High inflation could lead to recession

Bank of America warned that inflation will remain high and investors are still not fully aware of recession risks.

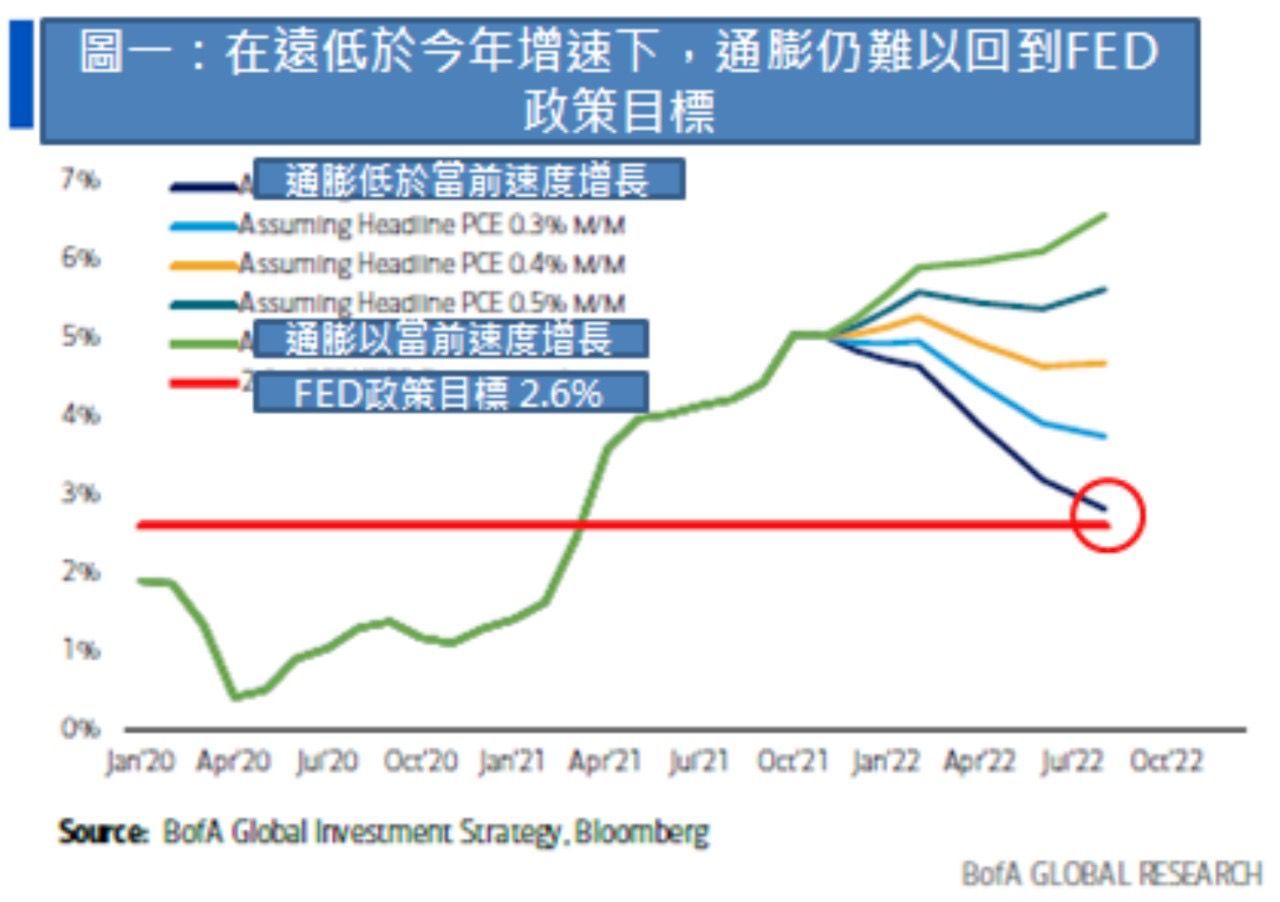

Bank of America pointed out that the current inflation rate in the United States, Europe and the United Kingdom has maintained an annual increase of 5%. Even if the subsequent inflation growth rate slows down from the current level to 0.4% month-on-month, inflation will be very high by the end of 2022. It's hard to fall back to the central bank's target of 2% on an annual basis.

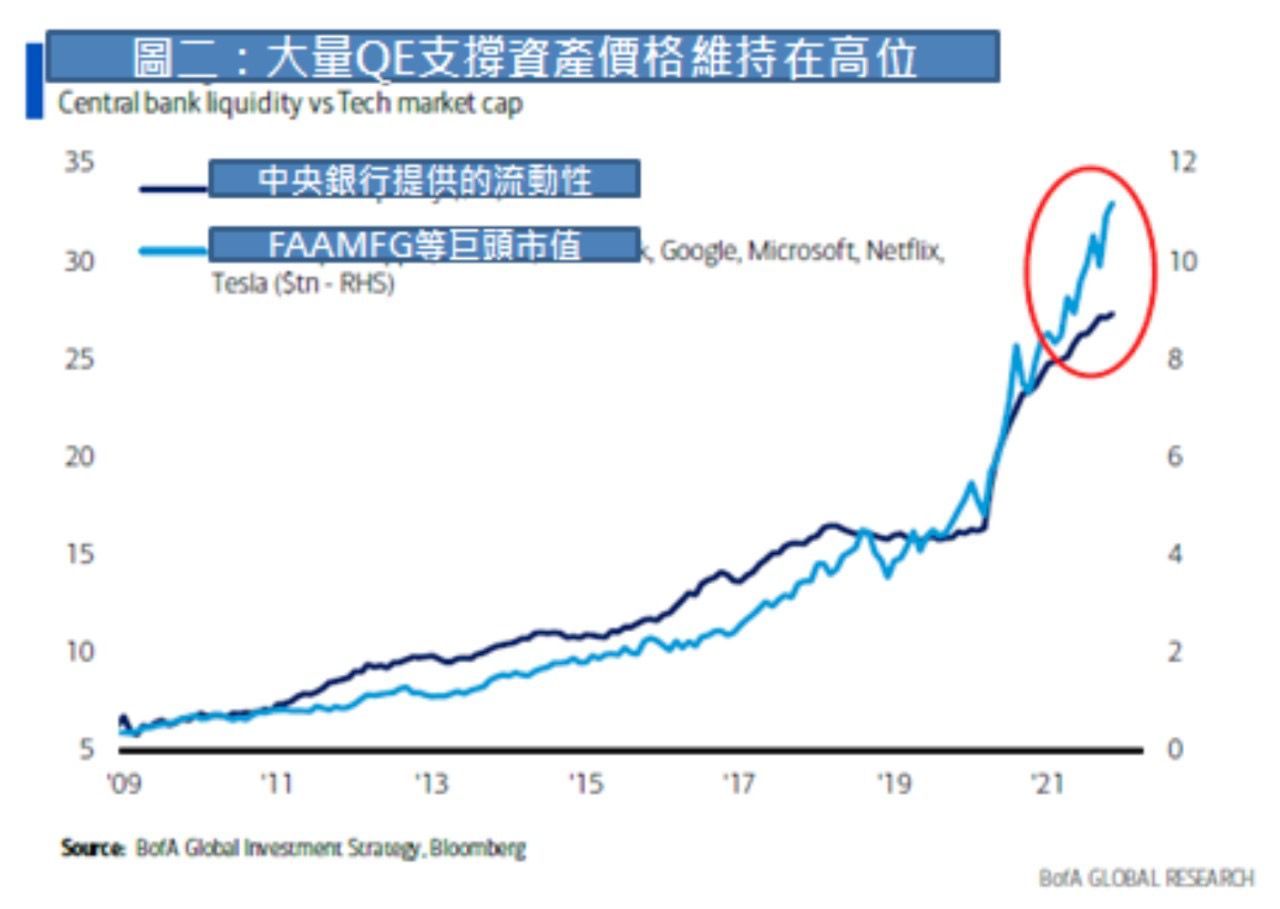

Although the current growth is still strong, the stock price has remained at a high level under the epidemic and high inflation (Figure 2).

According to the current market survey, only 6% of investors believe that there is a risk of recession in 2022. Excessive optimism and high market prices have become a potential crisis.

Bank of America said that against this backdrop, this rate hike is a bit different from previous rate hike cycles, which may trigger recession fears. Past rate hikes have been accompanied by strong economic growth, and the stock market is in the middle of a bull market cycle.

However, this time, the face of out-of-control inflation is more due to supply chain problems. Even if the Federal Reserve stops or raises interest rates, it will be difficult to solve the problem. If the tighter financial situation lasts for a whole year next year, it is easy for the interest rate shock to evolve. into recession panic.

Bank of America's trading strategy for next year is bullish on the dollar, quality stocks, defensive stocks, yields, and emerging markets; bearish on technology stocks and cyclical stocks.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More