Premium Financing ABC

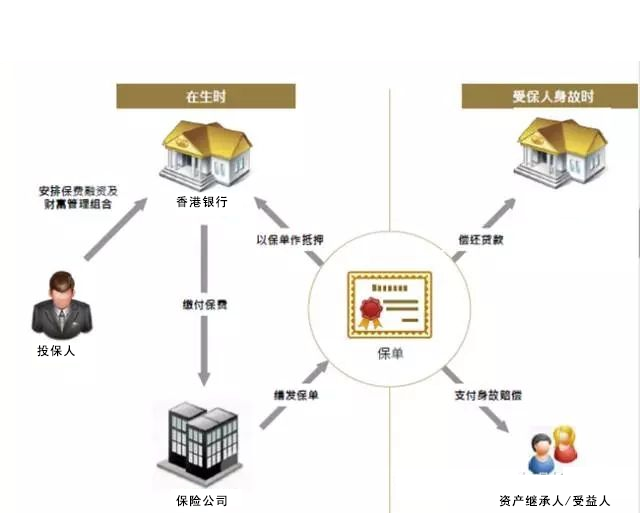

Premium financing used to be mostly the products of investment banks or private banks.

To put it simply, if a normal savings or universal insurance policy has 3-4%, and the bank accepts the policy as collateral and provides a loan interest rate of 1-2%, it is really like buying a house.

If you buy a 4,000,000 policy, you may need to lower the down payment by 1,000,000. The remaining 3,000,000 loan interest can be earned back with dividends, so that the annual return can rise to 8 to 10%.

One of the bigger problems is cash flow, because interest on bank loans is repaid every year, but policy dividends cannot be cashed out immediately. Therefore, you need to prepare additional cash to repay the interest every year. Now there are some banks in the market that can help you "add a mortgage" every year, and use the additional mortgage to repay the interest of the policy financing for the year.

The second question is that even if the policy claims an annual return of 3-4%, it usually takes three or four years for the cash value to return to the original purchase value. Therefore, if you are eager to cash out in the first few years, you need to Lose money and leave.

Third, the bank loan interest is usually a floating interest rate. If the interest rate increase cycle, especially the premium financing, usually takes more than five years to see a relatively considerable return, it is necessary to take a risk.

If the interest rate rises, the income may be greatly discounted immediately.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More