What is DEFI's lending service?

A friend just asked this question today, what is the working principle of compound?

It is better to choose a day than to hit a day. Today I will briefly explain what is going on with the decentralized lending platform.

When most people see this term, their first thought is whether the "lending platform" allows people to borrow money? How can I borrow it? How to pay it back?

Let go of the prejudice about nouns first. Although the so-called lending platform is borrowing, this borrowing is a “transaction model” loan, which is two different things from actually lending you money. Before talking about this, you must first understand the “contract transaction” For a preliminary understanding, you can read my article " What is a contract ".

First of all, before you want to borrow money, you need to pledge your assets, and the value is greater than the money you want to borrow.

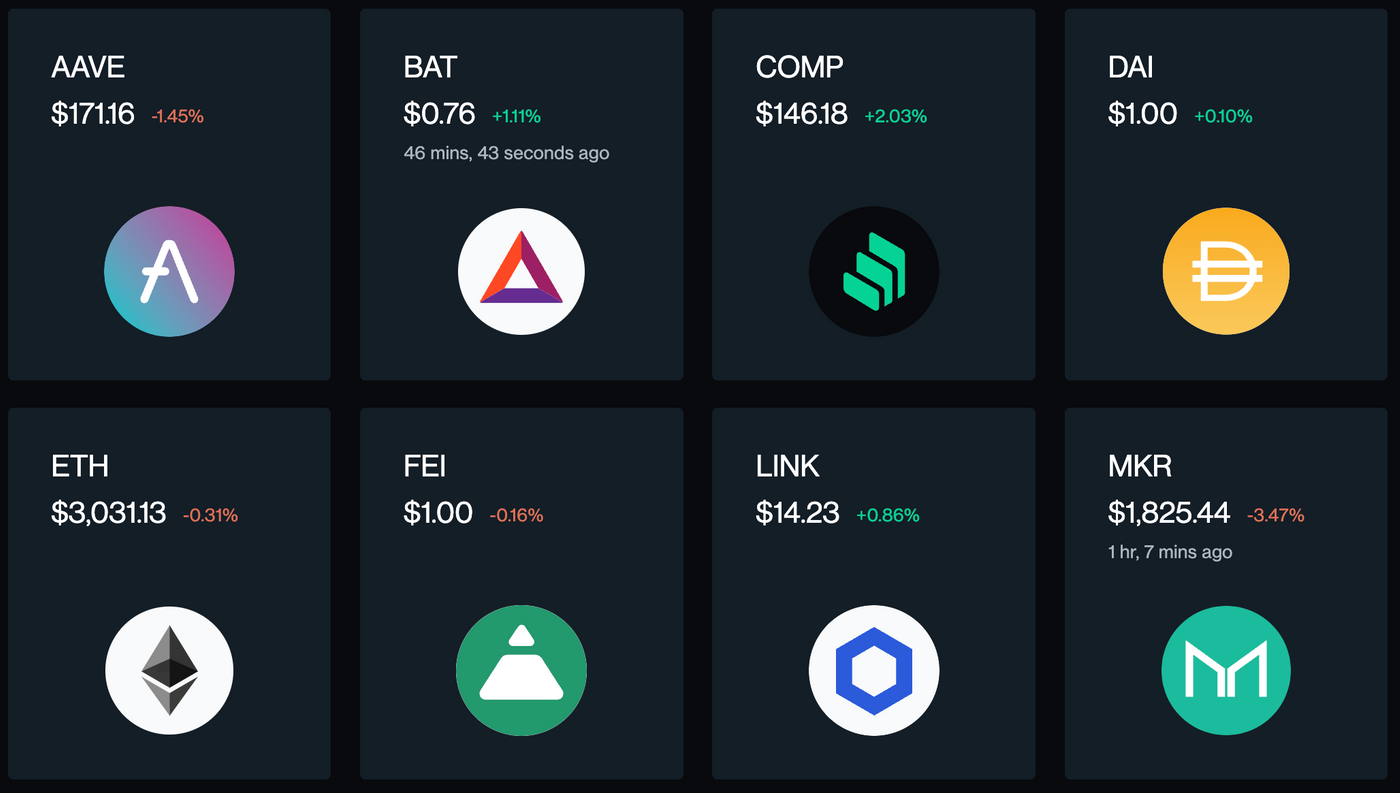

For example, you have assets BAT, LINK, and AAVE recognized by him in your wallet, which add up to $300. Then you can pledge these coins to borrow $200 of ETH.

Some people here will have doubts, why don't I sell BAT, LINK, and AAVE for ETH?

I assume you all understand and read my article " What is a Contract ". I went on

This concept of lending is more like short-selling in leveraged trading. If I borrow ETH, I will repay ETH + interest later. If the price of ETH falls, I will actually earn the difference.

Platforms such as compound and AAVE provide such services, which is equivalent to allowing users to do leveraged transactions across platforms in a decentralized world.

Since it is a leveraged transaction, it is natural to avoid the risk of margin and liquidation. Another risk in the transaction on the lending platform is the fluctuation of the annualized rate. The asset 300 mentioned above can be borrowed 200, and the 100 in the middle is your margin. , and the margin is deducted according to the annualized rate of borrowing.

Your 100 yuan deposit may be deducted for 3 months of interest when you borrow it. As a result, after one week of borrowing suddenly, the annualized rate of the loan has skyrocketed by 10 times, and the deduction will be completed in 9 days! At this time, if you do not make up the money, all your pledged assets will be liquidated!

If there is a problem, there will be demand, and if there is demand, there will be solutions (and create new problems), aave will provide loan products with a stable annual rate, so as to avoid being caught by surprise, and of course the interest will be higher.

There is another big difference between the concept of decentralization and centralization.

For every order on a centralized exchange, there is a corresponding counterparty. For example, if you want to buy an apple for 100 yuan, there must be someone willing to sell the apple at a price lower than or equal to 100 yuan, so this order will be established.

Decentralized exchanges are different. Their transactions are taken out of the capital pool, which means that every transaction you make is immediately completed without waiting for matching.

Finally, a conclusion is that the decentralized lending platform, although its process is like lending, is actually a transaction model disassembled from leveraged contract transactions, more like one of the links in the short-selling transaction is independent. Make a service.

If there is anything else you want to know, about blockchain or blockchain technology, you can leave a message to communicate

In another five or ten years, the blockchain will "begin" to become as closely related to everything in our lives as the Internet is now. I hope that I can use the simplest explanation to help more people understand this field.

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More