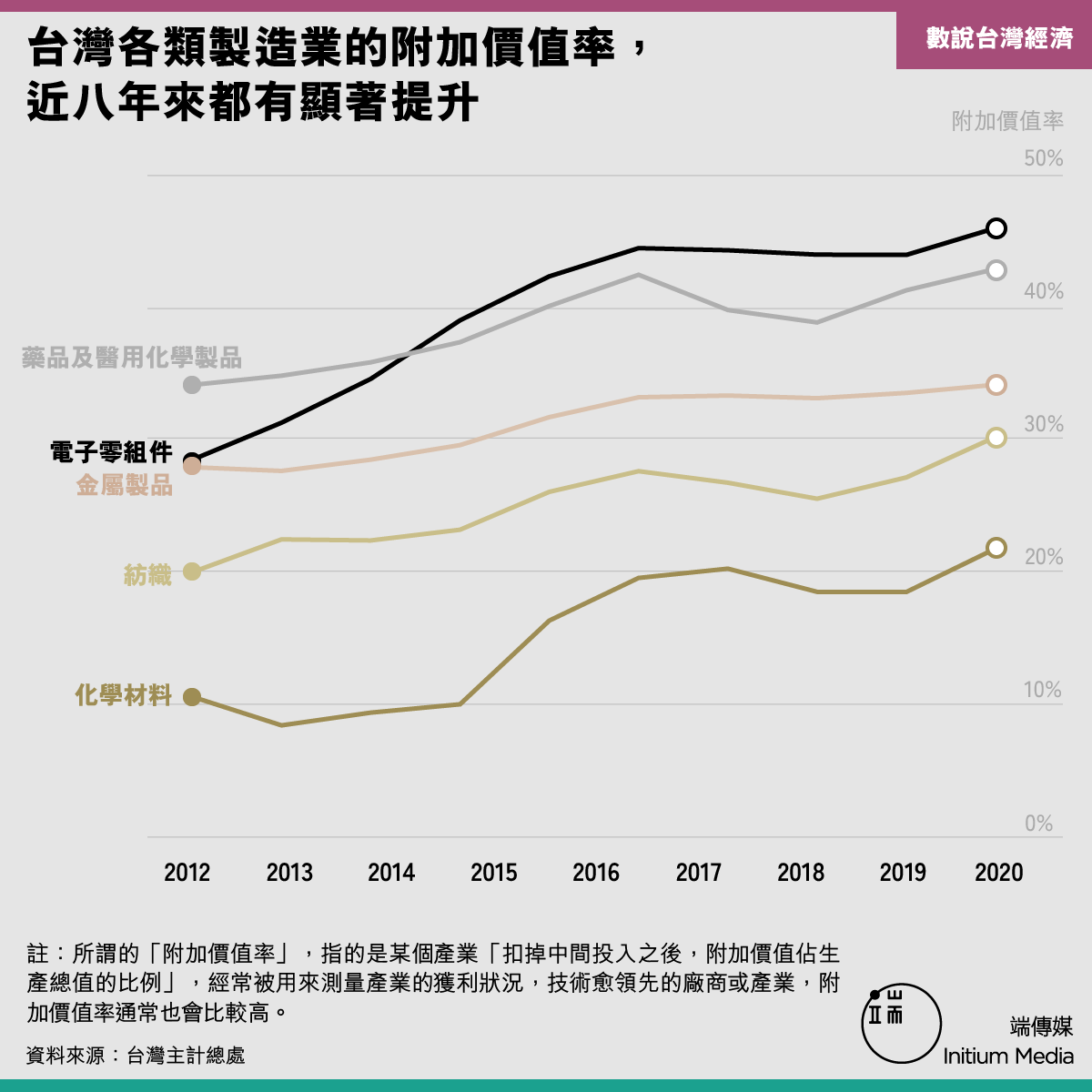

Regarding this point, this article attempts to use the "value-added rate" to explain: in recent years, the value-added rate of Taiwan's manufacturing industry has been continuously increasing (especially the "electronic components" belonging to the "semiconductor industry"), but The value-added rate of the service industry has barely grown.

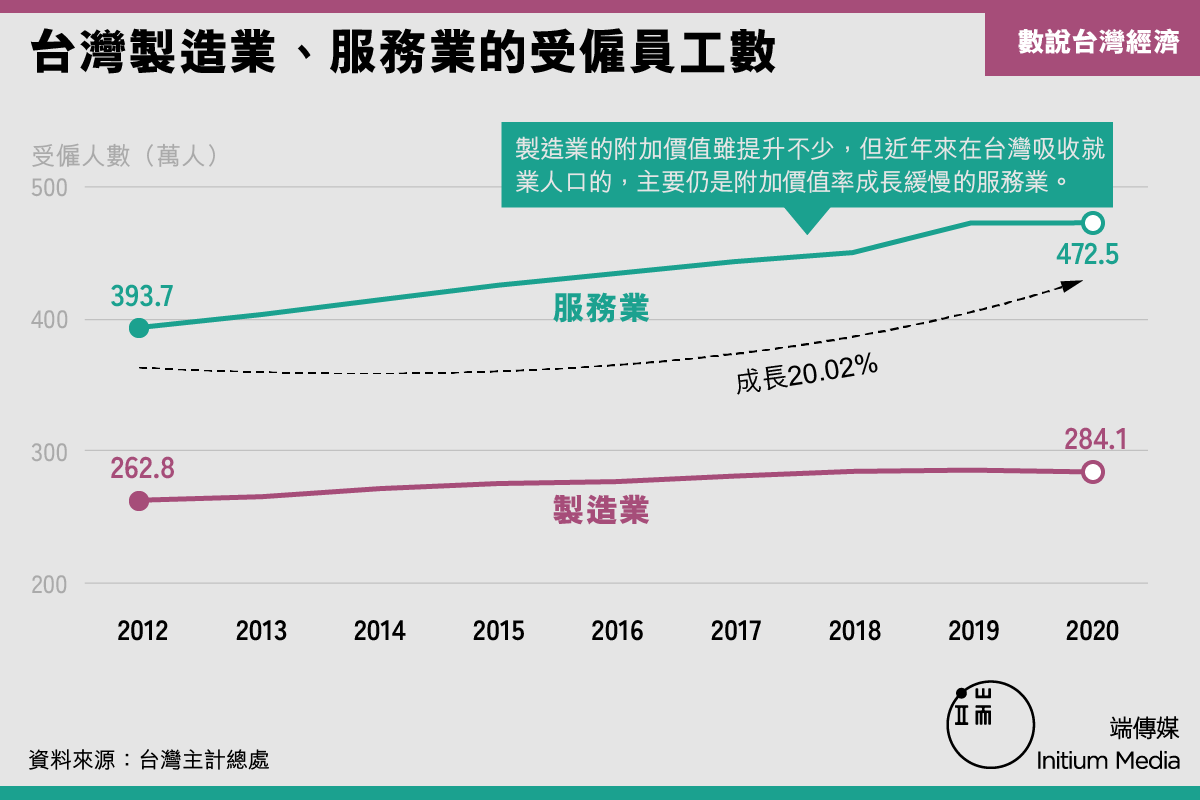

However, from 2012 to 2020, the number of employees in the service industry has grown by 20%, while the manufacturing industry has only grown by about 8%. In other words, although the added value of the manufacturing industry has increased a lot, the number of employed people in Taiwan has increased in recent years. , after all, it is mainly the service industry with slow growth in value-added rate.

And this may be the reason why most Taiwanese feel indifferent or even deceived when they see GDP per capita - because the fruits of growth are not distributed to you.

But in fact, as long as you go to the bonus bonus issued by Google Hon Hai this year , as well as the salary level of the semiconductor industry (people who make a lot of money usually do not make too much publicity), you will know that "per capita GDP exceeds 35,000", it is really not groundless. It's not that the Comptroller's Office is fraudulent, "the IMF was bought by Tsai Ing-wen".

In addition, some netizens also commented that although the prices of supermarkets in Japan are not as high as those in Taiwan, the cost of eating out, transportation, water, electricity and fuel costs are still much higher than those in Taiwan. Therefore, even if the wages are higher than those in Taiwan, the standard of living is not necessarily comparable. Taiwan is good.

Seeing this, I would like to recommend another website called " Numbeo " to everyone.

Numbeo is a website that provides data with the cooperation of users. On the website, anyone can fill in various living expenses of their own city, such as food, livelihood materials, entertainment, transportation, education, repair, water, electricity, gasoline, rent, etc. house prices, and after-tax income.

What's more, you can also compare the income and expenditure data of the two cities at will on this website.

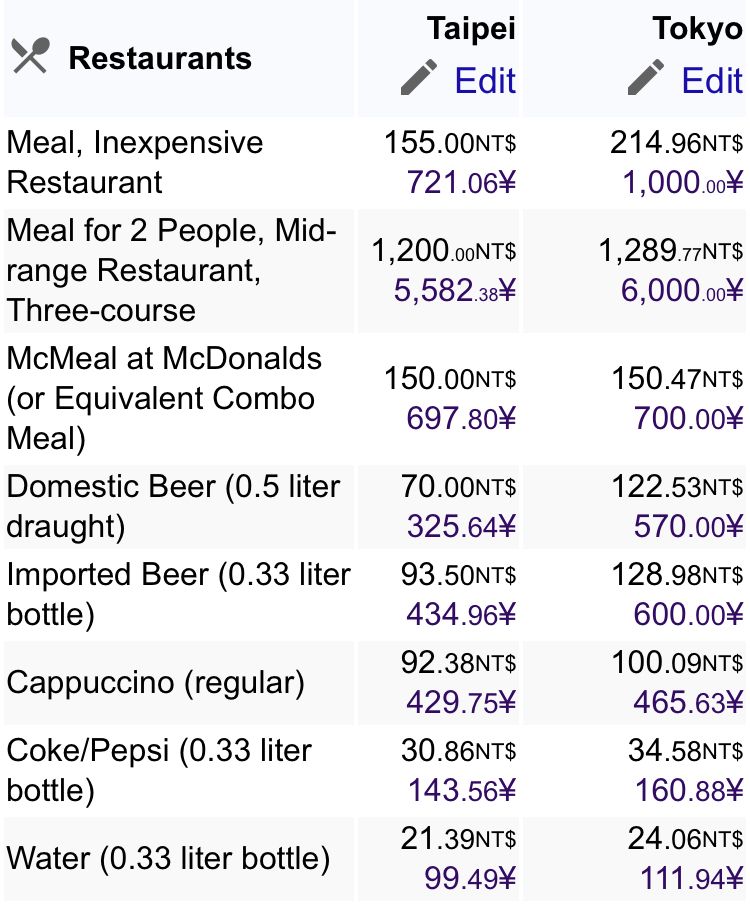

Take "Taipei vs. Tokyo" as an example, a simple meal at a cheap restaurant costs 155 TWD in Taipei and 1,000 yen in Tokyo (equivalent to 214 TWD at current exchange rates).

However, the Minsheng materials in Tokyo supermarkets are actually roughly the same as in Taipei, or even a little cheaper than Taipei. Only fruits are more expensive than Taipei (people who have been to Japan probably know how expensive Japanese fruits are...)

(By the way, a liter of milk in Taipei costs about NT$90 on average, which is one of the most expensive in the world XD)

Some people may suspect that this kind of database that everyone can provide data is not afraid of being flooded by people with intentions and causing data distortion?

Of course, this question is not unreasonable, but as long as the number of people who fill in the information is large enough and the extreme values are removed, I think it is still useful for reference. Take Taipei as an example. In the past year, 289 people provided 2,333 entries. As for Tokyo, 247 people provided 1,738 profiles, while 516 people in New York provided 2,461 profiles, and the last one was logged in October this year.

I have been to nearly 100 countries, traveled for business in the past five years, and often use this website to refer to local prices (vernacular translation: to ensure that I will not be deceived as a fat sheep tourist), I think Numbeo's data is generally consistent with actual situation.

In addition, in those countries with rapid currency depreciation and very serious inflation (such as Argentina, Venezuela, etc.), Numbeo has also changed the denomination unit to the US dollar instead of the local currency, so that the data in this database will not be affected by inflation. And distortion, convenient close to the current situation.

But this database is not without its shortcomings, and those shortcomings are basically related to the essence of this website:

It is an English website, and people who must understand English can fill it in, which also brings a threshold for database users; and in many developing non-Western countries, this also means that people who fill in the information are likely to Expatriate employees, or locals who can understand English and have higher incomes, may bring some distortion to the price data.

For example, the civilian materials listed in the database are obviously from a “Western-centric” perspective—in addition to eggs, fruit, and meat, other commodities such as cheese, milk, and wine are also listed, but these items are found in many East Asian countries. In the country, it is not necessarily a "necessity for people's livelihood", but an "exotic product" that must be imported, or a "luxury product" that is expensive to produce locally.

In addition, items such as "cheap restaurants" and rents for eating out are obviously controversial. In many developing countries, if you just want to eat, you can definitely find a lower price than the one listed on the Numbeo website. restaurants, or food stalls, probably because of Numbeo's information providers, may not necessarily go to restaurants that are really cheap and only visited by locals.

Fortunately, at least the "after-tax income" of the Numbeo database should be considered credible, because it requires respondents to fill in "the salary you heard most people get", not "you get it yourself" salary".

But even without the Numbeo website, we still have other data that can give us a glimpse of Taiwan's income, prices, and living standards—this data is actually GDP per capita in terms of "purchasing power parity ."

What is "purchasing power parity"? In simple terms, you can understand it this way: the price of a certain commodity or service is different in each country.

In the United States, you can buy a gyro platter at a street food truck for $10, but you can buy something similar on Raohe Street in Taipei for less than $2.

For another example, if you go to a dentist in the United States and have a root canal treatment, you may have to spray $1,000 (depending on whether your medical insurance includes a dentist plan and how much co-pay the patient pays), But for root canal treatment in Taiwan, the whole course of treatment is only about NT$500 (I just finished a root canal QQ recently)

Therefore, economists have developed the concept of "purchasing power parity" in addition to GDP. The purpose is to adjust the exchange rate of each country's currency according to the price level of various places, so as to more accurately measure the scale of production and production of people in various countries. and standard of living.

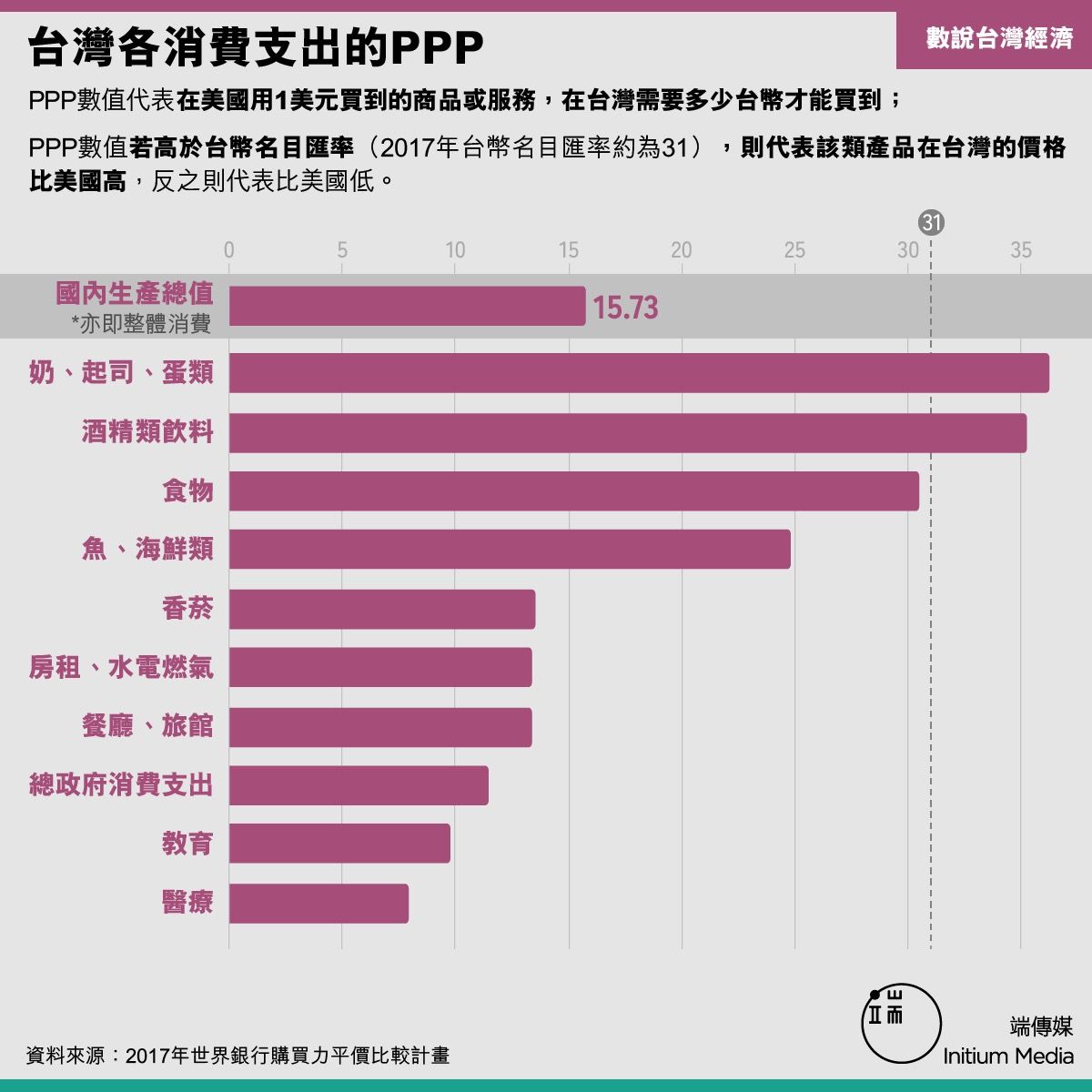

Taking the World Bank's 2017 "Purchasing Power Parity International Comparison Program" as an example, Taiwan's PPP exchange rate is actually 15.73, which means that the goods or services purchased with 1 US dollar in the United States only cost 15.73 Taiwan dollars in Taiwan as a whole. You can buy it without spending so much on the nominal exchange rate (about 30 Taiwan dollars per US dollar).

Following this, the World Bank will use the exchange rate of 15.73 to calculate the "GDP at purchasing power parity", so as to more accurately measure the income of Taiwanese, the items and living standards that can be exchanged locally.

If you take a closer look at the PPP details of various commodities, you will find that Taiwanese people are not cheaper to buy food in the market, and milk and eggs are even more expensive than the United States (PPP is 36.276, which is higher than the nominal exchange rate of Taiwan dollars, which means that in Taiwan needs to spend 36 Taiwan dollars to buy dairy and egg products that cost 1 dollar in the United States, which means it is more expensive than the United States);

However, in terms of rent, water and electricity, restaurants and hotels, education and medical expenses, Taiwan is particularly cheap, with PPPs of only 13.366, 13.353, 9.763 and 7.903 respectively. They are indeed highly subsidized projects by the government.

But in any case, if a Taiwanese does not go abroad to consume, then the standard of living he enjoys in Taiwan, calculated by "purchasing power parity GDP", is actually the 20th in the world, close to 70,000 US dollars, even higher than Germany, Western European countries such as France, as well as Western countries such as Canada and Australia are still higher, and have surpassed Japan for many years.

Of course, the "purchasing power parity" algorithm is not without flaws.

For example, purchasing power parity only considers the rent expenditure, and does not calculate the housing price of the house. It may not be close to the culture of Taiwan's high home ownership rate, and in Taiwan, where housing prices are high, it may also underestimate the living expenses of Taiwanese. In addition, the "high purchasing power parity" caused by the "undervalued exchange rate" also makes local people suffer especially when purchasing foreign goods.

Taiwan economist Wu Congmin once pointed out that in order to help export companies, the Central Bank of Taiwan seems to have been intervening in the foreign exchange market for many years and "deliberately lowering the exchange rate of the Taiwan dollar", but it is also like "taking the international purchasing power of the Taiwan people to subsidize Taiwan's exporter".

But in any case, just like what this report said at the end, at this stage of Taiwan's economic development, GDP may not be the most important thing; how to make economic achievements evenly distributed, and how to improve Taiwan's over-reliance on exports of the electronics industry, Maybe that's what we need to focus on right now.

PS. There are many Chinese and Hong Kong users on Matters, and the comparisons of " Taipei vs. Hong Kong " and " Taipei vs. Shanghai " are also posted here . You can click on the hyperlinks for reference.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!