记录一些东西。

Fair Funding for All: Basic Income on the Blockchain

The original text is from medium.

Original address:

https://medium.com/@ConsenSys/basic-income-on-the-blockchain-fair-money-45662889077c

For most people, money is something that exists. In order to receive money, someone needs to be willing to spend money on you. This concept of money can lead to a false assumption that money is "neutral" and has no properties worth discussing. The process of issuing new currency is highly obfuscated and hidden in the balance sheets of central and private banks. For cryptocurrencies, by contrast, the process has become very clear. Mining, pre-sale and proof-of-burn are concepts that have already been tried.

However, it is difficult to predict which cryptocurrencies will play a dominant role in the future. There are many possible stable equilibria, where one cryptocurrency is widely accepted, and for this very reason, others also accept it. From a game theory perspective, currency is a coordination game. If people around you accept a certain currency, you will most likely accept a certain currency. If no one does, neither will you.

In this ongoing cryptocurrency game, Bitcoin is currently the Schelling point for the simple reason that it was the first currency of this kind and therefore is currently the largest. Furthermore, there is no good reason to join an unlimited number of copies of Bitcoin. In fact, millions of people currently use Bitcoin. If a significant portion of the world economy starts using Bitcoin as a currency, it will mean an incredible transfer of wealth to early adopters. This is highly unlikely, as it would require the adoption of those who have been disfavored by this wealth transfer. This only happens when there is a complete lack of alternatives: only when traditional fiat currencies are generally in grave danger of collapse, and there are no other more favorable cryptocurrencies.

Leaving aside the moment of regulation that makes this extremely unlikely, let's imagine a few big players like Amazon, Walmart, and Apple launching cryptocurrencies while enacting similar rules to Bitcoin, such as fixed supply and Decentralized processing. However, the initial distribution is a mix of controlling most of the funds themselves and distributing them to clients. This currency would instantly render Bitcoin irrelevant.

Therefore, the meta-trend is that each entity tends to use a currency that it controls, or at least a currency that benefits the entity during the initial distribution. If we continue this trend to the end, we may end up in a situation where everyone issues their own currency. A naive approach, where everyone sets their own rules, is likely to fail in the metagame of competitive coordination games, due to higher complexity.

What makes coordination apparently easy, however, is the ability of smart contracts to limit themselves. Entities can control their own currency, but they can limit themselves in the set of allowed actions, making it easier for others to "trust" the currency.

A specific proposal for this monetary system is called "circles". The idea is that everyone can issue their own currency, however, this happens entirely with fixed rules around the world. These rules allow individuals to consciously issue new currencies in the issuance system, with the aim of achieving a stable ratio between newly issued coins and existing coins. Simply put, in the first year, people can release 1,000 units per week, and this number increases by 5% per year.

Now, all have comparable currencies. The second important simplification that would make it possible to coordinate such a system is that it really should be used as a currency, not as a person's equity - in fact, an hour's work of person A has a higher value, Instead of representing a higher value of personal currency, A will only charge more units an hour.

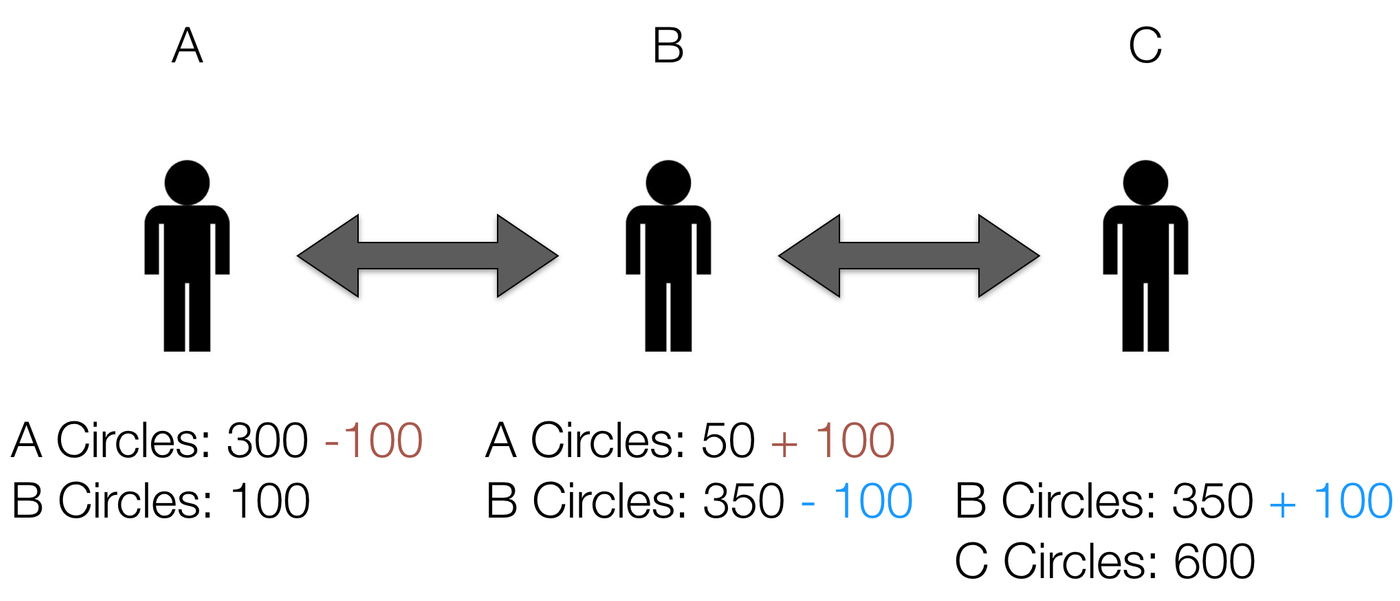

This allows for another big simplification that can become the world currency (system) of this monetary system. People who know each other can agree to a fixed 1:1 exchange rate between their national currencies. They would agree to each other's existence. They form a "circle" of two people in which the two currencies can be considered equal.

This concept allows for transitional foreign exchange transactions along a "loop", creating a consumer network that effectively acts as a large "circle". If a group of people are at least somewhat densely connected to each other, then all their currencies have the same value and can be considered one currency. For example, if A has a 1:1 relationship with B and B with C, A can still pay C with C coins by exchanging A coins for B coins, B coins for C coins, and B coins for C coins currency.

The result is a global cryptocurrency that every participant has a good reason to use (because they get free tokens), but with a fully decentralized mechanism to join this currency.

This concept draws on the concept of a universal basic income and answers the question of fair initial monetary distribution. Of course, the concept is an experiment or a long shot. However, Ethereum makes it as easy as ever to start such social experiments. You can find a more technical circle concept description here and a forum here .

—

I'm Martin Kopelman Decentralization Engineer and co-founder of Consensus Gnosis Prediction Market . All opinions are mine and not necessarily those of Consensus.

This article is machine translated content. Just to help people understand stuff from the previous post.

Like my work?

Don't forget to support or like, so I know you are with me..

Comment…