CoinEx Research Institute | Decentralized Stablecoin Market Survey and Analysis (Part 2)

(Continued from above) The decentralized stablecoin protocols currently on the market can be divided into four categories: over-collateralization, partial mortgage, ecological and comprehensive derivatives.

2. Some collateralized stablecoin protocols

Some mortgage-based stablecoin protocols generally use mainstream stablecoins plus their own governance tokens to mint protocol stablecoins in a certain proportion. Due to the low actual value support of governance tokens in the initial stage of the project, most stablecoins of this type are unavoidable from the death spiral, and very few survived.

Some mortgage agreements have a unique concept of PCV (Protocol Control Value), which can be understood as the protocol's vault, which is entirely the protocol's own assets and cannot be redeemed by users. PCV gains value through various interest-earning operations of the protocol itself and various handling fees of the protocol. A protocol stablecoin can be considered over-collateralized when the PCV is greater than the issuance value of the protocol stablecoin. It can be understood that the size of PCV determines the amount of stablecoins issued and the level of risk.

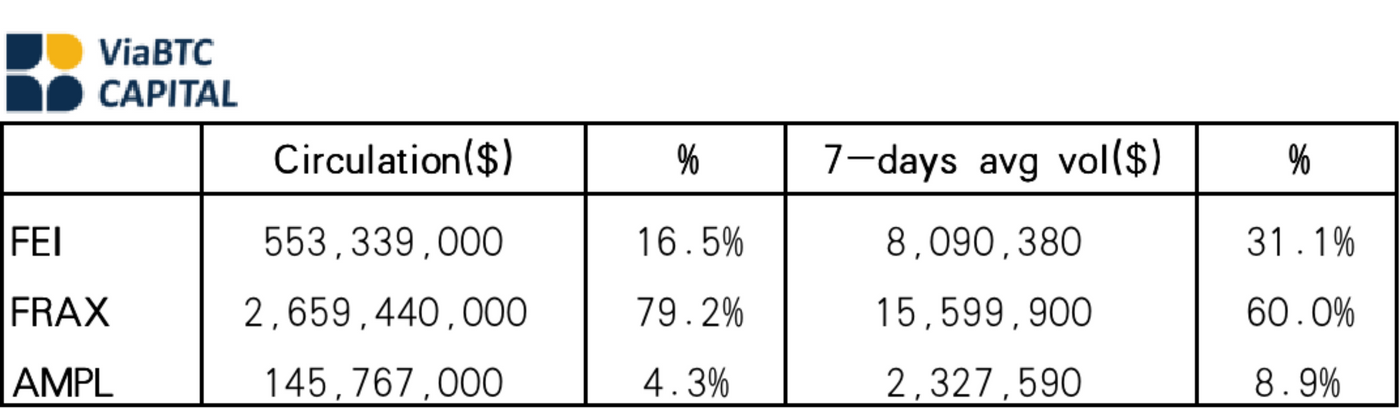

At present, some of the more mature mortgage protocols in the market are Fei Protocol (FEI) and Frax (FRAX), which together account for about 91% of the market share, including 60% for Frax and 31% for FEI.

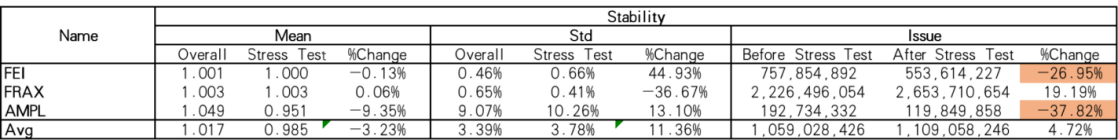

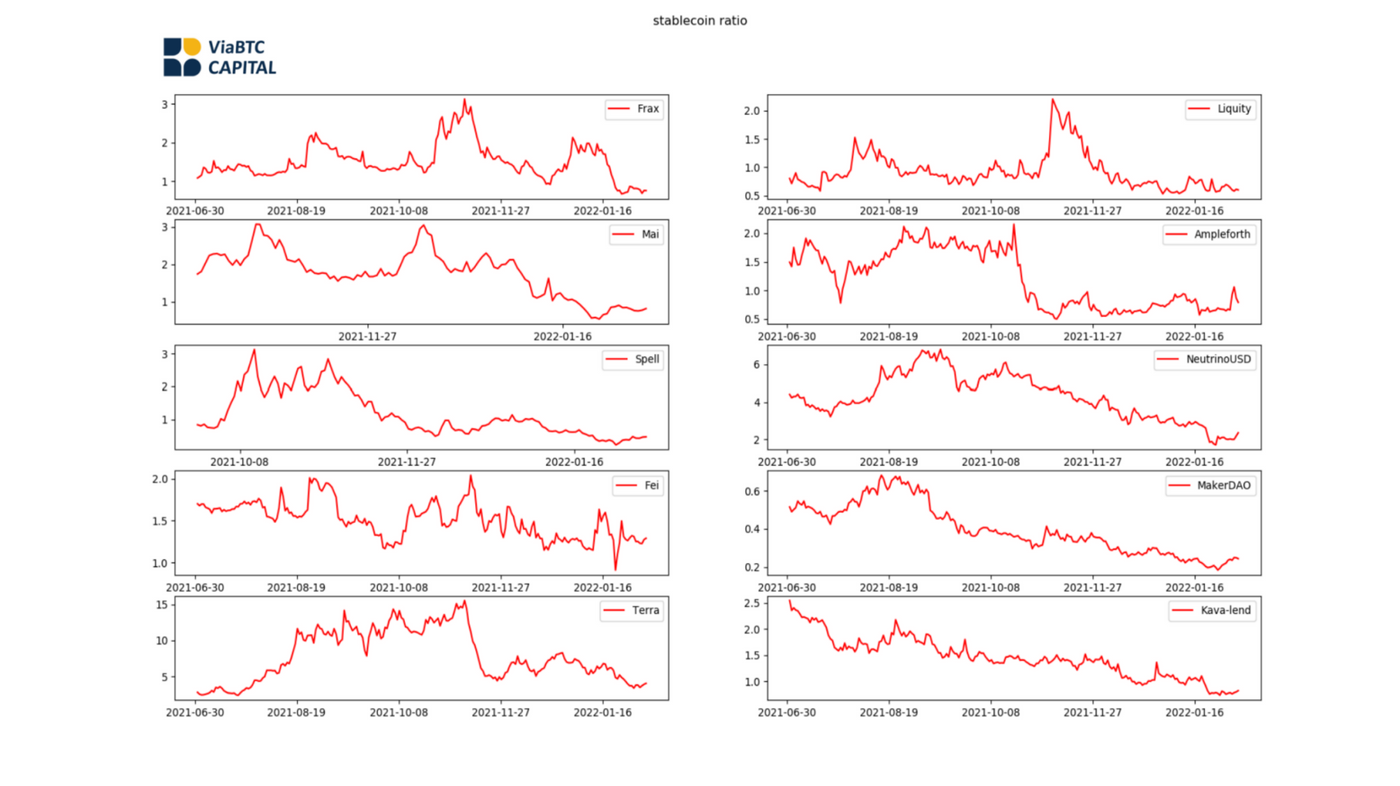

Stablecoins of this type have also been stress tested to observe their stability. It has been observed that FEI and FRAX are not inferior to those over-collateralized stablecoins that everyone thinks will be more stable, whether it is a stress period or a normal observation period. Even more stable than most overcollateralized stablecoins. A large part of the stability is due to the success of PCV, FEI's mortgage rate (PCV/stablecoin issuance) has reached 132%, while FRAX's mortgage rate is stabilized at 85% by its own mechanism.

The stability of AMPL is very poor, because its special Rebase mechanism makes its price fluctuate greatly.

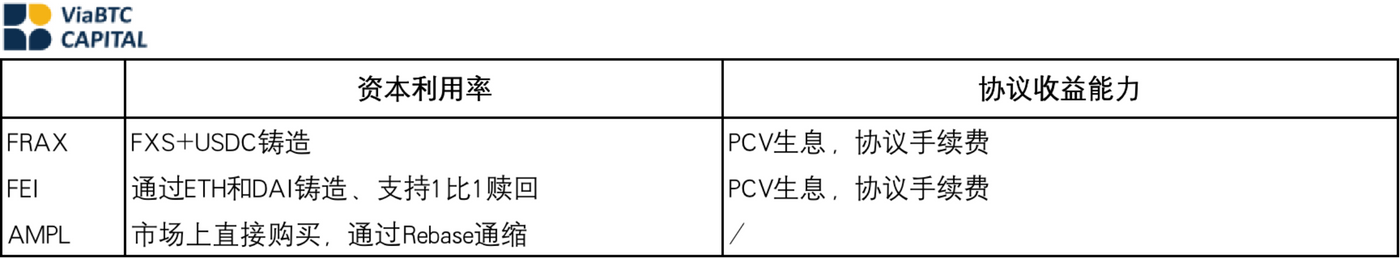

In terms of capital utilization, FRAX allows the mixed minting of governance tokens FXS+USDC, which increases the capacity of minting coins. It can be considered as 100% mortgage minting, and because it is directly minted and lent out, there is no liquidation. risk. FEI allows the direct minting of ETH and DAI, which also has no liquidation risk and 100% mortgage minting. In terms of profitability, this section is also the same, which is the income from the agreement income plus the PCV's asset management assets.

3. Ecological Stablecoin Protocol

The characteristic of the ecological stablecoin protocol is that the stablecoin can be minted and redeemed at 1:1 according to the U-standard price of the ecological public chain currency, which can be understood as using the value of the entire public chain ecology to issue the stablecoin as a value support.

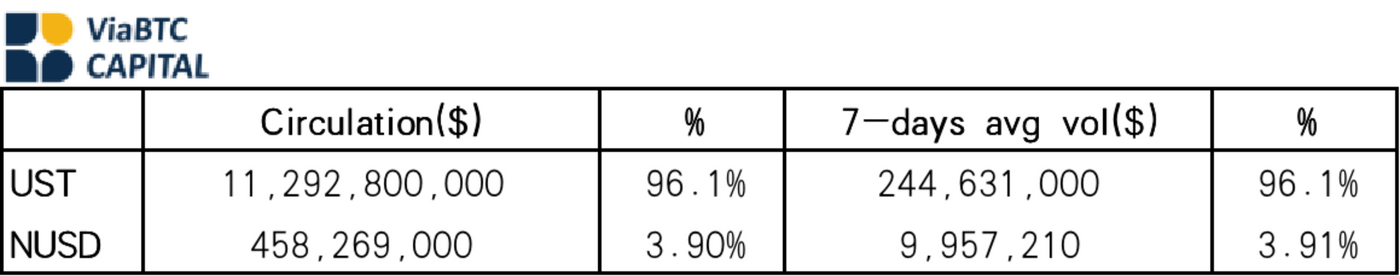

At present, only Terra's UST and Waves' NUSD have increased circulation in the market, of which UST accounts for 96% of the market share.

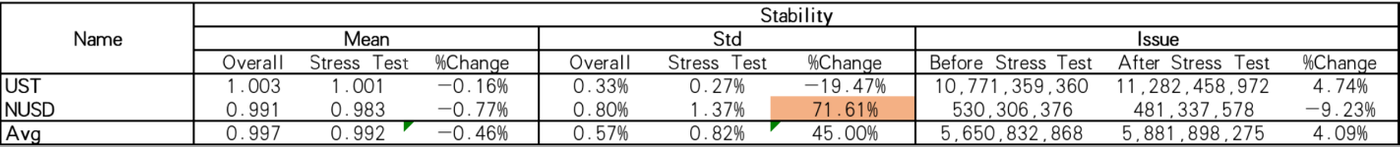

In terms of stability, UST is almost equal to DAI due to the rapid development of its ecology. Even if it was hit by the Twitter of the founder of MakerDAO during the stress period, the volatility was only a little larger, and the average currency price and circulation were not greatly affected. Waves may be less stable due to the fact that the ecology has not yet developed and there are not enough application scenarios.

In general, it can be seen that this type of stablecoin is closely bound to the ecology, the ecology can be stable, and the circulation is large .

The capital utilization rate is the largest in the ecological stablecoin protocol, because it uses the development of the entire ecology as collateral, so the amount of coins minted can be capped by the ecological valuation. And its profitability is also related to the use of ecology. Every transfer transaction, contract execution, etc. on the public chain will bring income to the ecology.

4. Derivatives Comprehensive Stablecoin Protocol

Most of these stablecoins are still in the early stage, and the number of issuance is not large or the issuance time is short, so there are not many more effective data observations. Among them, agEUR issued by Angle Protocol, which is anchored to EUR, has a relatively large number of issuances. Others are UXD Protocol, which issued about 10M USD-pegged UXD, and Hubble Protocol, which issued about 30M USD-pegged USDH. These protocols use on-chain derivatives to hedge their collateral for minting stablecoins and lock in their U-standard value, thereby eliminating the probability of liquidation and keeping the peg stable. For example, both agEUR and UXD have 100% capital utilization, and they can directly use their risk assets to mint stable coins at a ratio of 1:1. Since they require perpetual contracts on the chain to short-sell to hedge the price of minted products, they also send derivatives to derivatives at the same time. The market for products has injected considerable liquidity, which can also be considered another source of value for these types of protocols.

Market valuation preferences for different models

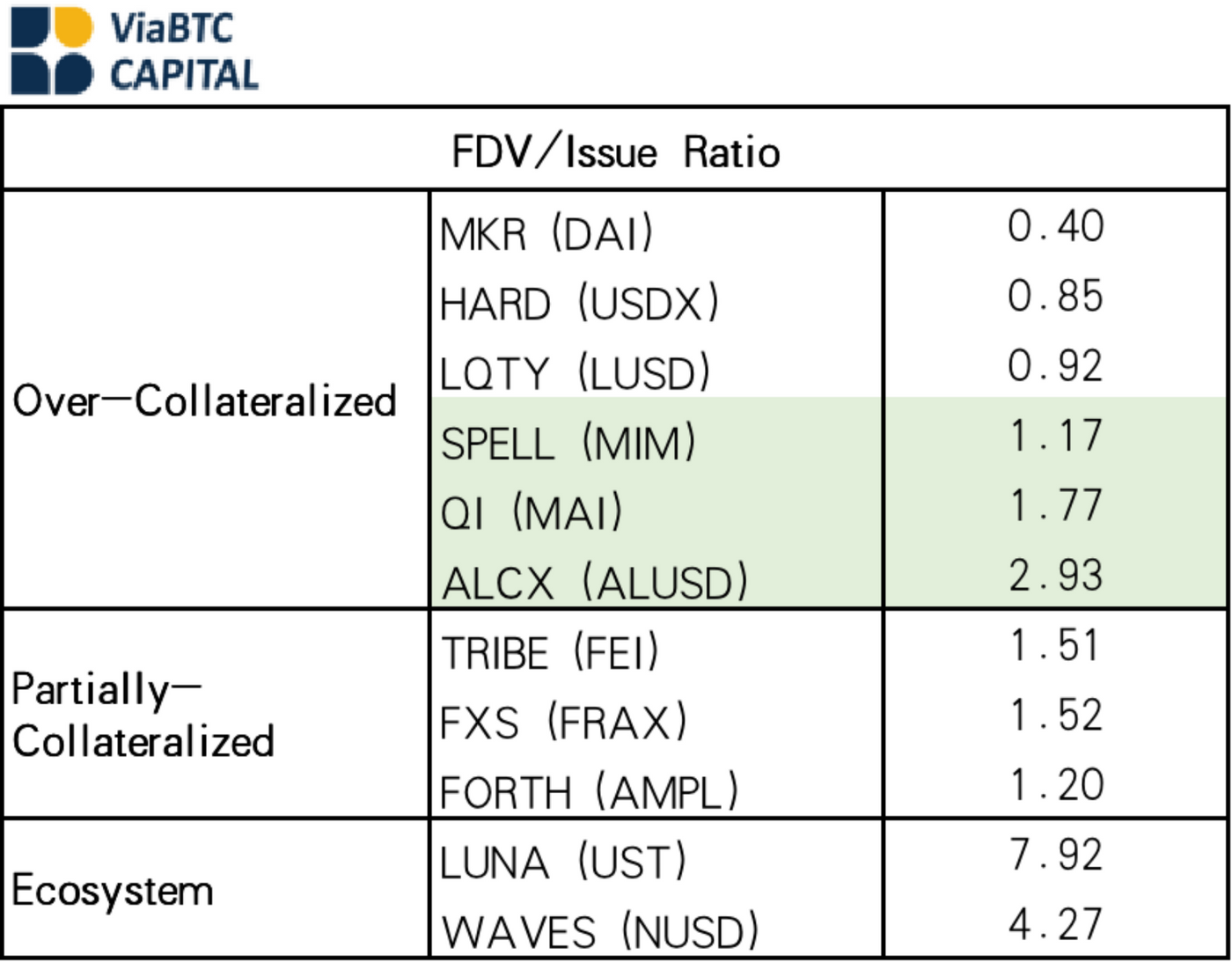

There is no significant correlation between the issuance of stablecoins and the total valuation FDV of governance tokens, and there is a regionalized median regression phenomenon (below). So I think (governance token FDV)/(number of issued stablecoins) will be a more effective valuation method for decentralized stablecoin protocols . The comprehensive category of derivatives was not included in the discussion due to insufficient samples.

After averaging the valuation issuance ratios of all observation intervals, some interesting findings were also obtained. First, in the classification of over-collateralized stablecoins, protocols that used interest-earning assets as collateral (ie, higher capital utilization) obtained higher valuation. The second finding is the valuation differentiation between categories, where the valuation ordering is normal overcollateralization agreement < supporting interest-earning overcollateralization agreement

Partial Mortgage Protocol < Ecological category. Combining the previous discussions on stability, capital utilization, and profitability, it can be considered that the market may give the most weight to capital utilization when valuing decentralized stablecoin protocols.

This article does not constitute any investment advice

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More