Block D Weekly Report - How Bearish Is the Market? Where can I find the data? Master the opportunity to turn cattle

After witnessing the bloodbath of Terra Luna and UST last month, the impact of interest rate hikes and wars continued to shroud the currency circle. This week, the Celsius crisis occurred again, causing the price of ETH to drop all the way. There must be many People are uncomfortable. The bear market in the currency circle is really here. I hope everyone can survive this wave of encryption winter safely.

Although watching these in a bear market only adds to the sadness, I still share a few data and where to look. In fact, the data in this article is not important, because the market is always changing, the important thing is to know where to look, and then use it as a guide for the next step. When the currency collapses, don't collapse your mentality. Let's wait for the bull market to return.

(Disclaimer: I am not a professional trader, this is just to share with the novice the source of my own observation data. As an old saying, if you do any investment behavior, please be sure to DYOR)

The price of the currency continued to fall, and the total market value fell by one trillion US dollars

The total market value of cryptocurrencies fell below $1 trillion on 6/13, and then continued to fluctuate. Compared with the total market value of $3 trillion when Bitcoin hit a record high in November last year (2021), it fell by 200%. . If you look at Bitcoin alone, it has dropped from a market value of as high as 1.3 trillion to the current (2022/6/14) with only 435 billion left. The price of the currency has dropped by 27.2% in seven days, and the market value of the second largest cryptocurrency, Ethereum, is only left. 148.9 billion, the seven-day coin price fell 33.9%. Chart source CoinGecko .

capital outflow

According to the CoinShares report , the outflow of cryptocurrency investment products this week was about 102 million US dollars, of which Bitcoin (BTC) accounted for 55.9% (57 million, and the cumulative outflow in June was 91 million), and Ether (ETH) accounted for 40.2% (4100). million, this year has accumulated 387 million). Most of the outflows came from the United States (98 million), and 2 million from Europe.

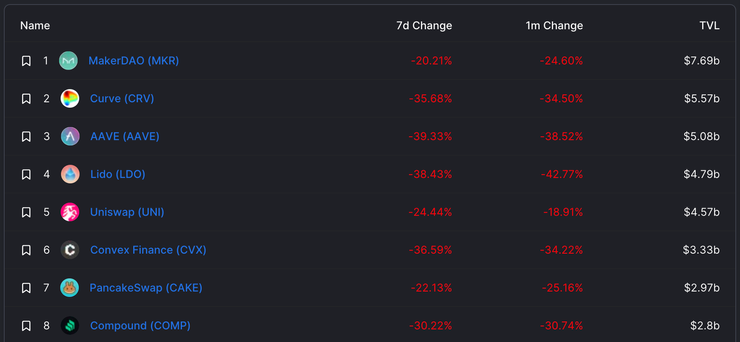

The total locked value (TVL, Total Value Locked) of each DeFi protocol continued to decline. From the chart of DeFi Lama , it can be seen that it began to decline sharply from the beginning of May. Although it seems to have stabilized in mid-May, it has been fell again.

Looking at each major DeFi platform separately, the TVL decline in the past seven days has exceeded 20%, and the AAVE has even exceeded 39.3%.

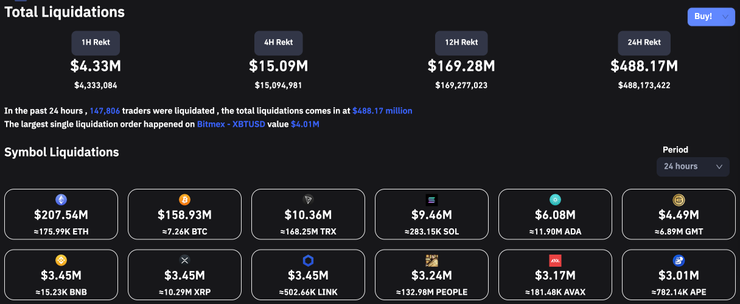

Liquidation quantity

Through coinglass, we can see that more than 147,000 people (accounts) have liquidated their positions in the last 24 hours (6/15), with a total liquidation amount of US$488 million. The largest single liquidation order occurred on Bitmex - XBTUSD worth 4.01 million.

Panic and Greed Index

The site analyzes various indicators of the bitcoin market on a daily basis, and then reduces it to a "fear and greed" reference index. The index ranges from 0 to 100. The larger the index, the more greedy the market is, which usually occurs when the Bitcoin outlook is optimistic. The smaller the index, the more panic, and usually occurs when the outlook is bad.

The index on 6/14 was "8" for "extreme panic".

Reference indicators for calculating the index include Bitcoin's "Volatility (25%)", "Market Momentum/Volume (25%)", "Social Media (15%)", "Survey (15%)", "Dominance" (10%)” and “Trend (10%)”

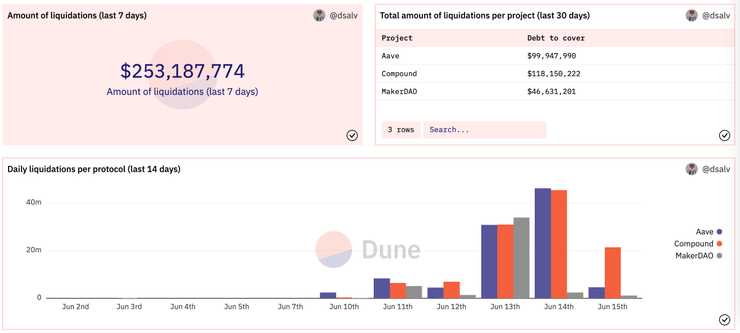

Decentralized Lending Service Liquidation Amount

On the well-known on-chain data analysis tool website DUNE, there are various data contributed by everyone for reference. This chart specifically calculates the amount that has been liquidated on the three major lending services (MakerDAO, Aave, Compound), which can be clearly seen. It can be concluded that when the ETH began to fall significantly on 6/13, the liquidation amount also increased significantly (because the price of ETH fell too much, resulting in the borrower's insufficient mortgage amount and was liquidated).

There are many dashboards made by many people on DUNE , most of which are related to NFT and DeFi. Many important data can be seen at a glance through the charts. I highly recommend everyone to take a look.

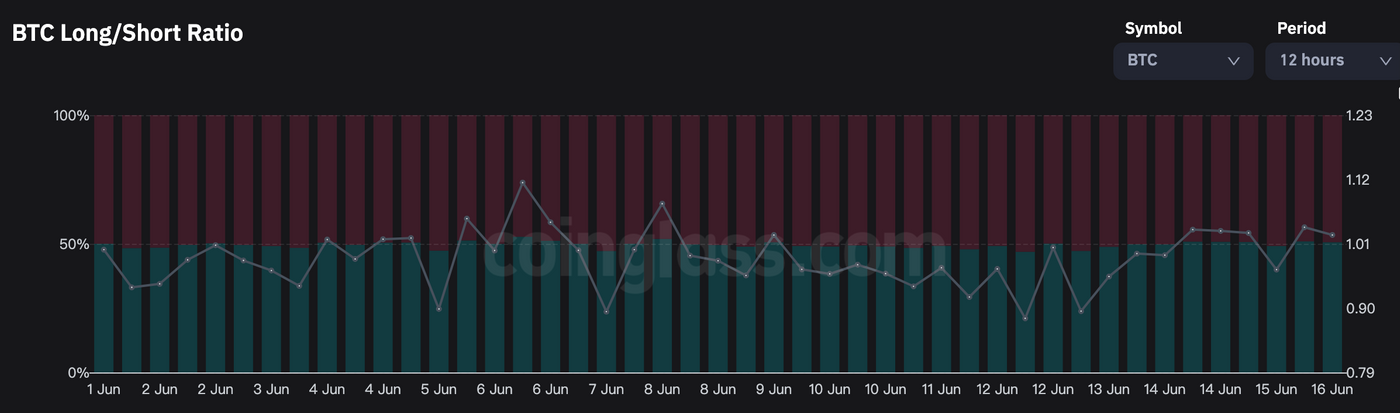

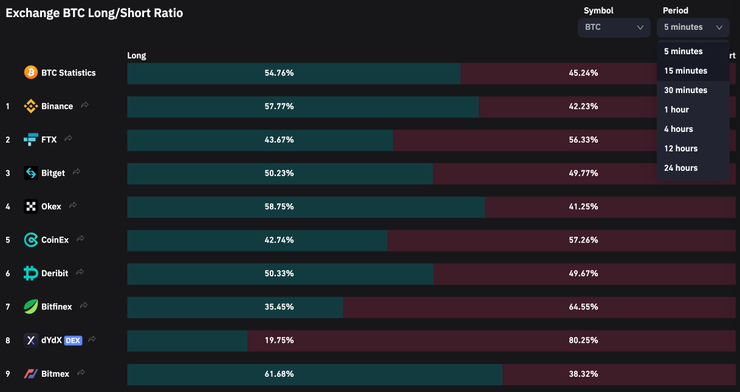

Long-short ratio

From coinglass , you can also see the current long-short ratio in the market (red short order, green long order). If there are more empty orders now, it means that the market is generally bearish, and vice versa.

You can choose the currency, time interval, etc., and you can also subdivide the long-short ratio of different exchanges.

The above is the content of this week's sharing, but most of the data shared here are "lagging indicators", which can only reflect the fall of the currency price and the impact, but there is no predicted effect. Please use it as a corroborative reference.

A little explanation of "lagging indicators": refers to data or events that present results, and trends can be observed but cannot change the results; relative "leading indicators" can predict the development trend of a subsequent event, and a solution should be formulated in advance. If I have to say it, only the "Panic and Greed Index" and "Long-Short Ratio" are barely leading indicators.

I don't know if you have any other indicators that you often refer to. I hope you can share it with me in the comments below, thank you.

If you are also curious about what impact the blockchain will have on the world in the future , leave an email subscription in the "Block D Weekly Newsletter" subscription area , and you can receive news worthy of attention in your mailbox every week!

Like my work? Don't forget to support and clap, let me know that you are with me on the road of creation. Keep this enthusiasm together!

- Author

- More